By investing in a good hedge fund, even ordinary people can increase their money at a high rate of return. However, there are many hedge funds that have failed as a result of poor investment management.

LTCM is one of the most famous hedge funds that failed in the past. It was called the Wall Street dream team, with Nobel Prize winners as members of its management team. However, it eventually lost a lot of money and went bankrupt.

Why did LTCM fail? People who fail in asset management have some common points. So by learning about the history and reasons why LTCM went bankrupt, you can learn investment methods that should be avoided.

There are some common features among hedge funds that fail to invest, and I will explain what kind of investments LTCM made and why it failed.

Table of Contents

LTCM Is a Hedge Fund That Once Existed

LTCM (Long-Term Capital Management) was a hedge fund that existed from 1994 to 1999. In other words, it went bankrupt only five years after it was founded.

It was big news at the time because it went bankrupt after collecting so much money from investors. Many financial institutions bailed out LTCM after the collapse to prevent a financial crisis.

Importantly, LTCM’s investment performance was excellent for the first four years after its establishment. However, during the next year, it suffered huge losses and went bankrupt.

Why LTCM Was Considered the Dream Team

When LTCM was founded, a large amount of money was raised for the hedge fund. One of the reasons for this was the fact that prominent people were members of the management team.

John Meriwether founded LTCM, and the management team included the following members.

- David Mullins: Former Vice Chairman of the Fed

- Myron Scholes: Nobel Prize winner in economics

- Robert Merton: Nobel Prize winner in economics

LTCM was a hedge fund that used advanced financial engineering to manage assets. LTCM was also considered a dream team because of its famous management members.

LTCM’s Investment Method Was Bond Arbitrage Strategy

Why did LTCM fail, despite having some of the best economists and experts in its management team? To understand why we need to learn about LTCM’s investment strategy.

There are many different investment methods adopted by hedge funds. Among them, LTCM used an arbitrage strategy. This investment strategy is also known as the relative value strategy.

Arbitrage strategy is one of the low-risk investment methods. The reason why arbitrage trading is considered low risk is that it is theoretically 100% profitable.

LTCM used to invest in bonds by leveraging them many times. In the case of bonds, the price rarely keeps falling forever like stocks, and at some point, the price will return. In the case of government bonds, in particular, the price is more likely to return to its original state because of their higher creditworthiness compared to corporate bonds.

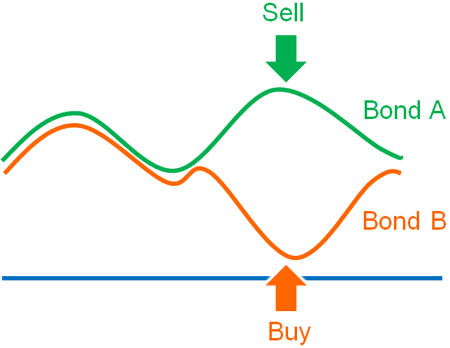

So they short the overvalued bonds and buy the undervalued ones. It looks like the following.

Then, when the bond price returns to its original price, the hedge fund can earn a profit. According to financial theory, the price of government bonds will always return to the original price at some point. Therefore, if we do arbitrage trading, theoretically we will always make money.

All trading decisions were made by computers. It automatically determined which bonds were overvalued and which were undervalued, and made profits by buying and selling short.

It Performed Well for the First Four Years After Its Establishment

The volatility of bond prices is small. Therefore, LTCM was trading with up to 25 times leverage. Also, as mentioned earlier, bond prices tend to return to their original prices. Therefore, it had a good performance for the first four years after its establishment.

LTCM’s annual interest rate was about 40%. Even though the 10% annual interest rate is an excellent performance, the 40% annual interest rate attracted a lot of investment money, and LTCM grew to manage over 100 billion US dollars in assets. At the time, LTCM was the largest hedge fund in the world.

As it began to manage the money of large banks and institutional investors, LTCM’s assets under management expanded.

When LTCM collapsed, it made headlines, and the Fed bailed it out because of the huge amount of assets under management. It was a shock that the company, which was larger than the national budgets of many countries, went under.

Losing Most of its Assets in the Asian Financial Crisis and the Russian Financial Crisis

Why did LTCM go bankrupt, losing most of its assets within a year, despite its excellent performance of about 40% annual interest rate? The reasons are the Asian financial crisis in 1997 and the Russian financial crisis in 1998.

During the Asian financial crisis, investing in emerging countries was deemed risky, and bonds were sold. However, it is common for bond prices to recover over time, and LTCM purchased a large amount of bonds in emerging countries that are judged to be undervalued. At the same time, it shorted US treasuries, which are judged to be overvalued.

But then came the Russian financial crisis. When Russian government bonds defaulted, the stocks and bonds of emerging countries were further sold, and their prices fell. However, the computers were judged to be undervalued, and LTCM continued to buy more bonds in emerging markets and shorted US treasuries.

