If you have money in your company, you should actively invest it. By investing in stocks, bonds, hedge funds, etc., you can increase your company’s money.

However, unlike individuals, corporations need to invest with as little risk as possible. They usually avoid investing in stocks because a major recession causes asset values to plummet every few years. Instead, they should choose low-risk investments.

Even with low-risk asset management, an annual interest rate of 6-13% is possible if you invest properly. If you have retained cash that you do not use, it is excellent to increase the money through corporate investments.

However, you need to understand in advance how you should invest the surplus cash. Therefore, I will explain the necessity of asset management by companies, including the advantages and disadvantages.

Table of Contents

Investing with After-Tax Excess Cash Is Excellent

When a company invests, it is using its after-tax cash. Money used for asset management, such as stocks and bonds, cannot be used as an expense and must be invested with corporate tax taken into account.

If your company has a large amount of excess cash, you should invest it actively. If you keep your money in the bank, it will hardly increase. Therefore, there is a need to increase the money through asset management.

In the case of a company, if your company makes a high profit, you should invest it. You can increase your company’s assets by investing a lump sum of money after the end of the fiscal year and after paying taxes. For example, if you invest $100,000 in a lump sum, your money will grow as follows.

-In the Case of 6% Annual Interest Rate

| 5th year | 10th year | 15th year | 20th year |

| $134,900 | $181,900 | $245,400 | $331,000 |

-In the Case of 10% Annual Interest Rate

| 5th year | 10th year | 15th year | 20th year |

| $164,500 | $270,700 | $445,400 | $732,800 |

An annual interest rate of 6% is a yield that anyone can achieve, and even if you estimate the rate to be low, your company’s money will increase many times over. If you have the extra money in your company, the reason why you should invest it aggressively is that you can increase your company’s money significantly.

Educational Institutions Often Invest Actively

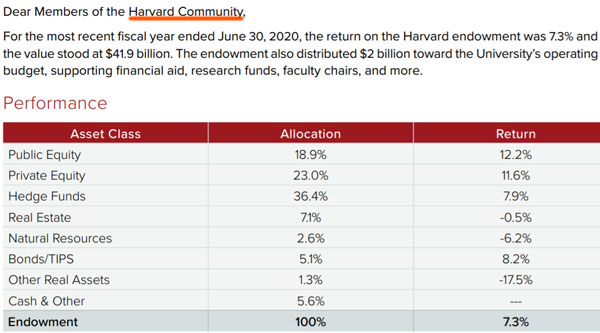

Universities in the US are famous examples of corporations actively managing their assets. Prestigious universities in the US receive large amounts of donations. Using these donations to invest is called endowment investment.

Among endowment investments, Harvard University is famous for managing its assets at an average annual interest rate of 10%. The following are the details of the portfolio disclosed by Harvard University.

In any case, it is usual to manage assets while running a corporation. By asset management, you increase your company’s money and use it in the future.

Don’t Use Debt to Invest

In addition to not using pre-tax money when managing assets, companies should also not use loans to manage assets.

If you manage your assets correctly, you can earn 6-13% annual interest even with low-risk investments. However, investments do not always increase your assets. In some cases, the investment may cause a decrease in assets. Therefore, you should not use debt to invest.

If you can borrow money at a low interest rate, you can make money by investing in higher-yielding investments. For example, you borrow money at an annual interest rate of 3% and invest it at an annual interest rate of 10%. As a result, you can make the difference of 7% annual interest.

However, most companies do not make this kind of investment. This is because investment involves risk and if the investment fails, the company will not be able to pay its debts and will default and go bankrupt. Therefore, you should only invest using your after-tax surplus funds.

Investing in Bonds Instead of Stocks Is Less Likely to Result in Losses

As mentioned earlier, when a company invests, it should always consider investing in low-risk assets. When investing as an individual, you should invest in stocks that offer high returns. On the other hand, companies should not invest in stocks.

When investing in stocks, an average annual interest rate of 10-20% is possible. However, a major recession can cause the stock price to drop by half or more.

On the other hand, if you invest in bonds, the value of your assets will not decrease significantly like stocks, unless the company you invest in defaults. While bonds are difficult to increase in value, they are also difficult to decrease in value. In addition, bonds offer dividends.

