By investing your assets abroad, not in the country you live in, you can make a significant fortune. It is natural that your assets can more than quadruple in a period of 30 years with offshore investments.

The most common way to invest offshore is through mutual funds. However, there is another option for investing abroad: offshore insurance (foreign life insurance).

By using foreign life insurance, you will be able to increase your assets significantly. Although many people in your country use life insurance for asset management, you can make more money with foreign life insurance. Life insurance can be paid in installments or in a lump sum. Also, many people use offshore insurance as an annuity.

So, what are the key points to understand when using offshore insurance as asset management? In this article, I will explain the points that you should understand when you invest offshore and use life insurance.

Table of Contents

Using Life Insurance Abroad as an Asset Management in US Dollars

What kind of image do you have when you think of life insurance? In general, the image of life insurance is that if something happens and the breadwinner of the family dies, the money will be paid.

In contrast, offshore insurance is used as a tool for asset management. In other words, by purchasing a foreign life insurance policy, you can increase your assets.

When you buy an offshore life insurance policy, you can expect to receive your money back roughly double in 20 years, quadruple in 30 years. Your money will grow at an annual interest rate of 4% or more with offshore insurance.

The important thing is that you can manage your assets in US dollars, not the currency of the emerging country. If you buy life insurance in an emerging country, it is possible to increase your money more than 4 times in 30 years. However, there is no point in managing assets in the currency of an emerging country that is less trusted.

The most trusted currency in the world is the US dollar. It is common sense to invest in US dollars, and offshore life insurance is superior because you can invest in US dollars.

Also, if you have an offshore life insurance policy in an offshore tax haven where there is no taxation, the insurance company can transfer the surrender value or death benefit to any bank in the world. In my case, I am Japanese, and I have purchased some life insurances in Hong Kong as follows.

Therefore, the most effective way to manage assets using life insurance is to use offshore insurance in tax havens.

Buying Whole Life Insurance or Endowment Insurance for Offshore Investment

What kind of life insurance should you buy? There are several types of life insurance in your country, and the same types of life insurance exist abroad as well. These are as follows.

- Term insurance

- Whole life insurance

- Endowment insurance

The most common types of life insurance for offshore investments are whole life insurance and endowment insurance.

With whole life insurance, you can get lifetime coverage. This means that your family will surely receive the death benefit. The advantage of whole life insurance is that it adds death coverage until you die. You can cancel it at any point or wait until you die or let your children inherit it.

On the other hand, you can also choose endowment insurance. With endowment insurance, you can set the maturity date freely; for example, you can choose to mature after 40 years. It is designed to return a high amount of maturity insurance money at the time of maturity.

Cancellation During the Term is Possible and Annuities Can Be Received

As mentioned above, you can cancel the policy without waiting for maturity. If the contract is canceled within a few years, the assets will not increase, but if more than 10 years have passed, you will be able to receive a high surrender value. As already mentioned, if you have a life insurance policy for about 20 years, you will receive double the amount of money back as a surrender value.

In addition to receiving the surrender refund in a lump sum, you can also choose to receive it as an annuity (installment payment). You can use offshore insurance as an overseas accumulation annuity and get paid gradually as your assets grow.

If you use an overseas life insurance policy, your money will be returned to you in US dollars after it has been multiplied many times over. In addition to the pension system provided by your home country, you can also create your high-value annuity.

It is a wise choice to use offshore insurance as a way to save money for your retirement.

Investing in US Dollars, but with No Exchange Rate Risk

As mentioned above, foreign investments are made in US dollars. You do not invest in the currency of the country you live in. If you don’t live in the US, there is a risk of exchange fluctuation.

However, with offshore insurance, there is no risk of currency fluctuation. This is because it is natural for your assets to double or quadruple in value.

If the currency of the country you live in goes up in value, it is easy to lose money when you convert dollars to the local currency. However, even if the currency of the country you live in increases in value against the dollar, if your assets have quadrupled in value in dollars, your assets have overwhelmingly increased.

