One of the companies that many people sign up for when it comes to offshore investments is Investors Trust (ITA). ITA is a popular insurance company for people all over the world because it offers excellent products, including the existence of principal-protected financial products.

Investors Trust offers not only safe financial products such as principal protection but also products that offer higher yields. One such product is Evolution.

When signing up for financial products at Investors Trust, many people consider Evolution. However, most of them don’t understand what the actual yield performance or loyalty bonus is.

So, I will review what the actual situation is at Evolution, including fees, bonuses, and investment yield performance, including my own personal experience.

Table of Contents

Building an Aggressive Portfolio with Investors Trust (ITA)

When you invest abroad with Investors Trust (ITA), unless you have a specific reason, you will sign up for one of the following two.

- Evolution

- S&P 500 Index

The S&P 500 Index is linked to the US S&P 500 and is a safe investment. Therefore, there is principal protection, and you are assured that your money will return in 20 years, increasing your assets to more than 160% of your original capital. It is popular among many people because it is sure to increase their assets.

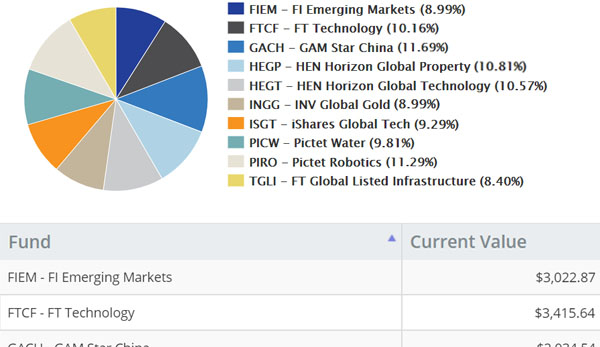

On the other hand, Evolution is a more aggressive type of asset management. You create your own portfolio and invest in it. The actual portfolio can be checked on the management screen, and my Evolution management screen looks like this.

To be honest, when you look at this portfolio, you probably have no idea what the content is about. However, that’s not a problem. We are not asset management professionals; we are investors.

We leave the asset management to the professional fund managers, and as long as we can check whether our money is growing or not, we are fine.

Checking the Performance of Yields and Interest Rates of Evolution

Since it is not a financial product with a guaranteed future profit, the most interesting point about Evolution is how much the yield is actually. What are the interest rates on this?

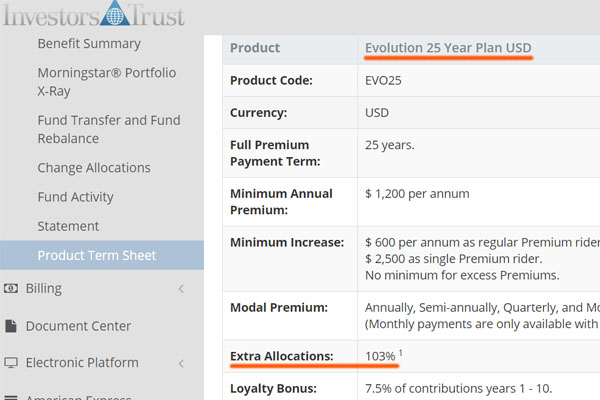

Since the actual results are not disclosed, I would like to show you the actual results of my contract with Evolution. First of all, I have a 25-year contract with the following details.

- Monthly investment of $450.

- Monthly credit card payments.

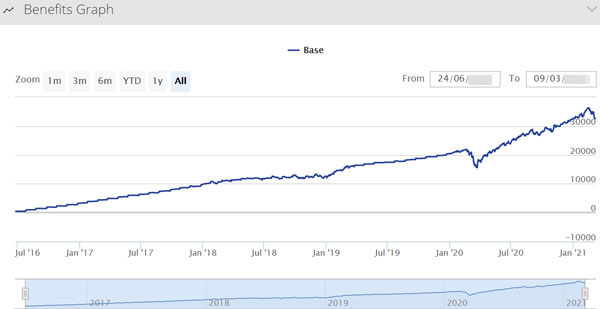

The following is what it looked like after about 5 years under these conditions.

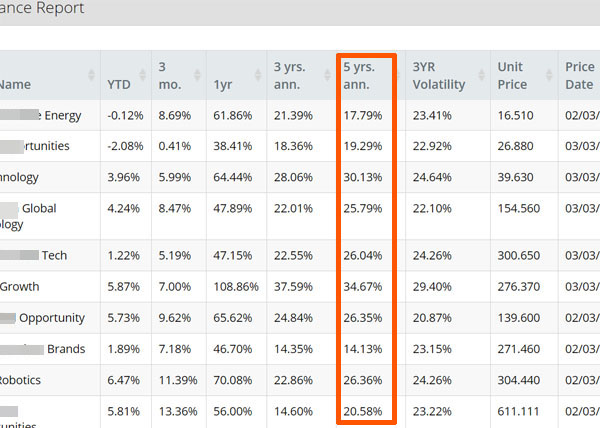

Like this, I am investing in a regular investment, and you can calculate how much yield I am getting from the following performance report.

