One excellent way to manage assets is through alternative investments. However, since it is not a common investment method, few individual investors understand the details of the advantages and disadvantages of alternative investments.

For institutional investors and family offices, alternative investments are the main investment method. It is common for institutional investors to have a larger percentage of their investments in alternatives than in stocks and bonds. This is because the benefits of alternative investments are significant.

However, there are also disadvantages to alternative investments, such as poor liquidity of money. You have to understand these disadvantages in advance before investing.

So what should you pay attention to when investing in alternatives? Here is an overview of alternative investments, their advantages and disadvantages, and the risks involved.

Table of Contents

Overview of Alternative Investments: Investing Outside of Stocks and Bonds

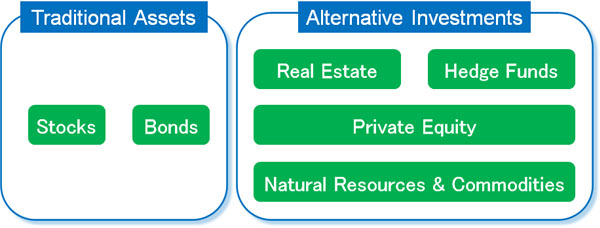

The most common investments are in stocks and bonds. In fact, many individual investors invest in stocks and bonds. These stocks and bonds are known as traditional assets.

On the other hand, there are ways to avoid investing in traditional assets. Understand that alternative investments are methods that do not invest in stocks and bonds.

There are many ways to manage assets. A variety of investment methods are included in alternative investments as a way to not invest in traditional assets.

There Are Many Types of Alternative Investments

What are the types of alternative investments? Among alternative investments, the following are some of the most well-known.

- Real estate

- Hedge funds

- Private Equity

- Natural resources and commodities

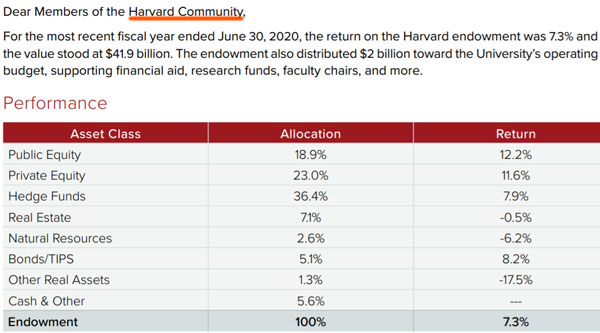

Institutional investors and family offices are known to actively incorporate alternative investments into their portfolios. For example, the following is a part of the official document published by the Harvard University Foundation.

As you can see, they invest not only in stocks and bonds but also in alternatives. Also, if you check the portfolio, you will see that the largest percentage is invested in hedge funds. From this fact, we can see that institutional investors and family offices are more focused on alternative investments than stocks and bonds.

The Biggest Benefit Is Not Being Affected by the Economy

Why are so many institutional investors investing in alternatives? It is because they have more advantages than investing in stocks and bonds.

The biggest advantage is that it is not affected by the economy. In the case of stock investments, the value of assets drops to less than half during a major recession. However, not only retail investors but also institutional investors do not want their asset value to plummet. This is why they prefer alternative investments that continue to increase in asset value even in a recession.

For example, when investing in real estate, as long as you have tenants, you can earn rental income regardless of the economy. In the case of hedge funds, they can increase their assets even in a recession because they take short positions (selling) as well as long positions (buying).

If you invest in stocks, you have the potential to increase your assets significantly. However, in the case of institutional investors and family offices, it is more important to ensure a return of 6-10% annually than to increase assets many times in one year. For this reason, alternative investments are preferred over stock investments.

Stable Returns Are Possible with Low-Risk Investments

There are also a number of low-risk investment options in alternative investments. For example, in the case of hedge funds, while there are high-risk, high-return hedge funds that invest in stocks with multiple leverages, there are also low-risk hedge funds.