Also, the value of a currency has a big connection with the value of the country. From that perspective, it is easy to imagine that the value of the US dollar (America) is very high in the long run. Therefore, there is no need to worry about investing in dollars.

Investing in a Huge Offshore Life Insurance Company

You may be wondering if it is suspicious to put your money in an overseas life insurance company as an offshore investment. When you invest your money in the life insurance or an offshore annuity, you may feel suspicious.

However, there is no problem at all because you will be investing in a huge life insurance company overseas.

For example, a company called Sun Life Hong Kong is famous for offshore insurance. Sun Life is headquartered in Toronto, Canada, and has a branch office in Hong Kong, an offshore region. Many people buy their life insurance in Hong Kong.

Sun Life has branches in many countries, but in many cases, Sun Life has a restriction that you cannot purchase life insurance unless you live in the target country. For example, if the policy is for the US or Singapore, you must be a resident of that country to purchase the policy.

For Sun Life Hong Kong, on the other hand, even foreigners who do not live in Hong Kong can purchase life insurance. This is the reason that many people choose Sun Life Hong Kong for their offshore insurance.

Also, Sun Life is rated by the following famous rating agencies.

- Standard & Poor’s (P&P): AA- (Very strong capacity)

- Moody’s: Aa3 (High quality and very low credit risk)

This is close to the highest rating, and Sun Life has a higher credit rating than most countries.

In offshore investment, you invest in a company that is overwhelmingly huge compared to the financial institutions in your country, making it excellent asset management. Since you invest in an insurance company that is highly rated by the global rating agencies, there is no fraud, and you can manage your assets.

There Are Two Investment Methods: Installment Payment and Lump Sum

When it comes to offshore investment, other than life insurance, regular investment is the most common. In other words, you accumulate a certain amount of money every month for decades.

In this case, the investment is accumulated over a long period of time, such as 15 or 20 years. However, you are under pressure to keep paying out the same amount even after decades.

With life insurance, on the other hand, you can freely choose the investment amount and period. You don’t necessarily have to accumulate and invest the same amount for a long time.

For example, you can start with a lump sum of US$15,000. This way, there will be no subsequent payments. Alternatively, you can pay $250 per month for five years, for a total of $15,000 over five years.

In this way, the money will increase many times over as the decades’ pass.

Also, of course, the earlier you start purchasing offshore insurance when you are young, the faster your money will grow. For example, if you want to make $100,000 in savings by the age of 65, you can do it by investing the following amount in a lump sum.

- Age 25: about $17,200

- Age 30: about $25,400

- Age 40: about $37,600

- Age 50: about $55,600

Since investments increase your money through compound interest, the younger you start investing, the bigger your assets will grow. Therefore, if you buy an offshore insurance policy when you are young, you will not have to worry about pension problems in your old age.

You Can Add Your Children to Whole Life Insurance

By the way, in my case, not only do I have overseas life insurance for myself, but also I have made my child insured offshore insurance. When my child was 2 years old, I invested about US$30,000 in a lump sum as whole life insurance. As you can see below, I put my daughter in life insurance when she was playing around at home.

She was insured when she was 2 years old, so after 33 years, she will be 35 years old, and the money has more than quadrupled to about $130,000. So I plan to give it to my daughter as a gift when she reaches the age of 35.

In my case, the investment was $30,000 in a lump sum, but it can be lower, and you can also choose to pay in installments. In any case, I have made over $130,000 in gifts for my child by utilizing offshore investments.

