Forex is well known as an investment method. Many people are looking for ways to increase their money by investing, and forex is one of them.

Hedge funds are managing huge amounts of assets. How do hedge funds that invest in forex increase their assets? Also, can we increase our assets by investing in forex hedge funds?

For example, stop hunting is one of the methods used by forex hedge funds. In reality, however, it is impossible for a forex hedge fund to use these techniques and increase its assets significantly. For this reason, there are no hedge funds in the world that specialize in trading forex.

All hedge funds that specialize in forex are scams. This is because it is impossible to increase assets only with forex. I will explain the reason for this.

Table of Contents

There Are Hedge Funds That Incorporate Forex

Hedge funds keep money from investors and increase their assets. Although the fees are very high, the yields are better than investing in indexes, and the returns are not affected by the economy. This is why many investors invest in hedge funds.

Some of these hedge funds incorporate forex. Hedge funds try to increase their clients’ assets if there is a chance. This is why they invest in forex when they can clearly predict the movement of the foreign exchange market.

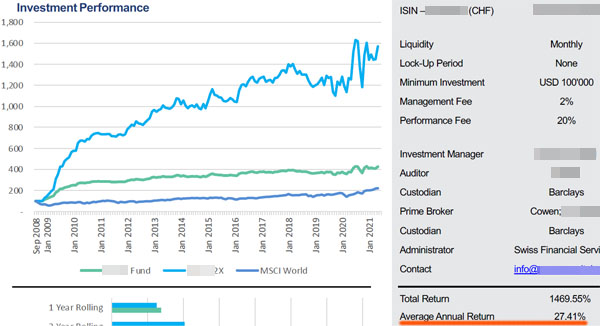

For example, here is a fact sheet on a hedge fund that invests in all kinds of assets, including stocks, bonds, forex, and futures.

In the case of this hedge fund, the average annual return is 27.41%. It has different investment targets at different times and also incorporates foreign exchange trading. In any case, forex is one of the investments for hedge funds.

There Is No Hedge Fund Specializing in Forex

However, the fact that hedge funds incorporate foreign exchange trading does not mean that they specialize in investing in forex. For the hedge fund I mentioned earlier, stocks, bonds, and futures are also their main investments.

First of all, it is important to realize that no one can increase their assets only by trading forex; it is widely known that forex is speculation and not an investment. This is because you can almost never make money through investing in forex.

We tend to think of hedge funds as manipulating the market by using huge amounts of money. However, hedge funds generally do not gamble. Hedge funds invest their clients’ assets. If the fund’s performance is poor and the clients lose a lot of money, the fund manager will be fired immediately.

In fact, unless there is a special case, it is impossible to predict whether a currency will rise or fall in value. In general, hedge funds do not speculate (gamble), so there are no hedge funds that invest only in forex.

Reasons Why There Are No Famous Forex Traders

Why do we know that it is impossible to make money only with forex? The reason is simple: no one has become a billionaire through forex alone.

There are people on the Internet who say they have made money with forex. However, you have never seen their bank deposits or brokerage accounts. In addition, they are not audited by any outside agency, and they can provide false information.

If you think about it from this perspective, you will realize that no one in the world makes money only by trading forex. For example, the following people are famous as investors.

- Warren Buffett

- George Soros

- Ray Dalio

Warren Buffett is famous for becoming a billionaire by investing in stocks. George Soros and Ray Dalio, famous for their hedge fund management, do not invest only in forex. They invest in all kinds of assets.

The companies that these people run are audited by outside agencies, and they have to prove their deposit balances and transactions to outside agencies. Therefore, there are no lies in their financial statements and fact sheets, and it is objectively clear that they are making money from their investments.

On the other hand, those who are making money as forex traders are doubtful whether the information is true or not. In addition, most of them disappear after a few years even though they are supposed to be making money from forex.

Forex is famous for its zero-sum game. In other words, if you add up those who made money and those who lost money, the total becomes zero. The only way to make money in this kind of investment is luck. It is not an investment that many people can make money from, like stocks and bonds. Considering these facts, we can see that forex, a zero-sum game, is a speculation, and even professionals can’t make money.

Forex Is a More Difficult Investment Method Than Cryptocurrencies

Similarly, cryptocurrencies are known for speculation. However, compared to forex, cryptocurrencies have a much higher earning potential because, unlike forex, you can predict the price movements to some extent.

In the case of forex, you have to predict the price movement of the currency value. However, it is impossible to predict the price movement of a currency’s value both in the short term and in the long term.

On the other hand, with cryptocurrencies, there is always a major crash every few years. In addition, the value of cryptocurrencies will rise sharply a few years after a major crash. For example, the following is the past price movement of Bitcoin.

This means that if you buy cryptocurrencies after a big crash and sell them when the price rises, you can make a big profit. Even though cryptocurrencies are speculative in the short term like forex, if you invest for the long term, you can greatly increase your assets.

On the other hand, what about forex? The following is the price movement of the USD/JPY.

As you can see, the price movements are random. The value of a currency may go up, or it may go down.

Many people can make money by investing in stocks and cryptocurrencies because they can predict the value of assets that will rise (or fall). However, no one, including professionals, can predict the rise or fall of a currency’s value in forex. This is why there are zero forex traders who can make money in the long term.

Naturally, there are no hedge funds specializing in trading forex. It is impossible to make money by investing in forex, which is a zero-sum game.