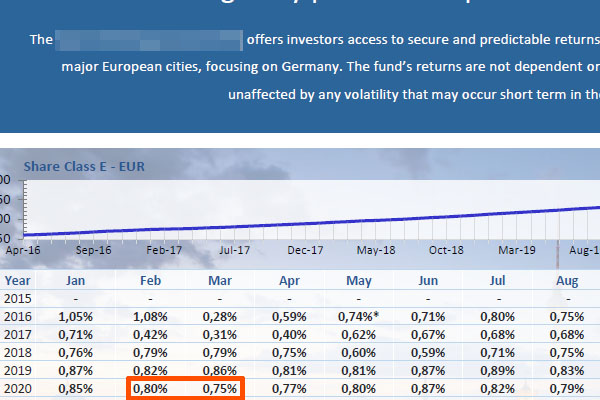

Low-risk hedge funds do not invest in stocks, but instead invest in real estate loans, bridge loans, or microfinance. For example, the following is a fact sheet on a hedge fund that provides bridge loans in Europe.

It is a hedge fund that grows money at an annual interest rate of 8-10% and has no negative returns in the past because it uses a low-risk investment method of bridge loans.

Also, if you check February and March of 2020, you will see positive returns. During this period, there was a pandemic caused by the coronavirus, and stock prices plummeted. Nevertheless, the result of asset management is positive. Since they do not invest in stocks, the assets are not affected by stock prices.

It is not an investment method that doubles your assets in a year like investing in stocks. On the other hand, the advantage of alternative investments is that you can increase your assets stably every year.

You Can Increase Your Assets Through Risk Diversification

Alternative investments can be low-risk investments, which allows you to diversify your risk.

Although investing in stocks is the most common investment method, it is risky. As mentioned earlier, stock prices often drop by less than half. Therefore, by incorporating low-risk alternative investments, you will steadily increase your assets every year.

In reality, many retail investors have a high risk investment approach. This is because they invest only in stocks and bonds.

So, just like institutional investors, individual investors should include alternative investments in their portfolios, which will provide excellent risk diversification. Even during a major recession, the value of your assets will not decrease if you have alternative investments.

Disadvantages of Poor Liquidity of Money

On the other hand, there are disadvantages to alternative investments. One of the most important disadvantages is the poor liquidity of money.

When you invest in stocks or bonds, you can turn them into cash immediately. If you need large sums of money, you can sell your stocks and bonds. Alternative investments, on the other hand, do not allow you to withdraw your money immediately.

For example, if you invest in real estate, you cannot turn it into cash right away. You need to find someone to buy the property, draw up the contract, and pay the taxes. Therefore, you will need six months to a year to convert the property into cash.

This is also true for investing in hedge funds. In the case of low-risk hedge funds that manage their assets through real estate or loans, the money you invest is turned into real estate or loans. For example, if they lend the money to a company as a loan, they will not get the money back for a year or two. Therefore, you will not be able to withdraw your money immediately.

For low-risk hedge funds, it is common to set a rule that at least six months notice must be given before withdrawing money. This rule is in place because real estate and loans cannot be cashed out immediately.

Some investment products Are Risky

Another disadvantage is that some investment products are risky. The best alternatives for retail investors are investments in physical real estate or hedge funds. On the other hand, investments in private equity and commodities are not recommended among alternative investments.

Private equity refers to investing in the stocks of unlisted companies. However, small unlisted companies have a high probability of bankruptcy. In order to convert your investment into cash, the company you invest in needs to be merged or listed. Therefore, the liquidity of the money is low, and the risk is very high.

