When managing your assets through offshore investments, Dominion Capital Strategies is known as an investment company that can help you increase your assets. Through regular investments (or lump-sum investments), you can earn more than 10% annual interest.

However, while annual interest rates of 10% or more are possible, there are also risks. Therefore, you need to understand the yield and details when using Dominion Capital Strategies. Dominion also offers a principal protection structure, which you can use to prevent a significant drop in your assets.

By learning the yields and fees on your investments, you have to understand in advance how your assets will grow.

So, when you invest offshore with Dominion Capital Strategies, I will explain how you can increase your assets through regular or lump-sum investments, including reviews, annual yields, and fees.

Table of Contents

Dominion Capital Strategies, a Company Registered in Guernsey

Managing assets in tax havens where there is little or no taxation are called offshore investments. By entrusting your assets to a professional investment company, you can have your money grow. One of these investment companies is Dominion Capital Strategies.

Originally, Dominion Capital Strategies was a company that managed assets as a family office. Later, it began selling financial products to the general public.

Dominion Capital Strategies is registered on the island of Guernsey. The following is the island of Guernsey.

Guernsey, a British Crown Dependency, is a famous tax haven located near the United Kingdom. The United Kingdom controls many tax havens, including the Isle of Man and Jersey, and Guernsey is one of them.

Because it is a tax haven, Guernsey attracts a lot of investment funds. Therefore, Guernsey is highly trusted and has a high rating of AA- from Standard & Poor’s (S&P).

Funds Are Segregated, and Assets Are Protected in the Event of Bankruptcy

In all tax havens, the main industry is finance. Guernsey is also a well-developed offshore financial center, with many large banks and investment companies registered on the island.

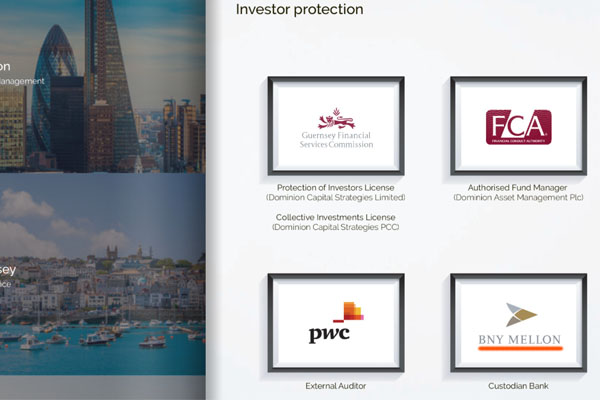

In addition, any financial company registered in Guernsey must segregate the assets of its clients. This is because there is such a law in place. For example, the following is the brochure of Dominion Capital Strategies.

When investors use Dominion Capital Strategies, they send their money to BNY Mellon (Bank of New York Mellon) because BNY Mellon is the custodian bank and keeps investors’ assets segregated.

BNY Mellon is an American bank. Therefore, although Dominion Capital Strategies is registered in Guernsey, when you invest offshore with Dominion, you are sending your money to a US bank.

Also, Dominion Capital Strategies does not allow withdrawals of segregated money, so you can manage your assets safely.

Furthermore, the auditing company is PricewaterhouseCoopers (PwC), which is one of the Big 4 accounting firms. Therefore, there is no fraud in the information disclosed, and you will not be scammed by using Dominion Capital Strategies.

Annual Interest Rate of 10% or More Is Possible with the Fund

If you invest offshore with Dominion Capital Strategies, what is the annual interest rate?

If you want to earn 10% annual interest by investing offshore, you have to invest in stocks. Therefore, if the economy is booming, the asset value will increase, but if the economy is in a recession, the return will be negative. Therefore, the average annual interest rate varies from year to year.

Dominion Capital Strategies has several funds. Here are some examples.

- New Technologies

- Managed Fund

- E-Commerce Fund

- Sustainable Growth Fund

- Global Equities

- Luxury Fund

- Global Bonds

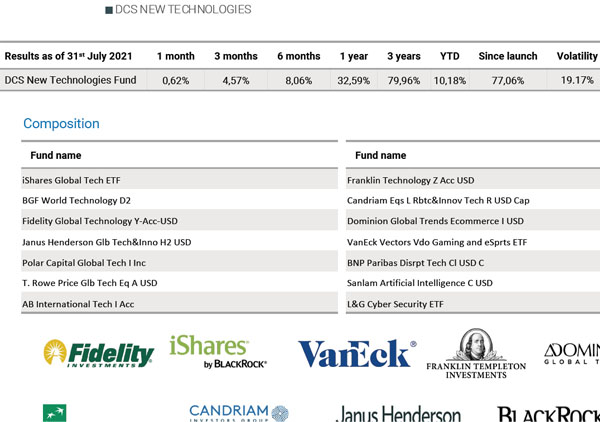

We will invest in a combination of funds from these funds. For reference, here is a fact sheet on New Technologies.

Since it invests in high technology companies, the stock price appreciation is excellent, with an average annual return of 28.14% over three years. However, the volatility is 19.17% per year, which can lead to negative returns in case of recession.

