Naturally, it costs a lot of money to raise children. One of the most expensive periods is when your kids are going to college. It may not be a problem when your children go to high school, but when they go to college, it will be a big expense.

You can save for tuition in cash, but a more efficient way is to invest. You can prepare for future tuition fees by investing in regular or lump-sum investments.

However, there are not many people who understand the right way to manage assets. For example, most people think of using investment products in your country. As a result, they fail to make funds for their children’s future education.

If you want to invest in creating funds for your kids’ education, there is a right way to save. Therefore, I will explain how you can create funds for your children’s education through investment.

Table of Contents

Savings and Lump-Sum Investment Is Important for Children’s Education Fund

If you save money without thinking anything, the speed of money growth is very slow. Therefore, it is normal to think about saving money for your kids’ education in the future by investing in savings or lump-sum investments.

How much money you need to save for your children’s education varies from person to person. College tuition is different for each student. It also depends on whether the child will be attending college from home or renting an apartment.

For example, if you were to save $200 per month for 20 years, the total would be $48,000.

- $200/month × 12 months × 20 years = $48,000

Therefore, you should try to increase your money through asset management. For example, if you invest $200 per month at an annual interest rate of 8%, you will have about $117,800 after 20 years. If you manage your assets correctly, 8% annual interest rate is easy to achieve, and anyone can do it.

On the other hand, you can also invest in a lump sum instead of regular investment. For example, if you invest $30,000 in a lump sum and manage it at an annual interest rate of 8%, your assets after 20 years will be approximately $147,800.

With asset management, there is no need to save a large amount of money. You can simply increase the amount of money you need for your kids’ future education by investing. You need to understand the right way to invest your money because it is natural to double or more your money through asset management.

Accumulation Through Mutual Funds in Stocks Is Excellent, But Risky

One of the most common ways to invest is in stocks. The best way to do this is through mutual funds, and investing in US stocks will increase your wealth.

The most common destination for stock investment is the United States. The US has the strongest economy and also has been growing in population for a long time. Because of this situation, stock prices keep rising all the time in the long run. For example, below is a famous American index called the S&P 500.

The S&P 500 is an index that invests in the top 500 companies in the United States. It is also widely known that the past annual interest rate of the S&P 500 has averaged 7-9%.

If you invest in investment products or life insurance in your country, the amount of money you will gain from asset management will be minimal. On the other hand, if you open an account with a brokerage firm and invest in the S&P 500 in a lump sum or in a regular investment, your money will increase at an average annual interest rate of 7-9%. Therefore, the more knowledgeable investors are, the less likely they are to use their home country’s investment products or life insurance.

Stock Investment Has Risk of a Global Recession

However, there is a risk when saving for your children’s education by investing in stocks. That is the recession. Every few years, there is a global recession.

In the past, the stock market has seen stock prices drop by 40% or 50% due to global recessions. For example, the following are famous events.

- 1929: The Great Depression

- 1987: Black Monday

- 2000: Dot-Com Bubble

- 2008: Bankruptcy of Lehman Brothers

No matter how good your stock investments are, you will lose a lot of assets if these recessions occur. Therefore, while investing in stocks is a very good way to increase your money, it is not effective in terms of saving money for education.

If you were to fall into a global recession at a time when you need funds for your kids’ education, your assets would be greatly reduced. The time for your children to go to college is fixed, and no one knows whether there will be a recession or not at this time. Therefore, we have to avoid this risk.

Offshore Investments Increase Your Assets

This is why many people with investment knowledge invest offshore. Offshore investment is to invest in offshore tax havens where taxes are almost non-existent. With offshore investment, you can solve all the problems I have mentioned so far.

- You can invest with excellent returns.

- You can increase your assets even during a major recession.

If you want to create a fund for your children’s education, you need to meet these two conditions. Only offshore investments can do this.

Specifically, there are two ways to invest: savings and lump sum. If you don’t have a lot of money right now, you can invest money every month by regular investments. On the other hand, if you have a large amount of money, you can easily increase your assets by investing in a lump sum.

For Regular Investment, Principal-Protection Mutual Funds Are Recommended

If you want to invest offshore as a regular investment, invest in the S&P 500 index provided by an offshore insurance company is a good choice.

As mentioned above, the S&P 500 has an average annual interest rate of 7-9%. Therefore, by investing in the S&P 500 through an offshore investment company, you can manage your assets at an annual interest rate of 7-9%.

Why do most people use an offshore investment company to save money for education instead of opening an account with a securities company and investing in the S&P 500? The reason for this is that the S&P 500 index offered by an offshore investment company provides principal protection.

Regular investment in tax haven offers the following principal protection.

- 15-year investment: 140%.

- 20-year investment: 160%.

In other words, there is no loss of principal, even during a major recession. On the contrary, you are promised that your money will surely increase.

For reference, if you manage your assets at an annual interest rate of 4%, your assets will increase to 140% in 15 years and 160% in 20 years. In other words, even if asset management does not go well due to the major recession, the annual interest rate of 4% is guaranteed.

In order for the principal protection to be applied, there is a condition that you must continue to invest the amount you have initially decided until maturity without any reduction or partial withdrawal. This is an investment product that promises to increase your assets as long as you keep this condition.

Lump-Sum Investments Can Increase More Than Quadruple Your Assets

On the other hand, there is also the option of investing in a lump sum instead of regular investment. If you have $30,000 in cash available, you can increase your assets more efficiently by choosing a lump-sum investment.

With offshore investments, you can open an investment account to invest in hedge funds. Although there are high-risk, high-return hedge funds, there are also low-risk hedge funds. Since our goal is to save money for education, we will naturally invest in low-risk hedge funds.