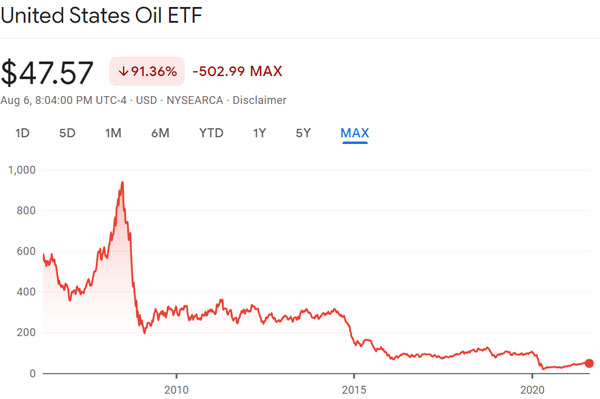

Investing in commodities is also risky. This is because it is very difficult to predict the price of commodity futures. For example, the following is a chart of the crude oil price.

As you can see, prices continue to fall, and the probability of losing money is high if you invest in crude oil. Although the price moves differently from stock prices, investing in commodities is more likely to result in large losses than investing in stocks.

By incorporating alternative investments into your portfolio, it is possible to achieve an average annual interest rate of 8-10% with low risk. However, among alternative investments, retail investors should avoid private equity and commodities, which are high risk.

You Can’t Invest in Small Amount of Money in Alternative Investments

Another disadvantage of alternative investments is that they require a large amount of money. When investing in stocks and bonds, you can invest as little as $100 by using a brokerage account. Alternative investments, on the other hand, require a large amount of money.

For example, if you want to invest in real estate, you have to prepare a large amount of money to buy the physical real estate.

Also, if you want to invest in hedge funds, the minimum investment to open an offshore investment account is US$30,000. Therefore, retail investors who do not have more than US$30,000 to spare cannot invest in hedge funds.

Anyone can easily invest in stocks and bonds. On the other hand, investing in alternatives is not as easy as investing in stocks, and the minimum investment amount is likely to be high.

The Risk of Being Scammed Is Disadvantage of Alternative Investments

The possibility of being scammed is also a disadvantage of investing in alternatives, unlike investing in stocks and bonds. When you invest in traditional assets, you open an account at an online brokerage and then invest. Therefore, you may lose money due to falling stock prices, but you will not be scammed.

On the other hand, individual investors who purchase physical real estate or invest in hedge funds as an alternative investment may be subject to fraud.

The real estate industry is known to be full of crooks, and there are many companies that sell bad real estate. There are few good properties, and you have to learn how to invest in real estate in order to earn money.

The same is true for investing in hedge funds; there are many scam hedge funds. For example, any hedge fund that is active in your country of residence is 100% a scam.

All hedge funds used by institutional investors and family offices are registered in offshore tax havens where there is little or no taxation. This is because tax havens are tax-free zones where there is no financial regulation, and hedge funds are able to manage their assets better.

Therefore, if a retail investor wants to invest in hedge funds, he needs to open an offshore investment account in a tax haven. If you don’t understand how to invest in hedge funds properly, you can get scammed if you use hedge funds with private placements in your home country.

The same is true for private equity. There are many scams that invest in shares of unlisted companies.

If you do not understand how to invest properly, you will inevitably get scammed. Unlike investing in stocks and bonds, one of the disadvantages of alternative investments is that if you do not understand how to invest correctly, you will inevitably be scammed.

If Invested Correctly, Alternative Investments Can Be Beneficial

Many institutional investors and family offices are investing in alternatives. It is also common to have a larger percentage of their portfolio in alternatives than in stocks and bonds. The reason for this is that alternative investments have the advantage of being independent of the economy.

Alternative investments also offer low-risk asset management. While there is no case where the value of assets can more than double in a year like stock investments, there is no case where assets are reduced to less than half in a recession.

However, there is a disadvantage of poor liquidity of money when investing in alternatives. Retail investors should also avoid investing in private equity and commodities, which are risky. In addition, you must understand the right way to invest and avoid falling for scams.

I have explained what alternative investments are, including an overview, advantages and disadvantages, and investment risks. Be sure to understand these precautions and take alternative investments.