When it comes to offshore investment, it generally indicates a regular investment. By paying out a fixed amount of money every month, you can continue to invest overseas.

On the other hand, there is also a type of offshore investment that is a lump sum investment. One of the most famous financial institutions for offshore investments is RL360°, which offers Oracle as a lump-sum investment product.

So, is it a good choice to sign up for Oracle? What are the fees, and what are the benefits? First of all, I would like to conclude that Oracle is not recommended because of its high fees. Of course, you can increase your assets, but there are other excellent products such as offshore insurance.

I will explain why Oracle is not recommended in terms of fees and what investment products should be used instead.

Table of Contents

The Main Product of RL360° Is the Regular Savings Plan (RSP)

The main investment product that most people subscribe to in RL360° is the Regular Savings Plan (RSP), which is the only investment product that you should choose to purchase.

The fees for the RSP (Regular Savings Plan) are also reasonably high. However, if you choose the proper IFA (Independent Financial Advisor), you can aim for an annual interest rate of over 10%, which means you will get a good return on your investment.

RL360° also has a financial product called Oracle. It is a lump-sum investment instead of a monthly accumulation.

Basic Specifications of Oracle

What are the basic specifications of Oracle? First, let’s understand the overview of the product. This is as follows.

-Minimum Investment Amount

Since it is a lump-sum investment, the amount required to open an account is reasonably high. The amount of money is as follows.

- US dollar: $32,000

This is the amount of money that you need to prepare. You must have some money in your excess fund.

-Contract Age and Saving Age Limitations

In the case of the Regular Savings Plan (RSP), there are restrictions on the contract age, such as up to 65 years old. However, the Oracle for lump-sum investment does not have such an age limit. Therefore, even elderly people can apply.

Since the investment period is 99 years from the date of the contract, it can be passed on to your children or others as co-signers.

Oracle Is Expensive for Commissions

When investing overseas, you have to consider the risks and disadvantages. One of these points that you must focus on is the fees.

The commission structure of Oracle is as follows.

| -Establishment Fee When you sign a contract for a lump sum investment, there is a fee that is charged for five years. This is the establishment fee, and it is 1.5% of the investment amount that is charged every year. For example, if you invest $40,000 in a lump sum, the fee will be $600 every year.

Since these fees will continue for five years, you can consider that 7.5% of your investment will surely disappear due to fees.

-Administration Fee A 1.2% fee is charged annually on the total market value of assets to manage the account. This fee will be charged for the entire period you are investing. -Fund Fee When you sign up for RL360°, you will be required to go through an IFA, that will actually give investment instructions to the fund and manage the assets. 1% of the annual fund fee will be charged. |

For the Regular Savings Plan (RSP), the fee rate is about 3%. On the other hand, with Oracle, the commission rate is 3.7% at first. Moreover, since it is a lump-sum investment, a large commission at the beginning is so costly.

In addition, if you cancel the contract before 5 years have passed, you will be charged an early cancellation fee. Therefore, if you cancel early, the risk of losing your principal is very high due to the high fees.

From the 6th Year, the Bonus Reduce the Fee

Are there any bonuses for making investments? The Regular Savings Plan (RSP) also has high fees, but there is a 6.25% loyalty bonus on the amount you save, which is added to the end of the plan when it matures.

The existence of a loyalty bonus will allow you to reduce your commissions.

In the case of Oracle, on the other hand, there is a small bonus, but not a large one. Therefore, the commission cannot be greatly reduced by the bonus. However, from the sixth year, the establishment fee is eliminated, and a small bonus is paid out, so the commission rate is reduced.

After the sixth year, you will receive an annual bonus of 0.5% on assets under management. However, the fact remains that the fees are unusually high.

Risk-Free Products Are Excellent for Lump Sum Investment

Since offshore investments aim for an annual interest rate of 10% or more, you may think that it is inevitable to be charged a high fee of about 3.7% per year.

However, it is not always possible to yield an annual interest rate of 10% with overseas investments. In addition, if the commission is too high, there is a possibility that the principal will be lost. Especially since the first five years of investment in Oracle are unusually high in terms of fees, it is difficult to increase assets during the first five years of a lump-sum investment.

This results in opportunity loss, and as a result, there are few people who utilize Oracle in RL360°.

When utilizing lump-sum investments in offshore funds, other investment products are superior. For example, life insurance is one of them. It is common to use life insurance for asset management, and by investing a lump sum, your assets will double in 20 years, quadruple in 30 years, and so on.

I have purchased offshore insurance (overseas life insurance). Not only that, but when my daughter was two years old, I also insured my child.

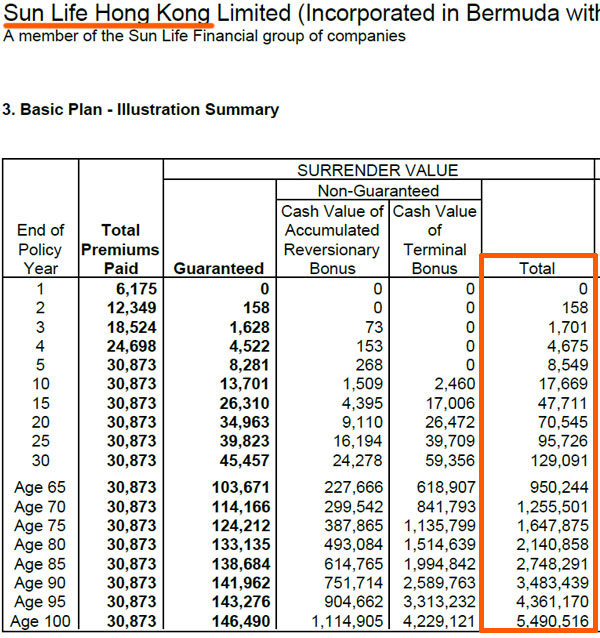

I plan to give my daughter an expensive gift when she reaches the age of 35, and the asset value will have more than quadrupled. For reference, below is a simulation of what it would be like when my daughter actually took out life insurance.

As you can see, the Total Premiums Paid is $30,873, but after 30 years, the Total is $129,091.

In the case of life insurance, there is no need to consider commissions, and the money is designed to grow significantly after 10 to 12 years of investing a lump sum. With life insurance, you don’t need to have excess money of $43,000 like Oracle; you can start with a lower amount, such as $5,000 to $10,000.

Considering these conditions, if you are thinking of investing in a lump sum, it would be wise to consider other investments such as offshore insurance instead of Oracle.

No Need to Subscribe to Oracle

Investing in RL360° is one of the most expensive ways to manage your assets offshore. In fact, the Regular Savings Plan (RSP) has an annual fee of about 3%.

Moreover, when it comes to Oracle, the fees are much higher. Especially for the first five years, if you do not perform well, you may end up with a negative return. For this reason, there are very few people who use lump-sum investments in Oracle.

So, if you are thinking about lump-sum investment, you should consider other offshore investments, which have better conditions.

Although you can increase your assets with Oracle in the long run, other financial instruments are better in terms of fees. The fees you pay can make a difference of tens of thousands of dollars in the future, so it is best to invest a lump sum in a product that will increase your assets.