By investing in stocks, you can increase your assets significantly. The reason for this is that investing allows you to benefit from compounding interest.

For amateur retail investors, the most important investments are index funds. By using mutual funds (ETFs), you can increase your money through compound interest.

However, when investing in index funds, it is important to know which funds to invest in. If you make a mistake in choosing the proper mutual fund to invest in, you will not be able to increase your money through compound interest. It is important to understand in advance which fund to choose.

Proper asset management can greatly increase the value of your assets. So I will explain how you should use index funds to get the compounding effect.

Table of Contents

Compound Interest Is the Most Important Factor in Stock Investment

The most important concept in investing is compound interest. The reason why many people have become rich through investment is that their money increases through the compounding effect.

For example, if you invest $10,000, it will increase by $1,000 after one year if the annual interest rate is 10%. In the case of compound interest, the following year, your money will grow at 10% per year on $11,000. In this way, the speed at which your money increases accelerates as the years go by.

For reference, if you invest $10,000 at 10% annual interest, your money will grow as follows.

| 1st year | 3rd year | 10th year | 20th year |

| $11,000 | $13,310 | $25,940 | $67,270 |

If you have surplus funds, you should invest them aggressively. The reason for this is that your funds will grow many times in a few years.

Compounding Effect Available Even Without Fixed Interest Rate and Dividends

Many people think of earning dividends when they manage their assets with compound interest. They use fixed interest rates at banks or invest in bonds to earn dividends. You can also earn dividends by investing in stocks, but the amount of dividends is less than bonds. Also, there are many stocks that do not pay dividends.

However, even if you invest in non-dividend paying stocks, you can still enjoy the compounding effect. The reason is that when investing in stocks, we think in terms of percentages.

Companies with a large market capitalization tend to attract more money. In other words, as the size of the company increases, the stock price will grow at an accelerated rate.

Let’s say you invest in a stock and your money increases five times. If the stock price doubles from there, your money will increase tenfold in total.

For companies with good performance, the stock price rises exponentially. For example, the following is the stock price history of Adobe.

Since the increase in stock prices is considered as a percentage, you can increase your money through compound interest even if you are investing in stocks.

The Case of the S&P 500, a Famous Index Fund

Many professional investors invest in individual stocks. On the other hand, amateur individual investors cannot decide which company’s stocks are superior. Therefore, they consider investing in index funds by using mutual funds.

Many people use index investing. With index funds, you can diversify your investment since you will be investing in hundreds of companies.

The S&P 500 is known as a good index. The S&P 500 invests in the top 500 companies in the US. The average annual interest rate for investing in the S&P 500 is 7-9%. The following is the stock price history of the S&P 500.

You can see that the stock price is increasing exponentially. When investing in the S&P 500, even inexperienced retail investors can achieve high annual returns with compounding effects.

Reinvestment of Dividends Increases Compounding Effect

When you invest in the S&P 500, you can also earn dividends. The chart above shows the stock price and does not include dividends.

The dividend for the S&P 500 is about 2% per year. Therefore, if you include the interest income from dividends, you can earn more than 10% per year when investing in the S&P 500.

Also, when you earn dividends, you can reinvest them. In other words, instead of having the dividends deposited into your brokerage account as cash, you can use the money to buy stocks. All securities companies allow you to choose whether or not you want to reinvest your dividends when you invest.

If you want to maximize the effect of compounding interest, use the dividends as reinvestment. This will allow you to earn more profit in the future.

The Index Fund You Invest in Is Most Important

When investing in index funds, the most important thing to consider is which mutual fund to use. For beginners in investing, they do not understand which mutual funds are superior, and as a result, they choose bad investments.

One of the worst choices is to choose a mutual fund in your home country. For example, I am Japanese, and the following is the Nikkei Stock Average (or Nikkei 225).

As you can see, stock prices are not growing. Japan is famous for its lack of economic growth and lack of stock price growth.

The same can be said for emerging market stocks. If you invest in index funds based on the assumption that countries with high economic growth rates will have growing stock prices, you will lose money at a high probability. For example, below is the stock price trend of the Shanghai Composite Index (SSE Composite Index).

As you can see from the chart, investing in a Chinese stock index fund will not increase your money.

It is true that you can increase your money through compound interest by using mutual funds. However, in order to get the compounding effect, there is a prerequisite that you have to invest in an index whose stock price is increasing. Therefore, make sure you are investing in the proper index.

The S&P 500 or Nasdaq 100 Is Recommended for Retail Investors

Which index fund should you invest in? There are two index funds that amateur retail investors should invest in.

- S&P 500

- Nasdaq 100

You should try to invest in one of these two.

The Nasdaq is an index of high technology companies listed in the US, and the Nasdaq 100 invests in the top 100 of them. For reference, here is the stock price history of Nasdaq.

Compared to the S&P 500, the Nasdaq 100 has a higher average annual interest rate. However, the risk is higher for the Nasdaq 100.

Both the S&P 500 and Nasdaq 100 are US stocks. Investing in US stocks is a common practice in stock investment, and this is also true for index investment. Buying mutual funds (ETFs) that invest in US companies will give you a compounding effect.

Possible to Have Mutual Funds Selected by Professionals

Alternatively, it is possible to have your investments chosen by a professional. It’s called offshore investments, and you invest in offshore tax havens where there is little or no tax.

In addition to the S&P 500 and Nasdaq 100, you can invest in other mutual funds in tax havens, including the following.

- Robotics stocks

- US small-cap growth stocks

- Brand related stocks

- Technology stocks

There are many more funds to choose from and invest in.

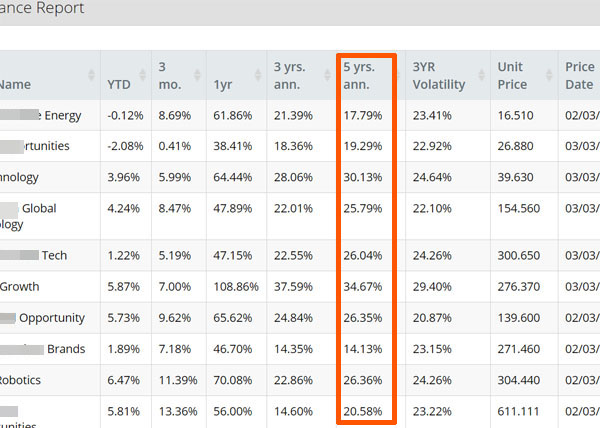

These are not index funds, but mutual funds that invest in stocks selected by professionals. For example, the following is the result of my offshore investment.

I have a diversified portfolio of 10 funds with an average annual interest rate of 24.1% over the past five years. In my case, I use mutual funds that invest mainly in US stocks. Even though it invests in US stocks, the yield is better than the S&P 500 if you invest offshore and choose the right investments.

Increase Money Through Compounding Interest by Index Investing

Investing in stocks allows you to increase your money through compound interest. With the compounding effect, your assets will grow as time goes by.

An excellent investment method for amateur investors is to use index funds. By investing in an index, you can diversify your investment across hundreds of companies.

However, it is important to understand in advance which index you should use. If you use an index fund of your home country or an emerging country, your money will not increase with compound interest. This is because there is almost no increase in the stock price. Instead, use mutual funds (ETFs) that invest in American companies.

Alternatively, you can buy mutual funds through offshore investments and invest in US companies. In this case, a higher yield is possible than the S&P 500. In any case, use mutual funds whose stock prices are rising to increase your money through compounding.