Offshore investment is an efficient way to increase your assets. One of the most common methods of offshore investment is a regular investment. It is a way to increase your money by investing a certain amount every month.

The regular investment overseas in offshore investment means, in essence, a mutual fund. By investing overseas as a mutual fund, you can increase your assets at an annual interest rate of more than 10%.

However, the method is different from international investment in mutual funds using a securities company. In the case of offshore investment, you start a mutual fund by purchasing an insurance product. Therefore, there are more precautions to take compared to general foreign investment.

So, how should you think about making an offshore investment? I will explain the right way to start a regular investment in a tax haven.

Table of Contents

Investing in Mutual Funds Is the Most Common Way to Manage Assets

Tax havens are areas where there is little or no taxation. In tax havens, you can buy investment products from all over the world, which allows you to increase your assets efficiently.

The most common method of investment is investing in stocks. Whether you use a brokerage firm or an offshore investment, the main way to increase your money is to invest in stocks.

When you invest offshore, you will not be investing in individual stocks. If you want to buy stocks of a specific company, you should open an account at a securities company and invest. If you use an online brokerage, you can invest in individual stocks with low fees.

When you start investing offshore in tax havens, the fees are much higher than when you invest using an online brokerage. Therefore, if you want to invest in tax havens as an overseas savings investment, you should always use mutual funds instead of individual stocks.

You Can Invest in the Excellent Mutual Funds Around the World

Using mutual funds does not mean investing in widely available mutual funds (ETFs). In tax havens, there are no restrictions on investment, and you can invest in funds from all over the world. In short, you can invest in funds that are not sold by securities companies.

There are many funds in the world. Each fund has a different investment portfolio. For example, the following types are available.

- US small-cap growth stocks

- Energy stocks

- Robotics stocks

- Global technology stocks

- Chinese stocks

- Real Estate (REITs)

Of course, there are many other types of funds. Investing in these funds, and being able to invest in superior funds that are not registered with a brokerage firm, is offshore investing. To be more specific, offshore investment is to invest in hedge funds.

It is not possible to invest in hedge funds through a brokerage firm. On the other hand, you can invest in a hedge fund through an offshore investment. The fund manager of the hedge fund chooses the stocks to invest in and invests on your behalf. You invest your money in the fund, and it manages your assets for you.

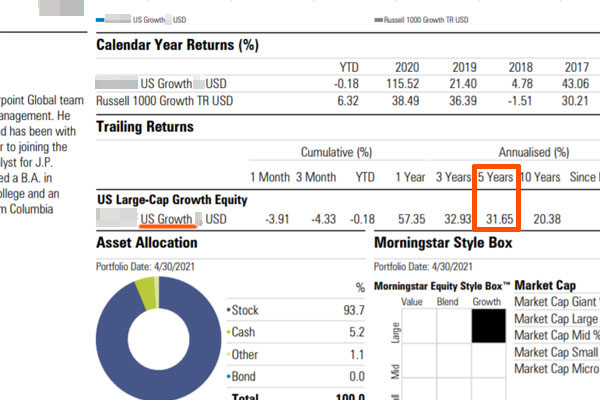

For example, here is an example of a fund that you can buy through an offshore investment.

This is part of a fact sheet for a fund that invests in US small-cap stocks. As you can see in the fact sheet, the average yield over the last 5 years is 31.65% per year. I have invested in this fund through offshore investments, and my assets have been growing at an excellent rate of return.

For reference, the Russell 2000 Index is a well-known ETF (Exchange Traded Fund) that invests in US small-cap stocks. Comparing over the same period, the average yield of the Russell 2000 over the past five years is 17.17% per year. Therefore, investing in a hedge fund instead of an ETF will give you a better yield.

*ETFs are mutual funds that can be purchased at securities companies.

If you open an account at a brokerage firm, you can invest in the Russell 2000. However, you cannot invest in hedge funds as I mentioned earlier.

The reason why many people invest offshore is that they can increase their assets more efficiently by investing in mutual funds that can be purchased in tax havens rather than opening an account at a brokerage firm.

Investment Performance Varies Depending on the IFA You Apply With

When starting an overseas savings investment, the most important thing to consider is which IFA (Independent Financial Advisor) you will apply to.

Financial institutions in tax havens do not sell investment products directly to investors. You need to apply for an offshore investment through an agent. It is important to note that the IFA decides which fund to purchase.

Foreign insurance companies (financial institutions) only hold a large number of funds. Of these hedge funds, it is the IFA that actually gives instructions on which funds to invest in.

This is the reason why the IFA you apply for offshore investment is the most important.

In my case, I have applied from a good IFA, so my investment performance is good. On the other hand, if you apply from a bad IFA, you should understand that you will have negative investment results.

