Many people want to invest in their personal assets and create a pension for the future. It is normal for people to want to create a private annuity because the pension from the government is not enough money.

However, it is difficult to increase your money in many countries by purchasing investment products. In some cases, it is rather common to lose money by purchasing investment products.

On the other hand, with an overseas accumulation annuity, you can be assured that your money will be returned to you many times over if you invest properly. For this reason, when creating a private pension plan, it is common to use an offshore savings annuity. In this case, you can use offshore annuity insurance or regular investment.

But of course, there are risks involved. In this article, I will explain how to create a private pension plan with offshore investments.

Table of Contents

Investing in Tax Havens to Create a Private Pension for the Future

Unless you are a good investor, achieving more than 10% annual interest on your investments is impossible. This is because many countries have strict financial regulations, and there are no good investment products.

On the other hand, there are countries overseas called offshore tax havens, where there are almost no taxes. In these countries, finance is the main industry, and if you buy financial products from these countries, your assets will increase many times over.

Investing in tax havens is called offshore investing, and with this investment method, annual interest rates of over 10% are natural.

However, when you aim for an annual interest rate of 10% or more, there are risks involved. If you want to create a private pension plan, you need to invest without risk. In this case, there are some low-risk offshore investment products.

There are three main low-risk ways to increase your money with an offshore annuity.

- Offshore life insurance: Receive money in a lump sum.

- Offshore life insurance: Receive money in installments.

- Offshore mutual funds (principal-protection plans)

When it comes to creating a future private annuity, each person has a different idea of how they want to invest and receive their money. Therefore, it is necessary to understand each offshore investment method.

Create a Private Pension with Offshore Life Insurance and Receive a Lump Sum

When thinking about creating a private pension for the future, the most common method is offshore insurance. It is a way to invest by purchasing life insurance sold in tax havens.

Of all the ways to invest your money, life insurance is the one that is the most reliable method to increase your money and rarely lose money. However, the speed at which you can increase your money is slower than other offshore investment methods because you are assured that your money will increase.

Even so, to create a private annuity, you need to eliminate as much risk as possible. For this reason, the use of offshore annuities is effective.

The specific life insurance you should use for offshore annuities is Victory, offered by an insurance company called Sun Life. As you can see below, I have purchased life insurance from Sun Life.

Sun Life is a bigger and more global company than any life insurance company in developed countries. This means that it is far safer than leaving your money with a life insurance company in your country.

Especially in Sun Life Hong Kong, even non-residents of Hong Kong can purchase life insurance. Therefore, it is common to purchase life insurance from Sun Life Hong Kong.

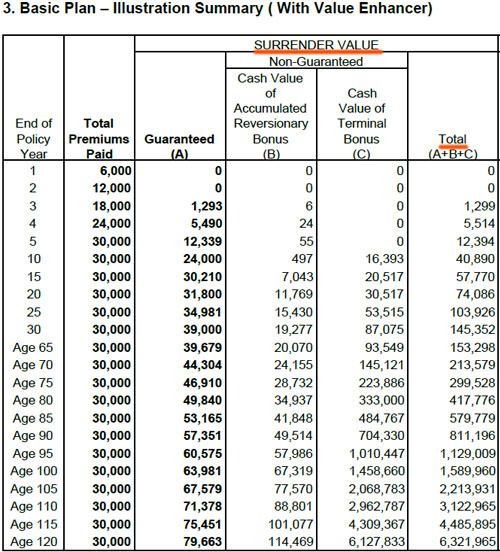

Sun Life offers many life insurance products, and the most important financial product for accumulation overseas annuity is Victory. For your reference, the following are the policy details when I paid US$30,000 when I was 34 years old.

Total Premiums Paid is $30,000. As the years go by, the amount of the surrender value (Total) increases as follows.

- After 20 years: $74,086 (about 2.5 times)

- After 30 years: $145,352 (about 4.8 times)

As you can see, my assets will definitely increase as time goes by.

Victory is an insurance product that specializes in asset management. Therefore, unlike ordinary offshore life insurance, it does not provide a high death benefit. However, this method will increase your assets efficiently. The table of return rate and yield is shown below.

| Number of years | Return rate | Interest rate |

| After 10 years | 136% | 3.2% |

| After 20 years | 246% | 4.7% |

| After 30 years | 484% | 5.4% |

| After 40 years | 940% | 5.8% |

| After 50 years | 1829% | 6.0% |

The younger you sign up for the policy and accumulate money, the more advantageous the annuity becomes. In my case, I paid a lump sum, but you can also choose to pay for 5 or 10 years as an overseas savings annuity.

