Hedge funds are generally thought of as investment funds that increase assets with high-risk and high-return strategies. However, hedge funds have various strategies, and some of them can increase assets with low risk.

As a low-risk hedge fund, alternative investments are the most widely used. On the other hand, hedge funds that invest in stocks and bonds can also be low-risk investments. It is a hedge fund that uses a market-neutral strategy.

With a market-neutral strategy, it is impossible to earn 20-30% annual interest. However, whether the economy is booming or in a recession, a good market-neutral hedge fund can increase your assets by about 10% per year.

If you want to invest in a low-risk hedge fund, investing in a market-neutral strategy fund is an excellent choice. I will explain how retail investors can increase their assets through market-neutral hedge funds.

Table of Contents

Market Neutral Strategies Are Low-Risk Investments

When it comes to hedge funds, we tend to think of them as high-risk, high-return asset management. However, hedge funds have different investment strategies, and some of them offer low-risk asset management.

There are several low-risk investment strategies, one of which is the market-neutral strategy.

Even if the stock market plummets during a major recession, there are few cases of negative returns with a market-neutral strategy. On the other hand, your assets will not more than double in one year, like hedge funds that manage assets with high risk and high return.

The market-neutral strategy is suitable for people who want to increase their assets stably every year. A market-neutral hedge fund manages assets at an average annual interest rate of 8-12%.

Take Both Long and Short Positions

Why is the market-neutral strategy low risk? Because they take long positions (buying) and short positions (selling) of the same amount.

When you are looking to earn a large return, it is appropriate to either buy or sell only. If you expect stock prices to rise, you will take a long position to increase your assets. On the other hand, if you expect the stock price to fall, you can increase your money by short selling.

In contrast, in a market-neutral strategy, the amount of money you buy and sell is the same. For example, if you buy a stock at $10,000, you simultaneously sell $10,000 short. This way, the amount of assets will be the same whether the stock price rises or falls.

Since the amount of assets will remain almost the same whether the stock price rises or falls, it is possible to manage assets with low risk.

Trade in Different Individual Stocks, ETFs, and Mutual Funds

However, many people have questions. They think that if they are buying and selling the same amount of money, the amount of assets will not change at all. Rather, they wonder if there will be a negative return because they will have to pay commissions to the brokerage firm for buying individual stocks, ETFs, and mutual funds.

If we buy and sell the same amount of money for the same individual stock or mutual fund, the amount of assets will not change. However, in a market-neutral strategy, hedge funds take long and short positions in different individual stocks, ETFs, and mutual funds.

If a hedge fund invests in different individual stocks or mutual funds, the price movements will naturally be different. Therefore, it is possible to earn a profit.

Also, the stocks they invest in are different for undervalued or overvalued. For example, when investing in ETFs (exchange-traded funds), they will sell short the overvalued mutual funds. On the other hand, they take a long position in undervalued mutual funds. This makes it easier to earn a profit.

For example, when stock prices fall due to a recession, the price of overvalued stocks is likely to fall. On the other hand, undervalued stocks are less likely to fall. Therefore, the market-neutral strategy allows us to make a profit even when the stock price is falling.

The Method Is Different from the Long-Short Strategy

Another strategy used by hedge funds is the long-short strategy. Like the market-neutral strategy, the long-short strategy involves both buying and selling. They are similar in the sense that they not only buy but also sell short.

However, the details of the market-neutral strategy and the long-short strategy are quite different.

A market-neutral hedge fund, as mentioned above, is a low-risk hedge fund and sells the same amount of shares as it buys.

On the other hand, in the case of the long-short strategy, the amount of buying and selling is not the same. Sometimes they have a lot of long positions, and sometimes they make a large amount of short selling. Therefore, hedge funds with long-short strategies are high-risk and high-return.

Examples of Market Neutral Hedge Funds

If an individual investor invests in a market-neutral strategy hedge fund, what kind of return can he expect?

