Investing in hedge funds will increase your wealth with excellent yields. Even ordinary people, not wealthy people, can invest in hedge funds, and if they know how to invest properly, high yields are possible.

However, few people understand how to invest in hedge funds properly. There are also many bad hedge funds, so you need to avoid such hedge funds. In other words, you need to know how to look for good hedge funds.

Few hedge funds actively disclose information. Therefore, investors have to invest in excellent hedge funds from the little information available.

There is a right way to invest in good hedge funds. I will explain the application process on how to invest in hedge funds that have excellent performance.

Table of Contents

There Are No Good Hedge Funds in Your Home Country

Where are hedge funds registered in the first place? There are hedge funds in all countries. However, these are fake hedge funds and are almost always a scam. This means that you will not get back all the money you invested.

Specifically, you should understand that all hedge funds in your country are scams.

All of the scam hedge funds collect money through private placement. The money is not segregated, and you will be sending money directly to the hedge fund’s bank account. Then, after a few years, the hedge fund disappears, and you never get your money back.

There are some characteristics of these hedge funds. Most of the hedge funds are as follows.

- High yield, but no negative returns in the past.

- Monthly dividends.

- Little or no disclosure of information.

- Private placement.

If you invest in scam hedge funds, you will not get your money back. So, first of all, do not look for hedge funds in your country of residence.

Offshore Investment Allows You to Invest in Hedge Funds

Hedge funds are registered in tax havens with a 100% probability. You will certainly not be able to invest in a good hedge fund in your country.

Hedge funds deal with clients all over the world. No hedge fund targets only people in your country of residence, and you can distinguish a fund as a scam if it offers its products only in certain countries. There are no hedge funds registered in countries with high taxes. Instead, they operate in offshore tax havens where there are almost no taxes.

Investing in tax havens is called offshore investing. If you want to invest in a good hedge fund, you must make offshore investments.

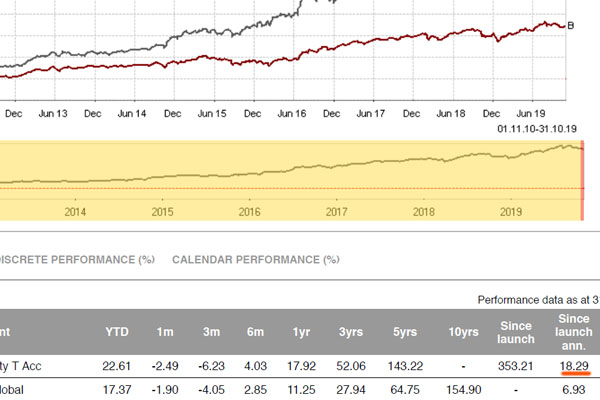

Also, hedge funds usually disclose information, including how they manage their assets and their past performance. For example, the following is a hedge fund with over $40 Billion in assets guaranteed by Morgan Stanley.

This is a partial fact sheet. It is a principal-protected investment fund, and its average annual yield for about 10 years of operation is 18.29%. Over the same period, investing in global stocks has yielded an annual return of 6.93%; this hedge fund has a better return than investing in global stocks.

When investing in a hedge fund, you should never invest in a scam company that you are not sure really exists. For example, in the case of this fund, investment money is coming from worldwide, the investment method is public, and Morgan Stanley guarantees it.

You should invest in hedge funds that are reliable, are actually managed, and have fact sheets that provide information about their operations. Otherwise, you will not be able to increase your assets by investing in a good hedge fund.

Open an Investment Account in a Tax Haven Through an IFA

How can you sign up for such a great hedge fund? Before investing in a hedge fund, you must open an investment account with an insurance company (investment company) registered in a tax haven.

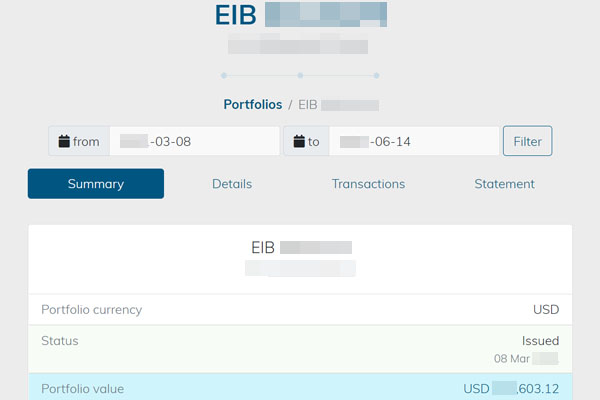

For your reference, the following is the management screen of the offshore investment account I opened in a tax haven.

When investing in hedge funds, it is common to open an investment account. If you open a securities account in your country of residence, you will not be able to invest in hedge funds. Securities account in your country does not allow you to invest in hedge funds because of financial regulations.

On the other hand, if you apply for an offshore investment account, you can invest in any hedge fund. Therefore, you need to open an offshore investment account first.

