Many people think of hedge funds as being invested in by wealthy people. Therefore, we think that we need to prepare a large amount of money, such as one million dollars.

In reality, however, even ordinary people can invest in hedge funds. You don’t need to have US$1 million to start investing in hedge funds; you can start with tens of thousands of dollars. In offshore investment through overseas savings, it is possible to invest as little as $100 to $200 per month.

Once you understand this fact, you will realize that anyone, including individual investors, can invest in hedge funds.

Even if you are an ordinary person, you can invest in the same hedge funds invested in by institutional investors and family offices with more than $100 million in assets. So, I will explain how retail investors invest in hedge funds.

Table of Contents

Individual Investors Can Invest in Hedge Funds

Most retail investors have a misunderstanding about investing in hedge funds. They think that only wealthy people can invest in hedge funds. In reality, however, even ordinary people can invest in hedge funds.

There are offshore tax havens in the world where there is almost no tax. Managing assets in tax havens are called offshore investment. Many offshore investment products are available for individuals, and some of them allow you to invest in hedge funds.

Some offshore investment products are only available to the wealthy. However, as mentioned above, ordinary people can invest in the same hedge funds that the super-rich invests in.

Of course, the method of investment is different from that of ordinary investment. The fund managers of hedge funds do not like investors who buy and sell in the short-term and assume long-term investments of 5 to 10 years or more. Therefore, they set purchase fees (or surrender fees) to prevent frequent trading.

Although high investment capital is not required, investment style is the same as institutional investors and family offices when investing in hedge funds. This means that you will invest a lump sum in a hedge fund and leave the assets for years.

US$30,000 Is the Minimum Investment Amount

Specifically, how much money will you need? To invest in hedge funds, you need to open an investment account with an insurance company (investment company) registered in a tax haven. You invest in hedge funds through an offshore investment account.

The minimum amount required to open is US$30,000. This means that if you can invest $30,000 in a lump sum, you can start investing in hedge funds right away.

After you have applied to open an offshore investment account, you need to send the money to an investment company in a tax haven, and you will receive an email like the one below.

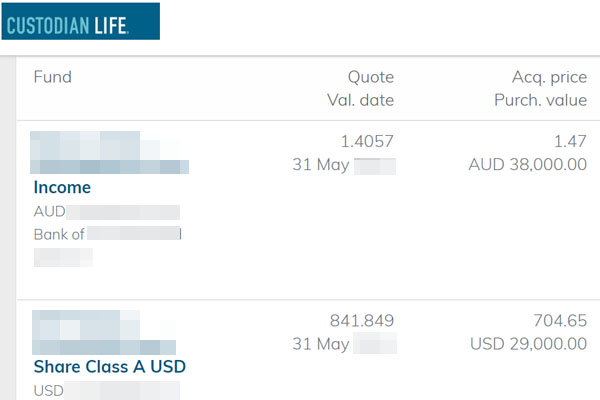

Thus, after activating my investment account, I have invested in hedge funds. I have been investing in hedge funds for many years, and here is the management screen of my offshore investment account.

As you can see, I can manage the hedge funds I invest in from a single management screen. I can also see how much my money is growing through asset management.

I am not an institutional investor, and I am not a wealthy person with hundreds of millions of dollars in assets. I am a retail investor, but I invest in several excellent hedge funds.

Private Banking Is a High Investment Amount

Some wealthy people use private banking services. Some banks registered in Switzerland offer private banking services to the super-rich.

To open a private banking account, a minimum of US$500,000 is required. Also, in the future, you must invest at least US$1 million. Therefore, only wealthy people can use private banking services.

However, regardless of whether you use private banking or an offshore investment account, the hedge funds you can invest in are the same. In other words, there is no significant difference in terms of function.

If you are a wealthy person, there is no problem using private banking. However, it does not mean that if you use private banking services, you will be able to make special investments. In any case, you can invest in good hedge funds by using an offshore investment account.

Low-Risk Hedge Funds Are Suitable for Retail Investors

When investing in hedge funds, what are some of the suitable hedge funds for retail investors? The best hedge fund for ordinary people is low-risk hedge funds.

Most people think of hedge funds as investing in stocks, bonds, forex, and futures and leveraging them many times to get returns. However, this is not actually the case.

It is true that when you invest in a high-risk, high-return hedge fund, the fund manager makes a high-risk investment. It is normal for a high-risk, high-return hedge fund to earn an average annual interest rate of 20-30%. However, the returns vary from year to year, and in some cases, assets frequently decline by -30% to -50% in a year. On average, an annual interest rate of 20-30% is possible.

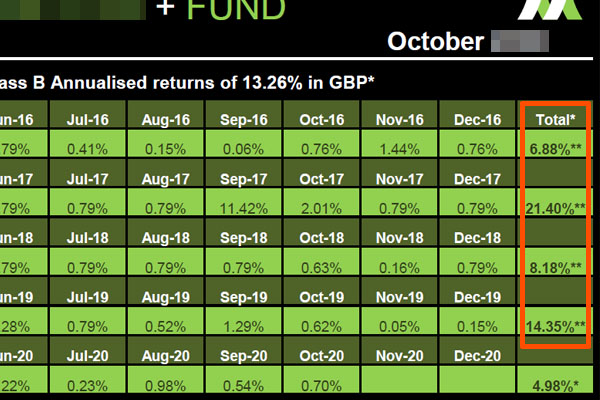

Even so, few investors can tolerate -30% to -50% in assets in a year. If you are an individual investor who can withstand a large asset loss, there is no problem, but if not, invest in low-risk hedge funds. For example, the following is one of the hedge funds I invest in.

