When it comes to asset management, financial products in most countries are of poor quality. On the other hand, if you invest in offshore funds in tax havens where there are no taxes, it is natural that your assets will increase more than ten times. This is why so many people invest offshore.

However, there are some people who have been deceived and scammed about managing their assets in tax-free offshore regions.

There is nothing legally wrong with the offshore investment itself, and if you use a proper financial institution, you will not sign up for a fraudulent product. However, it is a fact that there are some cases where the referrer is not good, and as a result, you may fall victim to a scam. Of course, you have to avoid fraudulent damage to protect your precious money.

Although offshore investment is excellent, how can you avoid being scammed by pushy introducers? In this section, I will explain the points to keep in mind when investing in offshore insurance and mutual funds to avoid being a victim of fraud.

Table of Contents

No Fraud, No Illegality with Huge Overseas Insurance Companies

First of all, as a basic premise, there is nothing illegal about signing up for an insurance company (financial institution) located overseas and making offshore investments. In other words, you will not be arrested even if you personally purchase and invest in financial products overseas.

In the past, there was an incident known as the Panama Papers, in which a list of people who had transferred their money to tax havens was made public, and the names of major politicians and celebrities were included in the list. However, they did not do anything illegal, and no arrests were made due to their investments.

*There have been cases of arrests due to the discovery of illegal funds.

In other words, it is completely legal to use offshore areas to manage assets and reduce taxation.

Also, when you invest offshore, it means that you are investing in an insurance company that is much bigger than the megabanks in your home country. In short, it is safer than depositing your money in a huge bank in your home country, and moreover, your assets will grow many times over.

Of course, these financial institutions do not sell fraudulent products. Therefore, when you buy offshore insurance or mutual funds, you can avoid being a victim of fraud by purchasing products from a proper insurance company.

The criteria are simple: check the ratings of the world’s most famous rating agencies, such as Standard & Poor’s and Moody’s. It is common for offshore investments to invest in companies that are rated better than your home country’s financial institutions, so check the ratings given by them.

The Financial Products Are Not Registered with the FSA in Your Country

However, although they are excellent products, these investment products are not registered with the FSA of the country where you live. Of course, they are registered with the FSA of the local offshore region. However, they have not been approved by the FSA of your home country.

In many countries, laws prohibit the advertising and promotion of insurance and investment products that have not been approved by the country’s Financial Services Agency.

Since the content of financial products in tax havens is overwhelmingly superior to that of financial products in your country, if we are allowed to freely advertise and sell foreign investment products, no one will buy the poor insurance products and mutual funds in your country. Many countries have laws that prohibit the promotion of foreign financial products, just to protect the banks and securities companies in your country.

The reason why many people do not know how to invest in tax havens is because of the financial regulations working in your country.

However, it is only prohibited for foreign funds to advertise, solicit, and operate in your country, and there is nothing legally wrong with you looking for and applying for foreign financial products on your own. It is important to understand that signing up for offshore investments is not illegal, and there is no fraud involved.

You Must Buy from an Excellent IFA (Agent)

Why do some people feel cheated even though they subscribe to insurance products and mutual funds that have overwhelmingly better conditions than the financial institutions in your country? If it is natural for your assets to grow more than ten times, you have a 100% chance of winning in your investment, even if you take currency risk into account.

This is due to the fact that the introducer is not good when you start regular investments.

In offshore investment, you must always apply through an IFA (Independent Financial Advisor). Overseas financial institutions do not sell products directly to their clients, and you can only sign up through an agent.

Since there is no fraud in the financial institution you subscribe to, the most important thing is the agency you sign up with (who you sign up with). Many people make a mistake here, and as a result, they encounter fraudulent damages.

The Most Common Trouble Is Not Being Able to Contact

One of the most common problems when making an offshore investment is to lose contact with the person who introduced you to the regular investment.

Since you are applying for an overseas financial product that is prohibited to be solicited and sold in your home country, naturally, there are no large companies in your country dealing with offshore investment products. In most cases, you will be introduced to offshore investment products by individuals or small companies, and you will invest in offshore financial products through them.

However, what tends to happen with personal introducers is that you lose contact with them a few years after you start investing.

Whether it is offshore insurance or mutual funds, it is assumed that the investment will continue for a long period of time, such as 10 or 20 years. It is an offshore investment until the money is returned to you, and you have to be supported at maturity.

However, if the agency is not good, you cannot get in touch with an IFA even though the maturity date has come, and as a result, there are often cases that you do not know how to get your invested money back.

It is true that your assets can multiply many times over. However, it is useless unless you can put the money back into your own bank account after a few decades and use it freely. But if it is a fraudulent introducer, he will disappear right after you have signed up. This is the reason why it is very important to decide who you subscribe from when investing in offshore.

