Some people who are thinking of managing their assets by investing in stocks are looking to invest in Chinese stocks. Since China has a high economic growth rate, they think that they can increase their assets by investing in China. Even if you are an amateur, you can invest in Chinese stocks by using mutual funds or ETFs.

However, I do not recommend investing in China. The reason is simple: the probability of losing money is very high. In spite of the high risk, the profit you get is small. In fact, there are almost no professional investors who invest in China.

Why is the probability of losing money when investing in Chinese stocks so high? And why don’t institutional investors buy Chinese mutual funds?

Although China has a high economic growth rate, it also has high government risk. This makes it an unsuitable investment destination. I will explain the reasons for this, including the actual stock prices.

Table of Contents

Many People Are Interested in Investing in China with Its High Economic Growth Rate

China is known as a country with a very large population. It is also a country with a high economic growth rate and a stronger economy. This is why many people consider investing in Chinese stocks.

In general, individual investors buy mutual funds. While there are retail investors who invest in individual stocks, for the amateur investor, investing in ETFs (exchange-traded funds) is superior because it allows for diversified investment in a large number of Chinese companies.

However, when investing, the most important criterion is whether the stock price will rise or not. If you invest in stocks that are likely to fall, you will not make any money and on the contrary, you will lose your assets. So let’s take a look at the historical stock charts of Chinese stocks.

China Is a Country Where Stock Prices Are Not Growing

The reason why you should not invest in Chinese stocks is simply that the stock price is hardly growing. The following is a historical stock chart of the Shanghai Composite Index (SSE Composite Index).

As you can see, the stock price has almost no growth. This is the reason why you should not invest in Chinese stocks. Not only are Chinese stocks not growing, but depending on the timing of your investment, the stock price may drop significantly, causing you to lose money.

For your reference, below is the S&P 500, an American index.

The S&P 500 represents the stock prices of the top 500 companies in the United States. As you can see, stock prices have been rising for a long time. This is the reason why most people, including professional and amateur investors, invest in US stocks instead of Chinese stocks.

It is true that China has a large population and a high economic growth rate. But if you understand the fact that stock prices are not rising, you can realize why you should not buy Chinese ETFs and mutual funds.

Professional Investors Do Not Invest in China

In the case of Chinese stocks, there are almost no professional investors who invest in Chinese stocks. Those who buy individual Chinese stocks or ETFs are almost always amateurs. This is because amateurs do not know the historical stock charts I mentioned earlier and invest only because China has a large population and a high economic growth rate.

For example, the following is news about a famous active fund in the US.

This is the news that she has sold most of the Chinese stocks. The reason why she sold most of the Chinese stocks in a short period of time is that the risk of Chinese stocks is very high.

The Most Evil Organization in the World Is the Chinese Communist Party

Despite China’s high economic growth rate and large population, why do stock prices rarely rise? There is one reason: the Chinese Communist Party, the evilest organization in the world, is the government.

People living in mainland China have no freedom. There is no freedom of speech, and if you speak out against the government in a negative way, you are immediately arrested. Also, the government can control the judiciary at will, so people can be thrown in jail for unfair reasons. In fact, in the past, the Chinese Communist Party has eliminated freedom in Hong Kong and arrested many people without reason.

Also, services that are commonplace in the world are not available in mainland China. Due to information control, the services of American, European, and Japanese companies are usually not available in China.

There is government risk in Chinese stocks. Few professional investors want to invest in Chinese stocks because the government can control everything in the country.

Government Regulations and Fines Stop Business

Why is the Chinese government a risk? The reason is that the government can impose regulations and fines at will. For example, in the past, the Chinese Communist Party (CCP) has fined the IT giants in their country for no reason.

In the past, the Chinese government also imposed a series of regulations on many industries, including IT, education, real estate, and gaming. In other words, the government made large companies unprofitable.

For the Chinese government, it is unfavorable for a company to become too big. For example, the government wants to control Chinese people’s bank accounts, but if a giant IT company provides an account management app and many Chinese people use it, the government cannot monitor the money in mainland China. So, the government issued a lot of regulations.