When you invest, you invest in multiple funds, not just a technology fund. Therefore, the annual interest rate will vary depending on which fund you invest in. However, if you choose and invest in the right funds, you can earn 10-17% annual interest by using Dominion Capital Strategies.

-Invest by Credit Card

Payment can be made either by overseas remittance or by credit card. Most people invest by credit card because there are no credit card fees.

Credit cards accepted are VISA, Mastercard, Amex, and JCB.

Investing in Bonds Is Not Recommended as a Conservative Investment

When investing offshore, conservative investment strategies are not recommended. For example, you should not invest in bonds. This is because of the high fees charged by Dominion. As with all offshore investments, you need to make a large return because of the high fees.

For example, even if you can increase your assets by 2% per year with bonds, there is no point in investing if you have to pay 2% per year in fees.

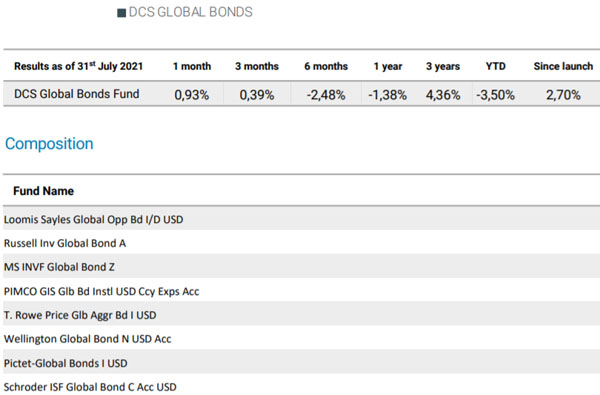

Also, Dominion Capital Strategy’s bond funds have poor investment performance. The following is a fact sheet on the Global Bond Fund.

The average annual interest rate for the past three years is 1.45%. In other words, the money has hardly increased. Also, as mentioned earlier, if you take into account the fees, you will have a negative return.

Always invest in stocks when investing offshore. There is no point in investing in bonds with low yields, and we can increase our wealth by investing in stocks, such as technology stocks and global stocks, which offer great returns.

PIP Is Available as a Principal Protection Program

Although you can increase your assets by investing in stocks, as mentioned above, the stock price will fall during a recession. When stock prices fall, the value of your assets will naturally fall.

In the past, major recessions have hit every few years. For example, the dot-com bubble in 2000 and the collapse of Lehman Brothers in 2008 caused stock prices to drop by about half.

To avoid this, Dominion Capital Strategies offers a principal protection structure called PIP (Protected Investment Portfolio). While it does not protect 100% of the principal, it can protect 80% of the principal even during a major recession.

If you add PIP, it will automatically increase the percentage of cash as the stock price declines due to a recession. Even if the stock price plummets, the stock is automatically converted to cash, thus preventing a significant drop in asset value.

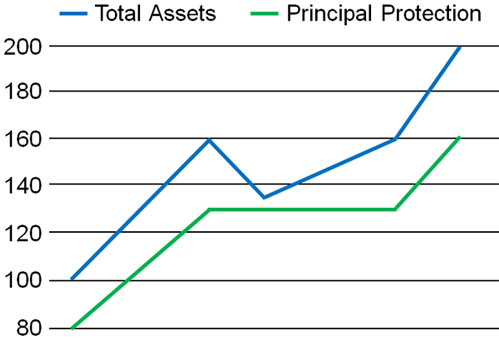

The principal is protected for 80% of the assets starting from the highest price. Therefore, if the stock price rises and the value of the asset increases, the principal protected asset will also rise. The result is as follows.

For example, if the highest value of an asset is 100, the principal protected asset is 80. If the value of the asset then increases to 200, the amount of principal protected is 160.

You can add or remove PIP at any time, and you will be charged an annual fee of 1% of the asset value if you use PIP. However, it can be added only during an economic downturn when stock prices are expected to fall, allowing you to increase your assets while protecting your principal.

You Can Invest Regularly or Lump Sum

There are two ways to invest offshore with Dominion Capital Strategies. Here are the two options.

- Regular investment: My Savings Strategy

- Lump-sum investment: My Investment Strategy

There are many investment companies that only offer regular investment products for offshore investment. Dominion Capital Strategy, on the other hand, offers not only savings investment (My Savings Strategy) but also lump-sum investment (My Investment Strategy).

The funds that can be invested are the same for both regular investment and lump-sum investment. The difference is in the fees, which are as follows.

Low Commission Regular Investment with Dominion: My Savings Strategy

One of the reasons why many people invest with Dominion Capital Strategies is because they offer low fees among offshore investment companies. The following are some of the most famous financial institutions for offshore investments.

