There are several ways to make money through investing, and one of them is arbitrage trading. Although it involves investing in stocks, bonds, forex, commodities, cryptocurrencies, etc., it is a far different approach than the general investment method.

While individual investors can engage in arbitrage trading, it is difficult to make money continuously. This is because it is a method of making money by taking advantage of market distortions, and these distortions are quickly eliminated.

On the other hand, it is possible to invest in hedge funds with arbitrage strategies and earn a steady return annually. Arbitrage is said to be a low-risk investment method. However, there are many hedge funds that perform poorly, and arbitrage is an investment strategy that you need to be careful about.

Arbitrage is a method that can theoretically make money with a 100% probability. However, in reality, there are many hedge funds with negative performance, and in the past, a huge fund has gone bankrupt. So I will explain the arbitrage strategy based on actual cases.

Table of Contents

The Concept of Arbitrage: Making Money with Market Distortions

When you want to increase your assets with low risk, you can use arbitrage. The arbitrage strategy is a way to earn profits by accumulating small returns, although you cannot earn large returns.

In arbitrage, you make money by taking advantage of market distortions. There will always be distortions in the market, and you trade by taking advantage of these distortions.

For example, when you buy an orange, the price is high in urban areas. Also, if you order an orange from a restaurant in a luxury hotel, the price is much higher. On the other hand, if you buy directly from an orange farmer, the price is lower.

Thus, even though they are the same product, prices vary depending on where you buy them. The same is true for financial products, and it is common for prices to vary by the brokerage firm. For example, it is as follows.

- Brokerage A: $1.00 per share

- Brokerage B: $1.01 per share

In this case, if you buy the stock at brokerage A and sell it at brokerage B, you will make 1 cent per share. This is a simple overview of the arbitrage strategy.

Trading in Stocks, Bonds, Forex, Commodity Futures, Cryptocurrencies, and More

There are many investments that can be traded in arbitrage strategies, including stocks, bonds, and commodities. In other words, all financial instruments can be considered as investment targets.

- Stocks

- Bonds

- Forex (currency)

- Commodity futures

- Interest rates

- Cryptocurrencies

These are the trading targets.

You Can’t Profit from the Same Investment

In practice, however, we do not use arbitrage trading to invest in the same stocks and bonds, even if they are priced differently at different brokerages. This is because even if it is theoretically possible to make money from price differences, it is impossible to make money this way.

Even in the real world, it costs a lot of money to buy oranges from farmers at a low price and transport them to cities. It also takes a few days to transport the oranges. This time and cost must be taken into account.

The same is true for financial transactions; you have to pay trading fees to buy stocks, bonds, currencies, and cryptocurrencies. In addition, you have to actually send the stocks, bonds, commodities, and cryptocurrencies in order to sell them through other brokerage firms. In other words, it takes time.

The prices of financial instruments, including stocks, are constantly fluctuating. Therefore, when you buy them, there is a distortion in the market price, and even if you can buy them at a low price, you may not be able to earn a profit. This is because the price often drops while you are sending it to another brokerage firm, and you end up losing money.

As an example, let’s consider the same situation as before.

- Brokerage A: $1.00 per share

- Brokerage B: $1.01 per share

In this case, you buy a share from Brokerage A for $1.00 per share. Next, you send the shares to Brokerage B to sell, but after 5 seconds, the price drops to 98 cents per share. In that case, you will lose 2 cents per share. Therefore, in practice, we do not use arbitrage strategies for the same investment target.

Even if you were able to get the price difference on the same investment, there would be almost no profit when you consider the trading fees and time.

Arbitrage Strategies Combine Linked Investments, So Theoretically 100% Probability of Making Money

The actual arbitrage strategy is a combination of linked investments. For example, the combination might look like this.

- Stock and Stock Futures

- Stock futures and stock options

- Government bonds and corporate bonds

- Two emerging market currencies

For the same investment, there is almost no price difference. Therefore, when hedge funds do arbitrage trading, they almost never make a profit. Also, if we take into account trading fees and other costs, the return will be negative. Therefore, in arbitrage, we use different but linked investments.

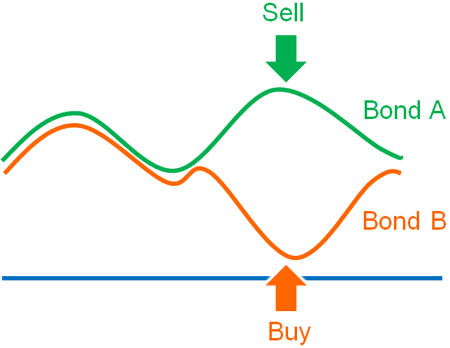

Although there is linkage, the two prices can be far apart. It looks like the following.

If there is a linkage between two prices, even if there is a temporary price difference, it will return to its original state after a period of time. So when a price difference appears, you sell the stock with the higher price and buy the stock with the lower price. Then, when the price difference disappears, you can make a profit.

Because we use linked investments, the arbitrage strategy is theoretically 100% profitable. The reason why arbitrage trading is said to be low-risk is that it is a theory that always makes money.

This strategy is also known as the relative value strategy. In the relative value strategy, you sell overpriced investment products and buy undervalued ones.

Difficult for Retail Investors to Make Money with Arbitrage Trading

However, although it is theoretically profitable, individual investors should not engage in arbitrage trading. This is because even if it is theoretically correct, prices do not move theoretically in the actual financial market.

