One of the most useless ways to manage your assets is to deposit money in a bank. Your money will hardly grow if you use bank deposits. Therefore, you have to think about increasing your money by actively managing your assets.

However, in the case of beginner investors, many people think that they do not have large enough assets to invest. However, one of the best points of investing is that the assets will increase with compound interest. Therefore, if you start investing now, your money will increase significantly in 10 or 20 years.

Even if you invest a small amount, it is easy to create hundreds of thousands of dollars in assets. With asset management, you can increase your assets many times through compound interest.

Of course, if you don’t invest correctly, you will suffer losses. Therefore, I will explain how beginners can increase their assets by investing in small amounts.

Table of Contents

Even Beginners Should Invest in Small Amounts

Many people want to start investing in small amounts using the money they have saved. Even if it is a small investment by a beginner, the earlier you start, the better profit you will get.

The reason why you should start investing as early as possible is that your money will grow through compound interest. For example, if you invest US$10,000, the compound interest will increase your money as follows.

-In the case of an annual interest rate of 10%

| 1st year | 3rd year | 10th year | 20th year |

| $11,000 | $13,310 | $25,940 | $67,270 |

As you can see, the money will increase significantly. In the case of increasing money through compound interest, the speed of money increase accelerates as time passes. This is because, for the money that has been increased by asset management, more money will be added by asset management.

The reason why you should start investing as early as possible even if you are a beginner is that if you do not invest, you will not be able to manage compound interest and you will be losing opportunities.

If You Invest Correctly, Anyone Can Achieve 10% Annual Interest

However, if you are an amateur investor, you may think that it is impossible for a beginner to achieve 10% annual interest rate through investment. It is true that when investing in individual stocks, it is difficult for an amateur investor to achieve a superior annual interest rate. Unless you are a professional investor, you will not be able to determine which stocks to invest in to increase your assets.

On the other hand, if you invest in index funds or offshore, it is possible for even an amateur investor to earn an annual interest rate of 10% or more. For example, the S&P 500 is known as an index that invests in the top 500 companies in the United States. The following is the historical stock price of the S&P 500.

One of the best investments for beginners is the S&P 500. This is because the US has the strongest economy, a growing population, and its stock prices have been rising for a long time.

It is also widely known that the average annual interest rate for investing in the S&P 500 is 7-9%. In addition, the dividend is 2% per year, so if you add the dividend, the average annual interest rate of the S&P 500 is over 10%. In other words, anyone, even a beginner investor, can achieve an annual interest rate of 10% by investing in the S&P 500.

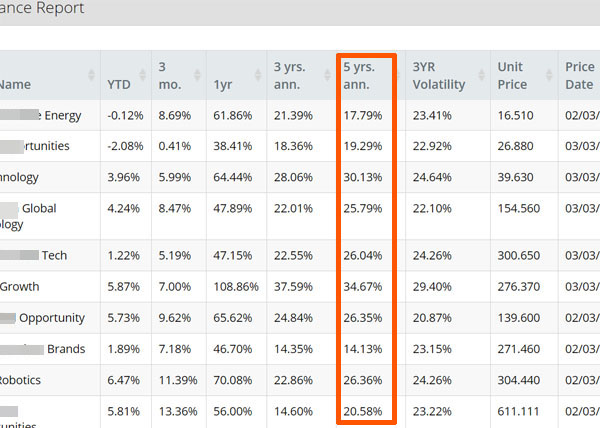

Alternatively, you can use offshore investments. Offshore investments involve investing in offshore tax havens where there are almost no taxes. For example, the following is the result of my use of offshore investment.

I manage my assets by using offshore investments and investing in professionally managed funds. The average annual interest rate for the past five years is about 24.1%. Although investment returns will be worse during a recession, we can increase our assets in this way.

If you understand these facts, you will see that depending on the method, even an amateur retail investor can achieve excellent results through asset management.

Monthly Regular Investment Is Better for Beginners

When managing assets with compound interest, savings investment is excellent for beginners. Since stock prices rise and fall, you can diversify your risk by investing a fixed amount every month.

If the stock price rises, the asset value will increase. If the stock price falls, you can buy stocks at a lower price. In other words, whether the stock price goes up or down, you will benefit. This is the reason why monthly savings investment is excellent for beginner investors.

Also, if you invest in the proper funds, the value of your assets will continue to rise over the long term. Even if the stock price drops temporarily, the short-term decline in asset value is irrelevant as long as the asset value will increase significantly in 10 or 20 years.

-Simulation of an Investment with an Annual Interest Rate of 10%.

If you save money and invest US$100 per month, what kind of asset management will be achieved by compound interest? With $100 a month, many people can invest.

In the case of saving and investing $100 per month at an annual interest rate of 10%, the results are as follows.

| Number of years | Principal | Amount of assets |

| 5 years | $6,000 | About $7,800 |

| 10 years | $12,000 | About $20,600 |

| 15 years | $18,000 | About $41,800 |

| 20 years | $24,000 | About $76,600 |

| 25 years | $30,000 | About $133,800 |

| 30 years | $36,000 | About $227,900 |

As you can see, the amount of assets increases at an accelerated rate as the years go by. It also shows that even a small investment of $100 per month can create a large amount of assets through compound interest.

High-Risk Investments Are Superior for Initial Investment

Even if you are a beginner, I recommend that you invest in high-risk investments at the beginning. This is because in the early stage of investment, the principal amount invested is small, and even if your assets are reduced due to a decline in stock prices, it will not have a significant impact. Rather, it is more favorable for you if stock prices fall because you can buy stocks at a lower price.

