By investing offshore instead of in your country, you can make your money grow significantly. This is especially true if you invest in offshore tax havens, where no taxes are charged.

When it comes to offshore investment, we tend to think that we have to go to the site and sign a contract.

However, in reality, it is not necessary to go to the country. There are financial products that allow you to make the contract online in your country without traveling. In fact, there are many offshore financial products that I have signed up for a while living in my current country without having to travel to the tax haven.

This is because there are a number of offshore investments that allow credit card payments. You can pay to the financial institution (fund) by credit card payment, and make a monthly accumulation. So, I would like to explain how to use a credit card to make an offshore investment, and what you need to know about credit card payments.

Table of Contents

You Can Sign Up Without Traveling While Living in Your Country

In offshore investment, there are some people who participate in tax haven inspection seminars. Of course, it is true that there are some financial products that can be contracted by traveling there. In particular, if you are thinking of purchasing offshore insurance (life insurance), there are cases where you need to go to a local hospital for a medical examination.

However, if you want to accumulate money as an offshore mutual fund, you don’t need to have a bank account in a foreign country, and you don’t need to visit the site.

So you can sign up for it while living in your country, without having to travel.

However, in order to actually have your assets managed, you need to send money to a foreign financial institution (fund). You have to pay money every month to accumulate, but if you send money overseas from a domestic bank, the fees will be very high.

This is why you should use a credit card. If you pay by credit card, you don’t have to bear the high overseas transfer fees each time. You can start regular investing by credit card immediately without any difficult procedures.

Examples of How You Can Pay by Credit Card to Invest Abroad

For example, the following is a statement from the official website of an offshore investment company.

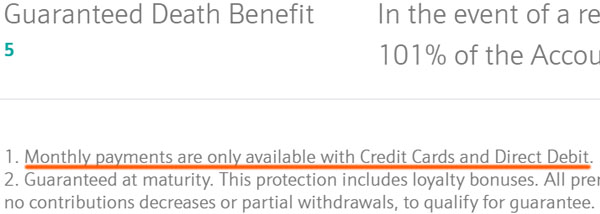

As you can see, it says that monthly payments are only available with credit cards and direct debit.

It is a very popular insurance company for people all over the world, and they accept payment by credit card. Bank transfer for annual payment is also possible, but there is a fee for transferring money overseas. Therefore, credit card payment is inevitable.

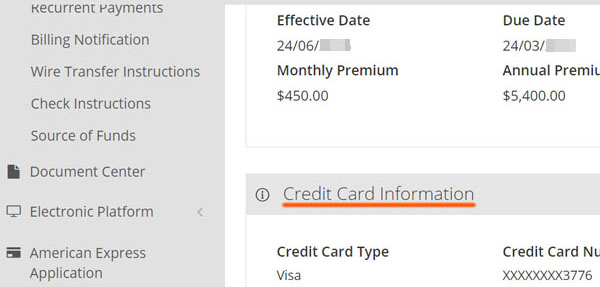

I also invest in foreign mutual funds, and naturally, I choose to pay by credit card. For your reference, the following is my management screen at my offshore investment company.

Thus, you can see that I am able to make my monthly payments by registering my credit card.

Credit Card Fees Vary by Insurance Company (Fund)

You accumulate money by making credit card payments to financial institutions, but some insurance companies (funds) may charge a credit card fee.

Generally, the fee is between 0.5% and 1%. In other words, of the money you pay, 0.5 to 1% will be deducted, and the money will be accumulated.

In investment, the difference of 0.5 to 1% is very large. In the case of offshore investment, you will be aiming for an annual interest rate of more than 10%. For example, if you invest 10,000 USD at 10% annual interest for 40 years, it will amount to about 452,500 USD. On the other hand, if the annual interest rate is 9%, it will be about 314,000 USD.

You may think it is only 1%, but this 1% can make a difference of about 140,000 USD in the future. Therefore, you should consider the issue of credit card fees as a big one.

-Financial Institutions with No Credit Card Fees Are Excellent

There are some financial institutions that allow you to invest offshore with no credit card fees. If you invest in such insurance companies, you can accumulate the entire amount directly as a regular investment without any commission.

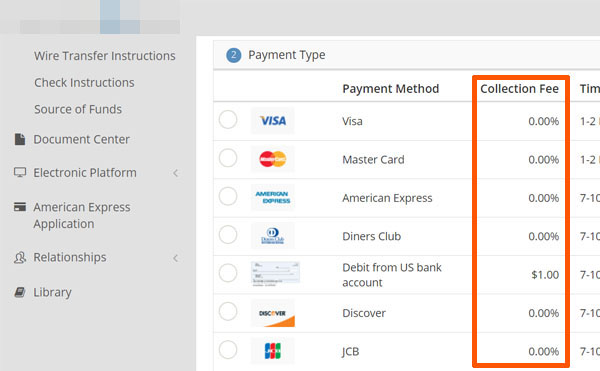

For example, the following is a part of my management screen when I log in to my offshore investment company.

