Even ordinary people can invest in hedge funds. Hedge funds are known as absolute return funds, which means that they can make a profit even in a recession.

Why are they able to make profits even in a recession? And what kind of hedge funds can provide superior returns?

Although hedge funds are absolute return funds, there are many funds with poor performance. As a result of investing in absolute return funds, investors often reduce their assets due to poor management. This means that retail investors need to invest in hedge funds correctly.

I will explain how to think about investing in absolute return hedge funds and increase your assets.

Table of Contents

Learn the Difference Between Absolute Return and Relative Return

When managing assets, many people use mutual funds. By using ETFs (exchange-traded funds) and mutual funds, we invest in stocks to increase our assets. Indexes are also used as indicators to check whether mutual funds have performed well or not.

Most funds provide relative returns. In relative return, we check whether the performance was superior compared to the index. Some famous indexes are as follows.

- Dow Jones Industrial Average

- S&P 500

- Nasdaq

All of these are US indexes, and we compare the fund performance with these indexes.

For example, if the performance of a mutual fund is -5% for the year, but the performance of Nasdaq is -8%, then the performance of the mutual fund is excellent. In relative return, the performance is compared to the index, so even if the return is negative, if the performance is better than the index, it is considered “excellent”.

During a recession, stock prices always fall. On the other hand, an absolute return hedge fund will try to make a profit even during a major recession. Therefore, an absolute return hedge fund can increase its assets regardless of the economy.

All hedge funds provide absolute returns. Therefore, many individual investors are using hedge funds to increase their assets even in a recession.

Profiting from Long and Short Positions

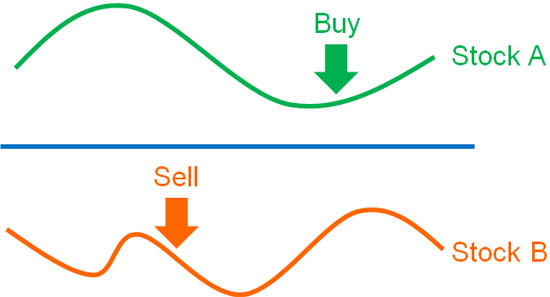

Why is it possible to profit in spite of the recession? The reason is that hedge funds take not only long positions (buying) but also short positions (selling).

In general, stock prices rise. Therefore, in mutual funds, retail investors increase their assets by buying. However, as mentioned above, stock prices fall during a recession. Therefore, when stock prices are expected to fall, short selling is used.

When short selling, you lose money if the stock price goes up, but you can make a big profit if the stock price goes down.

Although there are long-only hedge funds, most hedge funds use both buying and selling. The reason why investing in hedge funds is not affected by the economy is that they actively sell short.

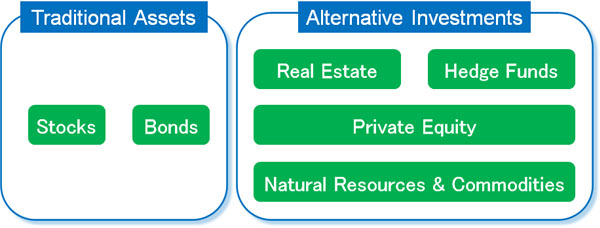

Investing in Hedge Funds Is Considered an Alternative Investment

Investment in hedge funds is known as an alternative investment. Alternative investments are those that do not invest in traditional assets (stocks and bonds).

Alternative investments have different price movements than stocks and bonds. Therefore, alternative investments allow you to increase your assets regardless of the economy. Investing in hedge funds is an alternative investment because, as mentioned above, hedge funds not only buy but also sell short.

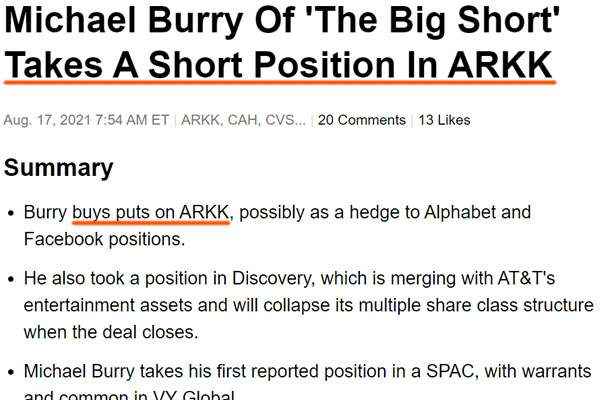

Also, high-risk, high-return hedge funds are frequently in the news. For example, here is an example.