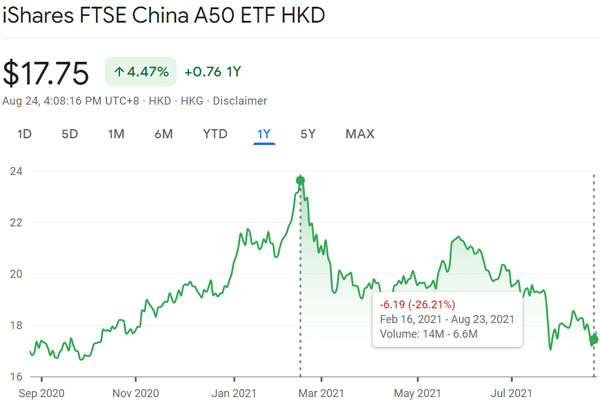

As a result, Chinese stocks plummeted. Below is a stock chart from that time.

When regulations are imposed, of course, the companies are unable to make profits. Naturally, the stock price will plummet. Also, investors are risk averse and do not want to invest in Chinese stocks, which have high government risk.

When you invest in stocks in the US, Europe, Japan, etc., you don’t have to worry about government regulations causing stock prices in all industries to plummet. On the other hand, in the case of Chinese stocks, there is a risk that government regulations and fines on large companies will cause the stock price to crash.

Foreign Institutional Investors Cannot Invest in China

I have already explained that professional investors rarely invest in Chinese stocks due to concerns about government risk. The same is true for institutional investors. Institutional investors include pension funds, life insurance companies, and banks.

These institutional investors hold huge amounts of money. They also want to increase their money by investing in stocks and bonds. However, pension funds and life insurance companies do not like risky investments. For example, pension funds have to invest in order to pay the citizens’ pensions.

As mentioned earlier, the risk of stock market crash is high in China due to high government risk. Also, institutional investors are obligated to explain to their clients when they invest in risky financial products. However, when they invest in Chinese mutual funds, they cannot explain to their clients because of the high government risk.

For this reason, institutional investors do not invest in Chinese stocks. The fact that institutional investors with huge assets do not invest in Chinese stocks is another reason why it is difficult for Chinese stocks to rise.

In addition, fund managers working for pension funds, life insurance companies, banks, etc., are company employees. When they think about increasing their clients’ funds through asset management, they usually invest in US stocks, which have a high probability of increasing their clients’ assets, rather than Chinese stocks, which have a high risk and low return. There is no reason to invest in high-risk Chinese stocks.

Only Amateur Retail Investors Use Chinese ETFs

If you understand what I have said so far, you will understand why people who invest in Chinese stocks are all ignorant retail investors. There are few professional or institutional investors who use Chinese ETFs.

- The risk from the Chinese Communist Party is significant.

- Checking the historical charts, stock prices have not risen.

- There has been a series of restrictions and fines on large companies

- Institutional investors can’t invest in China.

If you recognize these facts, you will know that individual investors should not invest in Chinese stocks.

Investing should be done in order to increase assets. High-risk, low-return investments need to be avoided. Therefore, you should not buy Chinese mutual funds.

You Should Stop Investing in Mutual Funds and ETFs of Chinese Stocks

It is true that China has a large population and a growing economy. However, it is not true that China is a great place to invest, and you must avoid investing in Chinese stocks. Chinese stocks have hardly increased in value and you are more likely to lose money by purchasing Chinese mutual funds.

Chinese stocks are a high-risk, low-return investment. Also, due to high government risk, institutional investors do not buy Chinese stocks. The Chinese Communist Party is free to destroy its own industries. In the past, the CCP has actually weakened its own large companies by tightening regulations and imposing fines.

Investors tend to be risk-averse, so professional investors do not want to invest in China. Only uninformed amateurs invest in Chinese stocks.

If you want to increase your wealth through investment, do not invest in Chinese stocks. If you avoid Chinese stocks and invest correctly, you will be able to increase your money through asset management.