One of the excellent investment methods is alternative investments. It is an investment method that is not affected by the economy, and it allows you to increase your assets even in a recession.

However, when you invest in alternatives, you have to buy physical real estate or open an offshore investment account to invest in hedge funds. This is a troublesome procedure. On the other hand, it is easy to invest in mutual funds through a brokerage firm.

Mutual funds that can be purchased through a securities account are called ETFs (Exchange Traded Funds). It is a so-called index investment, and some ETFs can be used for alternative investments.

However, I do not recommend alternative investments through index investments. This is because it is an investment in commodities. I will explain how alternative investments in index investments work.

Table of Contents

Alternative Investments Possible with ETFs (Exchange Traded Funds)

When you invest in assets, you generally invest in stocks. A popular choice for amateur investors is mutual funds, which allow you to grow your money through index investing.

There are many types of ETFs; for example, the S&P 500 and Nasdaq 100 are well known. The S&P 500 is an index linked to the stock prices of the top 500 US companies, and many people understand that they can grow their assets by investing in this ETF. This is because the stock prices have been rising for a long time, as shown below.

On the other hand, there are some mutual funds that are linked to a different index than stocks. For example, the following indexes exist.

- REITs (Real Estate Investment Trusts)

- Gold ETFs

- Crude oil ETFs

- Cryptocurrency ETFs

Thus, there are mutual funds that are not linked to a company’s stock price. These ETFs are financial instruments that can be bought and sold on the stock exchange, and although they have similar characteristics to stocks, they are not linked to the company’s stock, so their prices often rise even in a recession.

Commodities Can Be Invested in Indexes

Among the indexes that are not linked to company stocks, what kind of mutual funds can be used for alternative investments? In this regard, if you invest in commodities, you can invest in alternatives.

The best alternatives are investments in physical real estate or hedge funds. On the other hand, alternative investments include investments in commodity futures.

When investing in commodity futures through options trading, many people have gone bankrupt with huge debts. Index investing, on the other hand, does not involve any debt. There are several ways to invest in commodities, and if you invest in ETFs that are linked to commodity futures, your assets may be lower in value, but you will not be in debt.

For example, here is the historical price movement of a gold ETF.

It is widely known that the price of gold moves differently from that of stocks. Since there is no default risk like stocks, the price of gold tends to rise even during recessions. Also, when you invest in ETFs, although the price of futures may fall, you are not borrowing money to invest, so there is no debt.

Therefore, ETFs are one of the safest ways to invest in commodity futures. So, as an alternative investment, you can invest in commodities.

When using mutual funds, it is impossible to invest in physical real estate or hedge funds. On the other hand, it is possible to invest in commodity futures.

REITs Are Not Alternative Investments

Although real estate investment is an alternative investment, as mentioned above, it is important to note that REITs (Real Estate Investment Trusts) are not alternative investments.

A REIT is a financial product in which an investment corporation collects money from investors, makes a profit by purchasing real estate, and returns the profit to investors. However, REITs are greatly affected by the economy. For example, the following is a REIT called iShares US Real Estate ETF (IYR) that invests in US real estate.

As you can see, prices dropped significantly during the recessions, such as the subprime mortgage crisis in 2007, the collapse of Lehman Brothers in 2008, and the Corona shock in 2020. Especially in 2007-2008, the value of assets dropped by more than 70%.

When you understand this fact, buying REITs is not an alternative investment. Real estate investment can only be an alternative investment if you buy physical real estate or invest in real estate hedge funds.

Alternative Investments in Indexes Are Not Recommended

After reviewing the points so far, we can see that in order to invest in alternatives with index investing, we should invest in commodities.

However, I do not recommend commodity futures as an investment destination. Unlike stocks and bonds, it is challenging for an individual investor to predict the price movements of commodities. In fact, it is difficult to predict the future prices of gold, corn, and crude oil.

In addition, even for commodities that are not easily affected by the economy, prices can drop significantly during a major recession. In some cases, the value of an asset may drop to zero. For example, when the coronavirus spread worldwide, the price of crude oil futures temporarily went negative.

In other words, it has become an unusual situation to pay to sell oil. Investing in commodity futures can, in some cases, cause you to lose more money than investing in stocks.

Investing in commodities is known as one of the alternative investments. However, among the alternative investments, investing in commodity futures is risky and not recommended.

Types of Mutual Funds Available for Alternative Investments

If you understand these risks and want to invest in alternatives through index investment, you should invest in ETFs linked to commodities.

The following are the main types of mutual funds known to be linked to commodity futures.

- Precious metals: gold, silver, etc.

- Agricultural products: corn, soybeans, etc.

- Energy: crude oil, etc.

These ETFs have the potential to increase your assets even during a recession because their prices move differently from the economy.

