American life insurance is known for its excellent products. One of the life insurance companies in the United States is BMI (Best Meridian Insurance Company).

BMI offers Best Index Plus life insurance, also known as universal life insurance. In addition to a high death benefit, BMI offers a life insurance policy that allows you to grow your money through asset management.

So, what kind of life insurance is Best Index Plus? If you don’t understand the product, you can’t buy a good offshore life insurance policy.

Even though you are not an American, you can buy Best Index Plus. In this article, I will explain how you can take advantage of Best Index Plus.

Table of Contents

You Don’t Have to be a US Resident to Buy from BMI

BMI (Best Meridian Insurance Company) is a life insurance company based in the United States. The United States is known as the world’s largest tax haven, and many people use it to avoid taxes. Because it is a tax haven, the US has a developed financial system, and there are many excellent life insurance companies.

BMI is one of the American-registered life insurance companies, and many people use it for asset management.

BMI is a large insurance company and has been rated A- (Excellent) by A.M. Best. A.M. Best is the oldest insurance rating agency in the world (founded in 1899).

Naturally, BMI has large assets and policyholders, and it has many offices around the world. Since you are investing in a huge company, it is a good place to put your assets.

Buying Universal Life Insurance as Whole Life Insurance

Universal insurance is widely used in the United States. Universal insurance refers to an insurance product that not only provides a death benefit but also increases your money through a single life insurance policy. Most of the individual life insurance policies issued in the United States are universal insurance.

Universal insurance is whole life insurance, and Best Index Plus has a long policy age of 121 years old. In other words, universal insurance is a whole life insurance policy with a 100% probability of receiving death benefits.

In addition to the feature of whole life insurance, universal insurance allows you to increase your money through asset management, and in the case of life insurance offered by BMI, you can invest your money at an annual interest rate of more than 7%. Therefore, the surrender value is many times higher than the total amount of money paid.

-You Do Not Need to Travel to the US to Purchase Life Insurance

BMI is a US life insurance company, so of course, Americans can buy its products. In addition, as an offshore life insurance company, non-Americans can also purchase BMI products without having to travel.

Normally, life insurance sold in the US is only available to US residents. However, in the case of BMI, even foreigners who are not residents of the United States can purchase insurance.

People who can purchase BMI life insurance as offshore insurance are those who live in the following countries.

- EU regions

- Canada

- Japan

- Hong Kong

- Taiwan

- Singapore

- Australia

- New Zealand

If you live in any other country, you cannot purchase Best Index Plus.

Index-Linked Best Index Plus

What are the features of the Best Index Plus offered by BMI? The specifications of Best Index Plus are as follows.

| Minimum death benefit | USD 100,000 |

| Issue age | 1-75 years |

| Maturity age | 121 years |

| Payment period | Any (recommended: 15 years or more) |

| Payment frequency | Annual payment only |

| Payment method | The overseas remittance, credit card (VISA, MASTER, AMEX, JCB) |

| Interest rate | 1- 16% |

With Best Index Plus, you must always set the minimum death benefit amount to be at least US$100,000. There is a minimum death benefit amount, although the conditions vary depending on the age and health of the policyholder. In addition to this, the minimum premium to be paid is determined by taking into account the payment period.

Payments are always made annually, and lump-sum or monthly payments are not an option. It is an insurance product that requires you to invest your assets through a regular investment.

Payment can be made by overseas remittance or credit card. If you have a US account, you can also use a bank transfer in the US. However, unless there is a special reason, most people choose to pay by credit card.

As a reminder, when you pay by credit card, 2% of the payment amount will be deducted as a fee. Although this is not a problem since the money will increase with compound interest every year, you should be aware of the credit card payment fee.

You can choose the payment period for your premiums, such as 10 years or 20 years. The recommended payment period is 15 years or more to get the bonus from BMI.

No Loss of Principal and a Minimum Yield of 1%.

When you purchase Best Index Plus, the money you pay is invested in stocks. Best Index Plus is an index-linked insurance product that grows your assets by investing in US stocks (an Index Fund).

One important feature is that it is designed to ensure that your assets will grow. Specifically, a minimum yield of 1% is guaranteed.

Normally, when you invest in stocks, you will get a negative return during a recession because the stock price will go down. On the other hand, if you invest in Best Index Plus, you will not lose any of your assets even if the index fund performs poorly in a recession. On the contrary, you will earn a 1% yield.

On the other hand, the maximum annual interest rate is 16%. Therefore, even if the index fund has an excellent performance of 30% in one year, the rate of increase of your assets is 16%.