The arbitrage strategy is based on the assumption that extreme prices will return someday. If a company is profitable, its stock price will rise someday. And even if bond prices fall, the price of bonds that offer dividends will someday return to their original price.

However, phenomena that do not follow this assumption often occur in the financial market. For example, the following case is common.

- Stock prices fall and then do not rise at all.

- The value of a currency has continued to decline for decades.

- Bond values fall to almost zero and do not rise.

For example, let’s look at the value of the Turkish lira and the US dollar over the past 15 years.

As you can see, the value of the Turkish lira has been declining for a long time. In the real financial market, such phenomena occur frequently. As a result, it is impossible to earn money as the theory goes. In fact, retail investors who have invested in the Turkish lira in the past have lost a lot of money.

Even if it is theoretically correct, it is not useful in actual financial transactions. Therefore, there is no sure-fire way to make money with arbitrage strategies.

Also, when a hedge fund makes arbitrage trades, the computer makes decisions such as overpriced or undervalued and trades. Individuals, on the other hand, cannot make instantaneous decisions like a machine. This is another reason why arbitrage trading is not suitable for individuals.

Beware of Arbitrage Trading Hedge Funds

In addition to arbitrage trading by individual investors, they should also be careful about investing in hedge funds that adopt the arbitrage strategy.

Arbitrage strategies can theoretically increase assets with a 100% probability, as mentioned above. It is frequently used in scams because it is theoretically impossible to lose money, although in practice it is frequently possible to lose a lot of money.

-The Collapse of LTCM Using Arbitrage Strategy

There have been many cases in the past where hedge funds with arbitrage strategies have gone bankrupt, even if the funds were not fraudulent. One of the most famous examples is LTCM (Long-Term Capital Management), a hedge fund that went bankrupt in 1999.

LTCM had adopted a strategy of shorting overvalued bonds and buying undervalued bonds. In other words, it is an arbitrage strategy (relative value strategy) to generate profits. The management team included Nobel Prize winners in economics, and computers made all the trading decisions, resulting in an excellent performance in the first few years.

However, the Asian financial crisis in 1997 and the Russian financial crisis in 1998 caused LTCM to lose most of its assets. LTCM had invested in emerging market bonds, and under normal circumstances, the price of emerging market bonds would return over time. However, in times of financial crisis, the price does not return, and like the Turkish lira I mentioned earlier, there are frequent cases where the price continues to fall.

Also, LTCM was leveraged up to 25 times. As a result, LTCM suffered huge losses and went bankrupt.

You Should Check the Actual Investment Performance Before Investing

The collapse of LTCM is very well known and shows that even arbitrage strategies, which are considered low risk, can lose a lot of assets during a financial crisis.

So when investing in a hedge fund with an arbitrage strategy, check the past performance. By looking at the actual fact sheet, you will be able to know if you should invest in that hedge fund or not.

In addition, as an important point, find out what kind of returns they have produced in the past financial crisis. This is because they can lose most of their assets due to the financial crisis, even if they have been performing well in arbitrage strategies. An actual example is the collapse of LTCM.

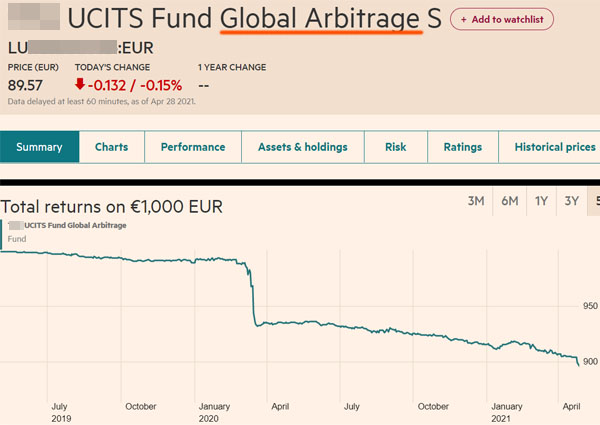

For example, the following is the performance of a hedge fund that uses an arbitrage strategy.

This fund was launched in February 2019 and has had negative returns all along. It also lost a lot of assets in February 2020 when the Corona shock happened. So, you can see that you should not invest in this hedge fund.

In the arbitrage strategy, there are hedge funds with excellent performance, and there are hedge funds with poor performance. Therefore, if you want to invest in a hedge fund that engages in arbitrage trading, make sure you understand the risks involved and check its past performance.

Be Careful Investing in Hedge Funds with Arbitrage Strategies

Arbitrage trading is effective for all types of investments, including stocks, bonds, forex (currencies), commodities, and cryptocurrencies. And theoretically, arbitrage trading has a 100% probability of making money.

However, even if we can make money theoretically, there are many cases where we cannot make money in the actual financial market. In fact, arbitrage trading is not suitable for retail investors.

It is not only individual investors who may lose money in arbitrage trading but professional investors as well. In the past, LTCM, which adopted a bond arbitrage strategy (relative value strategy), went bankrupt. There are also many hedge funds that use arbitrage strategies with poor performance.

Although arbitrage trading is said to be low-risk, it is actually a high-risk investment method. In fact, there are a number of hedge funds like LTCM that have made more than 20% annual interest through arbitrage trading, but collapsed due to the financial crisis. So, when investing in a hedge fund that engages in arbitrage trading, make sure to check its past performance.