Investing in Precious Metals Such as Gold and Silver

Gold is one of the most popular commodities to invest in. When investing in precious metals, it is possible to invest in silver as well as gold. Although the price of gold temporarily drops during the major recession, it quickly recovers and tends to rise during the recession.

There are several ETFs that invest in gold, and the following is one of the most famous ETF.

- SPDR Gold Trust (GLD)

I have already presented the past price movements of gold. However, while the price tends to rise during recessions, the price of gold tends to fall during booms. This is because, in a booming economy, investors are more likely to sell gold, and buy stocks and bonds because they can yield more.

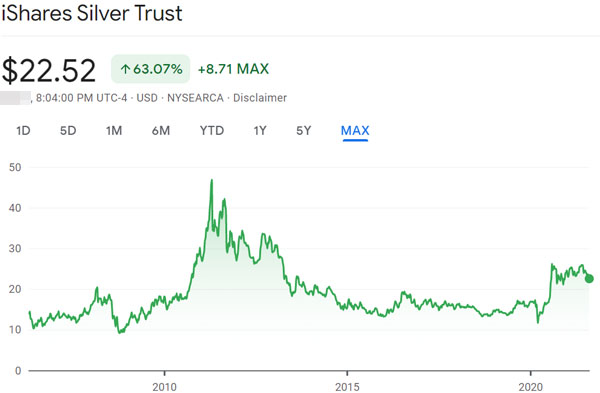

You can also invest in silver instead of gold. It is more difficult to predict price fluctuations than gold, but it moves at a different price than stocks. The following is a well-known ETF that is linked to silver.

- iShares Silver Trust (SLV)

There are several types of precious metals. Therefore, you can increase your assets by investing in these precious metals.

Using Mutual Funds Targeting Agricultural Products

When investing in commodity futures, one of the most common investments is in agricultural products. The following are some of the most popular agricultural commodities to invest in.

- Corn (maize)

- Soybeans

- Sugar

- Wheat

- Cattle

- Coffee

There are other types as well. When it comes to investing in indexes for agricultural products, there are few ETFs that are linked to specific agricultural products, and it is common to invest in ETFs that are linked to several commodity futures prices such as corn, soybeans, and sugar.

The following is one of the most famous agricultural commodity ETFs.

- Invesco DB Agriculture Fund (DBA)

Although it has the advantage of being less affected by the economy, it is very difficult to predict the future price of agricultural products. Therefore, it is an ETF for professionals, not for amateurs to invest in.

Using Commodity ETFs for Energy (Crude Oil, etc.)

Energy is also well known in commodity futures trading. By investing in commodities such as crude oil and natural gas, you hope to see their prices rise.

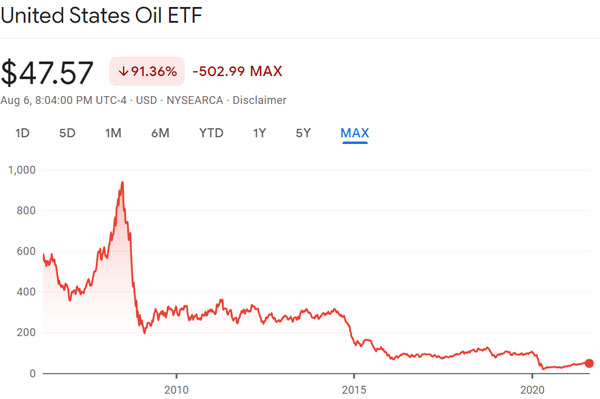

However, energy is one of the most difficult investments in commodity futures trading. The reason for this is that the prices of these commodities plummet during a major recession. Also, after the price drops, it does not recover quickly like gold, and in many cases, the price stays down.

In addition, clean energy sources that do not rely on oil and natural gas, such as solar power and hydrogen energy, are being promoted. Therefore, it is easy to predict that there will be a surplus of crude oil and natural gas in the long term. This means that energy prices will fall in the long run.

For these reasons, energy is one of the most difficult investments in alternatives. For example, here is an ETF that is linked to the price of oil.

- United States Oil ETF (USO)

As you can see from the index chart, the price keeps falling, and it is a very challenging investment. For this reason, only professional investors should invest in them.

Alternative Investments Using ETFs (Exchange Traded Funds)

It is important to invest in financial products that are not dependent on the economy. Many institutional investors buy physical real estate and invest in hedge funds to grow their assets even during economic downturns.

However, buying real estate or investing in hedge funds requires some steps. Index investing, on the other hand, does not require a lot of money, and you can invest as little as US$100.

However, when using ETFs (Exchange Traded Funds) to invest in alternatives, you can only invest in commodity futures. Gold is the most recommended commodity to invest in. However, even investing in gold is difficult for amateur investors to predict the price. For commodities such as agricultural products and energy, it is more difficult to predict the price.

For this reason, alternative investments using ETFs are not recommended. If you want to invest in alternatives, use methods other than mutual funds.