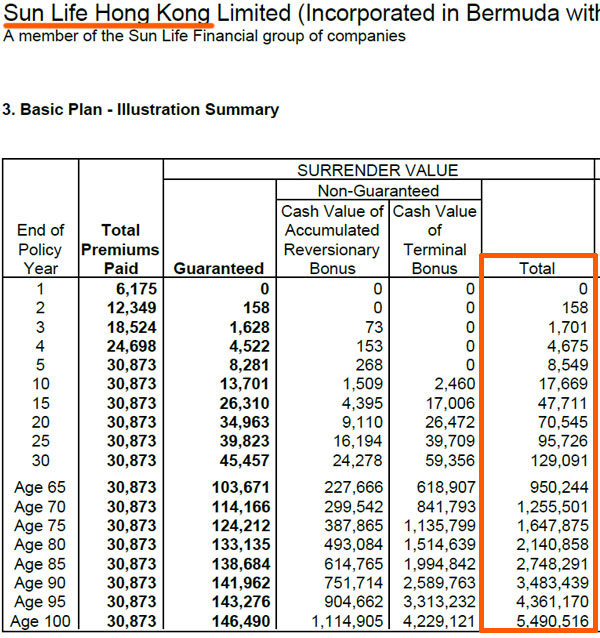

For your reference, the following are the actual simulated contents of my subscription from Sun Life Hong Kong.

The Total is the one you should check. As shown in Total Premiums Paid, I paid a total of $30,873. In the simulation, the payment is made in 5-year installments, but in reality, the payment is made in a lump sum.

You can see that the increase is $70,545 for 20 years (229% increase), and $129,091 for 30 years (418% increase).

As for the money I will give to my daughter, she can either surrender it immediately and convert it into cash for her living expenses, or she can keep it without surrendering it and increase her assets many times over. If she continues to hold it until she is 65 years old without surrendering it, the surrender value will be about $950,000. $30,000 will turn into $950,000.

It will be my daughter’s choice when she becomes an adult, and I am preparing so that my child can make various choices.

The Disadvantage Is the Loss of Principal on Early Cancellation

Of course, there are some disadvantages. That is, if you cancel within 10 years, you will lose your principal.

Unlike ordinary mutual funds, offshore life insurance promises that if you wait until the maturity date, you will not lose your principal, and your money will definitely increase. However, if you cancel your life insurance policy early, you will certainly receive less money back.

Even your home country’s life insurance will lose its principal if you buy life insurance and cancel it early. It is common all over the world that early surrender results in a loss of principal. In the actual simulation I just described, the break-even point is about 12 to 13 years.

While there are many advantages to using offshore life insurance and offshore accumulation annuities, the only disadvantage is the loss of principal due to early surrender.

Requires Travel Abroad, Such as Hong Kong

As mentioned above, normally, you need to live in the country to purchase life insurance. However, in some tax havens such as Hong Kong, non-resident foreigners can purchase life insurance. But, if you want to buy an offshore insurance policy, you have to travel to the country. It is not possible to buy insurance online.

Also, because it is life insurance, the contracting process is a little different from that of investing in a mutual fund. In some cases, a medical examination by a doctor is required because it is life insurance.

For reference, a medical examination is not required if the investment amount is not too high, such as the initial death benefit not exceeding $2 million.

Even though the contract is made abroad, there is IFA (Independent Financial Advisor) staff, so there are no problems with the contract itself. Hospital visits also go smoothly.

However, it is important to understand that unlike mutual funds, which you can easily invest in while you are in your home country by paying with a credit card, life insurance tends to require bothersome procedures and travel.

Considering Life Insurance with Offshore Investment

Generally, when it comes to regular investments overseas, you will think of mutual funds. However, you should also consider the option of life insurance.

Offshore life insurance is used not only for a death benefit but also for investment. It is a way to manage assets in a tax haven country and increase your assets many times over. Although life insurance in your country can be used for investment, offshore insurance is superior.

Also, with life insurance, you can choose the way you want to invest, such as investing in a lump sum or paying it in a few years. You can also invest in life insurance for your children who are small in age, as I did.

Many people think about managing their assets domestically, but if you focus your attention overseas, you will find that excellent asset management can be done without risk. Think about investing in huge foreign life insurance companies and increasing your assets with life insurance that suits you.