In this way, LTCM rapidly reduced its assets. Also, because the trading was automated by computer, the losses continued to increase. As a result, LTCM could no longer withstand the losses and went bankrupt.

Exceptions Happen Frequently in Financial Markets

While there are many reasons why LTCM failed, the most important reason is that they eliminated exceptions in the financial markets. At the time, LTCM estimated that the probability of Russian government bonds defaulting was three times in a million years. However, it actually defaulted.

While arbitrage trading is 100% profitable in theory, we realize that exceptions frequently occur in the real financial markets.

In the past, there have been many cases where countries have defaulted. In addition, there is always a financial crisis every few years, such as the dot-com bubble, the collapse of Lehman Brothers, and the Corona shock. When you understand this fact, it is normal for exceptions to occur in financial markets.

Also, all investors understand that stock and bond prices do not move according to theory. In short, we can use financial theories as a reference and should not rely on them. Nevertheless, LTCM’s management team relied solely on financial theory to make trades.

High Leverage Is a Major Cause of Failure

High leverage was also a major cause of LTCM’s collapse. As mentioned above, LTCM had been investing with up to 25 times leverage.

The important thing in investing is to keep investing. To be more precise, the most important thing is not to withdraw from the market due to large losses. Even if your investment performance has been excellent, if you are trading in such a way that you lose most of your assets in a single failure, your money will surely be reduced to zero at some point.

LTCM was using extremely high leverage and lost money rapidly when the financial crisis hit.

For reference, high leverage was also the reason why Lehman Brothers collapsed in 2008. When Lehman Brothers collapsed, many financial institutions were managing their assets with high leverage of over 30 times. As a result, they failed to manage subprime loans and went bankrupt.

There is nothing wrong with trading with leverage, and leverage can help us to increase our assets quickly. However, too much leverage increases the risk of bankruptcy because a single failure can result in losing most of our assets.

It is said that leverage should be kept to a maximum of three times, including retail investments and hedge funds. This is because there is a high risk of losing money if you use extremely high leverage.

There is no investment method that has a 100% chance of success. Even if a method is theoretically 100% profitable, like arbitrage trading, it will never work as the theory says. Therefore, you have to invest on the assumption that failures and financial crises will occur. In other words, you should not use too much leverage.

Instead of Cutting Its Losses Along the Way, LTCM Continued to Invest

The fact that they did not cut their losses is another reason why LTCM went bankrupt. In general trading, you cut your losses in the middle of a trade; even if you have doubled or tripled your leverage, if you sell a stock or bond in the middle, your losses will be less.

At LTCM, on the other hand, all trading decisions were made by computer. In addition, as mentioned earlier, LTCM continued to buy bonds in emerging countries during the financial crisis, judging that their prices were undervalued. This led to huge losses.

It is said that those who cannot cut their losses when investing in stocks and bonds will not be able to make money from their investments. In some cases, people may increase their losses by buying more stocks or bonds that have fallen in price.

LTCM did not cut its losses but rather bought more. In other words, they acted like people who lost money on stocks. LTCM eventually went bankrupt because it used financial theory to create an investment structure, but did not set exceptions or standards for cutting losses.

Judging Based on Short-Term Performance Can Lead to Failure

The collapse of LTCM means that many investors lost a lot of money. With more than US$100 billion in assets under management, many financial institutions and institutional investors lost money.

Even though LTCM was only a few years in business, investors decided to invest in LTCM. However, when investing in a hedge fund, it is common to check the fund’s performance over the past five to ten years. You also have to check the fact sheets to see how they performed in the past major recessions.

The reason for this is that you cannot know if a fund is a good one based on its performance over the past two to four years. For example, would you want to invest in the following fund?

The chart shows the performance over two years. The price is going up, and it looks like you can make a lot of money by investing in this fund.

On the other hand, below is the price movement over 6 years instead of 2 years.

As you can see, the assets have not increased at all. On the contrary, depending on when you invest, you will lose a lot of money. This chart shows the Shanghai Composite Index, which is the result of investing in Chinese stocks.

Whether a fund is worth investing in or not can be determined by reviewing past results. However, many investors invested in LTCM based on just a few years of asset management results. As a result, the company went bankrupt due to the financial crisis.

There Is Much to Learn from LTCM’s Collapse

We must learn from history. LTCM is well known for its hedge fund failures, and if we learn why they failed, we will know how to make money from our investments. Also, we will know what kind of funds to invest in.

The following are some reasons why LTCM failed, and many investors lost a lot of money.

- They did not prepare for the financial crisis that occurs every few years.

- They had invested using high leverage.

- They did not cut their losses along the way.

- Many people had invested based only on short-term performance.

When we check this way, we realize that LTCM’s bankruptcy contains many bad elements when we invest. So when you invest, do the opposite of these. This way, you will be able to prevent a huge loss on your investment.