Investing in tax-free areas (tax havens) is offshore investment. With almost no taxes, your money will grow quickly.

There are also financial products with interest rates of over 10%, so compounding interest will usually result in a difference of more than US$100,000 after 20 years, compared to investing assets in your country.

However, because it is done in a tax haven, it is not remarkably familiar to us. In fact, few people know much about offshore investment. Also, it’s not widely advertised, so people don’t understand how to start investing in Offshore.

In this article, we’ll show you how to make an investment in Offshore. When you invest your money in your home country, the interest rate is low, so it won’t increase. Instead, you can actively invest your money in tax havens and grow your money efficiently.

Table of Contents

Asset Management Using Tax Havens Around the World

Offshore investment means managing assets in an area where no taxes are levied. Offshore is also known as a tax haven.

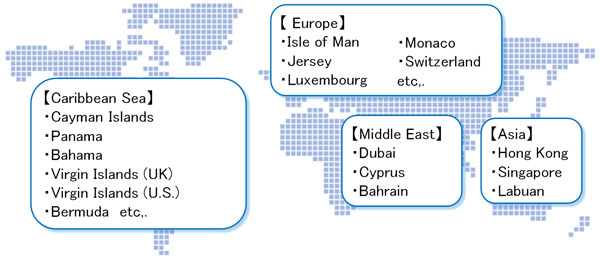

Here are some examples of tax havens that are located around the world.

In fact, there are many more offshore tax havens in the world. You’ve probably heard of rich people leaving their home countries and moving abroad to avoid taxes. To be more precise, this means moving to an offshore country where taxes are almost non-existent.

For example, in Asia, Hong Kong and Singapore have very developed economies. This is despite the fact that the land is very small and the population is small.

The reason for this is simple: they are tax havens. Taxes are extremely low, especially on the money earned from investments, which is tax free. This is why Hong Kong and Singapore have become one of Asia’s leading offshore financial centers, attracting money from all over Asia. For example, many wealthy people from China, Japan and South Korea use Hong Kong as a base for their investments.

Tax-Free and Invest in Financial Instruments Around the World to Make More Money

Why invest in a tax haven instead of your home country? As mentioned before, there is no tax on the money you make offshore.

When you make a profit from stocks and other investments, you have to pay taxes on your profits. This is called capital gains tax. However, in Offshore, there is no capital gains tax. Therefore, it is much better to use an investment company located in a tax haven instead of a company located in your home country, even if the yield is the same.

Moreover, if you deposit your money in an investment company located in a tax haven, you will have the advantage of having access to a wide range of financial products.

For example, as I am Japanese, I will give you an example of Japan.

In Japan, if you put your money in a life insurance company, your money will only increase to 110-120% of your original amount after 40 years. The reason for this is simple: there is a law that restricts you to invest only in Japanese government bonds. However, the interest rate of Japanese government bonds is low, so it is difficult to increase your money even if you invest in them.

On the other hand, in the case of overseas funds, there are naturally no such restrictions, and you can invest in stocks and bonds around the world as you like. The reason why there are financial products with annual interest rates of over 10% is that there are no unnecessary restrictions.

In tax havens, it is common for people to take out life insurance to manage their assets. Rarely do people use an insurance company to obtain a death benefit.

Also, promotions such as 8% extra on interest rates are commonplace. Because of this system, it is not surprising that money is easier to grow in tax havens rather than in countries with strict financial regulations.

What Are the Different Types of Offshore Investments?

In order to actually make an offshore investment, you need to understand the types of investment. There are two types of offshore investments: life insurance and mutual funds.

As I mentioned earlier, life insurance can also be used to invest in assets. Not only can you deposit money as a mutual fund, but you can also add a death benefit.

They each have the following characteristics.

Offshore Insurance: Accumulation or Lump Sum Payment Life Insurance

Offshore insurance is life insurance in tax havens. As already mentioned, life insurance is commonly purchased in tax havens for asset management purposes.

Therefore, although there is a death benefit, most of us do not expect to receive any money when we die. Rather, we expect to receive a maturity payment when the premiums we paid reach maturity, such as after 25 years. Even though it’s life insurance, think of it as a life insurance policy that you pay for and invest your money.

One disadvantage is that since it is life insurance, some financial products require you to undergo a medical examination. If the product requires a medical examination, you will have to go to a hospital to get examined. You will actually have to go to the following hospital.

When you buy life insurance in your home country, you have to see a doctor before you buy a life insurance policy. In some cases, a similar procedure is required. However, it will provide you with a higher death benefit than you could ever imagine in your home country, and it will also provide you with excellent asset management.

*There are also many offshore life insurance policies that do not require medical examinations.