Tax Saving Cannot be Achieved with Offshore Insurance and Mutual Funds

Not only can you not get in touch with your agent, but you may also be given false information. One of the most common is that you don’t have to pay taxes because you are investing your money in an offshore area where taxes are not imposed.

However, this is a lie. Even if you send your money abroad, you will still have to pay taxes in the country where you live. In other words, you must pay capital gains tax.

It is true that in tax havens, the money earned from investments is tax-free. Therefore, when a financial institution registered in a tax haven makes a profit, almost no tax is imposed, and the profit is returned to the investor (you).

However, you will have to pay taxes in your country on the earned money you have invested abroad.

The tax exemption is only for insurance companies located in offshore areas. It is important to understand that you will not be able to escape taxes.

While it is true that you can manage your assets tax-free, it does not mean that you are tax-free. If you live in a country that has a capital gains tax, you will have to pay taxes. If someone solicits you with false information, do not sign up from such an introducer.

Reducing or Stopping Your Investment Isn’t a Good Idea

Some agents, including IFAs, solicit investments by explaining that it is possible to reduce or stop the amount of money in the middle of regular investment. However, those who do this kind of solicitation and sales are almost always fraudulent and must be avoided at all costs.

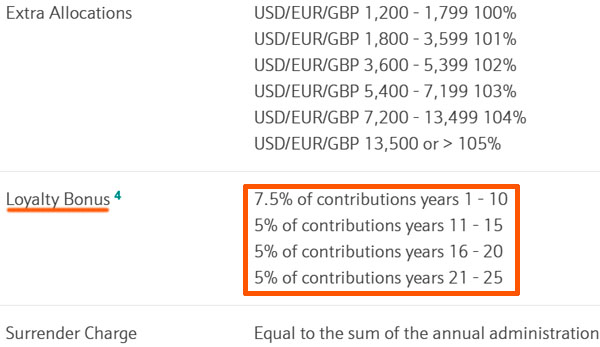

If you manage your assets through offshore investment, your money will grow two to three times, and depending on the financial product, it is normal for your money to grow over ten times. However, there is a prerequisite for many financial products. That is, there is a loyalty bonus or guarantee if you invest the initial amount of money you decide to without any reduction.

If you invest offshore, you will be added a favorable bonus, such as a 5% loyalty bonus. For example, an offshore investment company offers high bonuses such as 5% and 7.5% on the amount invested, as shown below.

However, it is only for those who have accumulated the amount of money that they set at the beginning without any reduction or stopping. It is true that you can reduce or stop the amount, but if you actually reduce the amount, there will be no bonus, and your offshore investment will be meaningless.

An agent who does not inform you of this fact and tries to get you to sign a contract with a high monthly accumulation amount is certainly a corrupt agent. It is very important to determine the amount of the monthly payment for offshore investment, and you should set the amount not too high.

Check the Fund Name of the Investment

By the way, I don’t discuss obvious scams such as multi-level marketing (MLM) and non-existent investment products so far. I am only discussing the points to keep in mind when investing your money in legitimate overseas funds.

However, there are some scam products that invest abroad in companies that do not exist, and offer an annual interest rate of 40%. Do not subscribe to such products.

When you are considering regular investments, make sure to check in advance what kind of financial institution you will be investing with. While there are a great many funds that exist in tax havens, there are only a few important funds. The well-known ones are the following financial institutions.

- Investors Trust

- RL360°

- Dominion Capital Strategies

- Premier Trust

These companies are relatively well-known funds for offshore investments. If you sign up with these companies, at least the financial products themselves are not fraudulent.

However, if you are going to invest in an offshore fund with a financial institution other than these famous companies, you should carefully check whether the product is a scam or not. Also, if you are a beginner in offshore investment and you are worried about regular investment, you can make sure that you do not join any financial institution other than the ones mentioned above.

Not Illegal, But Be Careful of Scams When Investing Offshore

When you invest offshore, there is nothing legally wrong with it, and it is not illegal. The only thing the law prohibits is promoting, soliciting, or selling products that are not registered with the Financial Services Agency of the country where you live. It is okay for you to research on your own and sign up from an IFA.

In addition, with regular investment, you will be depositing your money and managing your assets with a company that is bigger and more reliable than the megabanks in your country. Naturally, such companies will not sell fraudulent products.

However, when you buy foreign insurance products or mutual funds, some introducers may give you fraudulent information. So, make sure you understand the cautions mentioned so far and recognize the risks of the products.

Also, there are some real scam products mixed in, including those from multi-level marketing. To prevent scams, I have listed the names of safe financial institutions in this article, so do not invest in any other funds.

Since the investment is made overseas, there are naturally some shady things mixed in. Therefore, find a good distributor and try to avoid scams while increasing your assets many times over with offshore funds.