It is usual for wealthy people to think about getting a high-status credit card. Among such high-status cards, the Amex Black Card is one that only a few super-rich people have. It is also known as the Centurion Card.

In the case of the general black card, anyone can have it by paying an annual fee. The Centurion Card, on the other hand, can only be owned by invitation, even by the super wealthy. It is also difficult to get a Centurion card because of the high screening standards.

However, there is a way to get a Centurion Card in the shortest time possible. By opening an offshore investment account, you can apply for a Centurion Card through a financial institution, although you need to have at least US$500,000 in spare cash.

By what method will you be able to get an Amex Black Card? Also, what are the precautions to take? I will explain opening an offshore investment account, which is the most reliable way to get an Amex Black Card in the shortest time possible.

Table of Contents

- 1 A Common Way Is to Spend Money with a Platinum Card

- 2 You Need to Use a Financial Institution That Has a Connection with Amex

- 3 The Disadvantage Is Monthly Overseas Remittance

- 4 Get a Black Card in the Shortest Time Possible by Investing Offshore

A Common Way Is to Spend Money with a Platinum Card

Amex is known as a high-status credit card with a high annual fee. When making credit card payments in foreign countries, Amex is less useful than VISA or MasterCard, since many stores do not accept them. However, as a high-status card, Amex cards are favored by the wealthy.

The Centurion Card is the most expensive Amex credit card in terms of entrance fee and annual fee.

The most common way to get an Amex Black Card is to use your Platinum Card as much as possible. After that, if you receive a black card invitation from Amex, you will get a Centurion Card.

The Possibility of Getting an Invitation for the Centurion Card Is Low

In reality, however, it is unlikely that you can get a black card by waiting for an invitation. This is because there is a high probability that you will not receive an invitation. Also, you have to hold the Amex Platinum Card for years and pay a lot of money every month.

The criteria for the black card are unknown. Also, you don’t know how much you have to spend on your card to get an invitation. Therefore, the possibility of getting a Centurion Card in a regular way is low.

Also, in many cases, people who have the Amex Black Card apply for it through back channels rather than the traditional way. By using connections, they are able to get approved for the Centurion Card.

If you want to have an Amex Black Card, you have to learn how to have connections instead of the regular way.

You Need to Use a Financial Institution That Has a Connection with Amex

If you want to get a Centurion Card in the shortest time possible, you should use a financial institution that has a connection with Amex. The following are examples of financial institutions.

- Banks

- Investment companies

- Life insurance companies

Credit cards are part of the financial industry. Credit card companies place importance on the ability of their customers to pay their bills. This is why financial institutions sometimes have connections with Amex.

If you use a financial institution to deposit a large amount of money, Amex will know that you have a lot of assets. Therefore, if you use a financial institution that has a connection with Amex, you can be referred by the financial institution to apply for the Centurion Card.

Private Banking Services Don’t Have Invitations

Just as a reminder, even if you use a huge bank, there is no connection with Amex; the same goes for huge global banks such as HSBC Bank, there is no referral service for Amex.

The same can be said for private banking. Switzerland is known as an offshore tax haven where there are almost no taxes, and there are many banks that offer private banking services. Wealthy people use personal banking services to manage their assets.

However, even if it is a private banking service in Switzerland, there is no referral service to Amex. In other words, even if you are a super-wealthy person who has several billion dollars deposited in a private banking account, you will not be able to get a Centurion Card through the bank.

You can use a financial institution to ask for a black card. However, you have to use a financial institution that has a connection with Amex.

Invitations Are Available Using Offshore Investment

Which financial institutions should you use exactly? For this, you can use offshore investments. If you invest offshore and hold an investment account at a financial institution in a tax haven, you can get an invitation to apply for American Express.

Many offshore investment companies are insurance companies, but they do not offer life insurance with high death benefits. They offer investment products, and we can increase our money through asset management.

One of these offshore investment companies in tax havens has a connection with Amex. While not all offshore insurance companies offer invitations to Amex, one investment company does.

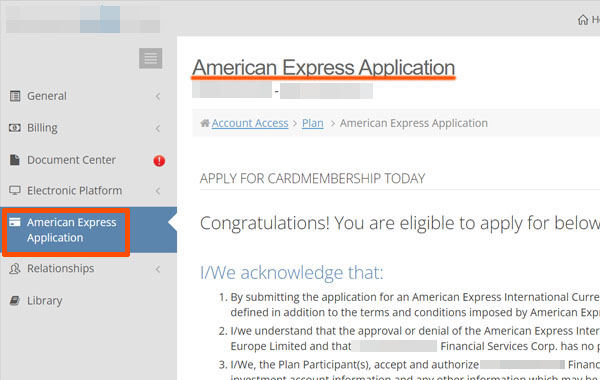

In fact, this offshore insurance company has an application page for Amex on its member website. The following is the management screen of my offshore investment.

To be more specific, this offshore investment company has a connection with American Express Services Europe Limited in the UK. Although Amex is a US company, it is a British company that has a connection with the offshore investment company.

Many tax havens are British Overseas Territories. This is why the offshore investment company has a connection with Amex in the UK. If you apply for an Amex card through an offshore investment company, you will get a British Centurion Card.

You Need to Have at Least US$500,000 in Assets to be Eligible

Although it is true that you can apply for the American Express Black Card through an offshore investment company, you cannot apply for the Centurion Card directly from the member site. If you want to apply for the Centurion Card, you need to contact an IFA (agency).

