It is usual for people who run a company to want to do asset management using the money that is saved in the corporation. If you use the profits after paying corporate taxes to manage assets, you will have more money.

There is a right way for companies to manage their assets. Unlike individuals, corporations should manage their assets in a way that is as risk-free as possible. This is because when you need a large amount of money, such as for capital investment, a risky investment method may result in a decrease in your money.

Generally, when we think of asset management, we tend to think of investments using stocks and mutual funds (ETFs). However, in the case of a company, you should also consider investments other than stocks, such as using hedge funds. While investing in stocks is excellent for individuals, other methods are best for companies.

I will explain what investment methods are best for companies and what kind of portfolio you should build.

Table of Contents

Unlike Individuals, Companies Should Avoid Risky Investments

When an individual invests, it is excellent to make high-risk investments. High-risk investments are, in essence, stock investments. Although there are more risky investment options such as forex and cryptocurrencies, stocks and mutual funds (ETFs) are the most common investment options for retail investors.

If you do not take risks, you will not be able to increase your assets. Therefore, individual investors should actively take risks. For example, it is widely known that if you use the S&P 500, which invests in the top 500 companies in the US, you can manage assets at an average annual interest rate of 7-9%.

However, unlike individuals, it is not advisable for corporations to use individual stocks and mutual funds. Investment in stocks is not a good way to manage assets for a general business company, although it is exceptionally fine for an investment company. This is because companies should avoid high-risk investment methods.

When individuals use their spare money to invest, they usually invest for a long period of time such as 15 or 20 years. On the other hand, a corporation may suddenly need a large amount of money after a few years. In that case, a company needs to convert the investment funds into cash.

However, in the case of stock investment, it is normal for the asset value to be reduced to less than half due to a major recession. For example, the following is the stock price trend before and after the Lehman Brothers bankruptcy.

This chart shows the stock price trend of the S&P 500. As you can see, the stock price has decreased by less than half. Corporations should not make high-risk investments because when they decide to withdraw the money they need, the value of their assets may have decreased significantly.

For individuals, you can wait for the stock price to rise through long-term investment. On the other hand, companies often need a large amount of money suddenly and do not have time to wait for stock prices to rise. For these reasons, the use of individual stocks and mutual funds is not recommended for corporate managers.

A Portfolio with a High Ratio of Stocks and Mutual Funds Should Be Avoided

Of course, there is nothing wrong with investing in stocks for the purpose of short-term trading for one or two years. However, in general, for the reasons I have mentioned, corporations should avoid a portfolio with a high ratio of investments in stocks and mutual funds.

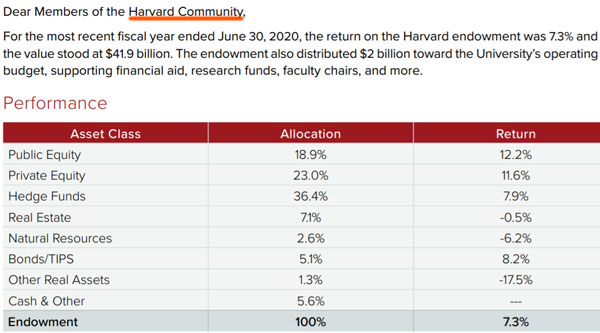

Well-known corporations, with the exception of investment companies, invest less in stocks in many cases. For example, the following is a portfolio disclosed by Harvard University.

Harvard University is famous for producing an average annual return of 10%, which is an excellent investment performance among prestigious universities.

If you check Harvard’s portfolio, you will see that the percentage of investment in listed stocks is 18.9%. On the other hand, hedge funds account for the highest percentage of investments at 36.4%. Stocks are risky among investment methods, and in order to reduce risk, the portfolio has a low percentage of investments in stocks.

Choose an Investment Method That Provides Excellent Asset Management Through Lump Sum Investment

There is another point that corporations need to understand when it comes to asset management. That is to choose an investment method that can achieve superior asset management through lump-sum investment.

For retail investors, an excellent method of asset management is a regular investment. By investing a fixed amount of money in stocks every month, you can invest while diversifying your risk.

Corporations, on the other hand, are not free to invest their company’s money. After preparing the financial statements and paying the corporate tax, there will be cash left in the company. It is only after the financial statements are closed that we can see how much money a company has at its disposal.

In short, a company must use the money after paying the corporate tax to invest. In this case, it is excellent to invest in a lump sum using the high amount of cash remaining after the closing of accounts. You can also invest in a savings plan with your company, but in that case, you will be investing little by little, which will create a period of time when you are not investing, resulting in lost opportunities.

Also, in the case of a corporation, you do not know if you will be able to make the same profit the next year. In the case of savings investment, the same amount of money is invested every month. Since you do not know what the future profits will be, lump-sum investment is a better method of asset management for corporations.

Optimal Types of Asset Management for Your Company

Try to understand these and learn how a corporation should manage its assets. For corporations, the following are some investment options to consider.

- Low-risk hedge funds

- Offshore life insurance

By using these investment methods, you can increase your company’s money with low risk. You are free to make partial withdrawals along the way, which makes them the best investment option for companies.

The Best Investment Is a Low-Risk Hedge Fund

The best investment for a corporate manager is a hedge fund. Invest in low-risk hedge funds instead of high-risk hedge funds that invest in stocks and bonds with multiple leverages.

There are no good hedge funds in your country of residence. On the other hand, you can invest in good hedge funds in offshore tax havens where taxes are almost non-existent.

