If you want to invest in bonds, you need to understand how bond values are determined. Most people who invest in bonds are looking to earn interest income. However, if the price of the bond declines, the income you get will decrease. In other words, you will lose your principal when you sell the bond.

If you do not understand the best time to invest in bonds, you may lose money by investing in bonds. Although bonds do not fluctuate much in value, you may not be able to profit from your bond investment.

The key factor in investing in bonds is the interest rate. When interest rates rise, bond prices fall. There is an inverse relationship between interest rates and bond prices.

So why do interest rates and bond prices have an inverse relationship? And when is the best time to buy bonds? Let’s take a look at these questions.

Table of Contents

Bond Yields Rise as Policy Rates and Long-Term Interest Rates Rise

The central bank determines the policy interest rate. The policy rate should be understood as a short-term interest rate with a term of less than one year. The policy rate has a significant impact on long-term interest rates. Roughly speaking, the long-term interest rate can be calculated as follows.

- Long-term interest rate = policy interest rate (short-term interest rate) + economic conditions

The long-term interest rate is determined by whether the economy will improve or worsen.

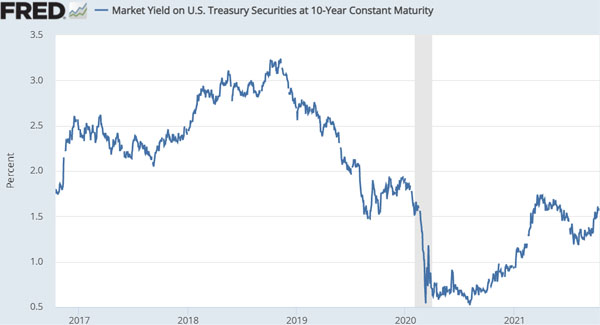

Also, when short-term and long-term interest rates rise, it means that the yield on purchasing government bonds will rise. For reference, here is the movement of the yield on the 10-year US Treasury bond.

When yields on government bonds fluctuate due to policy rates or long-term interest rates, other bond yields will naturally move as well. In addition to government bonds, there are also corporate bonds.

When the yield on government bonds rises, the yield on corporate bonds must be raised; otherwise, investors will not buy them. Government bonds are lower risk than corporate bonds, and if they do not offer higher yields than government bonds, the company will not be able to attract investment money.

In other words, understand that when the yield on government bonds rises due to rising interest rates, the yield on all kinds of bonds will rise.

When Interest Rates Rise, Bond Values Fall

On the other hand, when interest rates rise, bond prices fall. Why do interest rates and bond prices have an inverse correlation? Let’s understand the reason.

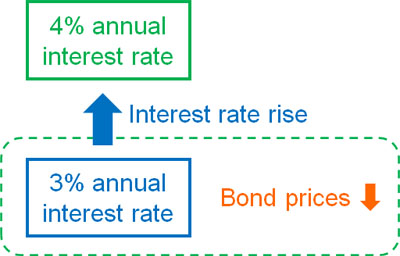

For example, suppose there is a corporate bond with a yield of 3%; if you invest $10,000 in this bond, you will get a dividend of $300 after one year. However, interest rates always fluctuate. Even if the bond is issued by the same company, the interest rate can be 4% or 2% depending on when you buy the bond.

What if the yield on a corporate bond rises to 4% due to a rise in interest rates? Newly issued bonds will have an annual interest rate of 4%. On the other hand, previously issued bonds have a yield of 3%. Therefore, at the same price, no investor would buy a bond with poor conditions (a bond with a 3% yield).

Therefore, when previously issued bonds with a 3% yield are sold to others, you must reduce the bond price. Because it becomes less attractive as an investment if the price is the same, investors are able to buy 3% yielding corporate bonds at a lower price than before.