Several investment companies offer accounts for investing in hedge funds. However, as is the case with all investment companies, you must sign up through an IFA (Independent Financial Advisor). It is impossible to sign up directly with an investment company, so be sure to look for an IFA supporting offshore investments.

Apply to Invest and Send Money Overseas

By applying through an IFA, you will be able to open your own investment account in a tax haven. You will then send money to the investment account you have opened and invest in hedge funds. This is the correct way to invest in hedge funds.

For example, when you invest in stocks, you need to transfer the money to your brokerage account. Then, you invest in individual stocks or ETFs. In the same way, you have to transfer your money to an investment company in a tax haven and then invest in hedge funds via an investment account.

However, since it is not a brokerage account located in your country, the method of transferring money is a bit more complicated. You need to transfer your money to a bank account in a tax haven by sending money overseas. So, after opening an offshore investment account, you must send the money abroad.

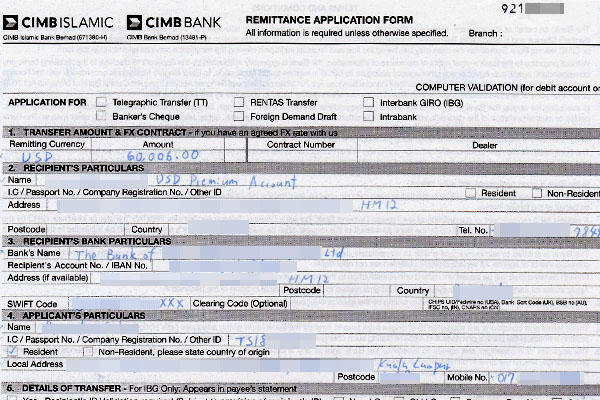

When I invested in hedge funds, I sent the money from my bank as follows.

Once the overseas investment company confirms the receipt of the money, you can invest in hedge funds from your investment account. If you actually invest in hedge funds, you will be able to manage your hedge funds from a single management screen, as shown below.

To invest in excellent hedge funds, you need to open an offshore investment account. For an offshore investment account, you can open an investment account with as little as US$30,000.

You Need to Find a Good IFA to Invest in Hedge Funds

What is the best way to search and find good hedge funds? First of all, you will not be able to find a hedge fund with excellent investment performance by searching on the Internet yourself.

Hedge funds have offering periods and are not always available. For example, the principal protection fund that I mentioned earlier has a subscription period, and you cannot apply for it after the subscription period has expired.

Also, hedge funds do not deal with poor people. You don’t have to be wealthy, but as mentioned above, you need to invest at least $30,000. This is why they don’t solicit widely, only through IFAs.

Therefore, the most important thing is to know which IFA to apply from. There are countless hedge funds and a lot of hedge funds with poor performance. Also, one IFA does not know all hedge funds.

So, try to find an IFA who knows many excellent hedge funds.

Direct Investment and Private Banking are Also Available for Purchase

When investing in hedge funds, direct investment and private banking are also possible. This method of investment is also only available through an IFA.

In the case of direct investment, the minimum investment amount is higher. In general, most hedge funds have a minimum investment amount of US$100,000.

When using an offshore investment account, the minimum investment amount when investing in a hedge fund is $10,000. So, for example, if you open an offshore investment account with $30,000, you can invest in three hedge funds.

Also, with an offshore investment account, you can manage all your hedge funds from a single management screen. For this reason, few retail investors invest directly, and they usually open an offshore investment account.

Alternatively, it is possible to invest in hedge funds by using private banking services. However, to use a private banking account, you need to invest at least $500,000. In addition, there is a condition that the investment amount must be at least $1 million in the future. Therefore, it is only available to the wealthy.

However, since offshore investment accounts are more convenient than private banking, people usually use offshore investment accounts to invest in hedge funds. Although there are several ways to purchase, you should use an offshore investment account to invest in hedge funds unless you have a special reason.

Choose Hedge Funds by Determining Your Risk Tolerance

When investing in hedge funds, which hedge fund is best for you depends on your risk tolerance.

If you have a low-risk tolerance, you should choose an alternative investment. Instead of a hedge fund investing in stocks and bonds, you can invest in a hedge fund that deals in real estate or bridge loans. In this case, you cannot expect a high yield, but you can get a stable yield every year without negative returns.

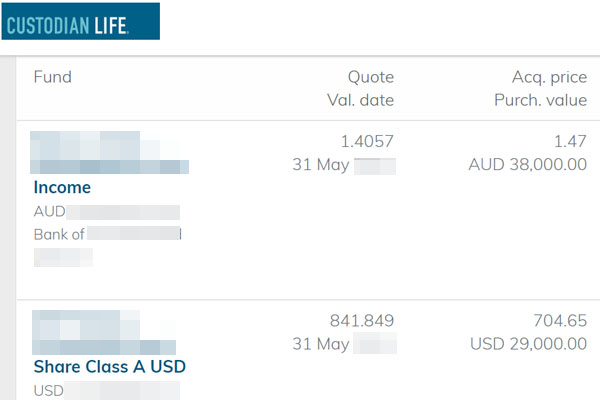

For example, the following is a loan fund that lends money to foreigners who want to invest in Australian real estate.

