China has a very large population and is a huge market. Some of them are actively thinking about asset management.

What are some of the best asset management strategies for people living in China? One of the worst things to do is to buy financial products in China.

Or, you may be thinking of investing in Chinese companies. However, it is extremely risky, and you should not do it. In the first place, Chinese yuan is not globally reliable, and it would be a mistake to invest in China.

Therefore, people living in China must manage their assets by investing overseas. I will explain how to avoid high-risk investments in China and how to invest offshore.

Table of Contents

- 1 There Are No Good Financial Products in China

- 2 Holding Renminbi Is Risky Due to Currency Exchange and Overseas Remittance Restrictions

- 3 You Should Transfer Your Money to Foreign Countries Little by Little Through Offshore Investment

- 4 Asset Management in Foreign Investments to be Made Outside of Mainland China

There Are No Good Financial Products in China

Of all the countries in the world, China is known to be one of the most heavily regulated. Even services that are naturally available in the US or Japan are not available to people living in mainland China. In addition, people living in China have no freedom and are constantly monitored by the Chinese Communist Party.

Naturally, the same is true for financial products. There are no good financial products available in China at all. China’s strict financial regulations do not allow for the development of superior products.

In fact, the Chinese authorities have banned cryptocurrencies, which can be invested in as a matter of course in foreign countries. In addition, it is difficult to transfer large amounts of money from China to foreign countries in order to prevent the outflow of funds.

Under these strict financial regulations, no superior financial products will be created. If there are any, they are fraudulent products. The first thing that Chinese residents and expatriates should consider when managing their assets is to give up investing in China.

Stock Investment in Chinese Companies Is Too Risky

Some of you may be thinking of investing in Chinese companies. They think that if they invest in China, with its large population and annual economic growth, the stock price will go up significantly.

However, when it comes to asset management, there are no professional investors who actively buy Chinese stocks as their main investment. The reason is simple: they are almost never profitable.

The reason is obvious if you check the charts of Chinese stocks in the past. Below is a chart of the Shanghai Composite Index for 10 years.

We can see that stock prices have increased a little over the past 10 years, but not much. During this period, stock prices in both the US and Japan have risen significantly. In particular, in the case of the USA, stock prices have more than tripled in the same 10 years (in the case of the S&P 500).

On the other hand, in the case of China, even if GDP has risen due to economic growth, stock prices have not risen. Even if you invest in Chinese stocks, you can hardly make any profit. If you look at the past charts, you can understand why.

The Chinese Communist Party Is the Biggest Risk

Why don’t stock prices rise in China despite its large GDP and huge market size? We understand that strict financial regulations have prevented the existence of superior financial products. However, it seems strange that stock prices are not rising.

The reason for this is that China itself is a huge risk. Most of the countries with developed economies are free economies, including the US, Europe, and Japan. There is freedom of speech, and even if you complain to the government, you will not be arrested.

In China, on the other hand, there is no freedom of speech, and the judiciary can be controlled by the government. It can also arrest innocent people at will and penalize companies without reason. In fact, there have been many times in the past when huge Chinese companies have been penalized and have fallen far behind.

Although these companies did not do anything wrong, they were ordered by the Chinese government to pay huge fines for no reason. If they refuse to pay, they will not be able to do business. Also, since the government can manipulate the judiciary, there is a 100% chance that they will lose in court. Therefore, they agreed to pay the fine.

Companies in China are not free, and there is always the risk of being dismantled by the Chinese Communist Party.

No matter how large the market is in China, the company’s stock price will never grow as fast as that of American companies because of these risks. This is because all investors are risk-averse.

No matter how high a company’s stock price rises, if they cannot make money due to pressure from the Chinese government or changes in the rules, the stock price will fall sharply. Investors do not like these situations, so it is important to understand that the stock prices of Chinese companies are unlikely to grow.

Holding Renminbi Is Risky Due to Currency Exchange and Overseas Remittance Restrictions

It is also very risky if you are thinking of investing your assets in Renminbi. This is because even if you have money in China, it is difficult to use it outside of China.

As I mentioned earlier, China is taking measures to prevent the outflow of funds. Specifically, there is a limit of US$50,000 per person per year for the exchange of Renminbi and foreign currencies.

If you want to exchange more than US$50,000 per year, you have to prepare transaction-related proof documents and get permission. In other words, you cannot freely exchange into foreign currencies. Because of these exchange restrictions, it is not possible to freely transfer Renminbi overseas.

Also, it is impossible to transfer Chinese yuan from mainland China to overseas banks.

The Renminbi used in China is called the onshore Renminbi. On the other hand, Renminbi that can be used outside of China is called an offshore Renminbi. While foreign banks can handle offshore renminbi, they cannot open accounts for onshore Renminbi (Renminbi that can be used inside China).

In other words, the Chinese domestic Renminbi can only be used in mainland China. It is not possible to send Chinese domestic yuan overseas.

Therefore, even in the event of a major event such as the collapse of the Chinese Communist Party, onshore Renminbi cannot be immediately sent abroad. Chinese yuan is extremely useless.

Because it is hard to use as a currency, the value of the yuan is naturally very low worldwide. It is not trusted as a currency at all.

In fact, even if China’s GDP is large, the share of the Chinese yuan is overwhelmingly small. Its global share is less than 2%.

