If you invest correctly, you can increase your assets significantly. However, investing in stocks and bonds is greatly affected by the economy. Especially during a major recession, it is common for stock investments to lose less than half of their asset value.

Instead, there is a way to avoid investing in traditional assets such as stocks and bonds. This is called alternative investment.

However, if you do not invest in alternatives correctly, you will not be able to increase your assets. There are alternative investments that have a high probability of failure. So let’s understand what types of financial products are available as alternative investments. Also, find out what kind of funds are best to invest in.

By understanding the types and properties of financial instruments that can be used for alternative investments, you will be able to know the right way to invest. So let’s take a look at what alternative investments are and the types of funds available.

Table of Contents

Types of Alternative Investments That Are Not Linked to the Economy

The most popular investment method in asset management is stocks. Many people have become millionaires by investing in stocks, and many people know that stocks can be profitable.

On the other hand, stock investment is greatly affected by the economy. In addition, every few years, there is a major recession, and it is common for stock prices to drop by half or more. For example, the following is the price movement of stocks during the financial crisis caused by the collapse of Lehman Brothers.

This is the price movement of the S&P 500, a leading index in the United States. If you check the stock price, you will see that the stock price has fallen by less than half due to the financial crisis.

On the other hand, alternative investments are a way to avoid investing in traditional assets. Since you do not invest in stocks or bonds, your investments are less likely to be affected by the economy. Diversification is important in investing. Many people invest in alternatives because it is possible to increase assets even during a recession.

There are many financial products for alternative investments, and the following are some of the most common investment products.

- Physical real estate

- Hedge funds

- Commodities: gold, crude oil, etc.

- Private equity (shares of unlisted companies)

We will explain the details of each alternative investment.

Investing in Physical Real Estate Is a Typical Alternative Investment

Among alternative investments, the most common method is to invest in physical real estate. There are different types of real estates, such as real estate in your home country or overseas, but in any case, you buy property by investing in physical real estate.

For example, the following is real estate in the US, and you can invest in this type of property.

Even if the economy is in a recession, if people are living in real estate, you can earn monthly rental income. There are many things to do, such as selecting a property to purchase, managing tenants, collecting money, and paying taxes. However, since you can earn a fixed amount of money regardless of the economy, real estate investment is one of the alternative investments.

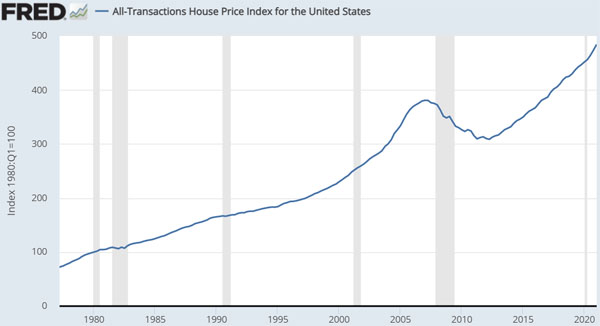

Even when investing in real estate, the prices of land and buildings are affected by the economy. For example, the following is a chart of housing prices in the US real estate market.

The US population continues to grow, and housing prices are known to have been rising for a long time. However, since 2007, when the world fell into a financial crisis due to subprime loans and the collapse of Lehman Brothers, housing prices in the US have temporarily dropped significantly.

When investing in real estate, the rental income remains the same. On the other hand, it is important to understand that real estate prices are affected by the economy.

Hedge Funds Are Recommended for Alternative Investments

Another financial instrument that is an alternative investment is investing in hedge funds. Like direct investment in real estate, you do not need to manage the property. With hedge funds, you can invest your money in professionals to make your money grow on your behalf.

In the case of high-risk, high-return hedge funds, they invest in stocks and bonds, and take short positions (selling) as well as long positions (buying). Therefore, hedge funds generate profits even during economic downturns.

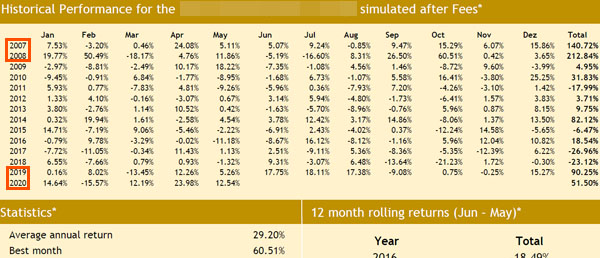

In fact, high-risk funds that take short positions can increase their clients’ assets at a higher rate of return during recessions because it is easier to predict stock price fluctuations in recessions. For example, the following is a fact sheet on a high-risk, high-return hedge fund.