- Investors Trust (ITA)

- RL360°

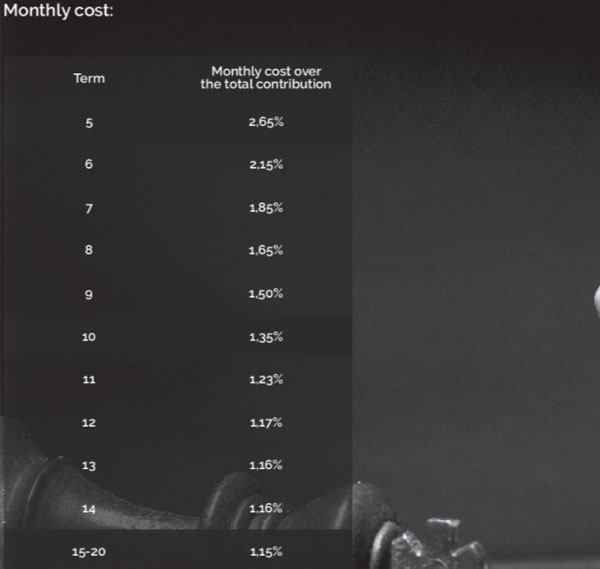

In the case of Investors Trust, the annual fee is about 2.5%. Also, RL360° has an annual fee of about 3%. On the other hand, if you invest overseas with Dominion Capital Strategies, the commission rate is 1.15% to 2.65% per year. The commission rate varies depending on the number of years you invest, as shown below.

In addition to this, there is a setup fee of US$25. These are the only fees; there are no other charges.

Importantly, the commission rate is 1.15 to 2.65% per year on the amount of investment you pay. You will not be charged an annual fee on your asset balance.

Usually, you pay an annual fee on your asset balance. Since the assets are managed through compounding, the amount of the fee will increase as the assets increase. In the case of Dominion Capital Strategies, the fee is calculated based on the amount invested, not the amount of assets. This is another reason why Dominion’s fees are lower than those of other offshore investment institutions.

Commission Payments Complete in the First Two Years: Free Money Withdrawals

One thing to note, however, is that Dominion Capital Strategies requires a unique method of a commission payment. The fee of 1.15-2.65% per year means that all fees are paid in the first two years, instead of being deducted every year.

Since you pay all fees for the entire period in the first two years, it is difficult to save money in the first two years after you start overseas savings investment. Specifically, it is as follows.

| 1-year (Fee rate) | 2-year (Fee rate) | |

| 5-year contract | 24.75% | 6.19% |

| 10-year contract | 49.50% | 12.38% |

| 15-year contract | 74.25% | 18.56% |

| 20-year contract | 99.00% | 24.75% |

For example, if you sign a 15-year contract to invest overseas, in the first year, 74.25% is commission and 25.75% will be accumulated in your investment account; in the second year, 18.56% is commission and 81.44% will be accumulated in your account. In the third year, there are no commissions and 100% of your investment amount is accumulated.

In the Dominion Capital Strategies brochure, the fee for a 15-year contract is listed as 1.15% per year. This does not mean that you will be charged a 1.15% commission every year; you will be charged all the required commissions in the first and second year, and from the third year there will be no commission.

-After the Second Year, You Are Free to Withdraw Money and Stop Payments

After two years, you are free to withdraw some of your money, stop making payments, or resume making payments since you have already paid all the necessary fees.

Usually, you should never withdraw or stop payments in the middle of an overseas savings investment. This is because the bonuses will not be paid, the fees will be high, and you will always lose money. On the other hand, if you use Dominion, you have the advantage of being able to stop payments at will because you have paid the fee initially.

However, you can only stop payments and withdraw your money after you have accumulated for two years. After you have paid all fees, you will be able to stop payments, withdraw during the process, and resume payments.

Offshore Investment in a Lump Sum: My Investment Strategy

On the other hand, you can choose to invest in a lump sum (My Investment Strategy). In general, offshore investments are usually made by regular investments. However, in the case of Dominion Capital Strategies, you can invest in funds as a lump sum.

The minimum investment amount is US$10,000, which is one of the lowest lump-sum investment amounts among offshore investments.

The initial setup fee of $25 is the same. Also, because it is a lump sum investment, the method of fee payment is different. For a lump-sum investment, you will be charged 1.6% per year on your contributions for the first five years, and 1% per year on your account value from the sixth year.

If you cancel your account within five years, you will be charged an early termination fee. Therefore, it is advisable to keep investing for at least five years.

Make an Offshore Savings or Lump-Sum Investment with Dominion

Among offshore financial institutions, Dominion Capital Strategies has an excellent review as an investment company with low fees. Because of the low fees, Dominion is an excellent choice if you want to invest offshore with an annual interest rate of 10% or more.

While investing in bonds is not recommended, annual interest rates of over 10% are possible if you invest in funds that invest in technology stocks or global stocks. You can manage your assets with low fees, although the payment method of fees is unique.

You can also choose to invest in a lump sum, so if you have more than US$10,000 to spare, you can start offshore investment with a lump sum.

One of the best investment companies for offshore savings and lump sum investments is Dominion Capital Strategies. With low fees, you can start managing your assets at an annual interest rate of 10% or more.