Offshore investments are popular for many people because they can offer unthinkable yields in your country.

However, in some cases, the initial investment amount is set so high that it becomes difficult to continue paying. We can see cases where people are cheated by corrupt companies, and the payment is set at a high amount instead of the proper amount.

In such cases, it is possible to reduce or withdraw the amount in the middle of the payment. It is also possible to receive a refund by canceling the contract.

But, you should not reduce, withdraw, or cancel your investment offshore because you will lose money with 100% probability. I will explain the reason for this.

Table of Contents

Existence of Initial Account (Locked Account) and Savings Account

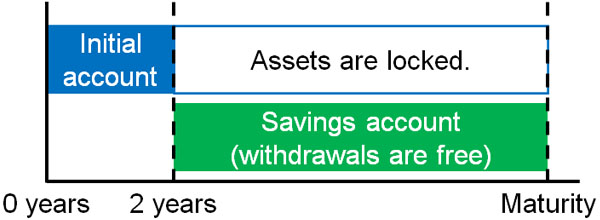

There is a basic concept that you need to understand when you start offshore insurance or mutual fund. That is the existence of an initial account (or a locked account) and a savings account. When you invest in a regular investment, you will have two saving periods, one for the initial account and one for the savings account.

-Initial Account (Locked Account)

The initial account (locked account) is, in short, the first two years of the accumulation period. This is the period of time when accumulation is mandatory. Even if you cancel the account in the first two years, the surrender value will be zero, and you will not be able to reduce or withdraw (including partial cancellation) during the period.

For example, if you decide to invest US$500 every month, you will need to make the following accumulation payments.

- $500 per month × 24 months (2 years) = $12,000

-Savings Account

A savings account, on the other hand, refers to the period of savings after two years have passed. After two years, you are free to increase, decrease, stop, or withdraw (partially cancel) your savings.

Therefore, it can be said that it is the same as having a bank deposit. However, even though it is a bank deposit, it is a savings account that allows you to increase your money through asset management.

If you understand these differences, it will be easier for you to understand what the surrender value of your offshore investment is.

Surrender Value Varies by Time of Cancellation

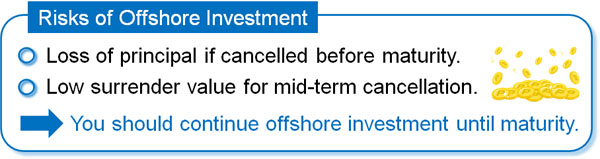

While reductions, stops, and partial withdrawals are available for offshore investments, what happens if you decide to cancel before the maturity date? For this, you need to consider that you will receive a very small amount of money back. In other words, there is a 100% probability that you will lose your principal.

As mentioned earlier, if you cancel within the first two years, the surrender value is zero. Since the account will be locked as an initial account, if you cancel early, you will lose all of the money you paid. If you do not reach maturity, you will not get back the money you paid in the initial account.

On the other hand, if two years have passed, you will receive the full amount of money saved in the savings account. For example, if you have been investing overseas for 14 years, you will receive the money back for 12 years.

If you have not yet reached maturity, you will not receive the full amount of the money in your initial account, and a portion of it will be returned to you after significant surrender fees are charged. In any case, it is important to consider that most of the first two years’ accumulated amount will disappear if you cancel your account before maturity.

The only way you can increase your assets significantly with offshore investments is if you invest until maturity. If you cancel your investment in the middle, you will lose your principal.

However, this is common. When you invest in life insurance in your home country, if you choose to surrender early, you will almost never get your money back. Whether in your country or abroad, it is common that there is almost no surrender value if you cancel your investment product early.

Loyalty Bonus and Principal Protection Are Only Available When There Is No Reduction

However, this does not mean that you can freely reduce, stop, or withdraw (partial cancellation) your savings after the two-year accumulation period has passed.

Some unscrupulous companies that solicit regular investments often advise that you should invest a larger amount at the beginning because you can freely change the investment amount and withdraw after two years. However, this is fraudulent, and you should never follow their advice.

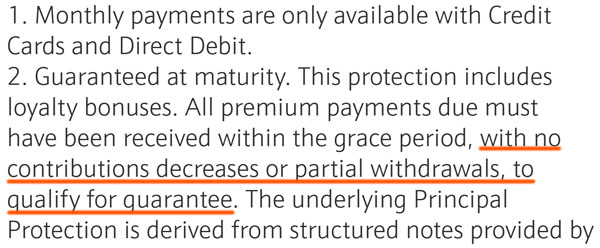

The reason why you should not reduce or partially withdraw your money in the middle of the process is that you will lose your loyalty bonus and principal protection.