By investing in high-dividend stocks and bonds, it is possible to manage assets with low risk. However, there is no point in investing in low-risk assets in the early stages of investment, and you should always choose high-risk investments.

High-risk investments include the S&P 500, which I explained earlier. In short, you should understand that any investment that can aim for an annual interest rate of 10% or more is high risk.

For your reference, below is a chart comparing the price of the S&P 500 and HYG which is a bond that pays about 5% annual interest.

HYG (blue line), a bond, has barely changed in price. On the other hand, the S&P 500 (yellow line) has a large price movement. The chart also shows that if you invest in a fund that will increase in value over the long term, you can increase your assets more than if you invest in bonds.

For this reason, even amateur individual investors should actively invest in high-risk assets in the early stages of investment.

The Most Important Thing Is to Choose the Suitable Fund to Invest in

However, investing in a high-risk fund does not mean investing in a fund with a high probability of loss. You need to invest in funds whose prices have a high probability of increasing in 10 or 20 years, such as the S&P 500, which I explained earlier.

For example, Chinese stocks are known for their high risk and low return, and are known as an investment destination that professional investors avoid. The reason is that China has almost no growth in stock prices. Below is a stock chart of the Shanghai Composite Index (SSE Composite Index).

You can understand that investing in Chinese stocks will not increase your assets by checking the historical stock prices. These funds have a high probability of reducing the value of your assets, so you should always avoid investing in them.

Therefore, even if you are a beginner, it is important to know which fund to invest in. If you invest in a bad fund like Chinese stocks, your money will not increase with compound interest. Rather, in some cases, your money will decrease with compound interest. This is the reason why even amateur retail investors should check the past average annual interest rates of the funds they invest in.

Low-Risk Investment Is Possible by Principal Protection

When beginners invest a small amount of money, they cannot decide which investment is best for them, so many people look for a lower-risk investment method. In this case, you can invest in offshore investments with principal protected.

In many countries, there is no excellent principal-protected investment product. On the other hand, in tax havens, there are a number of investment products that can increase your assets with principal protected investment. For example, the following is an investment product that promises to increase your assets to over 140% in 15 years and over 160% in 20 years.

This is an offshore financial product that invests in the S&P 500, allowing you to grow your assets at an annual interest rate of 10% or more, while adding principal protection. Although the stock price may decrease by half due to a major recession, the value of your assets will surely increase with the principal protected investment.

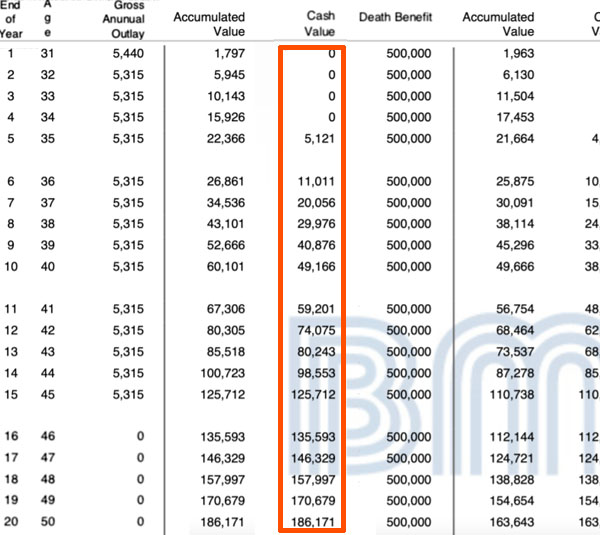

Alternatively, you can use offshore life insurance. As for offshore life insurance, you can also increase your assets while adding principal protection through savings investment. For example, the following is an American life insurance policy.

The US is the world’s largest tax haven, and there are many excellent insurance products available. In this life insurance, the investment yield is 1-16%. This means that even in a major recession, you are guaranteed a 1% yield.

Also, with this insurance design, you will pay a total of US$79,850 in premiums over 15 years. After that, the assets (surrender value) will increase as follows.

- Year 15: $125,712 (about 1.6 times)

- Year 20: $186,171 (about 2.3 times)

- Year 30: $450,212 (about 5.6 times)

- Year 40: $1,079,878 (about 13.5 times)

- Year 50: $2,590,018 (about 32.4 times)

Of course, you can use this life insurance with a small investment. If you don’t know which fund to invest in, or if you want to reduce your risk as much as possible, you can use an investment product that offer principal protected investment, so that even beginners can increase their assets significantly through compound interest.

For reference, this life insurance policy invests in Nasdaq 100, an American technology stock that is known for having a higher average annual interest rate than the S&P 500. Below is the stock price history of Nasdaq.

Buying financial instruments in tax havens allows you to invest in funds that have a high potential for stock price appreciation, while adding principal protection. This allows you to increase your assets through compounding while achieving high yields.

Amateur Retail Investors Should Start Asset Management as Soon as Possible

Even if you are an amateur investor, you should start investing as soon as possible. This is because the earlier you start investing, the greater the effect of compound interest. Even a small amount of money made by saving can become a large asset in the future if invested monthly.

High-risk investments are excellent, especially in the early stages of investing. Specifically, try to invest in stocks. Of course, invest in funds that have a high probability of rising in value over the long term, not in high-risk, low-return investments like Chinese stocks.

If you are worried about risk, you can also use investment products that protect your principal. For example, if you invest offshore, you can invest in the S&P 500, Nasdaq, etc., and your profits are promised to increase by principal protected investment.

Start investing now, even if it is as little as US$100 per month. If you do, your future assets will be in the hundreds of thousands of dollars.