A review of the fact sheet shows excellent yields in the following years.

- 2007: 140.72%

- 2008: 212.84%

- 2019: 90.25%

- 2020: 51.50% (results for the five months from January to May)

2007 and 2008 were years of financial crisis due to subprime loans and the collapse of Lehman Brothers. Also, the stock market crashed in 2020 due to the coronavirus. High-risk, high-return hedge funds can generate large returns before and after these recessions.

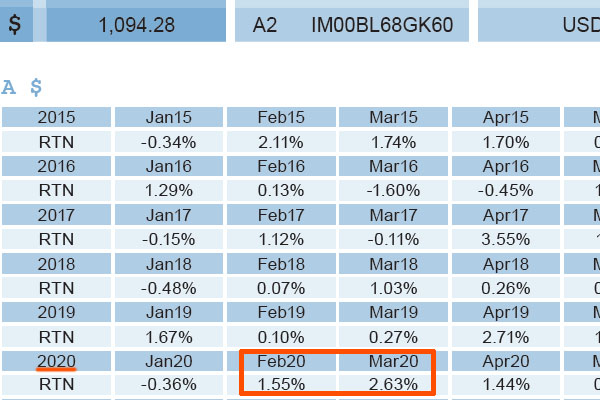

There are also hedge funds that do not invest in stocks and bonds. In this case, the risk is lower. For example, here is a fact sheet for a hedge fund that invests in nursing home real estate.

February and March of 2020 were the months when the Corona shock occurred. Nonetheless, this hedge fund has positive returns.

If you want to invest in alternatives, investing in hedge funds is recommended. Even though it is an alternative investment, the value of the real estate will decline somewhat in the real estate investment I mentioned earlier. On the other hand, if you invest in a good hedge fund, your assets will increase even during a recession.

Investing in Commodity Futures

Alternative investments also include commodity futures. Commodities are widely known as investment products. For example, the following are available.

- Precious metals: gold, platinum, etc.

- Energy: crude oil, etc.

- Grains: corn, soybeans, etc.

Among the commodities, gold is the most famous investment. Many amateur investors, as well as professionals, invest in gold. When investing in these commodities, the price movements are different from those of stock prices.

However, it is not recommended to invest in commodity futures as an alternative investment. The reason is that during a major recession, the prices of not only stocks and bonds but also commodity futures will crash. Also, unless you are a professional investor, it is impossible to predict futures prices.

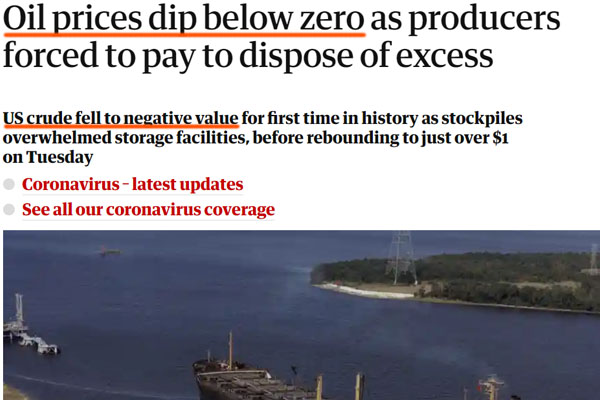

For example, after the Corona shock, the price of crude oil futures went negative. In other words, it became an abnormal situation where people had to pay for selling crude oil.

If you had invested in crude oil futures before the Corona shock, you would have lost a lot more money than if you had invested in stocks. The reason why I do not recommend investing in futures as an alternative investment is that it is very difficult to predict price movements.

Also, unlike investing in stocks and bonds, there are no dividends when investing in commodities. It is a method of investing in gold or crude oil and earning profits by rising or falling in price. Therefore, it is risky and not suitable for alternative investments.

Although it is an alternative investment, just like futures, one investment method that is not recommended at all is private equity. This is a method of investing in the shares of unlisted companies.

Since the company is unlisted, there is naturally almost no fluctuation in the stock price. Therefore, even if there is a recession, the value of the asset will not change.

However, in a recession, it becomes more difficult for a company to make a profit. Also, as an unlisted company, the scale of the company is small. Therefore, the cash flow will be poor, and the probability of bankruptcy will be high. As a result, you may lose all the money you have invested.