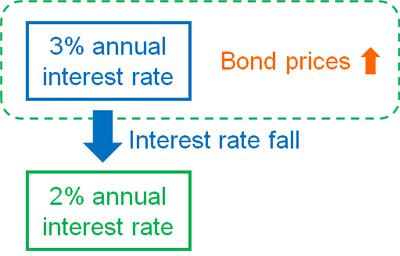

On the other hand, what happens when interest rates fall and the yield on corporate bonds drops to 2%? In this case, the previous bonds with a yield of 3% are superior to the newly issued bonds with a yield of 2%. Therefore, the value of the 3% yielding bonds will increase. There are many people who are willing to pay a lot of money to get a higher yield.

This is the reason why bond values rise when interest rates fall.

Understand how interest rates and bond prices are determined. Bond prices are closely related to interest rates.

When Bonds Are Sold, Long-Term Interest Rates Rise

To be more precise, long-term interest rates rise when government bonds are sold. The fact that many government bonds are bought means that they are trusted by the public. While central banks can decide the policy rate, they cannot decide long-term interest rates such as the 10-year bond yield. The market determines the long-term interest rate.

The creditworthiness of a country affects bond prices and long-term interest rates.

For example, when you buy a government bond, would you prefer to buy a US government bond or a North Korean government bond? Without a doubt, you would want to buy a US government bond. In the case of North Korean government bonds, there is a high possibility that you will not get your money back.

The interest rates on government bonds of emerging countries are high. The reason for this is that the country is not creditworthy. In other words, the default risk and currency risk are high, which is why the interest rates are high.

If the interest rates are the same, no one will buy the bonds of emerging countries. On the other hand, if interest rates are high, even if the country’s creditworthiness is low, investors who can take risks may pay for it.

There are several countries that have defaulted, such as Argentina and Russia. If the default risk is high, many people will sell their bonds because the risk is high. In that case, the yield of the bonds must be high; otherwise, investors will not buy the bonds.

A high yield on bonds means that the risk is high. Therefore, when bonds are sold, the bond yield becomes higher. Also, when bond yields are increasing, it means that bonds are being sold.

- Bonds are bought: Interest rates go down.

- Bonds are sold: Interest rates go up.

This is the relationship between interest rates and bonds.

Bonds with Longer Redemption Periods Have Higher Price Volatility and Higher Risk

Government bonds and corporate bonds have redemption periods, some of which are shorter, such as one year, and some of which are longer, such as 10-year government bonds.

The price of short-term bonds fluctuates little. Short-term bonds are heavily influenced by the policy interest rate, so unless there is a risk of default, the price of the bond will hardly change. On the other hand, if you invest in bonds with a longer-term, the yield will be higher, and the price will fluctuate greatly.

So, naturally, investing in bonds with longer redemption periods will result in significant price movements.

Many people buy bonds as mutual funds (ETFs). This means that regardless of the maturity period, you can buy and sell bonds at any time by using ETFs.

For example, below is a bond ETF called BND that pays about 2% annual interest.

- Vanguard Total Bond Market Index Fund ETF (BND)

This bond ETF is a mixture of government and corporate bonds and can be bought and sold at any time. The higher the yield, the lower the bond price.

Different mutual funds invest in different types of bonds. This means that yields and risks are different. Naturally, the higher the yield of a bond ETF, the higher the risk, and the longer the redemption period of a bond, the greater the impact of price declines due to rising interest rates.

The Best Time to Buy Bonds Is Right Before an Economic Downturn and Stock Prices Fall

Therefore, when investing in bonds, it is important to understand the best time to invest. That is before the economy turns bad.

