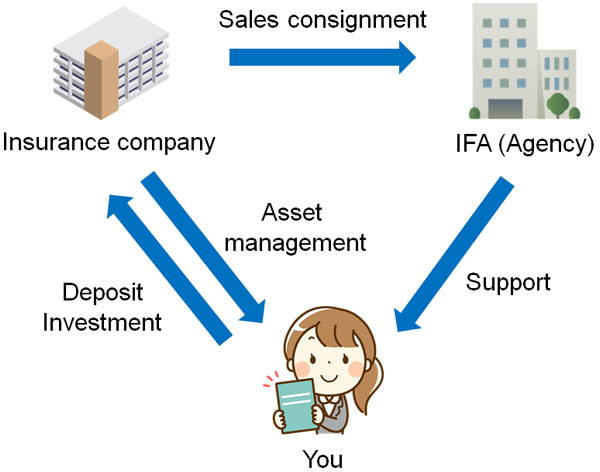

When making an offshore investment, you must hire an IFA. An IFA is an independent financial advisor, a specialist in investing in tax havens that can help you with your offshore investments. And they are also a sales agent for offshore investments.

Whenever you invest offshore, you must ask an IFA to open an offshore account for you.

However, we do not know what an IFA is. Also, there are not many people who understand how to find and choose an agency.

In this article, we will explain the importance of IFA in offshore investment. We will also discuss how to choose a good IFA, so if you are planning to invest offshore, make sure you know how to choose the proper agency.

Table of Contents

What Is an IFA for Offshore Investment and Offshore Insurance?

Even in your home country, you frequently go through a sales agent when purchasing insurance products. Instead of buying insurance products directly from the insurance company, you get your insurance through an agent. There must be many insurance stores in your city. These are all insurance agents.

There are agencies in tax havens that sell offshore insurance, and offshore mutual funds. These agencies are called IFAs.

Why is this agency important? Because the financial institutions in tax havens do not sell their products directly to their clients. So, you have to buy investment through an authorized IFA that can handle the products.

If you are planning to make an offshore investment, it is essential to ask an IFA to start your regular investment. This is the reason why the presence of an agent is so important in regular offshore investment.

You Need to Make Sure the IFA Is an Authorized Agent

How can you choose a good IFA and start offshore insurance or an offshore mutual fund? In fact, I think you may not know how to choose an IFA.

Even if you think it is a good IFA, you need to be careful because some people fall victim to fraud. In the case of an authorized agent, the IFA (agent) has a contract with an offshore financial institution, so it is a good idea to check first if it is an authorized agent.

Some financial institutions allow you to check whether they are an authorized agent or not on their official website.

In the case of offshore investment, you will apply to a foreign financial institution. In order to avoid getting into trouble, such as a scam, it is best to check beforehand.

-Do They Have a Business License?

At the same time, check the IFA’s business license. There are many types of IFAs, and some of them do not have a license.

Licenses are only issued to agents with excellent support and performance, so IFAs with licenses are more likely to be trustworthy. To identify a trustworthy IFA, make sure that they are licensed or not.

You Should Ask for Proper Explanation of Risks and Fees

Offshore investment has the advantage of increasing your asset, but it also has disadvantages. It is important to make sure that the agency explains the risks to you.

For example, there is an offshore product that guarantees your money will increase to more than 160% by investing for 20 years. Although it is not an aggressive investment, it is very popular among many people because it guarantees a profit.

The following is a partial list of actual products.

However, this financial product is subject to the condition that the principal protection is guaranteed if there is no reduction or withdrawal during the process. Therefore, it is very important to find an agency that properly explains these risks and disadvantages.

-Consider How Much the Commission Will Be

The best agents are those who also explain to you what the fees are for the product plan of the financial institution (insurance company) you are planning to invest in.

When you invest in offshore insurance or offshore mutual funds, you will always be charged a commission. However, some insurance companies charge unnecessarily high fees in some cases. For example, there are some insurance companies that charge an annual maintenance fee of 3% of the total investment.

In the case of regular offshore investments, the annual maintenance fee rate of 3% may be reasonable since we are aiming for an annual interest rate of over 10%. However, there are many insurance companies with lower commission rates, and there is no point in paying a high commission rate even if you are aiming for the 10% annual interest rate.

Therefore, be sure to check not only the yield of the investment, but also whether the IFA will explain the commission, including how much it is.

Investment from Your Home Country Is Possible

When you invest offshore, you transfer money directly to a financial institution overseas. If you have to transfer the money to an agent, it is likely to be a fraud.

The IFA is an agency, and its main function is to support you. It is important to keep in mind that the transfer of money is between you and the financial institution.

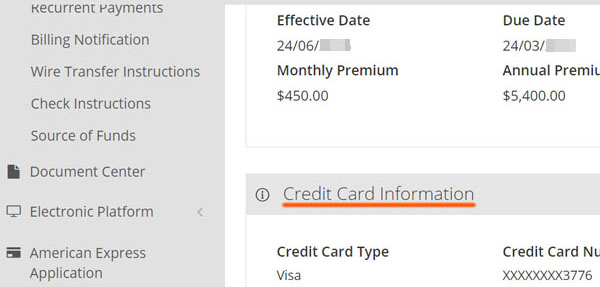

For example, some agents may gather people under the name of a tax haven inspection seminar, and charge high travel expenses. However, it is not necessary to travel to tax havens to invest in regular overseas investments; you can invest by paying by credit card from your country of residence.

I am also investing in regular offshore investments, and I started investing by paying by credit card while living in my country. The following is the actual screenshot of my offshore investment management screen (part of the member site).

In this way, money is paid directly to the financial institution by credit card payment.