When Lehman Brothers went bankrupt, this hedge fund is known to have made a large profit by shorting a large number of shares. In any case, absolute return funds make a profit even when stock prices fall.

Risks Vary Greatly by Investment Strategy

There are many investment strategies in hedge funds. Different investment strategies have different risks. In general, investing in hedge funds is high-risk, high-return. This is because although they can make a profit by short selling, the stock price does not always fall as expected.

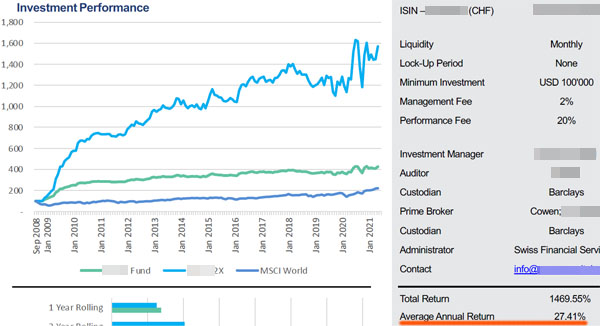

For example, here is a fact sheet on a hedge fund that invests in stocks, bonds, forex (currencies), and commodity futures.

As you can see, the volatility is high. However, the average annual interest rate is high at 27.41%.

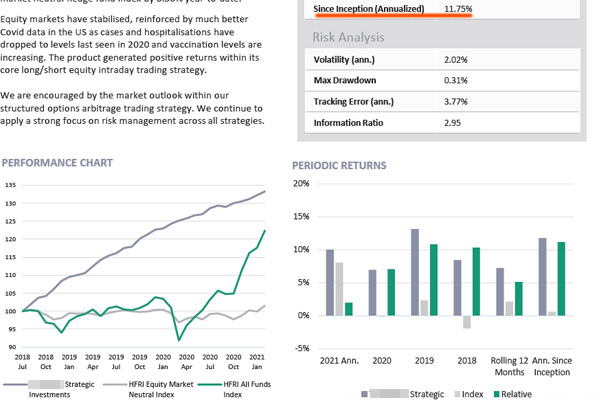

On the other hand, there are hedge funds with low risk. For example, the following is a fact sheet on a hedge fund that uses a market neutral strategy.

The average annual interest rate of this hedge fund is 11.75%. While it is not a high return hedge fund, it has low annual volatility of 2.02%, which provides a stable return year after year.

This hedge fund will sell short the same amount as its long position. It also sells short overvalued stocks and buys undervalued stocks. Therefore, you can make a profit whether the stock price goes up or down. This hedge fund is recommended for those who want to earn an annual interest rate of 10% or more with low risk.

Use Low-Risk Hedge Funds to Earn Profits

On the other hand, there are hedge funds that do not invest in stocks and bonds. For example, they manage assets through the following methods.

- Bridge loans

- Mortgage loans

- Microfinance

- Trading of accounts receivable

In other words, instead of investing in stocks, hedge funds manage assets by earning interest income. Therefore, although a high yield is not possible, you can increase your assets at an annual interest rate of 8 to 13%.

For example, the following is a real estate loan fund in Australia.

It is a fund that lends money to foreign investors who want to invest in Australian real estate. It has an average annual interest rate of 9.27% and has never had a negative return year in the past.

When investing in a hedge fund, if you prefer a lower-risk investment, use a fund that does not invest in stocks or bonds. Even during a major recession, these funds can increase your wealth with absolute returns.

Beware of Hedge Funds with Poor Performance

However, most hedge funds have poor performance. Therefore, many people lose their assets as a result of investing in hedge funds.