This is a hedge fund that deals with real estate loans in the UK. It lends money to individuals using real estate as security and earns interest income. The hedge fund also makes a profit by selling the right to earn interest income to other life insurance companies and investment companies.

Since they do not invest in stocks or bonds, their investment risk is low, and they have not had any negative return years in the past. Despite this, the average annual interest rate is 13.26%. When investing in low-risk hedge funds, the annual interest rate is often 10-13%.

If you open an offshore investment account with $30,000 and invest in the hedge fund mentioned above, your assets will grow as follows at an average annual interest rate of 13.26%.

- After 10 years: $104,200

- After 20 years: $362,000

- After 30 years: $1,257,000

In this way, your assets will increase through compound interest. Although it takes time, it is more reliable than winning the lottery to make more than 1 million dollars in assets.

To open an offshore investment account, as mentioned above, you need at least US$30,000. Therefore, while you do not have to be wealthy, poor people with no savings cannot invest. If you want to invest in hedge funds, save and prepare the money to invest.

With Regular Investments Overseas, You Can Invest as Little as $100 to $200 a Month

However, some people may not have $30,000 in savings. If you don’t have $30,000, do you have to give up investing? Actually, you can invest as little as $100 to $200 per month in some offshore investments.

The method I mentioned earlier is a lump-sum investment. On the other hand, it is possible to invest in installments as an overseas savings investment. In this case, if you are aiming for an annual interest rate of 10% or more, you cannot invest in low-risk hedge funds. Instead, you have to invest in high-risk, high-return funds.

In the case of regular investment, the investment is made over a long period of time, such as 15 or 25 years. For example, if you continue to invest $200 per month for 25 years, the total amount will be as follows.

- $200/month × 12 months × 25 years = $60,000

Thus, when you think about it over the long term, it becomes a lot of money. Therefore, even if you don’t have a large amount of savings right now, you can still invest in small amounts when you invest overseas.

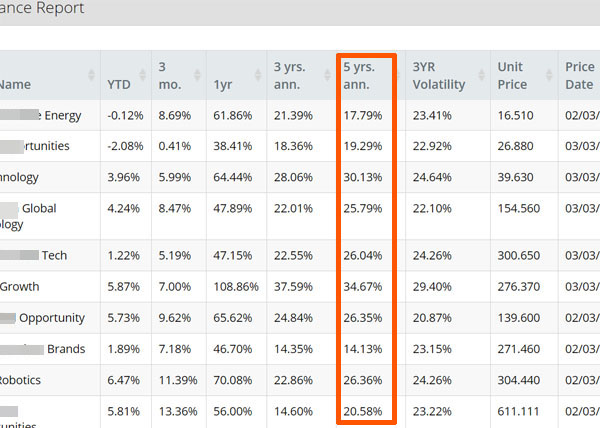

For your reference, the following is the management screen of my offshore savings investment.

In my case, I am diversified into 10 funds and the average annual interest rate over the past 5 years is 24.1%. Since this is a high-risk investment, the return may be negative in some years. However, averaged over the entire period, the annual interest rate is high.

Even if you can’t invest a large sum of money in a lump sum, you can invest in hedge funds in installments by using offshore investments.

Earning Investment Returns from Long Positions (Buying) Only

When you invest in offshore funds through a regular investment, the characteristics of the funds you invest in are different from those of hedge funds invested in a lump sum.

When you invest your money in a lump sum, the hedge funds you invest in are not affected by the economy. For example, the low-risk hedge fund I mentioned earlier deals in real estate loans. Therefore, you can earn a return regardless of the decline in stock prices.

Also, high-risk, high-return hedge funds take not only long positions (buying) but also short positions (selling). Therefore, they can generate returns even in times of recession when stock prices are falling.

On the other hand, when you invest offshore using a regular investment, you can take only long positions (buying). In other words, you invest with the expectation that the stock price will rise. Strictly speaking, they are not hedge funds because they only take long positions. However, the fund manager selects excellent stocks to earn a high yield.

Therefore, it is important to understand that investment performance is affected by the economy in the case of overseas savings investments. In short, there are different types of hedge funds that can be invested in through lump-sum investments and regular investments.

Both are the same in the sense that the fund manager manages the assets. However, the method of investment is different.

For your information, both savings and lump-sum investments are excellent for individual investors, and I use both. It depends on the retail investors which investment method they prefer. Choose the best investment method for you based on your preference and the amount of capital you can invest.

Even Individual Investors Can Invest in Hedge Funds

When investing in hedge funds, you might think that only wealthy people can invest in hedge funds. In reality, however, even retail investors can invest in hedge funds without any problem. In fact, I am an ordinary person, and I have invested in several hedge funds.

Using tax havens is a great way to invest, compared to investing in your home country. There are low-risk hedge funds that earn 10-13% annual interest regardless of the economy, and there are high-risk, high-return hedge funds that earn 20-30% annual interest.

Even if you can’t invest $30,000 or more in a lump sum, you can invest in hedge funds with as little as $100 to $200 per month through an offshore savings investment.

There are several types of offshore investments for individuals, and investing in hedge funds can provide excellent returns. If you want to increase your wealth by investing in hedge funds, you should take advantage of offshore investments.