Because of these characteristics, bonds are an excellent investment choice for a company’s asset management. For example, HYG is a well-known bond ETF that pays about 5% annual interest.

- iShares iBoxx $ High Yield Corporate Bond ETF (HYG)

The chart below compares HYG to the S&P 500, which invests in the stocks of the top 500 US companies.

Compared to the S&P 500 (yellow line), the HYG (blue line) shows much less price movement. This means that investing in bonds is much less risky than investing in stocks. In the case of bonds, even if the price falls, it will quickly return to its original value.

Unlike individuals, companies may suddenly need a large amount of money. Therefore, low-risk investments are preferable instead of high-risk investments for corporate asset management. One of them is to invest in bonds.

Investing in Hedge Funds Is the Best

One of the best ways for a company to manage its assets is to invest in hedge funds. This is because hedge funds can generate annual interest rates of 8 to 13% even with low-risk investments.

When investing in bonds, the dividend yield is about 5% per year, even if the bond has a high dividend. If you take into account the rise in the price of bonds, the annual interest rate is about 6%. On the other hand, if you invest in hedge funds, a higher yield is possible.

Investing in low-risk hedge funds involves using funds that do not invest in stocks, such as mortgages and microfinance. For example, here is a fact sheet on a hedge fund that offers mortgages in Australia.

If you invest in this hedge fund, the average annual interest rate is 9.27%. There are no negative returns in the past. This is because it does not invest in stocks and the investment method is mortgage loans, so the risk is low.

Unlike investing in bonds, investing in hedge funds does not allow you to invest in amounts as low as US$100. You need to invest a lump sum of at least US$30,000. However, if your company has more than US$30,000 in surplus funds, you can invest in hedge funds for low-risk asset management.

Investing in US dollars Is Common

All low-risk investments, including bonds and hedge funds, are in US dollars. There is no good low-risk way to invest in assets other than in US dollars.

The most common way to manage assets is in US dollars. In fact, HYG, the high-yield bond I mentioned earlier, is an ETF that can be invested in US dollars. By investing in US dollars, you can earn dividends of about 5% per year.

When you invest in hedge funds, you also invest in US dollars. In other words, you have to invest in the key currency.

Therefore, there is a currency risk except for American companies. However, the US dollar is the most trusted currency, so it will never lose its value. Only the US dollar can provide excellent asset management, and make sure you understand this in advance.

The Most Important Thing Is to Invest in Your Business and Expand It

As a corporation, the most important thing is to expand your business. In other words, while it is important to increase your money through asset management, you should think more about expanding your core business.

For a business, an annual interest rate of 50-100% is normal by investing in equipment and human resources. It is natural that the profit generated by a company increases by 50-100% per year, and the business must be expanded through management.

In the case of asset management, on the other hand, as mentioned above, bonds offer annual interest rates of about 5-6%. When using hedge funds, the average annual interest rate is 6-13% for low-risk investments. Therefore, compared to business investment, the annual interest rate is overwhelmingly poor. Therefore, if you can make more money by expanding your business, it is better to consider investing in business instead of asset management.

However, some companies are so profitable that they have no use for expenses. In such cases, it is better to actively invest in assets instead of keeping surplus funds in the bank.

For companies that have been in the red for years or have not been able to increase profits by more than 10% per year, it is also better to invest in assets rather than business investments. This is because you can make more money by managing assets than by investing in businesses.

In general, a business owner should prioritize business investment. However, in some cases, it is better to consider asset management. In that case, consider investing in bonds or hedge funds.

Asset Management by Corporations Using After-Tax Profits

It is recommended for corporations to invest in assets. Although high-risk stock investments are not recommended, using bonds and low-risk hedge funds to manage assets is excellent.

Note that despite the advantages of increasing your money, there is a disadvantage for companies to invest in US dollars in order to have excellent asset management. Except for US companies, there is exchange rate risk. All good investment products must be invested in US dollars.

However, business expansion is the top priority for business owners. Investing in the business is by far the best way to achieve higher annual returns. However, if your company has a lot of surplus funds accumulated in the company or has been losing money for years, you should actively invest in assets as an exception. This is because you can make more money that way.

With this understanding, managers should decide whether or not to use after-tax profits to invest in assets. Also, when managing assets, it is recommended to use low-risk investment products.