Offshore tax havens are areas where there are almost no taxes. When using tax havens, you can invest in hedge funds.

One of the best ways to invest in hedge funds is through the financial products offered by Custodian Life. By using Custodian Life, you can invest in some of the best hedge funds in the world and have your money grow.

However, not many people understand how to invest using an offshore investment account. Also, before investing, you need to learn about Custodian Life’s products, including the advantages and disadvantages.

An account for investing in hedge funds involves depositing a large amount of money through a lump sum investment. So, let’s check what the financial products of Custodian Life, which are frequently used for offshore investments, are structured.

Table of Contents

Offshore Investment Allows You to Create an Account to Invest in Hedge Funds

Usually, it is difficult to invest in hedge funds. It is not clear where the best hedge funds exist, and even if you open an account at a major megabank in your country, you will not be able to invest in hedge funds.

In many countries, there are private hedge funds, but they are all scams. Monthly distributions, high yields but no negative return years, etc. These are all typical scams, hedge funds with no operational reality.

It is important to understand that it is impossible to invest in a hedge fund through a financial institution in your country. You need to open an investment account in an offshore region.

In many countries, there are only bad investment products due to financial regulations. On the other hand, in tax haven countries, finance is the main industry. Naturally, financial regulations do not exist, and you can purchase any investment product in the world. One of the most popular investment options using tax havens is hedge funds.

The Product of Custodian Life in Bermuda Is EIB

The name of the product for the investment account to invest in hedge funds varies depending on the insurance company located in the tax haven. The name of the investment account offered by Custodian Life is called EIB (Exclusive Investment Bond).

Custodian Life is located in Bermuda. Bermuda is one of the tax havens, and the money made from the investment is tax-free, and there is no corporate tax. By opening an investment account with Custodian Life in Bermuda, you will be able to invest in hedge funds.

The reason why many people use the EIB when investing in hedge funds is that there are many financial instruments that can only be invested in through the EIB.

Through the EIB, you can manage structured notes, ETFs, stocks, bonds, and cryptocurrencies in one place. However, these can be invested by opening an online brokerage account yourself. There is no point in paying high fees and opening an investment account with a company located in a tax haven.

On the other hand, it is impossible to invest in hedge funds through a brokerage firm in your country. So, by using Custodian Life’s EIB, you can invest in excellent hedge funds. The reason why many people open investment accounts in tax havens is that they can invest in hedge funds.

An Insurance Company Specializing Only in Offshore Investment Accounts

For offshore investment, you can use an account to invest in hedge funds besides Custodian Life. Among these insurance companies, why do so many people use Custodian Life’s EIB?

In the case of Custodian Life, the only product they offer is EIB. In the case of general offshore insurance companies, they often offer multiple financial products, such as regular investment products through mutual funds. On the other hand, Custodian Life specializes in products only for offshore investment accounts.

As a result, it is possible to purchase any investment product in the world through EIB.

Some of the most famous companies for offshore investments are Investors Trust and RL360°. For Investors Trust and RL360°, the names of the investment accounts that can invest in hedge funds are as follows.

- Investors Trust: Access Portfolio (ACS)

- RL360°: Personal Investment Management Service (PIMS)

However, even if you open an offshore investment account with one of these companies, there are self-regulations on the funds you can invest in. For example, Access Portfolio has restrictions such as you can only invest in European hedge funds. Since there are almost no good investment options, it is not worth using.

For regular investment using mutual funds, Investors Trust and RL360° are excellent. But for lump sum investments in hedge funds, be sure to use Custodian Life’s EIB.

Exclusive Investment Bond (EIB) Available for $30,000

How much is the minimum investment amount required? In the case of EIB, you can open an account by sending US$30,000 to Custodian Life.

When you invest in a hedge fund, you may think that you need hundreds of thousands of dollars. However, this is not the case. By using Custodian Life, you can invest in hedge funds by sending a minimum of $30,000 to Custodian Life.

In most cases, the minimum investment amount for a hedge fund is $10,000. For example, if you send $30,000 to Custodian Life, you can invest in three hedge funds.

- $10,000 × 3 funds = $30,000

Of course, if you send higher amounts of money, you can further diversify your investments. As for me, I have created an EIB account with Custodian Life, and when I opened the account, I received the following email.

By actively investing in hedge funds, my assets have been growing at an excellent annual interest rate. Compared to other insurance companies, Custodian Life requires a lower initial investment to open an account, which makes it easier to invest in hedge funds.

Withdrawals from the account can be made at any time. When you need the money, you can use it.