Low-risk hedge funds invest in real estate, bridge loans, etc., and they do not invest in stocks. These hedge funds provide stable returns regardless of recessions.

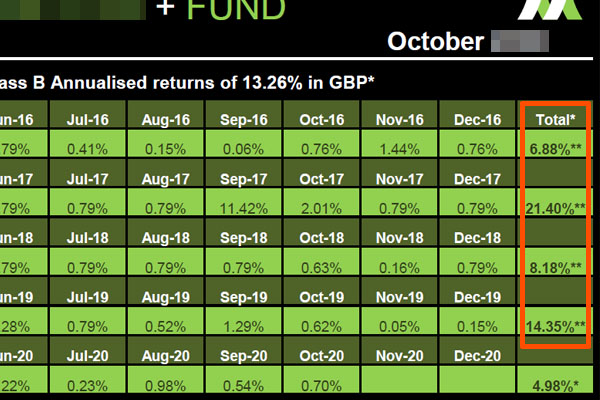

A high-risk, high-return hedge fund can achieve an annual interest rate of 20-30%. On the other hand, even a low-risk hedge fund can achieve 10% annual interest. For example, the following is a hedge fund that deals with real estate loans.

The average annual interest rate of this fund is 13.26%. Even during the global recession in the past, there has been no negative return. The method of not investing in traditional instruments, such as stocks and bonds, is called alternative investments. Hedge funds that invest in alternatives are low-risk investments.

If you want to build a fund for your children’s education, make sure to invest in low-risk hedge funds. That way, you can increase your assets regardless of the recession. For your reference, if you invest at an annual interest rate of 10%, your assets will increase as follows.

- After 15 years: about 4.1 times.

- After 20 years: about 6.7 times.

If you want to invest in a lump sum, you can invest in hedge funds through offshore investment. If you open an offshore investment account, you will be able to manage your assets efficiently.

There Is Little Risk of the US Dollar Becoming Less Valuable

One factor that can be a disadvantage in offshore investment is currency risk. In general, offshore investments can be made in the following currencies.

- US Dollar

- Euro

- British Pound

If you live in the US or Europe, investing in US Dollars, Euros, or British Pounds has no currency risk. On the other hand, if you live outside of the US or Europe, there is currency risk.

In general, offshore investments are made in US dollars. So, when you change the currency from US dollars to your country’s currency, there is an exchange risk.

However, the value of a currency has a lot to do with the strength of the country. If you compare your country with the US, it is obvious that the US has a stronger economy. In other words, it is natural to think that the value of the US dollar with its strong economy will rise in the long run.

Even If the Currency Appreciates, It Will Be a Positive Return

In some cases, of course, the value of your country’s currency may appreciate. But even in such cases, investing abroad will almost certainly increase your assets.

For example, let’s say the value of the US dollar falls dramatically, and it becomes 0.8 times the value of the dollar.

Even if there is a major recession, as mentioned above if you invest for 15 years, your assets will increase to 140% by principal protection, and if you invest for 20 years, your assets will surely increase to 160%. If the value of the US dollar declines and there is a foreign exchange loss, the asset management results will be as follows.

- 1.4 (140%) × 0.8 = 1.12 times

- 1.6 (160%) × 0.8 = 1.29 times

As you can see, even if you assume the worst-case scenario, your assets will have increased.

In the case of investing in hedge funds using an offshore investment account, instead of a principal-protection regular investment, the recession does not matter in the first place. Moreover, annual interest rates of 10% or more are common for lump-sum investments.

Also, as mentioned earlier, it is common to think that the value of the US dollar will appreciate. Even assuming the worst-case scenario, offshore investments will increase your assets, so if you are thinking of saving for your children’s education, offshore investments are the best choice.

You Don’t Need to Convert US Dollars into Local Currency

Note that when considering exchange rate risk, there is no need to immediately convert to your country’s currency. In offshore investment, it is common to invest in US dollars, and you can receive the money in US dollars at maturity.

Even if you need to pay for your kids’ college education, it doesn’t mean that you will need a lot of money in the first year of school. Since it is natural to pay tuition over several years, there is no point in converting the entire amount into local currency at maturity. Instead, try to convert the US dollars you need into the local currency.

Even if the value of the US dollars is low at maturity, the situation will have improved over the next two to three years. So, you can gradually change your money from US dollars to the local currency to pay for your kids’ school fees.

When you cancel your offshore investment and receive your money, you can specify all banks in the world. In addition, you can receive the money in a variety of currencies: local currency, US dollars, and Euros. Take advantage of this nature to convert US dollars into local currency whenever you want.

Saving for Your Children’s College Expenses Through Asset Management

Saving money in cash is extremely inefficient. Therefore, many people try to save money for their children’s education through asset management. If you invest in a savings or lump sum, you can increase your money many times over through asset management.

However, many people make a mistake in managing their assets. They think of using the investment products or life insurance of the country where they live. Alternatively, you can open an account at a brokerage firm and invest in stocks, but there is a disadvantage that your assets will decrease during a recession.

When you consider building an education fund, you need to eliminate as much risk as possible. Therefore, you should invest your money in offshore. By investing in mutual funds with principal protection or low-risk hedge funds, you will be able to increase your assets without fail.

People who live outside of the US and Europe have currency risk, but their assets increase many times over, so your assets will increase even after taking currency risk into account. Offshore investments offer low-risk investments, and if you want to create money for your children’s education through asset management, buy investment products in tax havens instead of investment products in the country where you live.