Of course, there are some types of investment products such as offshore insurance (life insurance), that you cannot purchase unless you have a medical examination abroad. However, in this case as well, instead of transferring the money to the IFA, you usually have to get your air ticket and hotel by yourself and go to the site. There is no point in transferring expensive fees in the name of a tax haven inspection seminar.

As long as you follow the rule that you must not pay an agent when you start investing offshore, you can greatly reduce the risk of being caught by a fraudulent IFA. You have to be careful not to be deceived about your valuable assets.

The Most Important Thing in Signing and Applying for an IFA Is Investment Performance

Despite these caveats, do you know what the most important thing to consider is before applying for an IFA? It is the investment performance of the agency you are thinking of applying to.

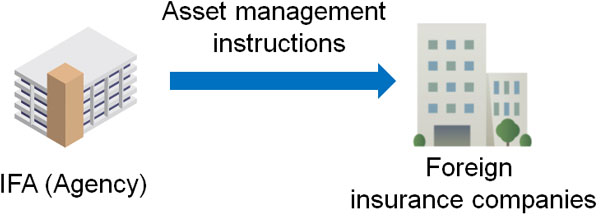

When you invest offshore, you have to apply to a financial institution through an IFA, but the insurance company (financial institution) does not actually manage your assets. The IFA decides what to invest in and how to manage it.

For example, there should be securities companies in your country. However, the securities company does not manage money and invest in something. The securities company has a number of funds to invest in, such as global stocks, developed country stocks, emerging country stocks, real estate, and gold. They only have these financial products.

This is also true for offshore financial institutions. Insurance companies only have hundreds of funds, and they are just a place to deposit your money. In reality, you have to choose funds and invest in them yourself among the funds held by insurance companies.

The IFA is the one who decides which fund to invest in. If you apply to different agents, the funds you invest in will be different even if you use the same financial institution. This is the reason why the investment performance differs depending on the IFA you apply to.

If you want to invest offshore, you should ask your IFA to show you their performance in the past, and then apply for the contract.

Examples of Different Investment Yield Performance by Agents

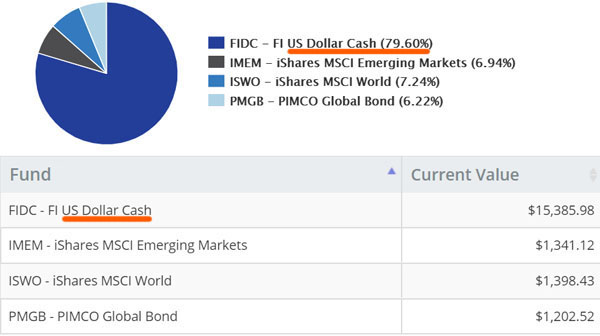

For reference, when I had little knowledge of offshore investment, I applied from a bad IFA and suffered a big opportunity loss.

When I first started investing overseas, I applied through an IFA for an offshore insurance company. It is a financial product that aims for an annual interest rate of more than 10%.

However, the portfolio was a disaster. The portfolio was as follows.

It says “US Dollar Cash: 79.6%”, which means it was left in US dollars. In other words, it was left in cash and not invested in any fund. And this continued for years, with no improvement at all.

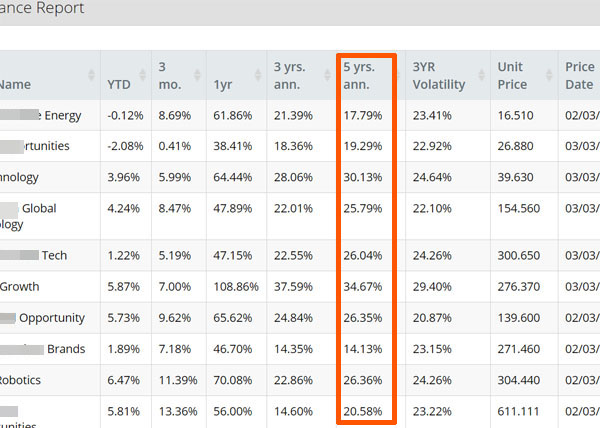

So I gave up on the first IFA I signed up with and switched the IFA. After that, the new IFA showed me the investment returns of each fund for the past five years, and created a new portfolio for me.

After reinvesting in 10 new funds, the assets are now well managed; the five-year average annual interest rate is about 24.1%, which is a high annual interest rate. It invests in a variety of stocks, including US stocks and emerging market stocks, etc.

Investing overseas does not necessarily mean that you can aim for an annual interest rate of more than 10%. Depending on the IFA you sign up with, there are cases like me that assets are left in cash and do not increase at all, or in some cases, your assets become negative due to poor management.

If you recognize this fact, you will understand that who you apply from (i.e., which IFA you sign up with) is the most important factor in regular offshore investment.

You Must Create an Offshore Account with a Good Company Agent

An IFA is an agent of an offshore investment (a company that sells overseas investment products). It is impossible to purchase financial products directly from financial institutions, and they are only available through IFAs. All financial products can be purchased through an IFA to start your offshore investment.

However, there are many IFAs. And the truth is that we do not know which agency is the best.

Therefore, please refer to the information described in this article to make your regular foreign investment. You need to carefully check the agency to see if it is an authorized agency, and has an explanation of the risks and fees. Also, instead of paying unnecessarily high overseas seminar fees to the agency, make sure the money is paid only to the financial institution.

Furthermore, the performance of investment returns varies greatly depending on the IFA. Consider that only an IFA with an excellent investment performance can manage your assets.

If you take these basic precautions, you can prevent yourself from being scammed, and also increase your assets significantly. Make sure to increase your assets by investing in offshore and open an offshore investment account with a good IFA.