-An Insurance Company, But No High Death Benefit

By the way, Custodian Life is an insurance company. However, even though it is an insurance company, it does not provide high death benefits. The EIB is just an investment account.

The EIB offered by Custodian Life is not a life insurance policy. When you die, the money in your EIB account will be inherited by your family at approximately the same market value.

-Available Investment Currencies

Usually, offshore investments are made in US dollars. The EIB also accepts euros, British pounds, Norwegian krone, Swedish krona, Australian dollars, and Swiss francs.

Why Use an Offshore Investment Account Instead of Direct Investment?

If you want to invest in a hedge fund, you can also invest directly. In other words, you can send money directly to the hedge fund instead of opening an investment account at Custodian Life.

Even though this is possible, why do so many people open an investment account at Custodian Life? This is mainly because of the following reasons.

- Low minimum investment payment compared to direct investment.

- Easy to manage investment funds.

- Ability to invest with segregated management.

When you invest directly in a hedge fund, you will have to prepare a large amount of money. You don’t need several million dollars, but a minimum investment of US$100,000 per hedge fund is often required.

With Custodian Life, on the other hand, the minimum investment payment for each hedge fund goes down to $10,000. The reason why the minimum investment amount is lowered is that many people have already invested in a hedge fund through EIB. This means that the investment is not a new one but an additional one.

Even if the new investment requires $100,000, the additional investment will be $10,000. This is the reason why the initial investment amount can be reduced compared to direct investment.

Also, the lower the minimum investment amount, the more hedge funds you can invest in, which makes it easier to diversify your risk and create a superior portfolio. However, the more funds you invest in, the more difficult it becomes to manage them. With EIB, you can view all your investments in a single management screen.

In addition, Custodian Life will segregate the assets. In other words, it is impossible for hedge funds to withdraw your money privately, and they can only give investment instructions such as buying and selling stocks. Therefore, your assets are safe and protected.

Understanding EIB Fees: You Should Invest for 10 Years or More

How much is the fee for using Custodian Life? In order to use the EIB, you need to pay the following fees.

- Account Maintenance Fee: 1.18% per year (1.01% per year from the 11th year)

- Policy Fee: $500 per year

- Transaction Fee: $45

The most important one is the account maintenance fee. The amount of the policy fee is fixed and will not increase. As your assets grow, the amount of the policy fee becomes negligible. On the other hand, an account maintenance fee is required at about 1% per year of the asset balance (or the total amount of deposits so far), and this fee tends to be very expensive.

In addition to this, a transaction fee of $45 is required when you submit a purchase order for a hedge fund.

Moreover, if you cancel your account within 10 years, you will be charged a cancellation fee. The surrender charge is the remainder of the account maintenance fee up to the 10th year that has not been paid. For example, if you cancel your account in the 7th year, the cancellation fee will be the account maintenance fee for three years.

Therefore, if you use Custodian Life, consider using it for more than 10 years. It is recommended to use this service if you want to increase your assets through long-term investment rather than a short-term investment. Although you will be charged a high fee for short-term surrender, there is no penalty for withdrawing your money in the middle of the term.

-Partial Cancellation at Will

You can make a partial cancellation (partial withdrawal of money) at any time with a minimum of US$1,000. If you close your account within 10 years, you will be charged a cancellation fee as mentioned above. On the other hand, there is no surrender charge for partial cancellation.

However, the account maintenance fee of Custodian Life is calculated based on the higher of the asset balance or the total amount of deposits so far. Therefore, if the amount of partial withdrawal is too high, the account maintenance fee will be higher.

-Leave 3% of Your Investment Amount as Deposit

Another thing to keep in mind is that you need to leave 3% of your investment to pay the account maintenance fee to Custodian Life. For example, if you invest $100,000, you need to leave $3,000 as a deposit in your account as cash and use the remaining $97,000 to invest in hedge funds.

- $100,000 × 3% = $3,000

Since the account maintenance fee of Custodian Life is 1.18% per year, the deposit will be gone after 3 years. In order to pay the custodian life account maintenance fee, you will need to send money overseas or partially surrender your fund.

Hedge Funds You Can Invest in Vary from Low Risk to High Risk

What kind of hedge funds can you invest in? When it comes to hedge funds, we tend to think of high-risk and high-return. In fact, hedge funds that deal in stocks, futures, and forex are high-risk and high-return in many cases.

In the case of high-risk, high-return hedge funds, you can aim for an annual interest rate of 20-30%.

On the other hand, there are also low-risk hedge funds. In the case of low-risk hedge funds, the average annual interest rate is about 10-12%. You can’t aim for a high rate of return, but if you want to increase your assets every year, low-risk hedge funds are suitable for you.