Offshore Mutual Funds: Overseas Accumulation Investment

Offshore mutual funds are the most common way to invest in tax havens. A mutual fund is a way to deposit money and have your assets managed by them.

Even in your home country, banks and brokerage firms sell mutual fund products. However, it is better to deposit your money in an insurance company located in a tax haven and set up a mutual fund, so that your money can grow at an accelerated rate with no tax.

One of the differences between offshore mutual funds and offshore insurance is that you don’t have to go to the hospital to see a doctor because you simply deposit your money. Furthermore, you can start investing in the offshore fund right away because you can pay your credit card.

For your reference, here is a screenshot of the management screen of my offshore mutual fund. I have registered my credit card information and make monthly investments by card payment.

I have never traveled to a tax haven for a mutual fund contract. I didn’t see a doctor, and I signed up for the policy while living in my current country, which made it very easy for me to start investing.

Compared to offshore insurance, offshore mutual funds are quite easy to invest in. All you have to do is to deposit your money as a mutual fund.

The First Step in Getting Started without Fail Is to Choose a Good Agency

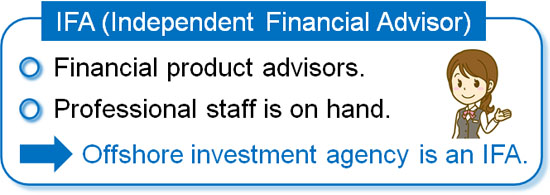

How can we start investing offshore? You need to hire an IFA (Independent Financial Advisor) to help you get started.

Think of an IFA as an agent who introduces you to foreign insurance companies.

Even in your home country, life insurance companies don’t always sell insurance products directly to you. There are plenty of insurance agents out there, and the agents sell insurance products on their behalf.

In the same way, an IFA sells life insurance and mutual funds on behalf of an insurance company in a tax haven.

With offshore investments, we all have to go through an IFA. Insurance companies do not sell financial products for offshore investment to their clients, and you can only invest offshore through an IFA.

Also, it is difficult to contact insurance companies in tax havens. However, IFA can handle all the procedures on your behalf.

Always ask your IFA to act on your behalf when dealing with foreign financial institutions. In fact, with offshore investment financial products, insurance companies do not sell products to their clients, and you can only purchase insurance through an IFA. Therefore, the first step in getting started when investing offshore is to find a good IFA.

Choose the Type of Investment Product

When you make an offshore investment, you have to choose which financial product to invest in. As mentioned above, there are life insurance and mutual funds. There are many areas to invest in, so you need to decide which area is the right one for you.

So consult with your IFA and decide together which investment products are suitable for you.

If you are a beginner investor, we recommend you to use a financial product that will allow you to surely increase your money rather than aggressively invest your money. For example, there are some products that will give you 160% of your assets at maturity by investing for 20 years. If you choose this type of product, the risk of failure will be reduced.

There are various types of offshore investments. You should consult with an IFA who can recommend the best financial products for you and help you choose the right financial products.

Decide How Much to Invest and Complete the Process

Once you have decided on a financial product to invest in, you must then decide how much to invest. Offshore investments can start with as little as $200 USD per month. The more amount you invest, the more money you will have. However, you should not invest too much because it will make your life difficult.

It is a risk to reduce the amount of money you invest, especially in the case of offshore investments. If you cancel or reduce your investment, you may receive less money than you have invested.

This is also the case with life insurance in your country. If you surrender your policy early, the surrender value will be low. The same thing happens with all insurance products.

Therefore, it is best to invest in excess funds to avoid future reductions.

– Just Follow the Procedures as Instructed by the Agent

Once you have decided on the amount to invest in this way, you just need to do is follow the IFA’s instructions. For reference, when I signed up with a tax haven insurance company for my mutual fund and life insurance, I sent the following documents to my IFA.

- Passport

- ID card

Also, since it is a tax haven financial instrument, you need to sign an investment agreement. In my case, I was instructed to sign the document sent to me by my IFA, scan it and send it back.

I followed my IFA’s instructions and completed my offshore investment without having to travel to a tax haven while living in my current country. It is also possible to pay by credit card, making it quite easy for even a beginner to start investing.

Understanding How Offshore Savings Investment Work and How to Get Started

In this article, we have explained how to invest offshore. If you are not familiar with the concept of offshore investment, you may have a better understanding of what it is and how it works.

Offshore investment is to manage your assets in tax havens at a high rate of interest with no taxes. In many countries, the interest rate is low when you invest, and you will also be charged capital gains tax.

However, if your investment is in an offshore company, you will be free of tax, and your money will grow significantly.

The first step in the process of investing offshore is to find a good IFA. After that, decide on the financial products and the amount of money you want to invest, and start investing in tax havens.