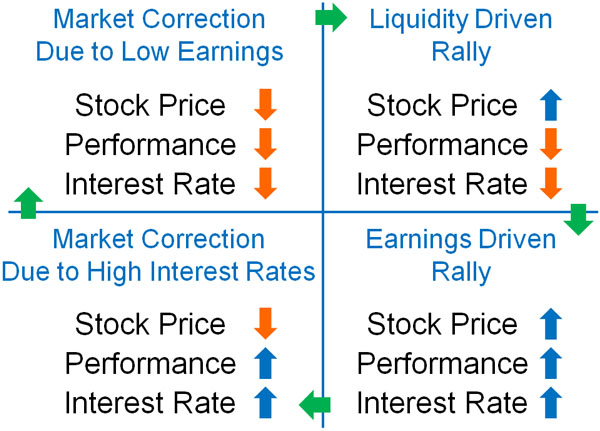

There is a cycle in the economy. Every few years, there is always a major recession. After a major recession, there is a liquidity-driven market, where interest rates are low, and stock prices rise sharply due to monetary easing. The following is the economic cycle.

With the exception of professional investors, you should not buy bonds after a major recession has occurred. After a major recession, policy rates are low and bond yields are low. Low yields mean high bond values, as mentioned earlier.

However, when the economy recovers, the central bank stops monetary easing and starts tightening monetary policy. This means that the policy rate will rise. When the economy is strong, long-term interest rates also rise. As both policy rates (short-term interest rates) and long-term interest rates rise, bonds are sold accordingly.

The reason why you should not buy bonds after a recession is that there is a high probability that bond prices will fall and you will lose money due to monetary easing by central banks and the growing economy. Also, after a recession, there is less interest income because you are buying bonds when interest rates are low.

Instead, invest in bonds in a recessionary situation. In this case, the Fed and other central banks will ease monetary policy. In other words, the policy interest rate will drop. In addition, if corporate earnings are poor, stock prices will fall, and bonds that are low risk will be purchased.

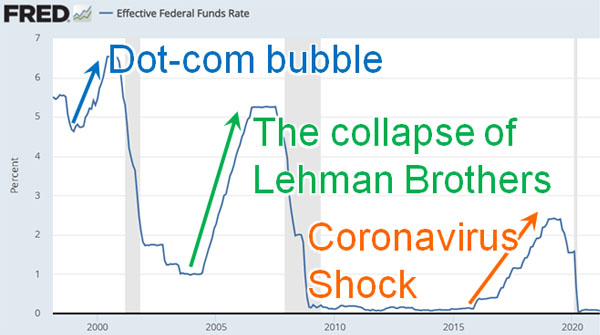

Before a recession hits, central banks always raise their policy rates several times. For example, the following figure shows the Fed’s policy rates and the timing of major recessions.

- 2000: Dot-com bubble

- 2008: The collapse of Lehman Brothers

- 2020: Coronavirus Shock

Also, when a recession hits, the policy rate falls. Naturally, since the economy is in a recession, long-term interest rates will also be lower. This means that bond prices will rise.

When the value of stocks plummets sharply, as in the case of the collapse of Lehman Brothers and the Coronavirus shock, the value of bonds as well as stocks will fall. However, bonds have a tendency to quickly return to their original value. Therefore, there is no need to worry about a temporary drop in prices.

In any case, you should not invest in bonds when you can expect interest rates will rise. Rather, invest in bonds when you can expect interest rates will fall due to economic recession. In short, buy bonds when you can expect stock prices to fall due to a recession and monetary easing to occur by central banks.

Interest Rates Greatly Affect Bond Prices

Bonds are known to be low-risk investments. By investing in government and corporate bonds, you can earn dividends. Many people invest in bonds by using mutual funds (ETFs).

However, bond prices fluctuate. The reason for this is that interest rates have a significant impact. Although the default risk also changes the price of bonds, in most cases, the interest rate is the reason why the value of bonds fluctuates. When bonds are sold, the yield becomes higher.

Interest rates are also determined by policy rates and economic conditions. Therefore, amateur retail investors should not buy bonds after a major recession has occurred. Rather, we should buy bonds when we can predict that a recession is coming. In other words, consider investing in bonds after the economy has been booming for several years.

There is a reason why interest rates and bond prices are inversely proportional. Understanding the relationship between interest rates and bonds will also help you determine when to invest in bonds. Individual investors should learn about the relationship between interest rates and bonds and invest in bonds.