When hedge fund managers manage their assets, they are constantly fixing profits and cutting losses. It is not surprising that hedge funds that produce absolute returns are always trading.

On the other hand, the same is true for individual investors. An ordinary person with 30,000 US dollars to spare can invest in hedge funds using an offshore investment account. After investing in hedge funds, you have to fix profits or cut losses depending on their performance.

However, compared to investing in stocks, investing in hedge funds is not as common. Therefore, there are few people who understand how to secure profits and cut losses.

So, I will explain how retail investors should think about fixing profits and cutting losses when investing in hedge funds.

Table of Contents

Cutting Losses and Fixing Profits Are Important When Investing in Hedge Funds

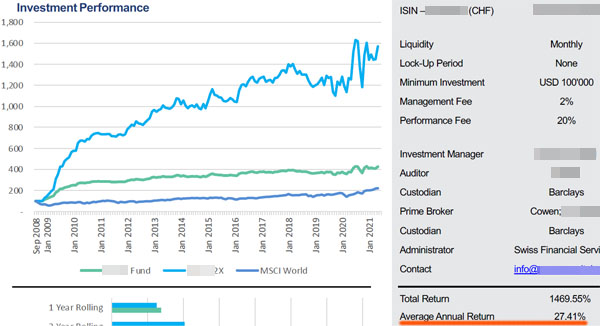

Hedge funds that invest in stocks and bonds are constantly cutting losses and fixing profits. For example, the following is a fact sheet on a high-risk, high-return hedge fund that invests in stocks, bonds, forex, and futures.

As you can see, the profits are not stable and the volatility is large. Although the average annual interest rate is high at 27.41%, there are some years when the return is negative.

Naturally, when individual investors invest in such hedge funds, they may lose money depending on the timing of their investments. Also, if you invest in a hedge fund with poor performance, you will not be able to make a profit in the first place. In that case, you should consider cutting your losses.

On the other hand, if you invest in a good hedge fund, your assets will be large. In that case, many people wonder when they should secure their profits.

You Should Cut Your Losses on Hedge Funds with Large Losses

So, let’s start by checking the timing of the stop loss. When you consider cutting your losses, you should cut your losses on the hedge fund with the largest loss.

The way of thinking when cutting your losses is the same as in stock investment. In stock investment, you have to cut your losses on the stocks with the highest losses. Many people sell stocks that are making a profit and continue to hold stocks that have losses. As a result, the losses become large.

Therefore, you have to sell the stocks with large losses. The same applies to investing in hedge funds. Cut your losses on hedge funds with large losses.

However, unlike investing in stocks, you should invest in hedge funds for at least three years, no matter how short it is. This is because investing in hedge funds requires long-term investment. Especially with high-risk, high-return hedge funds, it is common to see a large negative return for a year or two, even if the fund has a high average annual interest rate.

However, if you have invested in a hedge fund for more than three years and the return is still negative, it is not worth continuing to invest. In that case, you should cancel the investment and cut your losses.

Do Not Fix Profits on Hedge Funds with Large Unrealized Gains

On the other hand, what should we think about hedge funds with large unrealized profits? In this case, you should not secure profits.

When you invest in hedge funds, you can increase your profits not only in booming economies but also in recessions. Therefore, unlike investing in stocks, there is no need to lock in profits. While stocks have a 100% probability of losing value in a recession, you do not have to worry about this when investing in hedge funds.

If a hedge fund is making large profits, you can continue to invest in it and your assets will grow. In order to become rich, you must continue to use methods that are producing excellent results.

Rather, cut your losses on hedge funds that are performing poorly, and use the money generated to invest in hedge funds that are performing well. This way, your money will grow faster.

- Poorly performing hedge funds: Cut your losses.

- Good hedge funds: Don’t lock in profits (rather increase your investment)

If you do this, your assets will grow at a faster rate.

There Is Nothing Wrong with Locking in Profits If You Have a Reason

This does not mean that you should never lock in profits on hedge funds that are performing well. The money you make will be used someday. Therefore, if you need the money, you can cancel it and use it.

I recommend partial cancellation rather than full cancellation. For all hedge funds, partial cancellation is available. If you make a partial surrender of the money you need, the remaining money will continue to be invested in the hedge fund. You can use the money you need by withdrawing some of it while growing your money through investment.

Alternatively, you can secure profits and surrender in order to invest in a better hedge fund. There are many reasons to cancel, and if you have a reason, cancel it.

For example, I have invested in the following low-risk hedge fund.

It is a hedge fund that deals in mortgage loans in Australia, with an average annual interest rate of 9.27%. Since it is a mortgage in Australia, the investment is made in Australian dollars, not US dollars.

When the Australian dollar becomes more valuable and the US dollar becomes less valuable, I plan to terminate and lock in profits on this hedge fund. That way, I will get more US dollars. In other words, I will not only be able to manage my assets at an annual interest rate of 9.27%, but I will also be able to benefit from the foreign exchange gains.

I do not know when the Australian dollar will appreciate in value. However, looking at past history, there have been times when the value of 1 USD has been lower than 1 AUD.

By selling when the value of the Australian dollar is high, I am looking to make a currency gain. If you have a reason like this, it is okay to fix your hedge fund profits at the appropriate time.

