There are many banks that operate across multiple countries. One of the largest and operating in several countries is HSBC.

HSBC is known as an offshore bank, and it has branches worldwide, some of which operate in tax havens. Therefore, even if you are not a resident of the country, you can open an account with HSBC in a tax haven and manage your money there.

You can also open an investment account at HSBC. This allows you to invest in stocks, bonds, and mutual funds.

In fact, however, it is not worthwhile to open an investment account with HSBC. Although HSBC is an offshore bank, it is not the same as an offshore investment. I will explain why you should not use an investment account with HSBC.

Table of Contents

HSBC Is an Excellent Offshore Bank

When you want to deposit your money, HSBC is an excellent offshore bank to use. There are branches of HSBC in many countries. If you deposit your money in HSBC, you can withdraw your money in many countries.

Even if you have deposited money in US dollars or Euros, you can withdraw money in the local currency when you travel abroad. Using HSBC is better than using a money exchange because you can get your money at a more favorable rate.

HSBC also has branches in many countries, so you can open bank accounts in several different countries, making it easy to transfer money from one country to another. If you are a premier member of HSBC, you can transfer money between your accounts free of charge, which is an excellent feature for those who need to transfer money between countries.

Of course, you can deposit money in multiple currencies. This means that you can hold not only major currencies such as the US dollar and the Euro, but also many other currencies.

Opening an Investment Account with HSBC Is Meaningless

HSBC is only a bank. Therefore, although HSBC is excellent as a bank, you should not open an investment account with HSBC.

HSBC is a huge megabank, but it does not have private banking in the sense of increasing your assets. There are private banking services around the world that specialize in dealing with the super-rich, but HSBC does not have a private banking function.

As an image, you can think of HSBC as a huge version of your country’s megabank, with branches all over the world. In other words, HSBC has a general banking function and a poor function to increase your money through investment.

For your information, real private banking services are available at banks registered in Switzerland. You can use banks registered in Switzerland to increase your money by investing in hedge funds. However, HSBC does not have such a function.

Fees for Investing in Stocks, Bonds and Mutual Funds Are Very High

As a bank, HSBC allows you to buy stocks, bonds, and mutual funds. You can also buy these investment products at any bank in any country.

However, as is the case with all banks, the fees for purchasing investment products through the bank are unusually high. The same is true for HSBC; after opening an investment account at HSBC, you can buy stocks and mutual funds. But the fees are very high.

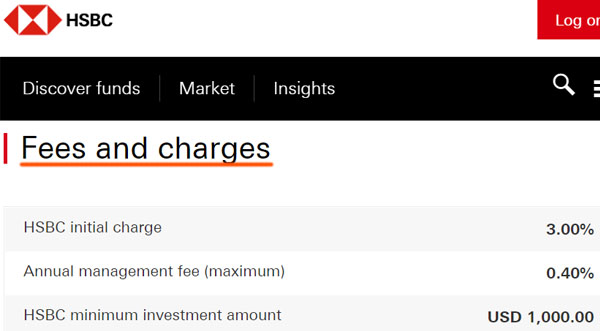

For example, here are the fees for the Global Stock Fund offered by HSBC.

In order to invest in this fund, you will be charged an initial fee of 3% of your investment. This is a very high fee, and in addition to this, there is an annual fee of 0.4% of the account balance.

The same investment can be made through other financial institutions. In that case, the fees are lower than HSBC, resulting in a better investment return.

You Should Use US Online Brokerage Instead of HSBC

If you want to invest in stocks, bonds, or mutual funds, you should not open an investment account at HSBC, but use a US brokerage firm.

There are many securities companies in the world. Among them, American online brokerages have extremely low fees. Therefore, if you want to invest in stocks or mutual funds, you should use American online securities—the lower the fees, the better the return on investment.

Some American online securities companies allow you to open an account even if you are a non-resident of the US and do not have US nationality. In fact, I am Japanese, have never lived in the US, and do not have a US bank account. Despite this, I have opened an account with a US brokerage firm and have been investing.

I use Interactive Brokers, which allows me to invest in stocks, bonds, and mutual funds around the world.

With Interactive Brokers, you can invest in ETFs (exchange-traded funds) such as the S&P 500 and the NASDAQ 100. You can also invest in individual stocks and bonds, and there are many more options and cheaper fees if you use a US brokerage instead of HSBC.

Use an Investment Company to Invest Offshore

On the other hand, if you want to invest offshore, you should invest in an insurance company (investment company) located in a tax haven.

HSBC is an offshore bank that has branches in tax havens. However, it is not an insurance company. In fact, as mentioned earlier, you cannot invest in a good hedge fund using an HSBC investment account.

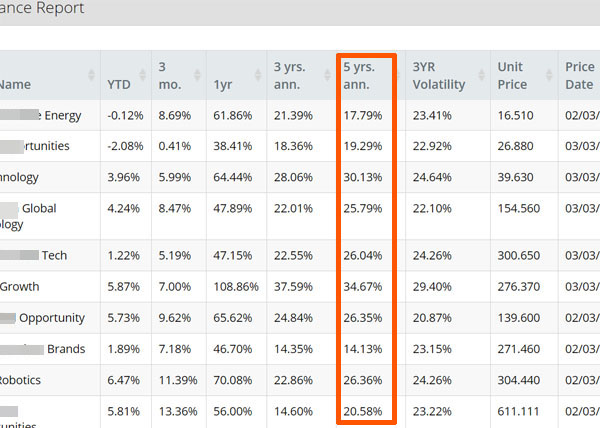

On the other hand, if you use an insurance company that specializes in investments and invest in tax havens, you can achieve excellent returns. For example, in my case, I use a company registered in the Cayman Islands to invest offshore. I have a diversified portfolio of 10 funds in offshore mutual funds, and the average yield over the past 5 years is 24.1%, as shown below.

The Cayman Islands is one of the tax havens where there are no taxes, and I invest in insurance companies registered there.

If you open an investment account with HSBC and invest in funds, you will not be able to achieve this yield. This is because HSBC is an offshore bank, not an offshore investment company. HSBC does not allow you to invest in excellent funds around the world.

It is important to understand that an offshore bank and an offshore investment mean completely different.

-Using HSBC to Receive Money Is Excellent

When you receive money from your offshore investment, using HSBC is an excellent choice. This is because you can receive money in a variety of currencies, and it is easy to send money overseas. There is nothing wrong with using HSBC to deposit your money.

However, do not open an investment account and invest in stocks or mutual funds. The fees are high, and it is better to use other financial institutions.

You Shouldn’t Invest with Offshore Banks

As with all banks, you should not use HSBC to invest. Because of the high fees, even if you succeed in making money from stocks, bonds, or mutual funds, the total amount of money you get will be small.

If you are going to invest, use a company that specializes in asset management. When investing in foreign stocks, bonds, and mutual funds, you should use an American online brokerage firm. There are many investment options available on the Internet, including stocks of listed companies and ETFs (exchange-traded funds).

Also, if you want to manage your assets more efficiently by investing offshore, use an investment company registered in a tax haven to invest in mutual funds and hedge funds. This way, you can achieve a higher annual interest rate.

In any case, you should not think of using an HSBC investment account to invest in stocks or mutual funds. There is a right way to invest, and when you use HSBC, you should only use it to deposit your money.