While your assets will not decrease during a major recession, you will not be able to increase them significantly during a booming economy. Therefore, universal life insurance is suitable for people who want to manage their assets with low risk and increase their money without fail.

Indexes Linked to the S&P 500 or Nasdaq 100

When you buy Best Index Plus, you will be investing in the S&P 500 or the Nasdaq 100.

The S&P 500 is an index that is linked to the stock prices of the top 500 companies in the US. The historical price movements of the S&P 500 are shown below.

On the other hand, Nasdaq is known as a stock market in the United States that mainly lists high technology companies and IT companies. Among the stocks listed on Nasdaq, the Nasdaq 100 shows the stock prices of the top 100 companies.

The following is the stock price history of Nasdaq.

The Nasdaq 100 has greater price movement than the S&P 500 because it is dominated by high-tech companies. Although the average yield of the Nasdaq 100 is better, the Nasdaq 100 is more likely to fall than the S&P 500 during a recession.

-When Investing in the Nasdaq 100, the Average Annual Interest Rate Is 7.56%

However, as mentioned above, if you use Best Index Plus, you are guaranteed a 1% yield even if the stock price has fallen significantly. For example, even in 2008, when Nasdaq’s stock price fell 40% due to the collapse of Lehman Brothers, your assets will still grow at a rate of 1%.

As mentioned above, the average annual interest rate of the Nasdaq 100 is better than the S&P 500. In other words, the stock price appreciation is greater in the Nasdaq 100. Therefore, investing in the Nasdaq 100 will increase your assets faster.

Specifically, the average yield from purchasing insurance products offered by BMI is as follows.

- S&P 500: the average annual interest rate is 6.93%.

- Nasdaq 100: the average annual interest rate is 7.56%.

The average annual interest rate is better for the Nasdaq 100, although it varies from year to year, and because of the greater volatility of the Nasdaq 100, it is easier to grow your assets by investing in the Nasdaq 100 in Best Index Plus.

You Can Stop and Resume Payments at Any Time

Another feature of Best Index Plus is that you can stop or resume payments at any time.

Usually, insurance products are designed to ensure that you lose money if you stop paying. If you pay your premiums according to the number of years you initially decided, you can achieve excellent asset management with offshore life insurance. On the other hand, if you do not pay the money according to the contract you initially agreed upon, you will lose a lot of money.

Also, if you want to resume payment, you have to pay the premiums for the period you had not paid.

With Best Index Plus, on the other hand, you set the payment period at the beginning, but you can stop paying in the middle. Although the surrender value will be higher if you continue to pay the premiums considering the commission refund and bonus, you can stop paying in the middle of the payment period if you become unable to pay due to unemployment or other reasons.

-Stop Payment by Yourself

To stop payment, you need to log in to the membership website and follow the procedures. If you find it difficult to make the payment, you can stop the payment by yourself. You can stop the payment before the payment period you initially set comes.

Also, if you are able to pay the money, you can resume the insurance payment. You are free to decide the payment of your money.

Note that the procedure to stop the payment must be done by you in any case. For example, if you set a payment period of 15 years, you will be required to pay premiums for the 16th year if you do not take any action. It doesn’t mean that the payment will stop automatically.

Refund of Fees and Bonus on Interest

As mentioned above, you can stop paying money at any time. However, unless you have a special reason, we recommend that you continue paying money. The reason for this is that Best Index Plus offers the following bonuses.

- 15th year: 75% of the fees you paid up to that point will be refunded.

- Year 20 and beyond: 1.5% interest added annually.

You can receive this bonus if you do not stop paying and make any partial withdrawals in the middle of the program. You will not receive the bonus if you stop paying in the middle.

The reason why it is recommended to set the payment period to 15 years or more is because of this bonus. Receiving the bonus will greatly increase the surrender value, so it is recommended to set the contract for at least 15 years of payment.

Check the Actual Insurance Design

What does the Best Index Plus insurance policy look like? Below is a description of the actual insurance policy.

