One investment method is private equity (PE). It is a method of investing in unlisted companies and is known as an alternative investment.

Institutional investors and rich people can use private equity to increase their assets. Although it is an extremely risky investment method, there are investment companies that specialize in private equity.

However, private equity should not be used by retail investors when considering alternative asset management. Not only is it risky, but there is a high possibility of being scammed.

Unless you are a billionaire, you should not use private equity. I will explain the reasons for this.

Table of Contents

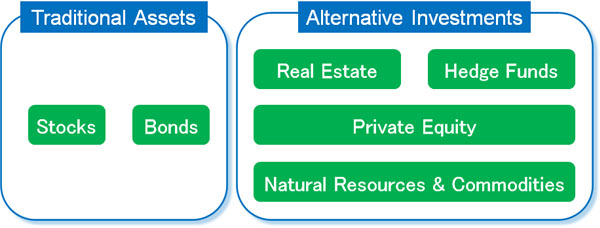

Private Equity Is a Type of Alternative Investment

Investment methods that are not influenced by the economy are called alternative investments. Specifically, alternative investments are methods that do not invest in stocks and bonds. There are many ways to invest in alternatives, and one of them is private equity.

During a major recession, it is normal for the stock price of listed stocks to drop by half or more. On the other hand, in the case of private equity investments, the stock price does not go down. In fact, as long as the company continues to generate profits, the stock price will rise.

This is why private equity is not affected by the economy. Even if there is a recession, the value of the stock rarely decreases as long as the company continues to do business.

You Can Only Cash Out If the Company Merges or Goes Public

Of all the investment methods, private equity is one of the riskiest. This is because you are buying shares of a company that is not listed on the stock exchange, and the liquidity of the money is poor.

In the case of listed stocks and bonds, you are free to sell them at any time. Private equity, on the other hand, cannot be freely traded on the stock exchange. In other words, in private equity, you cannot convert your investment into cash unless the company undergoes either mergers and acquisitions or goes public.

In private equity, you cannot convert your investment into cash for at least five to eight years after investing. On the other hand, if the company you have invested in goes public, it is normal for the money you have invested to increase tenfold or more.

-Private Equity (PE) Funds with High Bankruptcy Probability

Furthermore, companies that accept private equity have a high probability of bankruptcy. All companies that raise funds through private equity are planning for future mergers and acquisitions or going public. Therefore, there are no profitable companies, and they aim to rapidly expand their companies by using the money from investors for their businesses.

If they succeed in their business, they can be merged or go public in a few years. On the other hand, if their business fails, they will go bankrupt. The probability of bankruptcy is much higher than for ordinary companies because of the rapid expansion of the company, and private equity is said to be the riskiest investment method.

Private Equity (PE) Is the Investment Method for Institutional Investors and Wealthy People

So who invests in private equity? There are certain people who invest in private equity: institutional investors, investment companies, huge corporations, family offices, and super-wealthy people.

In other words, people with US$100 million or more in money can invest in private equity. People with less money than that cannot increase their wealth through private equity.

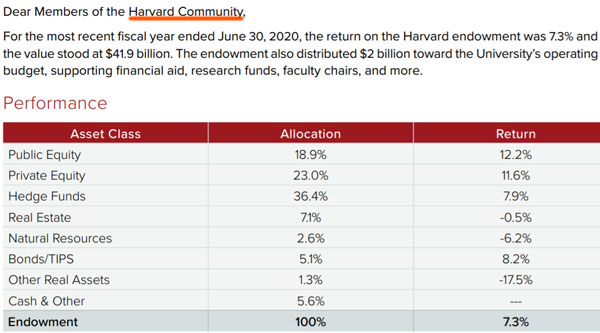

For example, the following is a portfolio published by the Harvard University Foundation.

Thus, we can see that the Harvard University Foundation invests in private equity. The reason why the Harvard University Foundation invests in private equity funds is that it has a lot of money.

Investors with large amounts of money receive many offers to invest. There are many companies that want investors to invest in them. Also, as investors, the success of the companies they invest in will allow their assets to increase many times over. Therefore, institutional investors and wealthy individuals actively support the companies they invest in.

For the company receiving the investment, finding investors also means finding connections. By raising funds from good investors, they can increase their connections and accelerate their business. For this reason, investment opportunities in excellent unlisted companies are only offered to investors with more than US$100 million in assets.

Good Private Equity Deals Do Not Come to Retail Investors

On the other hand, retail investors do not receive good private equity deals. This is because it does not make sense for a company to receive hundreds of thousands of dollars from individual investors if the company is looking for mergers and acquisitions or going public.

In private equity financing, the amount of money raised is a few million dollars, no matter how small it is. If they want to raise hundreds of thousands of dollars, they can just borrow the money from the bank, and there is no point in receiving investments from retail investors.

Also, if the manager is not capable of raising even hundreds of thousands of dollars, the company will not be listed in the future. In private equity financing, high amounts of money are usually invested by institutional investors, huge corporations, and super wealthy people, as shown below.

Moreover, it is common for unlisted companies to refuse investments from individual investors with little assets. A business owner does not want to accept investment from just anyone. They generally want to get good investors to invest in them and eventually go public.

As mentioned above, getting investment is one of the ways to make connections. In addition, it is common to want to receive a large investment from investors who will watch over the company’s growth not in the short term but in the long term.

Shareholders can complain to the company management. Managers need to exclude bad investors, so they choose investors before going public. For these various reasons, individual investors who do not have a lot of assets will never receive an offer for a good private equity investment project.

A Typical Scam Deal Is Investing in Private Equity

For your information, if there is a private equity fund for tens or hundreds of thousands of dollars, it is almost certainly a scam.

In this case, you are investing in a company with low corporate value and a high probability of bankruptcy. Alternatively, it is common to deposit money in a company that does not exist as a fraudulent project and not receive any money back at all.

For individual investors, private equity is one of the most common scams. Even if it is not a scam, it is common for investors to not get any of their money back due to bankruptcy of the company or the company not going public.

The most difficult investment method is private equity, and you need a lot of money to make money investing in private equity. Therefore, among alternative investments, the one investment that retail investors should never make is the use of private equity funds.

Not Recommended for Individual Investors to Invest in PE Funds

For institutional investors, large corporations, family offices, and super rich people, private equity is an excellent way to invest. By investing in unlisted companies and providing money, skills, and connections to the companies they invest in, they help them go public in the future.

Since private equity is an alternative investment, it can increase assets even during economic downturns.

On the other hand, one investment method that retail investors should never make is to invest in private equity funds. This is because there is no chance of receiving an excellent private equity investment offer for an individual with little assets, and it is almost 100% a scam.

There is a right way to invest in alternatives. There are also ways to invest that are good for institutional investors, but should not be invested in by individual investors. Make sure you understand these facts when investing.