I am invested in 10 funds through Investors Trust. Overall, the average yield over 5 years is 24.1% per year. As you can see, high returns can be obtained by investing in Evolution.

Of course, we need to review the funds we invest in from year to year, and since it is an investment, the results are largely dependent on the year. Also, if the fund you invest in is not good, you will have a negative result. However, if you choose the proper fund to invest in, you can earn such high yields.

Offshore investments aim for an annual interest rate of over 10%. Also, the low-risk principal-protected investment product (S&P 500 Index) offered by Investors Trust has an annual interest rate of 7 to 9%. From this perspective, I can say that my investment performance over the past five years has been good.

You Should Check the Fees for Evolution

Whenever you invest in an offshore company, be sure to check the fees. The commissions are high, so it is very important to understand what kind of fees are charged in order to make the best investment.

Investors Trust’s Evolution has three different commission fees as follows.

- Monthly Policy Fee: $7

- Monthly Structure Fee: 0.125%

- Annual Administration Charge: 1.9% for years 1-10, 0.35% for years 11 and beyond

The official website also clearly states the following.

Let’s check what each of them looks like.

Monthly Policy Fee Payment of $7

All investors will be charged a monthly management fee of $7. This is a small amount, but for those who invest a small amount each month, $7 is expensive.

In the case of regular investments, there is a minimum contribution amount. In the case of Evolution, the minimum contribution is $100 per month ($1,200 per year).

However, you should not invest offshore with a small amount of $100. The reason is simple: a fixed fee of $7 will be deducted every month. If you are accumulating $100 per month, $7 is about 7% for the first year. With 7% being deducted in fees, you are more likely to be in the negative asset management because of the high commission.

I am accumulating $450 per month, so as I have already shown, it is a positive investment result. However, if you contribute a small amount, Evolution is not suitable for asset management.

Therefore, if you are planning to invest a small amount, you need to consider other investment methods such as principal-protected financial products instead of Evolution. If you are planning to invest in Evolution, you should consider accumulating at least $200 to $300 per month.

For reference, if you are accumulating $450 per month like I am, $7 per month equals about 1.56% per year for the first year. While the fee will become a margin of error as your accumulation grows, the fee will seem large at the beginning.

Monthly Structure Fee Is 0.125%

In addition to this, you will be charged a monthly structure fee. Let’s think of it as a monthly fee of 0.125% of your total account value.

For example, let’s say you have $10,000 in your account at the moment. In that case, $12.5 will be charged as a fee and leaving you with $9,987.5.

- $10,000 × 0.125% = $12.5

If your assets are well managed, the asset management fee will increase by that amount, and if your assets decrease, the asset management fee will also decrease.

Since this fee is charged every month, the annual fee rate would be as follows.

- 0.125% per month x 12 months = 1.5%

You will be paying this commission.

A Fee Is Charged on Annual Contributions

In addition, you will be charged a fee for the amount you contribute annually. This fee is based on the amount of annual accumulation, regardless of the fund’s investment performance.

Again, the fee rate is as follows.

- 1.9% for years 1 to 10.

- 0.35% for years 11 and beyond.

You will be charged a fee of 1.9% or 0.35% of the total amount you plan to invest. Therefore, the larger the investment amount, the greater the commission. On the other hand, from the 11th year, the commission rate drops significantly. In other words, if you invest for a long period of time, you can reduce the commission.

For reference, if you sign up for Evolution and invest in savings for 25 years, the annual administration fee rate will be 0.97% when averaged over the entire period.

How Much Is the Overall Fee on Mutual Funds?

How much is the annual fee rate after all? The fee varies greatly depending on the amount of money you invest in the fund each month and the length of your contract. The amount will also vary depending on your asset management performance.

If you were to sign up for $450 per month and invest in an offshore fund for 25 years as I do, the fees would be as follows.

- Monthly Structure Fee: 1.5% per year

- Annual Administration Charge: 0.97% per year overall

*The monthly policy fee of $7.00 is omitted because it is a margin of error if the total amount is large.

Calculated in this way, the annual fee rate is about 2.5%. In other words, it is important to understand that this is a reasonably high annual fee. However, even with this high annual fee, my annual interest rate is over 20%, so my investment performance is excellent.

The Loyalty Bonus You’ll Receive from ITA

Many people feel that an annual fee of about 2.5% is too high, no matter how much you can expect excellent investment returns from regular investments with Investors Trust. Even for me, I think it is an unusually high fee.

However, this is not a big problem. This is because Investors Trust (ITA) Evolution has a loyalty bonus system.