For example, the following is part of a product description provided by an offshore financial institution.

In the case of this financial product, the principal is protected so that the assets will increase to more than 160% of the original amount through 20 years of regular investment. Therefore, it is popular among people who are looking for safer investments. I also signed up for this financial product in order to increase my assets.

However, it does not mean that your assets will increase by 160% in 20 years unconditionally. There is a condition for principal protection, and it is if you accumulate the initial amount of money without reducing or withdrawing. This is clearly stated on the official website, although the text is small.

This financial product offers an excellent loyalty bonus and principal protection through years of accumulation. However, you have to understand that it has conditions.

Naturally, there is no point in purchasing this product if the principal is not protected. Therefore, it becomes a meaningless financial product the moment it is reduced, stopped, or partially canceled in the middle. You should understand these risks, and in the case of bad companies, they will highlight to you the part that the reduction in the middle of the product is possible.

If You’ve Already Invested, Consider How to Handle It

While offshore investment is by far the best way to manage your assets, you must keep in mind that there is a condition that you must continue to invest the amount you initially set until it reaches maturity. Therefore, it is important to have a reasonable investment design.

However, in some cases, there are people who have already invested with an unreasonable investment plan due to being cheated by crooks. In this case, you should consider it as a learning expense and think of ways to deal with it.

Specifically, if you have been under contract for less than two years, I recommend that you terminate your contract immediately. You will not get your money back, but try to think of it as money that never existed.

-Wait for the Initial Account to Maturity, and Withdraw Rest

In some cases, you may have already invested for many years. In this case, withdraw all the money from your savings account. At the same time, try to stop your monthly savings investment. This way, only the money in the initial account (locked account) will remain.

You can then wait until the maturity date and the money in the initial account will be returned to you at maturity. This is the best way to minimize the damage.

Some Offshore Financial Products Have High Fees and Are Bad

In addition, the annual fee varies depending on the financial product you sign up for. Since you will always be charged an annual fee for offshore investments, consider that although your money will increase through asset management, you will have to pay fees for a certain percentage of your total savings.

If you apply for bad offshore insurance or mutual fund, the fee will be very high. In fact, there are some offshore financial products that charge an annual commission rate of 4-5% of the total amount as a management fee.

This may be low considering the fact that regular offshore investments aim for an annual interest rate of over 10%, but there are a number of financial products that offer much lower annual management fee rates under the same conditions. If the introducer is a crook, you may be forced to buy a product with a high commission rate, and naturally, your investment income will decrease by that amount.

Also, if you are thinking of canceling your account, the high fees will affect you negatively. I mentioned that you should leave the initial account alone and wait until it matures, but in this case, you will receive almost no money due to the fees.

-If You Reduce the Amount, the Fee Rate Usually Increases

Moreover, when you reduce, stop, or partially withdraw your money, the management fee usually goes up. Therefore, investment income is lost and there is no loyalty bonus, so asset management can easily become negative.

It is important to consider that all annual administration fee rates for offshore insurance and mutual funds are designed in the initial plan.

For the initial account, even if you wait until it matures, you should not think that you will get all the money you have accumulated in the first two years back at maturity. Also, if the annual administration commission rate is high, there are cases you should cancel the account, including the initial account.

You Should Design Your Investment to Avoid Reduction or Partial Termination

When considering offshore investment, there are a lot of negative aspects to canceling your investment midway. This is because there is an almost 100% probability that the principal will be lost.

Reduction, stopping, or withdrawal will also result in loss of principal. If you reduce or partially withdraw, you will lose your loyalty bonus and principal protection. Moreover, the annual management fee will also be higher in general.

Try to think of it as meaningful if you continue to invest in an overseas savings investment by keeping the amount you initially set. For this reason, the initial investment design is important, and it is necessary to see if the financial product has a low commission rate.

However, if the introducer is an unscrupulous company, they will recommend you to sign up with an unreasonable investment plan without explaining the fees and risks. In that case, think of it as a learning expense and take action now, such as canceling the contract. If you do so, you can minimize the damage.