Receive Annuity in Installments and Increase Your Assets

The annuity insurance mentioned above is an insurance product that provides a lump-sum payment. You receive a high surrender value by canceling the policy at any time you like.

On the other hand, there is an insurance product offered by Sun Life that pays in installments as an overseas savings annuity. In other words, instead of not being paid until the insurance contract is canceled, there is a system to get the money through installment payments. This insurance product is called Vision.

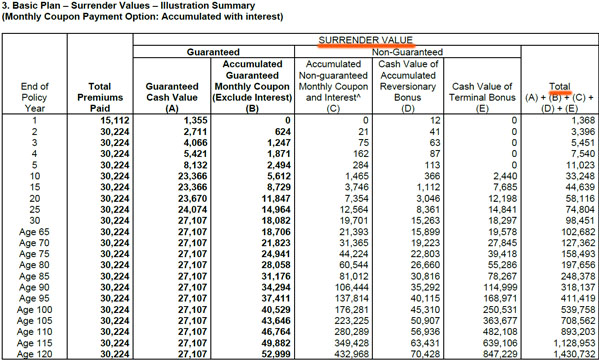

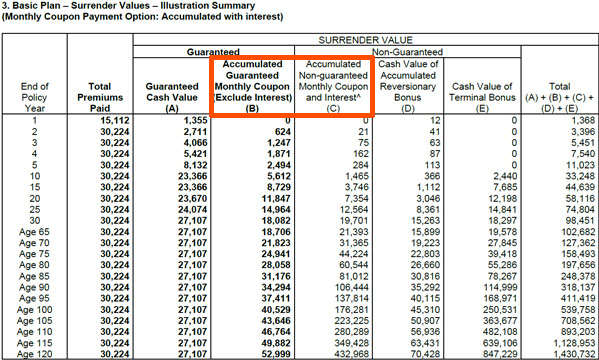

Since it is an insurance product paid in installments, the speed of asset growth is slower than the life insurance I mentioned earlier. For your reference, here is the insurance policy I bought when I was 34 years old and paid a lump-sum premium of US$30,224.

If you check the total surrender value, my money will increase as follows.

- Year 10: $33,248 (about 1.1 times)

- Year 20: $58,116 (about 1.9 times)

- Year 30: $98,451 (about 3.3 times)

Compared to the lump-sum payment mentioned earlier, the efficiency of asset management is lower because the money is paid in installments. However, if you want to receive the money in installments instead of a lump sum, this annuity is superior. In addition to the lump-sum payment, you can also choose to make 2-year, 5-year, or 10-year payments as an overseas savings annuity.

With this annuity, you will receive money every month, and the surrender value will increase. Not only will you receive the money in installments, but the surrender value will also increase over time.

So how much money can you receive in installments? To find out, let’s look at the Monthly Coupon section of the previous insurance policy.

Forty-six years after purchasing this insurance policy, I am 80 years old. I omit the details, but for example, in the five years from age 80 to 84, I will receive $23,586.

Although the initial payment is $30,224, I will receive this amount of money in just five years. In addition, the amount of money I will receive from my private pension plan will be larger when I am 85 or 90 years old. Also, I can surrender the policy in the middle of the year and receive a high surrender value.

In any case, if you prefer to receive your money in installments, you can use this annuity insurance to create your future private pension. It is better than the government’s pension plan, and offshore life insurance promises that your money will certainly grow.

Investing in a Principal Protected Offshore Mutual Fund with Installment Payments

While you can certainly increase your assets by using these offshore life insurances, some people want to increase their money more efficiently. In this case, you can use the principal protection plan of the offshore mutual fund by paying in installments.

It is impossible to make a lump-sum payment like offshore insurance, and it is an offshore investment that you must pay in installments. This is an investment product that requires you to make monthly payments until maturity.

The percentage of principal protection varies depending on when the maturity date is set. Specifically, the percentage of principal protection is as follows.

- 15-year contract: 140%

- 20-year contract: 160%

If you make installment payments as an overseas savings annuity, your money will increase at this rate if you invest at 4% annual interest. In other words, it is an investment product with a guaranteed annual interest rate of 4%.