Beware of Early Termination Fees When Cutting Losses or Fixing Profits

One thing to keep in mind when investing in hedge funds is the early termination fee. Unlike investing in stocks, investing in hedge funds requires a long-term investment of five years or more. Hedge funds do not like investors who invest for a short period of time, so they often have early surrender fees.

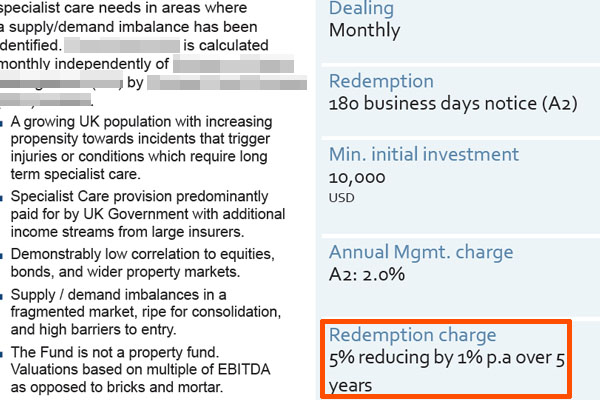

For example, the following hedge fund has an early surrender fee.

If you invest in this hedge fund, the surrender charge is 5% of the amount invested. However, the surrender charge will decrease by 1% every year, and after 5 years, the surrender charge will be zero. Many hedge funds have this kind of surrender charge.

Therefore, when you are cutting your losses or locking in profits, make sure you know what kind of surrender charge the hedge fund you are investing in has. You may be charged a surrender fee, especially if you have not invested in the fund for more than five years. Incidentally, some hedge funds do not have a surrender charge.

You Are Not Liable for Taxes on Profits

Many countries impose capital gains tax when you invest. If you live in a country that does not have a capital gains tax, it does not matter, but in many countries, you will be taxed on the money you make from your investment.

However, when you invest in hedge funds, you are not immediately liable for tax in your country of residence when you lock in profits. Although you are liable to pay tax when you make a profit on stock investments, this is not the case with hedge fund investments. Therefore, unlike stock investments, you can freely lock in profits.

The reason for this is that in order for retail investors to invest in hedge funds, they need to open an offshore investment account. By opening an investment account in a tax haven where there is almost no tax, even ordinary people can invest in hedge funds.

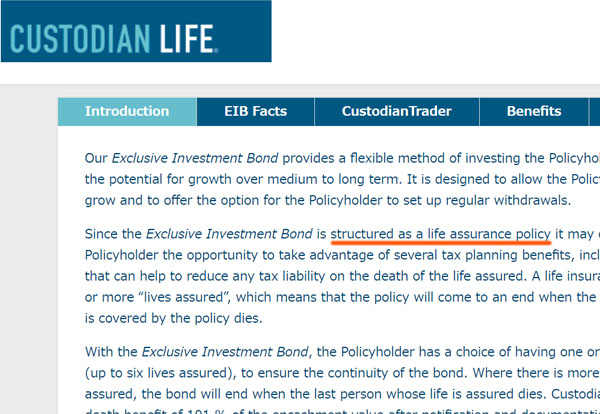

The offshore investment account is an insurance product. It is an investment product designed as life insurance, but unlike ordinary life insurance, the death benefit is as low as 101% of the asset’s value. In other words, it does not pay a high death benefit.

For example, the following is a Bermuda-registered company that offers an offshore investment account. The official website of the company says that the investment product (an offshore investment account) they sell is designed as a life insurance policy.

There are some life insurance products that invest in global stocks or US stocks. Likewise, you can invest in hedge funds using an offshore investment account that functions as a life insurance policy.

It is important to note that unless you cancel your life insurance policy, you will not be liable to pay taxes. Even if you take out life insurance and change your investment from US stocks to emerging market stocks, you have not fixed your profit. Similarly, if you invest in a hedge fund using an offshore investment account (life insurance) and then change the hedge fund you invested in, you are not liable to pay tax.

Offshore investment accounts have the property of an insurance product, so it is a great feature that you don’t have to pay taxes when you lock in your profits & change your investments.

Withdrawing Money or Terminating an Account Will Result in Tax Liability

On the other hand, if you withdraw your money or cancel your offshore investment account, you will naturally have to pay tax.

As for ordinary life insurance, if you cancel part of the policy or receive a surrender refund (or death benefit), you will have to pay taxes in your country on the money you have increased through asset management. Similarly, if you withdraw money from an offshore investment account or receive money by closing the account, you will be taxed on the profit.

You do not need to think about taxes when you invest in a hedge fund and cut your losses or lock in your profits. You do not have to pay tax on the profit you make within the life insurance.

On the other hand, if you send the cash to your bank account in your country of residence, you will be liable for tax.

Correctly Cut Losses and Fix Profits in Hedge Funds

High-risk, high-return hedge funds cut losses and lock in profits regardless of the timing. Therefore, if you check the fact sheet, you will see that the profit fluctuation is large. If you have invested for more than three years and the hedge fund is not performing well, consider cutting your losses.

On the other hand, don’t secure profits on hedge funds with excellent performance. To be successful in investing, you should keep funds with large unrealized gains and cut funds with large losses. Or, if you have a reason, you can change the hedge fund after fixing your profit.

In addition, if you want to use the money, you can cancel it. In this case, it is recommended to withdraw the money by partial cancellation. This way, you can continue to manage your assets.

There is a right way for individual investors to increase their money by investing in hedge funds. So let’s understand how to cut losses and lock in profits.