When you invest in a hedge fund, there are funds that offer annual returns with low risk. When it comes to hedge funds, you may imagine a high-risk, high-return investment. In reality, however, there are many hedge funds that offer low-risk investments. Specifically, there are hedge funds that invest in alternatives.

With offshore investments, you can earn an annual yield of about 10% by investing in low-risk hedge funds. Moreover, you can get a stable return regardless of the economy. For this reason, alternative investments are a popular choice for many people.

So, what are the different types of hedge funds that invest in alternatives? Also, what are the disadvantages of investing in these hedge funds?

If you can invest US$30,000, you can make a low-risk alternative investment. However, there are not only advantages but also disadvantages. So, I will explain how you can invest in alternatives with offshore investments.

Table of Contents

Hedge Funds That Invest in Something Except Stocks and Bonds

A typical hedge fund invests in stocks and bonds. Some hedge funds invest in forex or futures. In any case, they increase their clients’ assets by investing in these traditional products.

Think of all the high-risk, high-return hedge funds as investing in stocks, bonds, forex, or futures.

Almost all hedge funds in the news are those that invest in these traditional products. Traditional investments are also the ones that can multiply your assets many times in a year. On the other hand, if the hedge fund fails to invest, the assets can be lost in half in a year.

However, stocks and bonds are not the only ways to increase your money. There are other ways to invest, such as real estate and interest income. Investing in these non-traditional products is called alternative investments.

Alternative Investments Are Low Risk

Why are alternative investments so popular in investing in hedge funds? With high-risk, high-return hedge funds, an annual interest rate of 20-30% is possible if you choose an excellent fund. However, as mentioned above, investing in such funds may reduce your assets by half in a year.

Alternative investments, on the other hand, are less risky than hedge funds that invest in stocks and bonds. Yields vary from fund to fund, with some funds offering as little as 6% annual interest and others offering as much as 15% annual interest. The important thing to remember is that there are basically no years of negative returns for any of these funds.

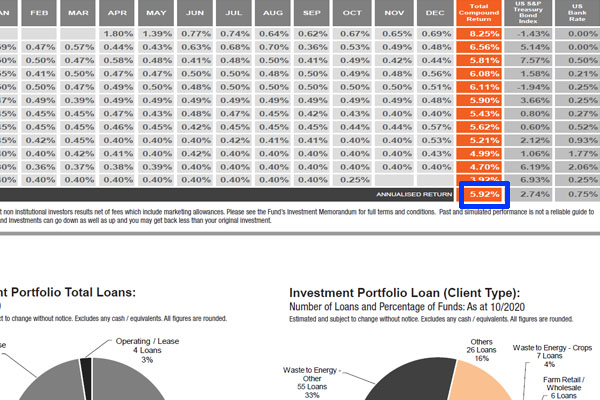

For example, the following is part of a fact sheet for a hedge fund that provides bridge loans in Europe.

It is a fund that earns interest income through bridge loans and is not an investment in stocks or bonds. It is an alternative investment, with an average annual interest rate of 8-10%.

Since it provides loans to corporations, in some cases, the company may go bankrupt, and the funds may not be recovered. Therefore, the yield varies from year to year. However, there has never been a negative yield in any of the past years, and the hedge fund has been able to achieve a stable annual interest rate of 8-10%.

One of the advantages of alternative investments is that they are not influenced by the economy. When investing in stocks, it is normal for assets to drop significantly in a global recession. Naturally, hedge funds that invest in stocks will have negative returns depending on the year.

Alternative investment hedge funds, on the other hand, can provide stable returns regardless of the economy.

Types of Alternative Investments Possible with Offshore Investments

If you use tax havens where there are almost no taxes, you can invest in hedge funds that offer alternative investments. You will need to invest at least US$30,000 to open an offshore investment account, and if you have this money available, you can invest in alternatives.

So, what kinds of alternative investments are available when investing in tax havens? Let’s consider two main types. These are as follows.

- Real estate related investments.

- Loan funds that earn interest income.

There are many other types if we break it down in detail. However, we can usually think of these two types.

Real Estate Related Funds Are Common in Alternatives

The most common alternative investment is real estate. By investing in real estate, you earn rental income and gains from the sale of real estate. For example, here are some examples.

- Buying real estate and earning rental income and profits from its sale.

- Lending money as a real estate loan.

- Lending money as loans to people who want to invest in real estate.

Thus, there are different types of real estate related alternative investments. The easiest way to understand is to collect money as a fund and then purchase real estate to earn rental income and profit from the sale. However, in alternative investments, there are hedge funds that are increasing their clients’ money through other investment methods.