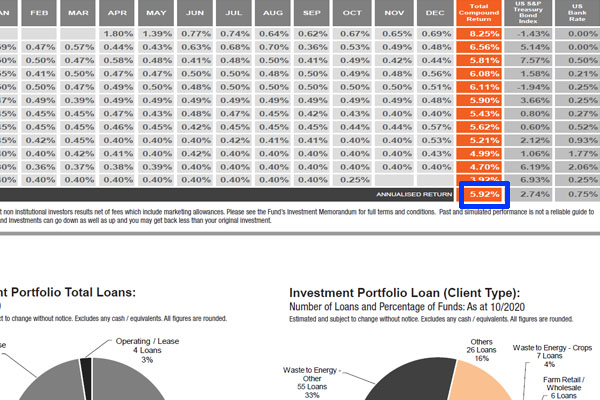

Low-risk hedge funds do not invest in stocks and bonds. Instead, they use bridge loans, mortgages, real estate, agricultural loans, or microfinance to increase their clients’ assets. For example, the following is a low-risk hedge fund that invests in agricultural loans.

The average annual interest rate is 5.92%, and the annual volatility is 0.75%. There have been no negative returns in the past, and it is a low-risk way to grow your assets. By opening an offshore investment account, you can invest in this hedge fund.

When investing in hedge funds, you can only invest in a lump sum. While opening an offshore investment account requires a lump sum investment of at least US$30,000, hedge funds allow you to increase your company’s assets with low risk.

Offshore Life Insurance Is a Good Choice for Long-Term Asset Management

On the other hand, there are some business owners who want to invest their assets for a long time. In that case, you can use offshore life insurance.

In many countries, there is no excellent life insurance. On the other hand, if you use tax havens, you can buy excellent life insurance. In other words, you should buy insurance products sold in tax havens such as Hong Kong, the Cayman Islands, and the United States.

When using life insurance as a corporate policy, you should consider receiving a high death benefit through whole life insurance. In other words, you buy life insurance to leave money to your future successors, not to spend it when you are running the company as president.

If you are planning to spend the money in a few years, you need to invest in hedge funds. By using an offshore investment account, you can withdraw your money at any time and increase your assets with low risk.

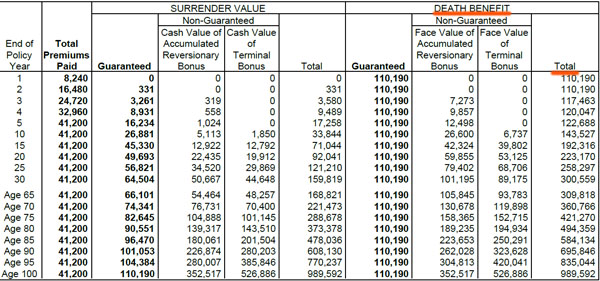

On the other hand, for the money you don’t use, you can use life insurance to increase your corporate assets for your successors. For example, here is a life insurance policy I took out when I was 31 years old with a lump sum of US$41,200.

After purchasing this life insurance policy, the surrender value and death benefit will increase as follows.

| Years of Participation | Surrender Value | Death Benefit |

| 20 years | $92,041 | $223,170 |

| 30 years | $159,819 | $300,559 |

When a company uses life insurance, it does not make sense to purchase insurance products for the purpose of surrender value. With offshore life insurance, the average annual interest rate on surrender value is about 4%. In other words, investing in hedge funds has a much higher average annual interest rate and is a more efficient way to manage assets.

On the other hand, we can receive an exceptionally high amount of money if it is a death benefit. Therefore, if you want to leave a large sum of money to your successor when you die, offshore life insurance is an effective way. For reference, many family business owners use offshore life insurance when they want their children or grandchildren to take over the company.

As for my life insurance policy, the death benefit will increase as follows.

- Age 65: $309,818

- Age 75: $421,270

- Age 85: $584,134

- Age 95: $835,044

- Age 100: $989,592

I do not know when I will die. However, I can leave such a high amount of money. Although the money I have paid is US$41,200, it will be hundreds of thousands of dollars in the future.

Make High-Risk Savings Investments with Surplus Funds You Will Never Use

After investing in these hedge funds and offshore life insurances, if you still have spare funds, there is nothing wrong with making regular investments as a corporation.

As mentioned above, it is not recommended for a company to invest in stocks. However, just as with individuals, it is excellent to invest in individual stocks and mutual funds (ETFs) as an exception if the following conditions can be met.

- Able to invest for 15-20 years or longer

- Can invest the same amount every month

Don’t invest a large amount of money in regular investments because the corporation needs to meet these conditions. You should also avoid having a high percentage of stocks in your portfolio because of the high risk. However, you can invest in stocks for 10-20% of your portfolio since a high yield is possible.

For corporations, you have to create a low-risk portfolio, such as hedge funds and offshore life insurance. However, it is not a problem to account for 10-20% of your portfolio in high-risk investment products.

Understand How to Build a Portfolio When a Company Manages Assets

If your corporation has a lot of cash, you should actively invest it. Keeping cash in the bank will not make your money grow. On the other hand, if you manage your assets, you can increase them at a high yield.

However, many managers make mistakes in managing their assets. In many cases, most of their portfolio is in individual stocks and mutual funds. Instead, you should invest in low-risk investment products when managing your corporate assets.

However, just like retail investors, if your company can invest the same amount of money every month and invest for a long period of time, your company can exceptionally manage its assets by investing in stocks. However, investing in stocks is a high-risk investment and should be limited to 10-20% of your portfolio.

When a corporation manages assets, there is a right way to invest. Make sure you understand which type of asset management is best for your company so that you can increase your company’s money.