There are many people living in Malaysia, and if you are a resident of Malaysia, you can purchase a variety of investment products.

So how can you manage your assets effectively in Malaysia? If you have little or no investment experience, you may not know the right way to manage your assets.

Normally, people living in Malaysia would think of purchasing investment products in Malaysia. However, there are no excellent financial products in Malaysia. Therefore, if you are a resident of Malaysia, you should buy investment products outside of Malaysia so that you can have good asset management.

That method of investment is called offshore investment, and we need to understand why it is better than investment products in Malaysia. So, I will explain offshore investments that Malaysian residents should make.

Table of Contents

No Capital Gains Tax for Malaysian Residents

Of all the countries, Malaysia has one of the best tax systems. In Malaysia, there is no capital gains tax. In other words, there is no tax on the money you earn from your investments.

Usually, capital gains tax exists in many countries. If you live in a developed country, you will be taxed on the money you earn from your investments. The tax rate varies from country to country. For example, in Japan, the capital gains tax rate is about 20%.

In Malaysia, on the other hand, there is no capital gains tax, so all the money you make from your investment is your profit.

There are areas in the world called offshore tax havens, where almost no taxes are levied. Although Malaysia is not a tax haven, it is a rare country that has zero capital gains tax. This makes it an excellent tax system for investors.

What Are Some of the Common Investment Products in Malaysia?

When investing from Malaysia, what are some of the investment options for local residents?

There are some products that you can invest in only if you are a resident of Malaysia. For example, there are many people who invest in the following types of products.

- Fixed deposits in banks.

- Palm oil plantations.

- Stocks and real estate (REITs).

Let’s check the details of each of them.

Make a Fixed Deposit at a Bank and Earn Interest

One of the most common and popular ways to invest money in Malaysia is to make a fixed deposit at a bank, such as Maybank or CIMB Bank.

The interest rate on fixed deposits varies from year to year. In Malaysia, the interest rate on fixed deposits is about 3% per year.

Bank fixed deposits are known to be the least risky way to invest. If you want to make a risk-free investment, use a Malaysian bank to set up a fixed deposit. Although the interest rate is lower than other investment methods, your money will certainly grow.

Investing in Palm Oil Plantations and Earning Dividends

One of the major industries in Malaysia is palm oil. It is possible to invest in palm oil plantations in Malaysia, and if you are a resident of Malaysia, you can purchase it as an investment product.

You need at least 1,000 to 20,000 RM to invest, and by investing this money, you can earn dividend income. The dividends are 6-10% per annum, and after 6-8 years, the principal is returned to you at maturity.

The investment amount is higher than that of a fixed deposit at a bank, and it is not always possible to invest. You need to invest in palm oil plantations when they become available.

The interest rate is higher than a fixed deposit in a bank, so it is one of the superior investment products if you want to invest in Malaysia. It is best to invest through a professional agent.

Investing in Stocks and REITs to Generate Income

If you live in Malaysia, stocks are an easy way to invest. There are many high dividend stocks in Malaysia, and you can also earn dividend income by investing in real estate investment trusts (REITs).

However, it is not recommended to invest in the Malaysian stock market. This is because Malaysia is an emerging country, and stock prices are unstable and not growing. For reference, the following is the price movement of the Kuala Lumpur Composite Index over 10 years.

As you can see, there has been no increase in stock prices at all. Even though the world is booming, Malaysia’s stock price continues to decline.

When investing in stocks, it is common sense to invest in US stocks. In fact, US stock prices have more than tripled in the same period (in the case of the S&P 500). You should not choose Malaysia as your investment country because you are more likely to lose money.

When you live in Malaysia, you may want to invest in Malaysian stocks in order to support Malaysia. However, investments need to be made in order to make money, and a calm judgment will lead you to realize that Malaysian stocks and REITs are not the right investments for you.

Investing in Ringgit Is Risky

Although there are these common investment methods, there is a major problem. That is, they all require you to invest in Malaysian Ringgit.