My Stock Investment Returns in Offshore Investments

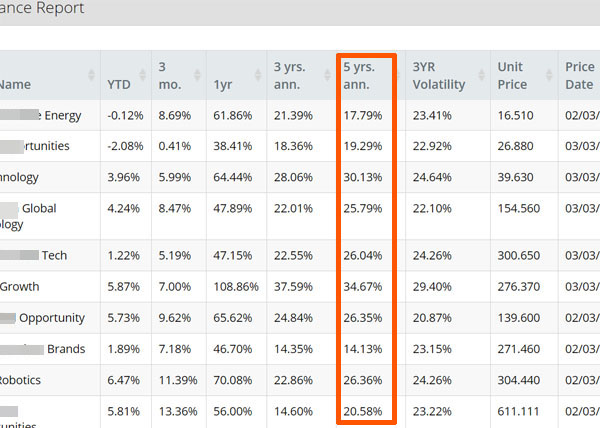

For your reference, I am investing in an offshore mutual fund with an offshore insurance company called. The offshore investment company has over 200 funds registered, and you can choose up to 10 of them to invest in.

I am also diversifying my investments into 10 funds through an IFA. One of the funds I invest in is the US small-cap growth fund I mentioned earlier. My investment performance is as follows.

If you check the investment performance of the funds over the past five years, the average annual interest rate is 24.1%. So you can see that it is excellent investment performance.

However, if you want to start an offshore mutual fund, you should understand that you will not get the same investment performance as me. Of course, if you apply from the same IFA as me, you will get the same investment results. But if you don’t, your investment results will depend on the IFA you apply to.

Offshore Mutual Funds Are Insurance Products

When investing overseas in stocks, there are other things to keep in mind with offshore investments. First, the investment is made in an insurance product. For example, the offshore investment company I am using is an insurance company.

It is an insurance company, but it does not mean that you buy life insurance. As a mutual fund, we invest in hedge funds that exist all over the world. Therefore, although the financial product is a mutual fund, the contract is an insurance contract.

When you open an account at a brokerage firm, you can cancel your account at any time after investing in an ETF (exchange-traded fund). You will not be charged any fees when you cancel your account, and the money will be transferred to your bank account at the market value when you sell the shares.

On the other hand, when you invest offshore, you are buying an insurance product. As is common with all insurance products, if you cancel your insurance policy early, the cancellation fee will be unusually high. Therefore, even if your investment performance is good, you will surely lose your principal.

This is also the case with offshore investments. If you do not continue investing until the maturity date, the surrender fee is high, and the risk of losing your principal is high.

The advantage of offshore investment is that a high yield is possible by investing in excellent funds. On the other hand, it is important to understand that there is a condition that you must continue to invest until maturity without canceling your investment.

You Cannot Expect Death Benefit

When you invest in offshore funds, you will be investing in an insurance company and purchasing insurance products. Although it is an insurance policy, you will be investing in funds as a mutual fund.

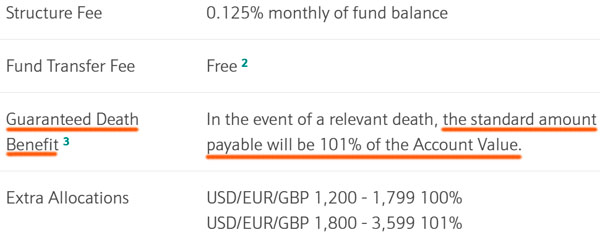

Since it is not a life insurance policy, your family will not receive a large death benefit even if you buy it through an insurance company in a tax haven. For example, the offshore investment company that I use for my offshore investments states that the death benefit will be 101% of the account value as follows.

Thus, it is important to understand that although it is an insurance product, you cannot expect a high death benefit.

Regular offshore investment is to purchase insurance products using an insurance company. In this case, the insurance product is a mutual fund, and you are investing in the funds. Therefore, you will not be able to get death benefits from offshore mutual funds in tax havens.

Offshore Mutual Funds Are Different from Investing Overseas Using a Brokerage Firm

If you understand these differences, you will understand that offshore mutual funds are quite different from investing overseas using a securities company. The following are the differences between investing in mutual funds with a brokerage firm and investing offshore.

| Offshore Investment | Brokerage Firm | |

| Investments | Hedge Funds | ETFs |

| Commission | High | Low |

| Early cancellation | Loss of principal | No problem |

| Yield | Depends on the investment portfolio. | |

Yields vary depending on which mutual funds you buy. If you find a good IFA and invest offshore correctly, you will have better investment results than opening an account with a brokerage firm. Although offshore investments have higher fees, your money will grow faster because you can manage your assets more efficiently.

On the other hand, since it is an insurance product, there is a disadvantage of losing your principal due to early cancellation. When investing in foreign countries, it is important to understand that there are these differences between offshore investment and purchasing mutual funds through a securities company.

Start Asset Management by Investing Abroad in Mutual Funds

Investing in stocks is the most common method of asset management. When investing in stocks, many people invest in mutual funds instead of individual stocks.

When investing in mutual funds, you usually open an account at a securities company and then start investing. This allows you to buy not only mutual funds in your country but also mutual funds in other countries.

On the other hand, there is also a way to purchase mutual funds through offshore investment. With this method, you can invest in funds that are not available at securities companies. In other words, by investing in hedge funds, you can increase your assets more efficiently.

The most common way to invest offshore is to invest in overseas funds. In this case, the investment portfolio consists of funds, which are mutual funds. It is important to understand the difference between offshore investment and using a brokerage firm to start offshore investment.