Which hedge fund is better for you depends on your risk tolerance. If you have a high-risk tolerance, you should invest in a high-risk hedge fund. On the other hand, if you have a low-risk tolerance, you should invest in a hedge fund that offers a low annual interest rate, and your assets will almost certainly grow.

Low-Risk Hedge Funds Deal in Corporate Loans and Mortgage

What do they deal in as low-risk hedge funds? These hedge funds almost never trade in stocks, bonds, futures, or forex. Rather, they manage their assets through methods that differ from traditional investments.

Also called alternative investments, they include, for example, the following.

- Earning interest income through corporate loans.

- Mortgage loans to generate interest income.

- Microfinance to earn interest income.

- Lending money and earning interest income through agricultural loans.

In short, they make money mostly by earning interest income. The value of the investment does not rise (or fall) like stocks or forex, and you earn a certain percentage of interest income. Although there is a risk of bankruptcy of the lender, the risk is much lower than that of traditional investment products such as stocks and bonds.

For example, the following is a fund that provides bridge loans to corporations in Europe.

As you can see, we can earn a stable annual interest rate of 8-10%. The fund will provide a bridge loan of up to 18 months, allowing the corporation to continue its business until it receives a bank loan. Because it is a bridge loan, many companies are willing to accept such loans with higher interest rates.

Institutional investors and family offices around the world are investing in this fund, partly because some of its clients are huge European companies. The EIB offered by Custodian Life allows you to invest in this fund.

High-Risk, High-Return Hedge Funds Trade Stocks and Futures

On the other hand, you can choose to invest in high-risk, high-return hedge funds. Different hedge funds have different investment performances, and some have high-risk and low-return results. You need to avoid these hedge funds and invest in hedge funds that offer high returns.

Also, since each hedge fund has a different strategy, if you invest in multiple high-risk hedge funds, you should diversify your investments among hedge funds with different strategies.

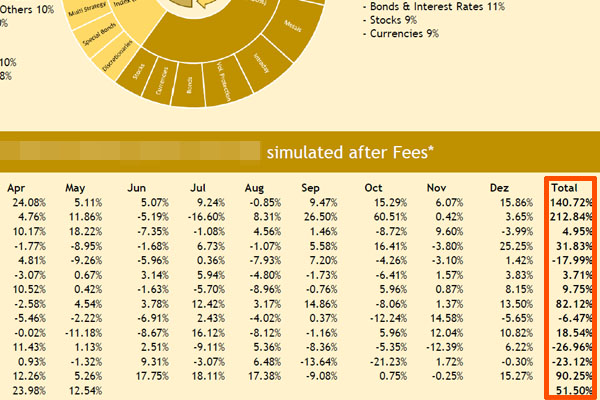

For example, I invest in the following hedge fund.

This hedge fund has made an increase of about 30 times in assets in 14 years. Even after deducting the fees paid to the hedge fund, the returns are huge.

Checking the actual results, we can see that sometimes the assets have almost tripled in one year (212.84%), and sometimes they have lost about -25% for two years in a row. Overall, the average annual interest rate is 29.20%, but it is high-risk and high-return.

Investment Performance Varies Depending on the IFA You Sign Up With

Custodian Life offers accounts to invest in many hedge funds. However, it is the IFA (Independent Financial Advisor) who actually gives the investment instructions.

When investing offshore, you must go through an agent. Also, each IFA deals with different hedge funds. Therefore, which IFA you contract with is the most important.

Earlier, I showed two hedge funds. I have invested in both of these. However, even if you find an IFA on your own and want to invest in the same hedge fund as I do, you will not be able to invest. This is because the IFA knows only a limited number of hedge funds.

You need to apply from an IFA who can find and suggest an excellent hedge fund from the myriad of hedge funds that exist. Otherwise, even if you invest a lump sum, your investment performance will be poor. It is important to understand that investment returns using Custodian Life will be completely different depending on the IFA you apply to.

Investing in Hedge Funds with an Offshore Investment Account

It is not possible to invest in hedge funds in the usual way. It is also difficult to find an excellent hedge fund in the market.

So, you can use Custodian Life to open an offshore investment account called EIB. You can buy investment products from all over the world, including hedge funds.

If you can pay $30,000 in a lump sum, this is the best way to invest offshore. There are other insurance companies that allow you to open an investment account. Among them, Custodian Life offers only EIB, which is the best product in the market.

However, there are countless hedge funds. There are hedge funds with poor quality and others with excellent performance. Determine your risk tolerance and then try to increase your assets by investing in hedge funds.