The US dollar has the highest share as a currency. Therefore, it is natural that asset management is done in US dollars, and there are no professional investors who manage their assets in Renminbi. The euro is the second largest currency in the world, and the Japanese yen and British pound also have a large share.

These currencies can be used to pay and receive money freely, and there are no restrictions on currency exchange or overseas remittances as the Chinese government does. It is natural for businesses to use unregulated currencies instead of regulated ones.

By checking these facts, it is risky to hold money in Renminbi. Considering the risk of countries and currencies, Investing in China is extremely high risk. Therefore, you need to invest your money by exchanging yuan for US dollars as soon as possible.

You Should Transfer Your Money to Foreign Countries Little by Little Through Offshore Investment

So, let’s invest your money abroad outside China. If you invest your money offshore, even if the Chinese government collapses, your assets will not be affected. Also, if you keep US dollars, which is the most valuable currency, instead of the less reliable Chinese yuan, it will not be affected even if the value of the yuan falls.

However, as mentioned above, there are restrictions on currency exchange and overseas remittance in China. Therefore, even if your assets in China are huge, you cannot transfer large amounts of money overseas.

If you have a company in China and have a special way to send large amounts of money overseas, there is no problem. However, if an individual wants to send money abroad through official channels, the only way is to transfer $50,000 per year to a foreign country gradually.

Since there is a limit to the amount of money that can be sent abroad, the earlier you start managing your assets in foreign countries, the more protected your assets will be.

With Tax Havens, You Can Freely Use the Increased Money from Asset Management

The best place to invest your money is in tax havens. Tax havens are areas where taxes are almost non-existent, also known as offshore areas.

A simple example is Hong Kong. Hong Kong is one of the tax havens where taxes are quite low. Because of this situation, the main industry is finance, and there are many excellent financial products that do not exist in mainland China.

Since Hong Kong is part of China, it is not advisable for Chinese residents and expatriates to invest their assets in Hong Kong. This is because Hong Kong is under surveillance by the Chinese government.

Although there is no problem if you use a foreign company registered in Hong Kong, you should not use a company that operates only in Hong Kong to manage your assets.

Therefore, you should use other tax havens. In addition to Hong Kong, there are many other tax havens such as Singapore, Cayman Islands, and Bermuda. This is the right way for Chinese residents to manage their assets in these offshore areas.

-Receipt of Money Is Available at Banks Worldwide

When managing assets, the most important thing is to receive the money. When using financial products in China, the money must be received in a bank account registered in China. Therefore, you cannot use the money freely outside China.

On the other hand, when managing assets in a tax haven, you can receive your money from any bank in the world. Also, you can receive your money in any currency, not just US dollars.

Even if you are living in China now, you may move to another country in the future. Even in such a case, asset management in tax havens will not cause the problems as asset management in China since it is available to all banks in the world.

Annual Interest Rate of Over 10% is Normal for Offshore Investment

For your information, an annual interest rate of more than 10% is normal for offshore investments. In China, there are no financial products that offer more than 10% annual interest, and if there are, they are fraudulent products. On the other hand, if you invest offshore, you can achieve a high yield.

Of course, there are low-risk financial products even in offshore investments. But even with low-risk investment products, the annual interest rate is 4-8%.

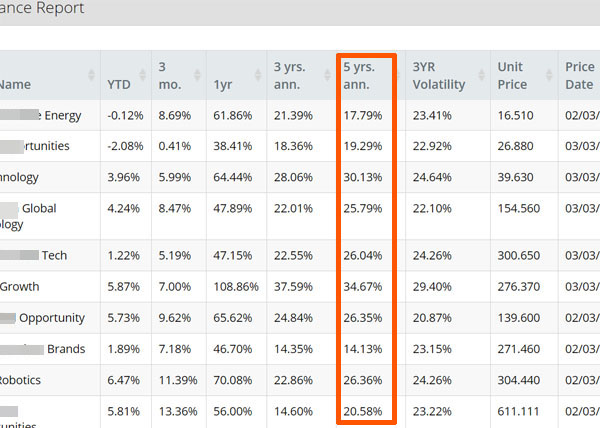

If you are willing to take the risk, the annual interest rate will be higher. For your reference, I invest with an offshore financial institution, and the following is a part of my management screen.

Thus, I am diversified into ten funds with an average annual yield of 24.1% over the past five years.

I also invest in hedge funds around the world. When investing offshore, you can also use hedge funds to increase your assets. In my case, the average yield of using hedge funds is 17.52% per year.

There is no advantage for a Chinese resident or expatriate to buy financial products in China and invest in yuan. Instead, invest overseas in US dollars and manage your assets properly.

Asset Management in Foreign Investments to be Made Outside of Mainland China

There are countless ways to manage your assets. Among them, there are many investment methods that are only available to residents of China. However, all of these financial products in mainland China are of poor quality and are not suitable for investment. Also, due to the strict financial regulations imposed by the Chinese government, it is impossible to develop superior products.

In the first place, it is a mistake to invest in Renminbi. The yuan is a very risky currency, and it is useless. In fact, despite the fact that China’s GDP is large, its share of the world currency market is low.

Therefore, invest your assets in the US dollar, which is the key currency. In addition, the right way to invest is to invest overseas by using tax havens.

If you invest offshore, the annual interest rate is more than 10%, you can invest in US dollars, and you can receive money from any bank in the world. Investors need to avoid risk and should avoid investing in China using the yuan and try to increase your assets by investing offshore.