There are many people who are considering the Cayman Islands for offshore investment. The Cayman Islands is well known as a tax haven (an area where there is little or no taxation), and there are many companies registered in the Cayman Islands offering offshore investment.

Since there are numerous regions for offshore investment, many people wonder which region they should invest in. Among the tax havens, such as Hong Kong, the Isle of Man, and the Cayman Islands, people don’t know which region is appropriate to invest in.

Naturally, there are unique characteristics when managing assets in the Cayman Islands, and there are advantages and disadvantages. Without understanding these, you will not be able to achieve an excellent investment.

Therefore, I will explain the necessary information for those who want to invest offshore in the Cayman Islands.

Table of Contents

Characteristics of the Cayman Islands as a Tax Haven

The Cayman Islands are a small island in the Caribbean Sea. The map below shows where they are located on the globe.

The Cayman Islands is an overseas territory of the United Kingdom, and other summary information is as follows.

- Area: 259 km2

- Capital: George Town

- Currency: Cayman Islands dollar

The Cayman Islands is a tropical resort area located south of the United States, and is famous mainly for tourism and scuba diving. As a result, the standard of living is high in the West Indies. As you know, it is also offshore.

The Cayman Islands are famous for their tax havens, which means that there are no taxes (capital gains tax, etc.) on investments made there.

However, in the past, the Cayman Islands have been used as an offshore region for money laundering (the use of criminal money).

In 2005, because of the unclear financial situation, the OECD (Organisation for Economic Co-operation and Development) requested the Cayman Islands government to disclose information to increase the transparency of its fiscal situation. In addition, many huge corporations have been hiding large amounts of income in the Cayman Islands, which has been discovered.

As a result of these events, the image of the Cayman Islands as an offshore region where bad money flows became established. However, this is no longer the case, and many people are now investing in the Cayman Islands.

Advantages of Offshore Investment in the Cayman Islands

What are the advantages of investing offshore in the Cayman Islands in the Caribbean? The following are some of the advantages.

- Close proximity to the US and famous for offshore investment.

- No time difference from the US.

Let’s take a look at each of them in turn.

Close to the US and Famous for Offshore Investment

The Cayman Islands is very close to the United States in terms of distance. As we all know, the center of the world is the United States. The world’s key currency is the US dollar, and all the money in the world gathers in the US.

However, taxes tend to be very high in all developed countries, including the United States. So, as a general rule, asset management should be done in offshore areas. In such cases, the Cayman Islands, which is very close to the United States, is a tax haven that attracts a great deal of investment money.

For example, if you live in Europe, it is easy to invest in European tax havens. Also, if people live in Asia, there are many people who invest in Hong Kong and Singapore. This is because they are geographically close to each other, and if there is any trouble, they can travel immediately and reduce the risk.

Likewise, for Americans, the Cayman Islands are very close geographically. For this reason, rich Americans used to invest their assets in the Cayman Islands.

Currently, Americans are not allowed to invest in the Cayman Islands due to FATCA (a law that prohibits Americans from investing abroad). However, in the past, the Cayman Islands became a very famous tax haven due to a large amount of investment money from the United States.

Because of this history, the Cayman Islands has attracted a lot of investment money, and in fact, the Cayman Islands has a higher credit rating than many developed countries such as Japan and Germany. Global rating agencies such as Moody’s have rated the Cayman Islands as safer than Japan and Germany, proving that there is less risk of bankruptcy than managing assets in your country.

Although Americans are no longer allowed to invest in the Cayman Islands, its proximity to the US makes it an ideal location for offshore investment. As a result, a lot of money is attracted to the Cayman Islands, and excellent asset management is possible.

No Time Difference from the US, Advantageous for Asset Management

The Cayman Islands are located in the Caribbean Sea. Therefore, there is no time difference with the United States. The lack of time difference is one advantage when dealing with financial institutions.

Financial institutions cannot perform procedures after hours, so money cannot be handled smoothly. In this respect, the Cayman Islands has no time difference from the United States, where the money comes from all over the world, which is a great advantage in terms of asset management.

Offshore investment can be a regular investment or life insurance. It will be a mutual fund, and you will not be following the charts like a trader. You will be increasing your assets in US dollars by investing in an offshore accumulation fund that allows you to leave it completely alone.

Therefore, you don’t need to worry about the time difference when you invest. It is important to understand that investing in the Cayman Islands through a regular investment is advantageous.

Choose a Reliable IFA (Agent)

When you start to invest in the Cayman Islands, what should you do? The most common way to invest in the Cayman Islands is to ask an IFA (Independent Financial Advisor) to introduce you to financial products. If you want to buy a product, you have to purchase it through an agent, because financial institutions do not sell products directly to their clients.