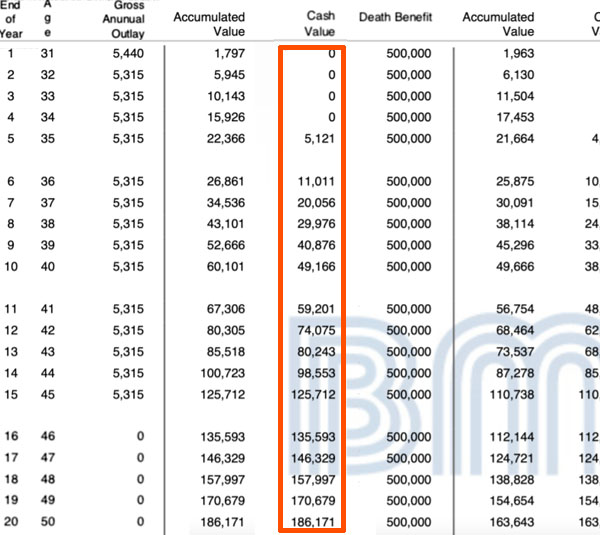

This is the insurance design for a 30-year-old male with a payment period of 15 years and a death benefit of US$500,000. You can see that the Gross Annual Outlay is zero from the 16th year.

The total payment over 15 years is US$79,850. Nevertheless, the death benefit is as high as US$500,000.

-The Break-Even Point Is the 11th Year

The break-even point for surrender value (Cash Value) is the 11th year. Therefore, if you use Best Index Plus, you can see that your assets will increase significantly after the 11th year.

For reference, for a total payment of US$79,850, the surrender value increases as follows with this insurance design.

- 15th year: $125,712 (about 1.6 times)

- 20th year: $186,171 (about 2.3 times)

- 30th year: $450,212 (about 5.6 times)

- 40th year: $1,079,878 (about 13.5 times)

- 50th year: $2,590,018 (about 32.4 times)

In the death benefit, on the other hand, the money increases as follows for a total payout of $79,850.

- 20th year: $500,000 (about 6.2 times)

- 30th year: $603,284 (about 7.6 times)

- 40th year: $1,252,658 (about 15.7 times)

- 50th year: $2,719,519 (about 34.1 times)

As time passes, both the surrender value and the death benefit will increase. Also, the more years pass, the greater the effect of compound interest on the investment.

Early Cancellation Results in Loss of Principal

It is important to note that early surrender will always result in a loss of principal. As is the case with all life insurance products, there is almost no surrender value if you cancel early. If you check the insurance policy mentioned earlier, you will see that the surrender value is zero until the fourth year after purchase.

Among offshore investments, life insurance is the least risky way to invest. In fact, as I have mentioned, if you use Best Index Plus, your assets will be invested at an annual interest rate of 1-16%. In other words, there is no negative return.

However, due to the nature of insurance products, the surrender value is low initially. Also, the break-even point is the 11th year. Therefore, you should never cancel your policy early.

-The Recommendation Is to Stop Payment, Instead of Early Termination

The recommendation is not to cancel early, but to stop payment. As mentioned above, Best Index Plus allows you to stop payments at any time. Although no bonus is given, the surrender rate increases as time pass. In other words, after 15 or 20 years from the date of purchase, the surrender value will be larger than the payment amount.

Therefore, even if you can no longer afford to pay the money, you should choose to stop paying instead of canceling.

What Is the Minimum Annual Payment?

How much will the minimum annual payment be? The minimum death benefit must be set to be US$100,000. However, the annual premium will vary depending on your age when you sign up and the payment period.

So, as an example, let’s consider the following case.

- Sign up at age 30.

- The payment period is 15 years.

In this case, the minimum annual premium payment is US$871. Only in the first year, a setup fee of $125 is added, but other than the first year, the premium is $871. Although the minimum premium varies depending on the policy age and payment period, it is an example for your reference.

-Add a High Death Benefit with Low Premiums

If you pay $871 annually for 15 years and pay a setup fee of $125 in the first year, the total premium paid is $13,190.

By paying $13,190, you can get a whole life insurance policy with a death benefit of $100,000. Also, the surrender value will increase, so you can withdraw or cancel the policy at some point and use the money. Universal insurance in the US is a great way to get a high death benefit at a low premium.

Universal Insurance in the US Is Superior

As the largest tax haven in the world, the United States has many excellent insurance products. One of the American life insurance companies is BMI, and they offer a universal insurance policy called Best Index Plus. This is an offshore life insurance policy that can be purchased even by non-residents of the US.

It is an insurance product that provides high death benefits with low premiums, and a high annual interest rate to increase your assets. Although it is an index-linked insurance product, there is no negative return, and the yield is guaranteed to be 1% even during a major recession.

If you want to invest in an index that will ensure your money grows while getting a death benefit, buying Best Index Plus is an excellent choice.

If you want to buy life insurance in the United States, choose the Best Index Plus offered by BMI. By paying annually, you can increase your future assets many times over.