There are regions in the world where it is little or no taxation, called offshore tax havens. Most tax haven regions involve the United Kingdom or the United States.

Among these tax havens, the United States is known as the largest offshore region in the world. Instead of a country with a small area like the Cayman Islands, Bermuda, the Isle of Man, or Singapore, the US mainland itself is a huge tax haven.

This is because different states have completely different laws and systems in the US. Some of these states are functioning as tax havens; the most famous state is Delaware. Although there are other states with lower taxes, such as Nevada and Texas, Delaware is particularly famous as a tax haven.

Why is the United States the world’s largest tax haven? Let’s take a look at some of the reasons.

Table of Contents

The United States Is the World’s Largest Tax Haven

Although the United States is a developed country, it is known for its low taxes. Many ordinary people who work for American companies feel that taxes are not low and pay high taxes. This is true, and ordinary people have to pay taxes.

On the other hand, for the wealthy, there are a number of ways to avoid taxes. In particular, if you are running a company, you can create a tax-free situation.

In fact, many wealthy people from Europe and Asia are moving to the US. The reason for this is not only because the US is a huge market, but also because it allows them to avoid taxes.

As mentioned earlier, there are many ways for the wealthy to avoid taxes in the US. Also, since the US is a tax haven, a lot of money gathers in the USA, making the United States richer.

One of the reasons why the US is such a huge country is because the US mainland is an offshore area.

Delaware Is Excellent for Running a Company

One of the most famous tax haven states is Delaware. The following is the location of Delaware.

It is the second smallest state in the United States and naturally has a small population. In spite of this, there are more companies registered in Delaware than the population.

More than 50% of the companies listed in the US are headquartered in Delaware. The reason why there are so many companies based in Delaware, a state with a small population and a small area, is because Delaware is a tax haven. This means that taxes are extremely low.

In Delaware, money earned inside the state is taxed, but money earned outside the state is not subject to state tax. As a matter of fact, very few business owners do business in Delaware. As a result, they pay no state tax.

Even if you are from out of state, you can easily set up a company and do not need to sign up for an office. Of course, even if you live outside the US, it is easy to incorporate a company in Delaware.

In addition, Delaware law makes it difficult to disclose corporate information and allows for a high degree of corporate anonymity. Moreover, it is widely known that court rulings are more favorable to the company, and the advantages of establishing a company in Delaware are great for business owners.

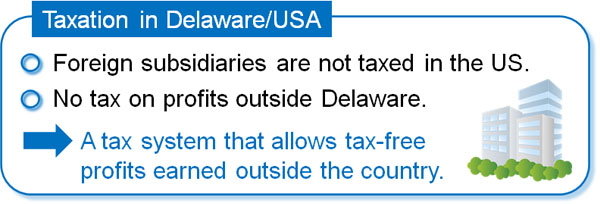

Profits Outside the US Are Tax Free, Including Federal Corporate Tax

For those who are able to make profits outside the US, federal taxes are also tax-free. Even though Delaware is a tax-free tax haven, it only reduces the state corporate tax to zero, not the federal corporate tax. All companies are subject to federal corporate tax if they earn profits inside the US.

On the other hand, for those who do business outside the US, the federal corporate tax is zero as well as the state corporate tax. The reason for this is because of the following system.

- Profits earned by foreign subsidiaries outside the US are not subject to taxation unless they transfer money into the US.

Because of this system, profits earned through business are tax free.

Many tax havens have a system of taxing profits earned domestically, but not taxing foreign earnings. The USA has a similar system, where profits earned abroad are not taxed unless they are transferred to the US.

As a matter of fact, there is no problem in doing business even if you do not remit profits earned outside the country to the US. Therefore, you can use the Delaware system to avoid taxation.

Although there is a standard of 15% as the lowest corporate tax rate in the world, this system is only for huge corporations that do business all over the world. Therefore, it is irrelevant for many business owners, and the fact remains that the US is a tax haven.