However, there are hundreds of IFA companies all over the world, and some of them are good, and some of them are bad. If you make a mistake and order an offshore investment from a bad company, you may get a bad response or no after-sales service.

It is important to avoid problems when investing money. In addition, when you invest offshore, you are dealing with a foreign financial institution in a different country. Therefore, if you want to manage your assets, you must entrust them to a good company.

When making offshore investments, make sure to ask a good IFA. In order to do so, you need to check that the IFA will explain the risks to you and that they have a license to operate.

Choose an IFA Who Supports the Whole World

When investing offshore, choose an IFA that supports a large number of people from all over the world. Also, companies with offices in tax havens are preferable.

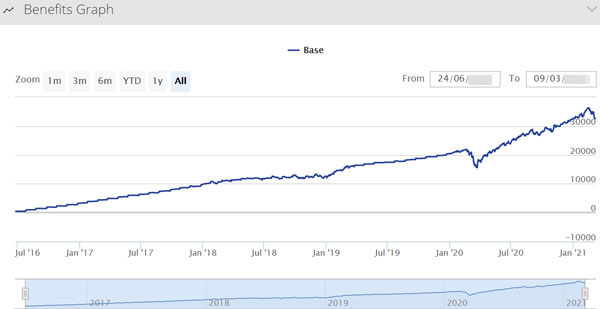

I also invest in regular investments, and I signed up through an IFA that supports the whole world. The following is my actual contract.

*I am Japanese, so my contracts are in Japanese as well as English.

In addition, with offshore insurance and mutual funds, you will continue to invest for 10 or 20 years. Since it will mature after decades and the money will be paid out, you have to purchase it from an introducer (IFA) that you can contact without any problem, even in the future.

While regular investments, including investments in the Cayman Islands, offer great advantages in asset management and can certainly increase your money. But it is important to understand that there is a disadvantage, and if you choose a bad agent, you will not be able to contact them in the middle of the investment.

Be Careful of Scam Tours

You can sign up for these offshore investments while living in your country, without having to travel. In fact, I have a contract with an offshore insurance company, which is registered in the Cayman Islands, but I have never been to the Cayman Islands.

For your reference, here is my management screen at my offshore investment company.

When you start offshore investments, there are some investment methods that require you to go abroad, but you do not have to travel there. Therefore, be careful of scam inspection tours. This is because there are scam tours to open accounts and participate in investments. In addition to flight and accommodation costs, a tour to open an account can cost $3,000 or more.

Opening an account at an overseas insurance company (financial institution) is free of charge. In addition, if you open an account at a financial institution, the only costs are transportation and hotel fees. However, in the case of corrupt companies, they charge more than double the normal cost for the tour, so be careful.

You might be worried about opening an account overseas. Therefore, I understand why there are many people who want to apply for the tour. However, most of the tours are expensive inspection seminars, so you should not participate in them.

Investing in the Cayman Islands without Traveling There

There are many different investment products available in the Cayman Islands. For example, the following investment products are available in the Cayman Islands.

- Regular investments

- Life insurance

- Offshore Custodian Accounts

As mentioned above, you do not need to travel to the Cayman Islands to invest in these products. You can invest by sending money overseas while you are in your home country.

However, since the Cayman Islands is one of the most famous tax havens, regulations are becoming stricter every year. For example, it is no longer possible to invest in non-European funds in the offshore custodian accounts that can be opened in the Cayman Islands. As a result, it has become a useless investment product.

Because it is a famous tax haven, the Cayman Islands are prone to regulation. Therefore, if you are thinking of investing in the Cayman Islands, you should do so as soon as possible before the regulations become more strict than they are now.

US Dollar Asset Management in the Cayman Islands

We have explained the characteristics of investing in the Cayman Islands, one of the most popular tax havens. If you are considering investing in the Cayman Islands, you may now have a rough understanding of what kind of offshore area it is.

Because the Cayman Islands is close to the United States, it attracts investment money from all over the world, and as a result, it has become a very famous offshore region. You can also manage your assets in a safer state than your country, and furthermore, it is possible to increase your assets many times over by investing for 10 or 20 years.

However, as is common with any offshore investment, it is important to decide which IFA you apply to invest your money abroad. This is because you will be in trouble if you cannot contact your agent when you want to receive your money at maturity.

With this understanding, you should consider investing your assets in tax havens, including the Cayman Islands. There are offshore regions all over the world, so you should choose your ideal investment country to invest in offshore.