In the case of this offshore investment, you will invest 100% in the S&P 500, which is a leading index that represents the stock prices of the top 500 companies in the United States. In the past, the S&P 500 has continued to increase in value over the long term, as shown below.

The average return of the S&P 500 is 7-9% per annum. Therefore, the annual interest rate of 4% for principal protection is a fairly low estimate, and the actual annual interest rate is 7-9%.

Unlike offshore life insurance, you cannot choose to pay the premiums in a lump sum and receive the money in installments. However, the annual interest rate is 7-9%, making it a more efficient way to invest your money than life insurance. In addition to that, the principal is protected, so even if the global recession continues for a long time, the annual interest rate of 4% is guaranteed for this investment product.

The Investment Yield Is the Same for All Agents

These low-risk offshore investments have an excellent feature. It is that the investment performance will be the same no matter which agency you apply from.

When you invest offshore, you have to go through an agent called an IFA. In the case of offshore investment, the performance of the investment varies depending on the agency you apply to. This is because the IFA is the one who gives the investment instructions.

There are some exceptions to this rule, and these are the three financial products I mentioned above. In the case of these low-risk investment products, the details of asset management are as follows.

- Victory (annuity insurance with receive lump-sum payment): Sun Life manages the assets.

- Vision (annuity insurance with receive installment payments): Sun Life manages the assets.

- Principal protection plan: 100% investment in the S&P 500.

In Victory and Vision, you invest in a life insurance company called Sun Life. Since Sun Life manages all the assets, the investment performance is the same regardless of which IFA you apply.

As for the investment products of the principal protection, all the money you pay for the regular investment will be invested in the S&P 500. The IFA does not give investment instructions, and the investment portfolio has already been fixed; therefore, there is no difference in investment performance depending on the agency you apply for.

If You Don’t Understand the Risks, You Will Get Scammed

However, even if you start investing offshore with these low-risk investment products, some people will get scammed. In particular, if you buy an investment product without understanding the risks, there is a high probability that you will be scammed.

Even though the future profits are fixed, why do some people lose money due to fraud? This is because there is a risk when you make a private annuity with an offshore investment. The same is true for all offshore investments; if you reduce the payment or surrender early in the process, you will lose your principal.

For example, in offshore annuities, you have to pay the premiums that you set at the beginning. Also, if you surrender early, such as within 8 years after paying the premiums, you will lose your principal.

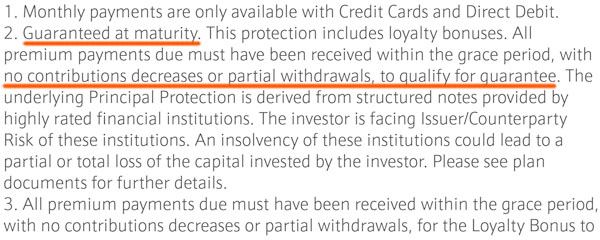

The same can be said for a principal protection plan. In the case of a principal-protection, the principal will be guaranteed only if you continue to pay the amount determined in the contract until maturity without any reduction. The official website also states the following.

It is worst if you do not understand these risks and set your monthly payment to a high amount. This is because there is a high probability of losing the principal.

Some fraudulent agents may tell you that you can reduce the payment amount midway and recommend a higher payment amount. As a result, you will not be able to pay the money after a few years, and the principal will be lost by reducing or canceling the payment in the middle. You should never apply from such scam companies.

To avoid scams, you must understand the risks of offshore investment beforehand. Although offshore investment will significantly increase your assets, you will lose your principal if you do not understand the proper way to invest.

Offshore Investment Recommended for Making Private Annuity

The public pension system provided by the government will inevitably be insufficient to cover the cost of living in old age. Therefore, it is an excellent idea to create a future annuity by investing. However, many people are not professional investors and do not know how to manage their assets.

So, let’s use offshore investment. It is possible to manage your assets in foreign countries. By paying money as an overseas savings annuity, you are promised that your assets will grow many times more than the premium you paid.

Although it is not an aggressive offshore investment with an annual interest rate of over 10%, if you want to invest in low-risk financial products with an annual interest rate of 4-8%, investing in tax havens is an excellent choice. Offshore investments are better than government pension plans and promise money growth.

However, there are risks. If you apply from a scam agency, you will lose your principal. It is important to understand the correct way to invest offshore and apply for it from an excellent IFA so that you can create a private annuity for the future.