For example, there are many companies that offer real estate loans. They use real estate as security and lend out money as loans. So, hedge funds collect money from customers all over the world and lend money to someone as a real estate loan.

There are also hedge funds that lend money to people who want to invest in property. For example, if a non-resident foreigner wants to invest in Japanese real estate, he or she cannot get a loan from a Japanese bank. Therefore, they use hedge funds that lend money to foreigners.

For example, the following is a loan fund that provides loans to foreigners who want to invest in real estate in Australia.

The average annual interest rate of this fund is 9.27%. There have been no years with negative returns in the past. Although there is a risk of bad debts, it is far less risky than hedge funds that invest in stocks and bonds.

In any case, alternative investments allow you to invest in hedge funds that manage real estate related assets.

Loan Funds That Earn Interest Income

Real estate is not the only asset that can be invested as an alternative. Offshore investments allow you to invest in other investment companies.

The main way to invest in alternatives other than real estate is to earn interest income by lending money. Examples are as follows.

- Lending money to corporations as a bridge loan.

- Lending money to self-employed as microfinance.

- Lending money to a company in the agricultural business as an agricultural loan.

- Lending money using accounts receivable as security.

They are alternative investments that earn interest income by lending money. The hedge fund I mentioned earlier, which provides bridge loans to corporations located in Europe, falls into this category.

The following is a fact sheet on a hedge fund that lends money to companies that run businesses in the agricultural sector.

The average annual yield is 5.92%. Compared to other alternative investments, the annual interest rate is lower. However, the annual volatility is less than 1%. Naturally, there have been no years with negative returns in the past.

If you want to reduce the volatility in alternative investments, you can invest in these loan funds to reduce the risk.

Not Many Capital Gains, Not High Returns

Alternative investments have the advantage of being low-risk investments and can earn a stable annual interest rate of about 10% every year. On the other hand, there are some disadvantages, and the biggest disadvantage is that you may not get a large return.

For hedge funds that invest in stocks and bonds, an annual interest rate of 20-30% is possible. On the other hand, if you invest in a hedge fund that invests in alternatives, you will definitely not be able to earn more than 20% per year on average. If there is such a fund, it is a scam hedge fund.

If you want to invest in alternatives with low risk, even the best yielding hedge funds will give you an average annual return of about 15%. If you want to achieve a higher yield, you have to invest in high-risk, high-return hedge funds that invest in stocks, bonds, forex, and futures.

The reason why high returns are not possible with alternative investments is that you cannot earn large capital gains.

For example, with stocks, you can earn not only dividend income but also capital gains from stock price increases. Also, if you use higher leveraged investment, such as 3 or 5 times, the capital gain will be larger.

Alternative investments, on the other hand, focus on earning interest income and do not offer high capital gains. Therefore, although the risk is lower than that of hedge funds investing in stocks and bonds, it is not possible to earn a large return.

Liquidity of Funds Is Poor, and Risk of Not Getting Cash Immediately

Another major disadvantage of alternative investment hedge funds is the poor liquidity of the funds.

Stocks and bonds can be immediately converted to cash when sold. Therefore, even if there is cancellation from a customer, the money can be returned immediately.

Alternative investments, on the other hand, cannot be converted into cash immediately. This is because they use the money deposited by clients to buy real estate or lend money to companies to generate revenue. For example, when they lend money to a company, they often have a contract to lend the money for a year or two.

This means that the money lent to the company will not be returned until at least one or two years have passed. Also, as soon as the money is returned, it is natural for them to try to earn interest income by lending the money to other companies. By doing so, they are able to increase their clients’ assets.

This is why in some cases, after investing in a hedge fund, you may have to wait a few months or so if you want to cancel the high amount of money. Understand the disadvantages of alternative investments, which cannot be cashed out immediately.

Making Alternative Investments in Tax Havens

Investing in tax havens through offshore investments can give you excellent returns. One of the most popular hedge funds for many people is funds that invest in alternatives.

As is the common case with all alternative investments, they are low-risk investments. Since they are not hedge funds that invest in stocks, bonds, forex, or futures, they do not offer high yields, but they offer annual returns of about 10%. Also, with alternative investments, there is no year of negative returns unless it is a bad hedge fund.

The disadvantage is that you cannot get high returns, and you cannot cash out immediately when you cancel. However, the investment yield is not affected by the economy, and you can get a stable return even in a global recession.

If you want to make such an investment, open an investment account through offshore investment. If you prefer to invest in low-risk investments, investing in hedge funds with alternative investments is the best choice.