As you can see, most credit card fees are zero. Since commissions are a very important factor in offshore investment, you need to check in advance what fees you will be charged.

Earn Points with Investors Trust and RL360°

If you invest offshore while living in your country, many people invest in insurance companies such as Investors Trust and RL360°.

These insurance companies accept credit card payments. This allows you to sign up without having to travel to tax havens. In short, you can easily manage your assets overseas.

It is important to note that both Investors Trust and RL360° do not charge credit card fees (with some exceptions).

Since there are no credit card fees, the entire amount can be accumulated directly. Moreover, the credit card companies will give you their original points or miles. Although the points awarded vary depending on the credit card’s rate of return, for example, if your credit card has a 1% rate of return, you can think of it as 1% of your money growing at a simple interest rate when you invest abroad.

If you invest 300 USD per month, you will be paying 3,600 USD per year. If the rate of return is 1%, you can earn the following points.

- 3,600 USD per year x 1% = 36 USD

If you use a credit card, you can earn various points and miles. In this way, paying by credit card for offshore investments has a secondary effect other than increasing your money by asset management. Therefore, even if you have an overseas bank account in a tax haven, you should choose to pay by credit card instead of direct deposit.

You Can Change Your Credit Card at Any Time

There are some points to keep in mind when using a credit card. In particular, how to change your credit card is one of the points of concern.

The basic principle of regular offshore investment is to invest for a long period of time such as 10 or 20 years. If you don’t do this, your money will not grow at a compound interest rate, which is meaningless.

However, credit cards have expiration dates. Therefore, you must update your credit card information at some point in time. There are also cases when you want to change the credit card information you have registered.

This is no problem, and you can change your card at any financial institution that accepts card payments, including Investors Trust and RL360°.

Example of Credit Card Change at an Offshore Investment Company

How can you change your credit card? You can contact your IFA, or you can log in to the official website and change your credit card yourself.

For example, I have a contract with an offshore insurance company, as I have already mentioned, and I pay my mutual funds by card.

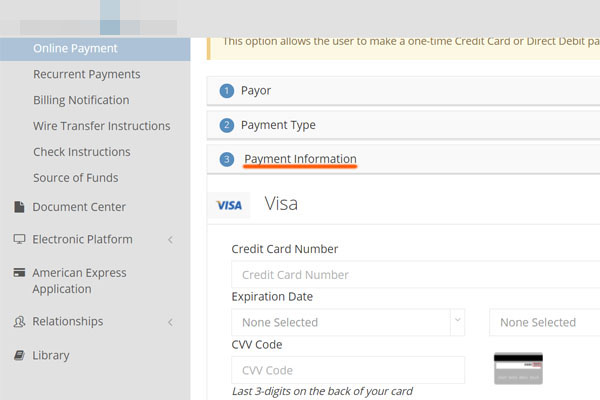

The offshore insurance company I signed up with allows me to change my credit card from the following page after I log in to their member site.

There is a page on the member’s site where you can change your credit card information. If you want to change or update your credit card information after you have made an offshore investment, you can contact the agency you signed up with, or if it is not bothersome, you can log in to the member site and do it yourself.

Be Careful of Credit Card Payment Limits

One of the disadvantages of paying with a credit card is that it needs to be updated.

You will be able to earn points from your credit card company without any fees, and you will be able to invest in offshore funds without owning a foreign bank account and without traveling to the local area. However, you need to adjust your payment so that you can pay without delay.

Not only that, when you choose to pay by credit card, be sure to pay attention to the limit, not only when you change or renew your card. Each credit card has its own credit limit, such as up to 10,000 USD.

Credit card payment methods and limits vary from country to country.

However, what they have in common is that credit cards cannot settle more money than the limit. Therefore, if you use up to the credit card limit, you will not be able to settle, and your regular investment will be stopped. Be sure to pay attention to these limits, not just the expiration date, and make use of card payments.

If you have reached your credit limit, you need to contact your credit card company and make an early repayment. Also, if there is a month when you are unable to make a payment by card, you need to log in to the member’s website and make a payment.

Paying by Credit Card and Investing in Foreign Mutual Funds without Traveling to the Area

You don’t necessarily have to travel to a foreign country (tax haven country) or have an overseas bank account to purchase foreign financial products and manage your assets. Also, you don’t have to transfer money overseas, and you can invest abroad by paying your credit card.

When you invest offshore, you can send money to financial institutions by credit card, and you can sign up with insurance companies without traveling while living in your country.

When investing in an offshore fund, it is best to choose an insurance company that does not charge credit card fees. This is because a small difference of a few percent affects the amount of money you invest in the future.

Moreover, if there are zero card fees, you will benefit according to the points that the credit card company will give you uniquely. Although you have to be careful about credit card changes and limits, you will benefit from paying by card for regular investments.

Understand what I have explained so far, and use credit card payments to manage your assets. The financial products that can increase your assets at an excellent speed are overseas mutual funds, and you can accumulate them monthly through credit card payments.