Also, in order to be approved for the Centurion Card, you need to invest at least US$500,000 with the investment company.

There are several investment products offered by this offshore investment company. It does not matter which financial product you use, you must make a deposit of at least US$500,000 to the investment company.

However, this does not mean that if you have assets of US$500,000 or more, you will pass the screening. US$500,000 is just the minimum amount that American Express will accept for screening. Depending on Amex’s review, you may not be approved.

For your reference, one of my clients, who has an asset value of US$600,000 in this offshore investment company, passed the Centurion Card screening. He holds an Amex Corporate Black Card and a Personal Black Card.

In any case, while you can ask Amex to review your application through an offshore investment company, it does not mean that you are guaranteed to get a Centurion Card. However, it is possible to get a black card in the shortest time compared to waiting for an invitation from American Express.

Apply for an Offshore Investment Account

If you want to get a Black Card through a financial institution in a tax haven, you generally need to apply for an offshore investment account. One of the financial products offered by offshore financial institutions is an offshore investment account.

An offshore investment account is an account for investing in hedge funds. Although you cannot invest in excellent hedge funds from your country of residence, you can invest in hedge funds by opening an offshore investment account in a tax haven.

You can open an offshore investment account by investing in a lump sum. So, you send US$500,000 or more overseas to an offshore investment company, apply for an offshore investment account, and then ask for a black card.

-Investing in a Lump Sum Instead of Regular Investments

It is possible to increase your financial assets by investing in savings. However, in the case of savings investment, it takes time for the asset balance to grow. For this reason, people who want to have an AMEX Black Card should use an offshore investment account that allows lump-sum investment instead of regular investment.

Many People Apply for Centurion Card as a Corporation and Then Get It as a Personal Card

Many people who think about owning a Centurion Card invest in an offshore investment account as a corporation first. With the exception of wealthy individuals who have inherited large sums of money, most wealthy people are entrepreneurs. In many cases, they have more money in their corporate accounts than in their personal accounts.

So, they invest a large amount of money as a corporation and ask AMEX to review them for the Corporate Black Card. Also, after the corporate black card is issued, it is easy to get a personal Centurion Card.

For example, in the case of my client, after he was issued his Corporate Black Card, he transferred US$100,000 overseas as an individual and opened an offshore investment account for himself. He then obtained his personal black card.

If you have a Corporate Black Card, it will be easier for you to get your Personal Black Card issued. This is why you should get a corporate black card first.

Of course, if you are an individual with high assets, there is no need to get a Corporate Black Card. However, as mentioned above, even if you do not have high assets such as over US$500,000 personally, you can still get a Centurion Card if your corporation has a lot of savings.

The Disadvantage Is Monthly Overseas Remittance

The Amex Black Card, which can be offered by offshore investment companies, is an overseas card. When you use your card, you need to pay the amount you used.

This means that the money will not be automatically deducted from your bank account. You need to remit the money you have spent to American Express every month. There are several ways to send money to Amex.

- Overseas remittance from your bank account.

- Intra-US remittances from accounts in the US.

- Remittance from your offshore investment account.

For many people, the disadvantage is that the payment method is troublesome because monthly payments are not made by domestic remittance, but by overseas remittance. Interest rates on overdue payments are high, so be sure not to forget to pay after using an overseas credit card.

Offshore Investment Accounts that Support Black Card Issuance Have Low Specifications

There is another caveat that you need to understand in advance. When you use a financial institution that supports issuing black cards, the specifications of the offshore investment account are low.

When using this offshore investment company, you can only invest in European-registered hedge funds due to regulations. This means that the number of hedge funds you can invest in is small.

Usually, when you invest in hedge funds using an offshore investment account, you can get 8-13% annual interest rate even for low-risk hedge funds. Although these offshore investment companies do not support issuing black cards, their asset management efficiency is excellent.

On the other hand, if you use an offshore investment company that can offer a black card, the low-risk hedge funds that you can invest in have an annual interest rate of about 6-7%. Therefore, the efficiency of asset management is lower than that of investment accounts offered by other offshore financial institutions.

Of course, an annual interest rate of 6-7% is superior to a bank deposit. If you want to get a Black Card, you need to understand that the investment accounts offered by investment companies that can offer a Black Card are not as good as other offshore investment accounts.

If you still want to have a Black Card, you should open an investment account with an offshore insurance company that can offer you a Black Card, with the understanding that the investment efficiency will be low.

Get a Black Card in the Shortest Time Possible by Investing Offshore

The most difficult credit card to issue is the Centurion Card. Many people, even super-wealthy people with extremely large assets, are not able to hold an Amex Black Card. You can use the platinum card and wait for an invitation from American Express, but it is unlikely that you will get an invitation.

So if you want to get a Centurion Card in the shortest time possible, use a financial institution that has a connection with Amex. If you use a private banking service, there will be no connection, and you will not be able to apply for the Centurion Card. Therefore, use an offshore insurance company that has a connection with Amex.

If you use an offshore investment account and send money overseas through lump-sum investments, you can hold a black card while increasing your money at an annual interest rate of about 6-7%.

Both corporations and individuals can apply for the Centurion Card. If you want to have an American Express Black Card in the shortest time possible, use offshore investment.