There are many people who start investing offshore. This is because it is much more advantageous than managing assets in your country.

When investing offshore, Premier Trust (PA) is a financial institution that many people can sign up with. They sell principal-protected financial products, and they promise that your money will surely increase if you continue saving and investing until maturity.

So what is the fee structure when investing with Premier Trust? Also, what is the reputation and review?

In conclusion, you should not sign up with Premier Trust because there are other financial institutions that offer superior investment products than Premier Trust. If you have already signed a contract, you should continue to invest, but if not, you should consider investing in other financial institutions. I will explain the reason for this.

Table of Contents

Premier Trust Is a Financial Institution in a Tax Haven

There are areas worldwide where almost no taxes are charged, and these are called offshore tax havens. Premier Trust (PA) is a company registered in the British Virgin Islands (BVI), one of the tax havens.

The British Virgin Islands are located in the Caribbean Sea. Since it is located just below the United States, it attracts a lot of investment money from the United States.

Among financial institutions, Premier Trust is a trust company. In offshore investments, we often invest our money in insurance companies; Premier Trust should be considered as a trust company.

Even if Premier Trust goes bankrupt, 100% of the assets under management will be protected. Therefore, even if there is some trouble, there is basically no problem.

Provest Principal Protection Is the Main Product

Which product should you use when starting an offshore investment in Premier Trust (PA)? It is Provest Principal Protection.

The most important feature of this product is the principal protection. In other words, it is a financial product which promises you that your assets will almost certainly grow. Although you can’t aim for an annual interest rate of over 10% like most offshore investments, you can manage your assets with low risk.

The percentage of principal protected differs depending on the contract period, as follows.

- 15-year plan: 140% or more.

- 20-year plan: 150% or more.

- 25-year plan: 160% or more.

Although it will take a certain number of years, you can manage your assets with low risk because you are assured that your money will increase by this amount.

-The Risk Is Continuous Investment until Maturity

One thing to keep in mind is that it is principal protection. It is not a principal guarantee.

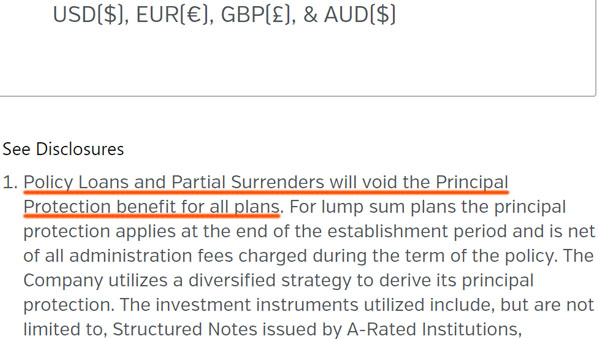

Principal protection is to guarantee the principal under certain conditions. In the case of Premier Trust, the condition for principal protection is that you continue to invest the amount you initially set until maturity. In other words, if you reduce, stop, or partially surrender (withdraw) your investment in the middle of the term, the principal protection will not be applied.

This is clearly stated on the official website of Premier Trust as follows.

While investing with Premier Trust is almost risk-free, this is the only disadvantage. It is important to understand that this is an investment product that you have to keep investing in at all costs until it reaches maturity.

Fees Are Low Among Offshore Investments

Premier Trust (PA) also has relatively low fees for offshore investments. Specifically, the fees are as follows.

-Monthly Fee: $5

Every offshore investment will charge you a monthly fee. However, this fee is fixed and becomes negligible when the saving amount increases, so it will not affect you that much.

-Annual Asset Management Fee Rate: 1.90% for the First 10 Years, 0.75% from the 11th Year to Maturity

In the case of Premier Trust, the annual management fee is 1.9% of the total investment amount for the first 10 years. In ordinary offshore investments, the annual fee rate is around 2.5 to 3%. Therefore, you can understand that Premier Trust has a low commission rate.

Also, after 10 years, the commission rate will be 0.75% per year until maturity. Considering the commission rate, it is excellent.

-Loyalty Bonuses also Exist

We feel that the fees are inevitably higher than those of ordinary online securities. However, this is not a problem because of the loyalty bonus offered.

In the case of Premier Trust, the following loyalty bonuses are available.

- Years 1-10: 10% of contributions.

- Years 11-15: 8.0% of contributions.

- Years 16-20: 8.0% of contributions.

- Years 21-25: 8.0% of contributions.

These bonuses can reduce the fees. In order to get the loyalty bonuses, there is a requirement that you continue to make monthly contributions, just like principal protection. If you continue to invest properly, your assets will sure to increase.

Structure of Investing in Premier Trust’s Index Funds

When you sign up for Premier Trust’s Provest Principal Protection, you will be investing in index funds. In other words, the fund manager does not manage your assets, but you invest in some indexes that exist in the stock market.

You will choose the index to invest in from the following.

-S&P 500

The S&P 500 is a leading index of US stock and represents the stock prices of 500 leading US companies.

-MSCI ACWI IMI

This is a stock price index for global stocks (stocks in the world).

-S&P Asia 50

The S&P Asia 50 is a stock price index covering about 30 countries, including both developed and emerging economies. Although it includes the word “Asia,” it also includes the United States, Canada, and Australia.

