Many people invest in bonds and can earn interest income as dividends every year. Bonds are known to be one of the safest investments.

On the other hand, when investing in bonds, you can also use hedge funds. Hedge funds that invest only in bonds are low risk, and depending on the hedge fund, your assets can grow at an annual interest rate of about 10%. This makes them a popular investment choice for people who want to grow their assets in a stable way.

In general, it is impossible to earn 10% annual interest by investing in bond ETFs. However, it is possible with hedge funds that invest in bonds.

Why is the yield higher when investing in fixed income hedge funds? And how can you invest in fixed income hedge funds? I will explain how to use hedge funds that invest in bonds.

Table of Contents

Investing in Bonds with Low Risk and Earn Dividends

The most common method of asset management is a stock investment. By investing in stocks, you receive dividends and gains on stock price increases.

On the other hand, investing in bonds is also common. Government bonds and corporate bonds are called bonds, and if you want to get a higher yield, you should invest in corporate bonds. In this case, the following ETF (exchange-traded fund) is famous for its high yield.

- iShares iBoxx $ High Yield Corporate Bond ETF (HYG)

HYG has a dividend yield of about 5%, and by investing in HYG, you can receive monthly distributions. HYG is called a high yield bond, also known as a junk bond. Investing in HYG means investing in low-rated bonds, which is why the dividend is as high as about 5% per year.

However, even though the rating is low, you will be investing in companies that are classified as large corporations.

Also, since it is a bond, the price does not fluctuate much, and there is almost no price movement, as shown below.

This chart shows the price movement over 5 years. The yellow line is the price of the stock when invested in the S&P 500 (VOO). On the other hand, the blue line shows the price movement of HYG.

If you invest in the S&P 500, the price of the stock will continue to increase over the long term. For HYG, on the other hand, the price of the bond has risen and fallen from year to year, but overall there has been little price movement. As you can see, while you can’t expect prices to rise, there is almost no price decline in bonds. Investing in bonds is an investment method that earns a stable monthly dividend.

Hedge Funds Can Be Used to Earn High Yields

When investing to earn dividends, some people prefer to invest in low-risk, higher-yielding bonds. While investing in low-risk bonds, they want to achieve an annual interest rate of about 10%.

The most famous high yield bond ETF in the world is HYG. If you want to get a high yield from your bond investments, HYG is the most common way to invest. On the other hand, if you know how to invest offshore, you can use hedge funds that invest in bonds.

You can invest in fixed income hedge funds by opening an investment account in offshore tax havens where there is little or no tax. For example, the following is a fact sheet on a hedge fund that invests in bonds in the UK and US.

For reference, Swiss institutional investors (pension funds) also invest in this fixed income hedge fund.

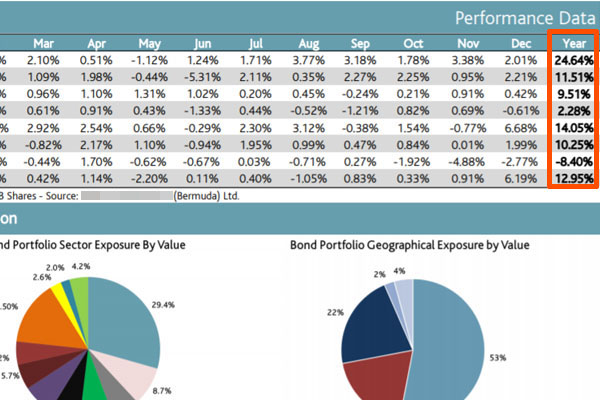

If you check the yield of this hedge fund for the past 8 years, the average annual interest rate is 10.46%. This is a general annual interest rate for a low-risk hedge fund for offshore investment. Although there have been some years of negative returns in the past, the returns have been positive in most years.

The average annual interest rate of 10.46% is after deducting the fees paid to hedge funds. By investing in corporate bonds of banks, insurance companies, construction companies, etc., this kind of yield is possible due to the fixed interest rate (dividend yield) of about 7% plus the gain in the price of bonds.

While this is an ordinary yield among low-risk hedge funds, the yield is very high when considered in terms of bond investments. As mentioned above, even if you invest in HYG, the most famous high yield ETF, the annual interest rate is about 5%. Therefore, among bond investments, hedge fund investments have an extremely high yield.

Hedge funds achieve higher yields than investing in HYG by selecting bonds with high yield and price appreciation potential.

Lower Risk Than Investing in Stocks, Forex and Futures

High-risk, high-return hedge funds invest in stocks, forex and futures. With these hedge funds, annual returns of 20-30% are possible. However, the return can be negative by 20-30% in one year.

In the case of stocks, once a stock price falls, it often does not rise again. It is well known that if you invest in a bad stock, you will lose a lot of money.

On the other hand, when you invest in bonds, there is no risk of a sharp drop in price as when you invest in stocks or futures. Of course, a global recession can cause bond prices to fall, but even if bond prices fall temporarily, they usually return to a normal state after a few months.

Although bonds have a small range of price appreciation, they also have a low risk of decline. Some people who invest in hedge funds want to earn an annual interest rate of about 10% with low risk, rather than high-risk, high-return. In this case, a hedge fund that invests in bonds is the best choice.

Disadvantages of Not Earning High Yields

What are the disadvantages of hedge funds that invest in bonds? As I have already explained, it is impossible to get a high yield.

High-risk, high-return hedge funds also invest in bonds. However, when they invest in bonds, they do not invest for the purpose of earning a fixed interest rate. Rather, they look to make a profit by predicting the rise or fall of bond prices.

If they expect bond prices to rise, they will leverage their investments many times over. If they think bond prices will fall, they prepare for the fall by shorting (selling). They trade bonds in the same way they trade stocks.

In the case of this method, the interest income from bond investments is small.

Unlike high-risk, high-return hedge funds, fixed-income hedge funds generate profits through dividends from fixed interest rates and gains in bond prices. Therefore, while high yield is not possible, asset management with low risk is possible.

Since It’s a Hedge Fund Investment, There is a Minimum Investment Amount

There are also other disadvantages compared to general bond investments. That is the minimum investment amount. When you invest in a hedge fund in a tax haven, there is a minimum investment amount.

When investing in ETFs, anyone can invest in small amounts. Investing in hedge funds, on the other hand, requires a minimum investment of US$30,000 to open an offshore investment account.

For fixed income hedge funds, you can invest as little as US$10,000. However, the minimum investment amount to open an offshore investment account is $30,000. Therefore, only those who have enough money can invest in fixed income hedge funds.

HYG is an ETF that offers a high yield in fixed income investments. On the other hand, if you want to get a higher yield than bond ETFs at a lower risk, using a fixed income hedge fund is an excellent choice.

Fixed Income Hedge Funds Offer Fixed Interest Rates and Price Gains

A low-risk way to invest is to invest in bonds. Bond prices don’t fluctuate as sharply as stocks, and even if the major recession brings bond prices down, they will come back up in a few months.

When investing in bonds, HYG is a well-known bond ETF that offers a high yield. If you invest in HYG, you can get an annual return of about 5%. On the other hand, when investing in bonds, there are hedge funds that can give you an annual return of about 10%.

By selecting bonds to invest in, hedge funds are able to offer higher fixed interest rates and higher returns than investing in ETFs. While they cannot provide the high returns as hedge funds with high-risk and high-return, they are suitable for those who want to manage their assets with low risk.

There are various types of hedge funds. If you want to invest in low-risk assets, you should invest in hedge funds that earn fixed interest income, not high-risk hedge funds using high leverage and shorting (selling).