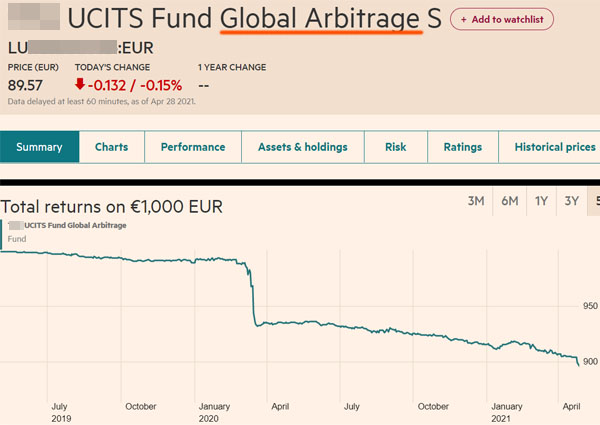

While investing in hedge funds provides absolute returns, it is meaningless if the investment results in a loss of assets. For example, the following is the result of a hedge fund that uses an arbitrage strategy.

Arbitrage strategy is known as a low-risk investment method. However, in the case of this hedge fund, we can see that it is a poor asset management and has lost a lot of assets.

There are many hedge funds like this one. So be sure to check the fact sheet to see the actual investment performance.

You Need to Use a Tax Haven to Invest in a Good Hedge Fund

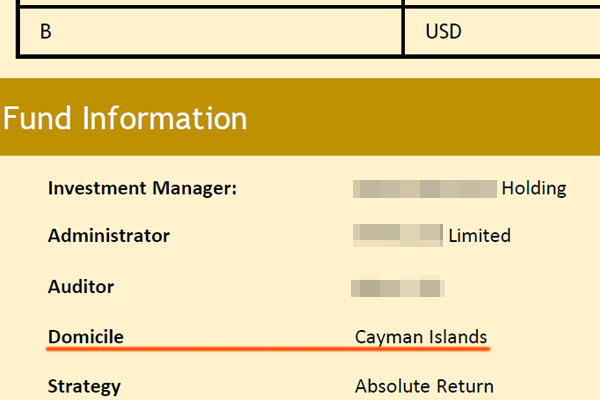

When investing in absolute return hedge funds, there is one more thing to keep in mind. It is to invest in hedge funds that are registered in offshore tax havens where there are almost no taxes. For example, the following hedge fund is registered in the Cayman Islands, a well-known tax haven.

Any private placement hedge fund that is not located in a tax haven but in your country of residence is a scam. Also, absolute return funds that can be invested through banks and brokerage firms have poor results.

For example, the following is the result of an absolute return fund offered by BlackRock, the world’s largest asset management company.

- BlackRock: Global Equity Absolute Return Fund

As you can see, the assets have not increased at all. On the contrary, the result of asset management is negative. Therefore, we can see that we should not invest in this fund.

Almost all active funds registered with securities companies are known to perform worse than index funds. This is the reason why you should not invest in active funds. They are company-employed fund managers, and poor investment performance is not a problem because it does not reduce their personal assets.

On the other hand, in the case of hedge funds registered in tax havens, the fund managers put their assets into the funds. In other words, they manage their own assets as well as their clients’ assets. Therefore, they seriously try to increase their money by investing.

You should not invest in active funds that are managed by company employees. Instead, invest in hedge funds that are managed by professional fund managers. Therefore, offshore investment using tax havens is a must.

The reason why many people fail to invest in hedge funds is that they do not understand how to find a good fund that can give them absolute returns. So use offshore investments to manage your assets.

You Can Increase Your Assets with Absolute Return Hedge Funds

Hedge funds are not affected by the economy and make profits through absolute returns. Most hedge funds take not only long positions but also short positions. And while there are funds with high risk and high return, there are also hedge funds with low risk.

Some hedge funds do not invest in stocks or bonds. In this case, the risk is extremely low and the probability of a negative return is low.

If you want to invest in absolute return hedge funds, make sure to use offshore investments. If you invest in your country of residence, you will only find fraudulent private placement funds or poorly performing active funds.

It is excellent for individual investors to invest in absolute return hedge funds as well as relative return index funds. This is because risk diversification allows you to grow your assets significantly even in a recession. However, it is important to understand how to invest in a good hedge fund.