-FTSE 100

FTSE 100 is the stock price on the London Stock Exchange.

-EURO STOXX 50

This is a stock price index consisting of 50 stocks of 11 developed countries in the Eurozone.

-MSCI EAFE

MSCI EAFE is a stock index that invests in developed countries other than the US and Canada. This index has a large percentage of investments in Japanese companies.

-MSCI Emerging Markets IMI

MSCI Emerging Markets IMI is a stock index for emerging markets, representing the stock prices of 24 countries.

-MSCI World

MSCI World is a stock index, representing the stock prices of companies listed in 23 developed countries.

You Should Choose US and Global Stocks

Even though there are eight indexes, you may be confused about which index you should invest in. For this, you should invest in US stocks (S&P 500) and global stocks (MSCI ACWI IMI).

The S&P 500 is known as an excellent stock index, and over the long term, it has been growing all the time, as shown below.

Of course, we have experienced several major global recessions so far. However, the stock prices have still continued to rise like this.

Also, the MSCI ACWI IMI is a global stock index, which means it invests in stocks from all over the world. Even though it is a global stock, most of the stocks are in the US, but you can diversify your risk by investing in stocks other than the USA.

Therefore, if you cannot decide which index to invest in with Premier Trust, you should choose as follows.

- S&P 500: 50%

- MSCI ACWI IMI: 50%

When investing in stocks, it is common to invest in the US and global stocks. You should ignore emerging countries and invest in developed countries, including the US, where stock prices are expected to grow in the future. In this way, it makes sense to choose this type of asset management structure.

Investors Trust Is Superior in Product

So far, it seems that investing in Premier Trust (PA) is excellent. This is true, and Premier Trust is one of the safest financial institutions to invest in among the numerous offshore investments because it has very low risk and principal-protected products.

However, there is another company that has an excellent reputation and reviews for principal protection. That is Investors Trust (ITA).

In the case of Investors Trust, the principal protection is as follows.

- 15-year plan: 140% or more.

- 20-year plan: 160% or more.

The same condition is applied to the 15-year plan (140% or more), but Premier Trust provides 150% of principal protection for 20 years and 160% for 25 years. On the other hand, Investors Trust offers more than 160% principal protection for 20 years, which is superior to Premium Trust.

For principal-protected investment products, low risk is the biggest selling point. However, it is better to have your money grow in a short period of time, even with the low risk. In this regard, it is more effective to invest in Investors Trust instead of Premier Trust.

IFAs Who Recommend Premier Trust Are Inferior

When you are aware of this fact, unless you have a special reason, you should choose Investors Trust (ITA) for your principal-protected investment.

There are some IFAs who recommend Premier Trust. However, they are not knowledgeable IFAs, and you should never buy from them.

In terms of overall fees, Premier Trust has lower fees than Investors Trust. However, in the case of principal-protected investment products, the commission is not important at all. The most important thing is that it promises to protect your principal in a short period of time.

The most important point in low-risk offshore investment is to increase your money with a promised yield by continuing to pay until maturity. In this case, Investors Trust is the best choice.

Surrender Fee Is High; Surrender Refund Is Low

Some people may have already signed up for a Premier Trust with terms such as 160% or more for a 25-year investment. In this case, even if you want to change to Investors Trust, which is a financial institution that offers better conditions, it is already too late, and you need to give up.

As mentioned above, offshore investments are meaningful only if you keep investing until maturity. Also, even if you want to switch, the cancellation fee is quite high.

For Premier Trust’s surrender charge, it is the total amount of the remaining management fee. For example, if you have contributed $10,000 per year, the fee will be as follows.

- Year 1: $10,000 x 1.9% = $190

- Year 2: $20,000 x 1.9% = $380

- Year 3: $30,000 x 1.9% = $570

If you cancel at the end of the third year and you have a 20-year contract, the cancellation fee is the total amount of fees you have to pay from the 4th year to the 20th year. Specifically, it will be as follows.

- Year 4: $40,000 x 1.9% = $760

- Year 5: $50,000 x 1.9% = $950

- ……

- Year 20: $200,000 x 0.75% = $1,500

This is the reason why the surrender charge of Premier Trust is higher. Naturally, the surrender value will be lower. To prevent loss of principal, continue to invest without thinking about surrendering.

You Should Understand the Details of Premier Trust

Premier Trust is one of the best offshore investment companies in the world. In fact, the commission rate is low, and since the principal is protected, the future profit is assured.

However, people who understand the details of offshore savings investments will not recommend Premier Trust. This is because there is a financial institution called Investors Trust that offers investment products with better conditions.

Therefore, if you are thinking of investing in principal protection, it is better to avoid Premier Trust. However, there are some people who have already started investing with Premier Trust. In that case, it is too late, and you should continue to accumulate overseas until maturity with Premier Trust. This is because the surrender charge is high, and the principal will be lost if you cancel.

In offshore investment, the financial institution you subscribe to and the person who introduces you are very important. Instead of investing in inferior investment products, find out the details of the products from an excellent IFA. Also, you need to compare the investment products of other financial institutions before making an investment.