There Are Other States That Offer Tax Benefits, Such as Nevada and Texas

Since Delaware is a famous tax haven, there are several states that have imitated Delaware’s system in the past.

As for offshore regions, Dubai is known as a country that has succeeded in attracting foreign currency by making its own country a tax haven. Similarly, in the United States, there are cases where states have been turned into tax havens. Examples of this are Nevada and Texas.

These states do not have a state corporate income tax. There is also no income tax for individuals. Like Delaware, they have a very good tax system. As a result, large corporations often move their headquarters to these states.

However, Delaware is still the superior state when it comes to taxation and court systems. For this reason, not only Americans but also people from all over the world incorporate their companies in Delaware.

Compared to Other Countries, the US Tax System Is Superior

If you live in the US, you may think that taxes in the US are high. However, as mentioned earlier, if you are running a company, you can reduce the tax on your earnings outside the US to zero. The following is how to save on taxes.

- Create a corporation in Delaware.

- Create a subsidiary in a tax haven with zero corporate tax.

There is no tax on your overseas earnings if you receive the money in a tax haven with zero corporate tax. Also, as mentioned earlier, if you do not remit profits earned by your overseas subsidiary to the US, you will not have to pay any federal corporate tax. This means that you will not pay any taxes.

In addition to the system for corporations, the US tax system is superior to that of other countries.

As an example, let’s consider the situation of inheritance. In Japan, for example, the maximum inheritance tax rate is 55%. The basic exemption is small, and anyone with assets over 36 million yen (or US$360,000) may be subject to inheritance tax. Germany and France also have high inheritance taxes, with low exemptions and rates of 30% or 45%.

On the other hand, in the US, the basic exemption for federal estate tax (inheritance tax) is over $10 million. The amount of the basic exemption varies depending on the president’s policy, but the basic exemption is larger than in other developed countries, and the federal estate tax is not imposed unless the person is extremely wealthy.

To avoid taxation, wealthy people from Europe and Asia are actively moving to the US because if they live in the United States, they will not have to pay taxes.

The US Does Not Have Tax Treaties with Other Countries, and Money Laundering Is Common

Since the US is a tax haven, the financial system is less strict than in other countries, and as a result, a lot of money is attracted to the country. In fact, although I am not an American and have never lived in the US, I have opened an account with an American online brokerage firm to invest in stocks.

Normally, in order to use financial products, you have to be a resident of the country. However, in the case of the USA, even if you are a non-resident of the United States, you can use financial services in the USA.

Tax havens usually allow non-resident foreigners to use financial services, and as a result, money gathers from all over the world, and finance has become the main industry. This is the same situation in the United States.

Moreover, in the case of the US, there are no tax treaties with other countries. The US has its own system called FATCA, and based on this system, the USA does not exchange tax information with other countries.

The US is cracking down on other countries for money laundering as tax evasion and criminal financing by Americans. On the other hand, even if people from other countries send money to the US for tax evasion or criminal funds, the US will not pass on the information because the US does not have tax treaties with other countries.

Moreover, if they use a corporation in Delaware, it is more difficult to keep track of the money transfers because the company is protected by the state’s laws. This is why the US is the most used country for money laundering.

However, for the US, even if the money is related to tax evasion or crime, the US becomes wealthy because of the high amount of money coming into the US. Since the United States is the most influential country, this kind of behavior is tolerated.

The United States Attracts Money from Around the World

There are a number of reasons why the US economy is so large. One of them is tax havens. In the United States, there is an offshore region called Delaware, where money from all over the world gathers.

In fact, there are so many companies that are registered as corporations in Delaware that more than half of the companies listed in the US are headquartered. Although the office buildings where the employees work are located in other states, the tax base is in Delaware.

In addition, the US does not have tax treaties with other countries. Moreover, Delaware’s state laws protect companies and do not tax out-of-state income. Because of this function as an offshore, finance has been developed in the United States.

When it comes to tax havens, we tend to think of famous offshore regions such as the Cayman Islands, Bermuda, and the Isle of Man. However, it is important to understand that the United States is the largest tax haven in the world.