This is the reason why private equity is not recommended as an alternative investment at all.

Furthermore, the liquidity is inferior. If you buy shares in an unlisted company, the investor (you) can earn a high return if the company is merged with another company or goes public. Until then, the money invested cannot be converted into cash, and private equity is a very risky investment method.

Recommend Investing in Physical Real Estate and Hedge Funds

Once you understand these types of alternative investments, you should try to invest in physical real estate or hedge funds.

For retail investors, the probability of losing money is overwhelmingly high when investing in commodity futures or private equity. Rather than losing half of your assets like stocks, you could lose all of your assets investing in futures or private companies.

There are different types of alternative investments. Among them, the individual investor must choose the one with lower risk.

If you are good at investing in properties, buying physical real estate is an excellent way to diversify your risk.

On the other hand, in my case, for example, I do not invest in real estate. This is because I don’t understand the criteria of good real estate, and I don’t want to manage tenants. In such cases, alternative investments by investing in hedge funds are excellent.

There Are Many Types of Hedge Funds for Alternative Investments

There are many types of alternative investments that use hedge funds. This is because each hedge fund has a different investment strategy.

For example, in the case of low-risk hedge funds that do not invest in traditional assets, there are the following types of investments.

- Bridge loans

- Real estate purchase & management

- Mortgage loans

- Agricultural loans

- Microfinance

- Purchase & sale of accounts receivable

Of course, there are other types as well. Each hedge fund has a different strategy, and by diversifying your investments, you can create a better portfolio. For example, below is a fact sheet for a hedge fund that provides mortgage loans in the UK.

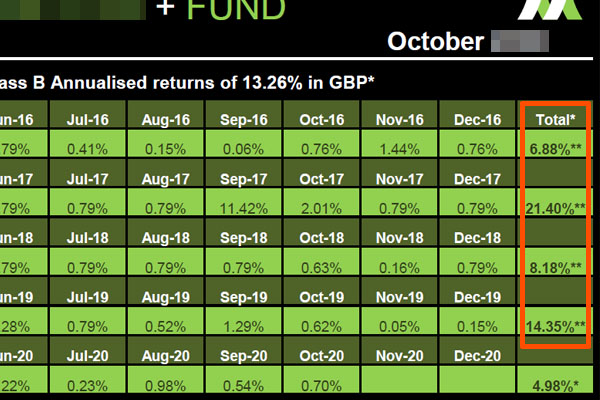

This fund has an average annual interest rate of 13.26% and has never had a negative return year in the past. By investing in a low-risk hedge fund, you can grow your assets every year.

The Disadvantage Is Poor Liquidity of Money

If you choose the right financial products, alternative investments can help you increase your assets regardless of the economy. However, there is one major disadvantage of alternative investments. It is the poor liquidity of money.

If you invest in listed stocks or bonds, you can sell them at a brokerage firm and turn them into cash immediately. On the other hand, with alternative investments, assets cannot be converted into cash immediately.

For example, when investing in real estate, you need to find someone who wants to buy it, draw up a contract, and pay taxes before converting it into cash. This is why it usually takes six months or a year to sell a property.

The same can be said for hedge funds. As mentioned above, low-risk hedge funds increase their clients’ assets by investing in real estate or providing loans. In other words, they turn money into real estate or lend it to others as loans.

Since the money is turned into real estate or loans, the money cannot be withdrawn immediately. For this reason, these hedge funds often set conditions, such as that if you want to withdraw your money, you must contact them at least six months in advance. In any case, it is important to understand that alternative investments have poor liquidity of money.

Invest in Non-Traditional Assets

Many people invest in traditional assets such as stocks and bonds. However, if you invest in traditional assets, the value of your assets will decrease during a recession. This is why you should consider alternative investments.

However, there are different types of alternative investments. Among them, the ones you should consider are investments in physical real estate or hedge funds. You can also invest in commodities or stocks of unlisted companies, but this is not recommended at all because it is too risky.

Among alternative investments, there are some excellent financial products and some funds that should not be invested in by amateurs. So make sure you understand the different types of alternative investments and manage your assets correctly.

Although there is a disadvantage of not being able to turn them into money immediately, one of the major advantages of alternative investments is that they are not influenced by the economy. Make sure you understand these types and their characteristics to invest in good real estate and hedge funds.