It Is Impossible for Hedge Funds to Engage in Stop Hunting

There are few people who have a good impression of hedge funds that invest in forex. This is because many people think that hedge funds, which have large amounts of money to invest, are manipulating currency markets and making money.

In reality, however, it is impossible for hedge funds to manipulate currency markets. In short, a hedge fund can’t do stop hunting.

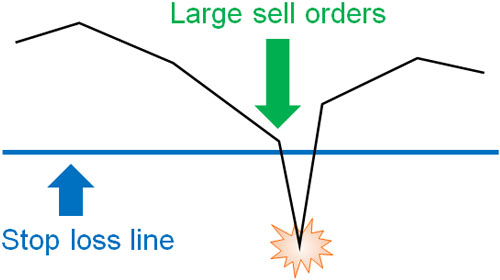

Stop hunting is a method in which hedge funds make large profits by placing a large number of sell orders and forcing retail investors to place stop-loss orders.

In the case of individual investors, they often set a nice round number such as 100 or 90 as their stop-loss value. In other words, if the value of the currency falls below this number, the system will automatically cut its losses. So, for example, if the value of a currency is 101, a large number of sell orders will be placed to bring the value of the currency below 100, causing many investors to place stop-loss orders.

Then, a large number of stop-loss orders will occur, causing the value of the currency to fall further, allowing the hedge fund to make large profits.

Investments by Hedge Funds Do Not Affect the Foreign Exchange Market

However, it is impossible for hedge funds to do stop hunting in forex. This is because the market size of currencies is unusually large.

In the case of stock investment, it is possible to stop hunting. If they place a large number of sell orders against a company with a small market capitalization, they can make the stock price fall significantly. On the other hand, the amount of currency traded in the market is large.

For reference, the daily trading volume of the USD/EUR is over US$1.7 trillion. The daily trading volume of the USD/JPY is over US$900 billion.

Even the huge hedge funds have about $50 billion in assets. Also, hedge funds do not only invest in foreign exchange trading, as forex is not their only investment. Understanding this fact, hedge funds cannot manipulate the exchange rate.

Also, hedge funds cannot know what part of the market many retail investors are setting their stop loss. This is another reason why stop hunting by hedge funds is impossible.

In the past, it is said that George Soros’s hedge fund sold a lot of British pounds, causing the pound to fall and the pound crisis to occur.

However, the hedge fund sold a lot because the value of the British pound was overvalued. It does not mean that hedge funds’ massive selling caused the decline of the pound. In fact, it is estimated that George Soros’ hedge fund made $1-2 billion in profits from the pound crisis.

Compared to the amount of currency traded per day, the amount of profit they made is very small. In other words, it can be said that they have had little impact on the market. The decline in the pound was not caused by a hedge fund but because the pound was obviously overvalued.

The idea that hedge funds can manipulate the foreign exchange market is clearly a fantasy.

Any Forex Fund That Gives Excellent Yields Is a Scam

Even if a hedge fund trades forex, it does not affect the currency market. Also, once we realize that it is impossible to make money in forex, a zero-sum game, we know that all hedge funds specializing in forex are scams. This is because it is impossible to make a profit in forex alone.

If there is a hedge fund that is making excellent returns trading only forex, it is a scam.

There are many examples of hedge funds that have traded in the forex market and made profits. In the pound crisis, the Asian financial crisis, etc., hedge funds invested in overvalued currencies with leverage and made huge profits.

However, there are few situations where we can clearly predict that we will make money in currency trading. At least, if you trade forex many times in a short period of time, you will not be able to achieve high returns. Also, there is a very high probability that all the information in the fact sheets of forex hedge funds is false.

Automated AI Trading Cannot Predict the Market

The same is true for automated trading by AI. Although there are hedge funds that use automated trading using AI, these hedge funds invest in stocks and bonds, not the foreign exchange market.

As mentioned earlier, there are more people who make money in the stock market. In fact, it is widely known that an annual interest rate of about 10% is possible if you invest in well-known indexes such as the S&P 500 or the Nasdaq 100. Since there are many people who are making money in stocks, there are hedge funds that are also making money in AI automated trading.

On the other hand, there is no case of automated trading in forex that is profitable. Currency values are deeply influenced by political factors and world trends. Of course, AI can’t predict future events.

- Lehman Brothers goes bankrupt, and a financial crisis occurs.

- 911 terrorist attacks in the US.

- A coronavirus pandemic occurs.

For example, these major events happened in the past, and the exchange rate fluctuated greatly. However, neither humans nor AI can predict these events. There are no full-time traders making money in forex because it is impossible to predict the forex market, and you cannot use AI to make money.

In order to make money from your investments and understand the nature of hedge funds, examine the various facts. If you do so, you will realize that it is impossible to make money in Forex.

Hedge Funds Only Trade Forex When They Can Predict

Of all the investment methods, forex is known to be the one with the lowest probability of making money. Although cryptocurrencies are also considered speculative, forex is a more difficult speculative method to earn money than cryptocurrencies.

Also, the foreign exchange market has a very high daily trading volume. Therefore, it is impossible for even a large hedge fund to manipulate the value of currencies. Naturally, hedge funds cannot target individual investors to do stop hunting.

Even if a hedge fund were to trade forex, it would have no impact on the market. Also, there are no profitable hedge funds that specialize in forex. Moreover, there is no successful forex trader. This is because their track record is all a lie.

If you want to invest, you should check the facts in advance. Then you will understand not only the investment methods of hedge funds but also whether or not you should invest in forex.