In investing, you need to reduce the risk as much as possible. There is no professional investor who invests in the developing country’s currency. They all invest in US dollars. There is little point in increasing your assets in Ringgit. Increasing your assets in US dollars is the most important part of managing your assets.

For example, when a global recession occurs, the value of currencies in emerging countries will drop significantly. Naturally, the Ringgit is likely to lose value. The US dollar, on the other hand, is the most trusted currency, so you don’t have to worry about it losing its value.

Also, if you invest offshore in a tax haven, the offshore financial institution will send the money to all banks in the world at maturity. You can receive the money in any currency, even if you do not have a US dollar account. For these reasons, Malaysian residents must invest offshore.

Offshore Investment with US Dollars

Use the US dollar to invest offshore. There are many tax haven countries in the world. For example, Singapore, which is next to Malaysia, is one of the offshore regions. In these areas, finance is the main industry, and there are many excellent financial products.

In addition, in tax havens, you can invest in good mutual funds in US dollars. It is also possible to invest in hedge funds.

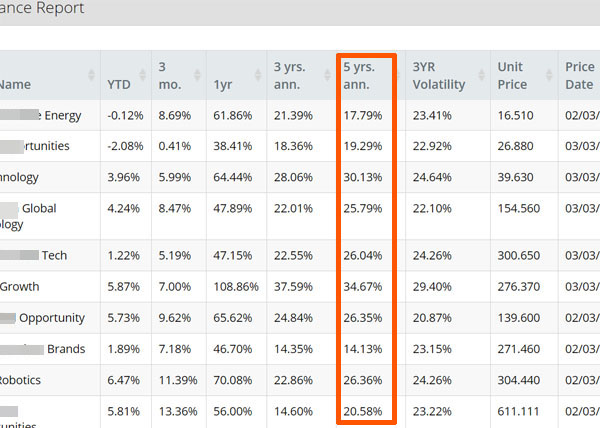

With offshore investments, it is common to earn an annual yield of over 10% while managing your assets in US dollars. For example, in my case, I use a financial institution registered in a tax haven to invest offshore. The following are the actual results.

As you can see, I am diversified into 10 funds, and the average annual interest rate over 5 years is 24.1%. Of course, this result is based on investment in US dollars.

There are no investment products in Malaysia that can achieve such excellent investment results. On the other hand, this kind of investment is possible with offshore investments.

Offshore Financial Institutions Have High Rating Ranks

Also, the rating of these offshore financial institutions is very high. As you can see from the banks and insurance companies in Singapore, the financial institutions in tax havens are much larger than those in Malaysia.

Therefore, the risk of bankruptcy is less than making a fixed deposit at a major Malaysian bank such as Maybank or CIBM Bank, and you can increase your assets significantly.

Offshore investment does not mean that you are putting your money into a shady company. Offshore investment means investing in a huge financial institution that is highly rated by global rating agencies. Moreover, the investment currency is the US dollar, not the Ringgit.

Malaysian residents must manage their assets correctly. If you are a resident of Malaysia, you should invest your money in tax havens through offshore investments, not in Malaysian financial products, which are risky and have low interest rates.

There Are No Great Investment Products in Malaysia

It is normal to want to buy and invest in financial products in the country where you live. Unfortunately, in the case of Malaysia, there are no good financial products.

You can use low-interest bank fixed deposits or invest in risky Malaysian stocks, but if you want to manage your assets properly, do not invest in Malaysia. All of these investments are made in Ringgit, which is risky, and the returns are not high.

Instead, consider investing in tax havens. Singapore, for example, is famous for its tax havens, and you need to invest your money in these areas.

If you invest offshore, you can invest in US dollars and earn more than 10% annual interest. Also, offshore financial institutions can send you money all over the world, no matter which bank you use. Understanding this fact, Malaysian residents should try to invest offshore.