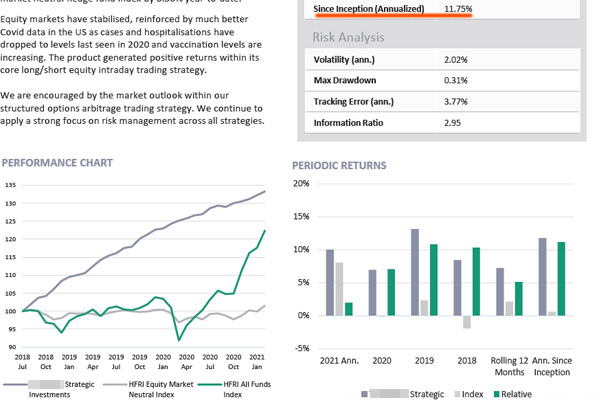

Let’s take a look at an actual hedge fund. The following is a fact sheet on a hedge fund that uses a market-neutral strategy.

The average annual interest rate for this hedge fund is 11.75%. Although there are rare months with negative returns, most of the months have positive returns. The annual volatility is low at 2.02%.

It is important to note that the returns were positive in February and March of 2020 when the Corona shock caused a major stock market crash. On the other hand, when the stock market surge happened all over the world, global stocks rose significantly in value, but only slightly in this hedge fund.

In any case, you can gradually increase your assets at an annual interest rate of about 8-12%. Although it is impossible to aim for large returns, retail investors who want to earn a stable yield are suitable for the market-neutral strategy.

Some hedge funds that use market-neutral strategies have not been able to generate returns. So, check the fact sheet to see what the results have been in the past.

Liquidity Is High and Can Be Turned into Cash Quickly

When investing in hedge funds, there are other funds that offer low-risk asset management. A typical investment strategy is an alternative investment, which is a low-risk way to invest that does not invest in stocks and bonds.

In alternative investments, you invest in hedge funds that deal in real estate or mortgage loans. However, we cannot immediately convert real estate and loans into cash. Therefore, the liquidity of funds is poor in alternative investments, and it usually takes more than six months to cash out.

On the other hand, among low-risk investments, money liquidity is good when investing in hedge funds with market-neutral strategies. Since the investments are in individual stocks, ETFs, and mutual funds, they can be sold immediately.

However, when you invest in hedge funds, you are often charged high fees for early termination. Therefore, try to invest for at least five years or more.

You Can Invest in Hedge Funds with an Offshore Investment Account, Not ETFs or Mutual Funds

As is the case with all hedge funds, you cannot invest in hedge funds by opening a brokerage account in your country. In other words, you cannot invest in hedge funds through ETFs or mutual funds.

Therefore, be sure to open an investment account in an offshore tax haven where there is almost no tax. Individual investors can also invest in hedge funds, although they need to have at least US$30,000.

For your reference, you can invest in the market-neutral strategy hedge fund I mentioned earlier with an average annual interest rate of 11.75% by opening an offshore investment account.

Hedge funds are not permitted and registered with the FSA of most countries because they engage in short selling. On the other hand, in tax havens, there are no financial regulations, and all investment products can be purchased. Therefore, instead of ETFs and mutual funds, retail investors must use investment accounts that can be opened in tax havens.

Market Neutral Strategy Is Recommended for Low-Risk Asset Management

When individual investors want to increase their assets, they can invest in hedge funds. There are many types of hedge funds, and the market-neutral strategy is known as a low-risk investment method.

Hedge funds are not registered with brokerage firms in your country, and you cannot invest in them as ETFs or mutual funds. However, if you open an offshore investment account, you can invest in market-neutral hedge funds even if you are a retail investor.

Although it is impossible to increase your assets many times in a short period of time, it is an excellent investment method if you want to manage your assets at an annual interest rate of 8-12%. Also, since the investments are in individual stocks and ETFs, the liquidity of the money is high.

These are the characteristics of the market-neutral strategy. Unlike the long-short strategy, it is a low-risk investment method. If you want to earn a stable return every year, consider investing in a hedge fund with a market-neutral strategy.