When investing in this hedge fund, the average annual interest rate is 9.27%. While it is impossible to earn an annual interest rate of 20-30%, there have been no negative return years in the past. If you don’t like negative returns, investing in low-risk hedge funds is an excellent choice.

On the other hand, if you are willing to take some risk, invest in a high-risk, high-return hedge fund. In this case, although there are some years with negative returns, there are several hedge funds that can yield an overall annual interest rate of 20-30%.

Selecting the Best Hedge Funds Based on Fact Sheets and Charts

When investing in a hedge fund, you need to choose a fund based on the information disclosed. Check the numbers and charts in the fact sheets.

If you invest through an offshore investment account, you will invest in hedge funds that have passed a screening process that includes information disclosure and investment strategies. Also, your assets are segregated, so the hedge fund cannot use your money for anything other than investing.

Therefore, unlike hedge funds that are private placements, fraud does not occur. However, there are frequent cases of negative returns after investing in a hedge fund. In particular, high-risk hedge funds are prone to negative returns. So, check the numbers and charts in the fact sheet to see if the hedge fund is worth investing in.

For example, here is a hedge fund with an average annual interest rate of 20.46%.

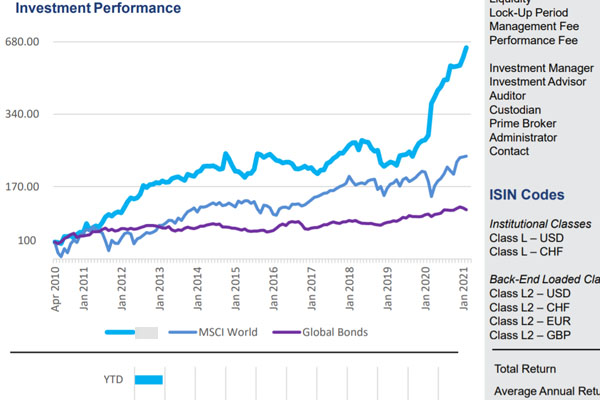

If you check the chart, you will see that the assets have increased by about 680% (about 7.8 times) after about 11 years of asset management.

This is an investment method that uses computers to decide where to invest. The strategy is to take only long positions (buy) and sell all stocks before the end of the trading day to avoid the risk of after-hours price declines.

Also, the investment yield for 2020 is 105.99%, which means that if you were invested in this fund, your assets would have more than doubled in that year. Do you want to invest in this hedge fund?

In my case, I avoided investing in this hedge fund. The reason is that the investment performance is not excellent except in 2020. Also, 2020 was the year of the global stock market rise, so I thought, “maybe they just happened to have good performance in that year.”

Even if we exclude the performance in 2020, investing in this hedge fund is clearly better than investing in global stocks, so you can make more money by investing in this hedge fund than investing in mutual funds. However, I did not invest in this hedge fund because there are many high-risk funds that perform better than this hedge fund.

It is true that this hedge fund has excellent performance. In fact, if you check the chart in the fact sheet, it has better performance than global equities (MSCI World). However, judging from the overall performance, I did not invest in it.

You Make the Final Decision Based on What Is Disclosed

As for the high-risk, high-return hedge fund I mentioned earlier, there are many people who have invested through IFAs. In my case, I did not invest in it, but for others, that hedge fund was a good one to invest in.

In short, it is up to you to make the final decision on which hedge fund to invest in.

As mentioned earlier, to find a good hedge fund, you need to find a good IFA that introduces you to various hedge funds, including low and high-risk hedge funds.

You have to decide for yourself which hedge funds to invest in with the help of your IFA’s sources of information.

For reference, in my case, I mainly invest in low-risk hedge funds with annual interest rates of 10-13%. On the other hand, about 30% of my investment is in high-risk, high-return hedge funds. I expect to grow my money steadily every year in low-risk hedge funds while also expecting to grow my assets significantly in high-risk hedge funds.

Everyone has a different investment strategy. Each hedge fund has a different yield and risk, so be sure to discuss with your IFA which hedge fund you want to invest in.

Understanding How to Subscribe to and Find Hedge Funds

Few people understand how to invest in hedge funds correctly. In fact, many people look for hedge funds based in the country where they live, and as a result, they get scammed. Instead, you should always use investment companies located in tax havens.

Hedge funds that can invest through investment companies in tax havens are subject to audits by outside agencies. Furthermore, institutional investors and family offices around the world invest in them. The assets are segregated, so there is no risk of fraud, unlike shady hedge funds with private placements.

The best way to find a good hedge fund is to look for a good IFA, which can provide you with information on hedge funds, and you cannot find information on hedge funds yourself. The IFA is the source of information on hedge funds.

So check your risk tolerance, read the disclosures, see the charts, and then invest in hedge funds. This is the right way to choose hedge funds.