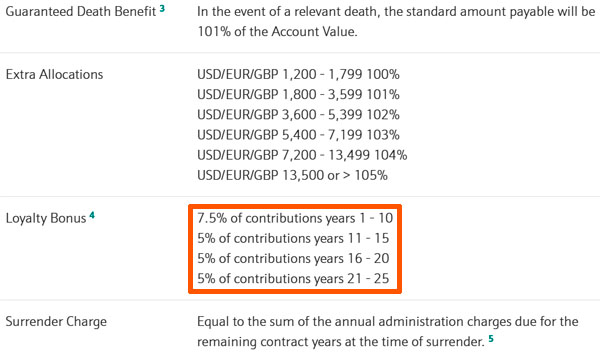

With Evolution, if you continue to make monthly accumulation payments, you will be paid a loyalty bonus as follows.

For example, if you invest $5,000 per year in offshore funds, your total contribution (total amount of money accumulated) over 10 years will be $50,000. Therefore, the following amount will be paid as a loyalty bonus.

- 50,000 × 7.5% = $3,750

Also, in years 11-15, you will accumulate $25,000.

- 5,000 × 5 years = $25,000

In this case, the loyalty bonus is 5%, so the bonus is $1,250.

- $25,000 × 5% = $1,250

-The Commissions Can Be Offset by Loyalty Bonuses

The fee rate for Investors Trust’s Evolution is unusually high. However, you don’t have to worry too much about the problem of high commissions because you can offset it with loyalty bonuses.

Think of the loyalty bonus as a tool to offset the high fees charged by foreign insurance companies, rather than something that gives you a bonus. If you invest in offshore funds, you will be able to reduce the fees by the bonus.

Extra Allocations for Larger Annual Contributions

When you invest with Investors Trust, you will also receive an extra allocation depending on the amount of your annual contribution. In other words, if you invest a lot every month, the money will be added to your account through extra allocation.

On the official website, it is stated as follows.

The conditions for extra allocations can be summarized as follows.

- Payments of $1,800 or more per year ($150 per month): 101%

- Payments of $3,600 or more per year ($300 per month): 102%

- Payments of $5,400 or more per year ($450 per month): 103%

- Payments of $7,200 or more per year ($600 per month): 104%

- Payments of $13,500 or more per year ($1,125 per month): 105%

For example, for a person who pays $300 per month, the annual accumulation amount is $3,600. Therefore, he will receive an additional bonus of 2%.

In my case, I invest $450 per month ($5,400 per year) in regular investments. Therefore, I get an additional 3% bonus for every payment I make. For your reference, the following is my Investors Trust management screen.

You can see that the extra allocation is 103%. The annual commission is about 2.5%, but I am getting a hefty bonus from the extra allocation.

In addition to the bonus from the extra allocation, there are loyalty bonuses as well. Therefore, when you invest with Investors Trust, the more you invest in large amounts of money each month, the more your assets are likely to grow.

Do Not Reduce or Withdraw During the Process

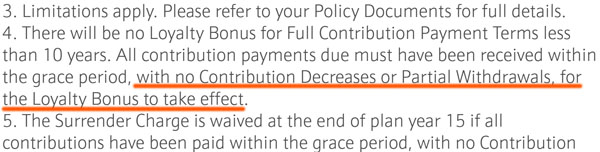

You have understood that you can get a loyalty bonus by regular investment in Evolution, which can offset your fees. However, there is a condition for getting the loyalty bonus. The condition is that you must continue to invest without reducing, stopping, or withdrawing.

If you make a reduction or partial withdrawal during the middle of the investment, you will not receive the loyalty bonus. Therefore, you must not make any reduction or cancellation during the process of investment in Evolution.

This is also stated on the official website as follows.

Some introducers of Investors Trust may advise you to set a higher amount at the beginning because it can be reduced, stopped or partially canceled in the middle. However, if you sign up with such corrupt companies, you will surely regret it.

Not only Investors Trust (ITA), but all financial products in the offshore investment have one thing in common: you can only grow your assets if you keep investing the amount of money you set at the beginning until maturity. If this basic premise is broken, the probability of losing the principal is very high.

After understanding these points, set an amount of money that you can continue to invest until the maturity of 10 or 20 years later, so that you can achieve high-yield asset management.

*If 15 years have passed since you started regular investment with Evolution, there is no cancellation charge as an exception. In other words, if it has been more than 15 years since you started accumulation, such as 17 years or 21 years, there is no penalty no matter when you cancel.

Offshore Investment with Excellent Annual Interest Rates

Offshore investments allow you to manage your assets at a higher rate of return than is possible with financial products in your country. By investing in life insurance or mutual funds abroad, you can make your assets grow significantly. Among them, Investors Trust (ITA) is famous and popular among many people.

Investors Trust has several products, some of which are principal-protected, while others, such as Evolution, are designed to invest in a unique portfolio.

Evolution offers a high yield, but it also has its risks. The fees are also set higher. However, the commissions can be offset by the loyalty bonus, as I have explained so far.

There is a disadvantage that you should not reduce, stop, or partially withdraw until the maturity date. However, as long as you follow the rules of not reducing, stopping, or partially canceling until maturity, Evolution is a financial product that has a high potential to increase your assets. Make sure you understand these features before you apply for Investors Trust’s Evolution.