Asset management through investment is usually dependent on the economy. If you invest in traditional assets such as stocks and bonds, the value of your assets will decrease significantly during a recession.

On the other hand, there are investments that are not affected by the economy. These are called alternative investments. Among alternative investments, real estate is a typical investment target.

One of the most famous methods is to buy real estate and earn rental income or profit from its sale. However, a direct purchase is not the only way to invest in real estate; there are also REITs and hedge funds that can be used.

So what is the best way to invest in real estate as an alternative investment? In this section, we will explain the types and methods of alternative investments using real estate investments.

Table of Contents

Real Estate Is a Typical Alternative Investment

Alternative investments are methods that do not invest in stocks or bonds. In the past, there have been times when stock prices have fallen sharply, such as the dot-com bubble, the collapse of Lehman Brothers, and the Corona shock. During these recessions, stock prices crashed.

Many people do not want to see their assets fall by less than half. So, by investing in alternatives, you can continue to invest even in a recession without losing much of your assets. A typical example of alternative investment is real estate investment.

The following are the two main types of alternative investments using properties.

- Direct investment in real estate.

- Investing in hedge funds.

By using these methods, you can increase your assets regardless of the economy.

Direct Investment in Property Regardless of the Economy

The most common type of real estate investment involves you buying a property. You buy a condominium or a single-family home and rent it out to others to earn rental income.

When investing in real estate, you can buy real estate in your country of residence, or you can invest in foreign real estate. For example, the following is real estate in the US. You can invest in US property, including foreigners.

If people do not live in the house, you will not be able to earn rental income either in a good economy or a bad economy. On the other hand, even if the economy goes down, if people are living in the property, you can still earn monthly rental income. This is the reason why real estate investment is not affected by the economy.

When investing in real estate as an alternative investment, you should buy properties where people live. In other words, do not invest in real estates such as office buildings or warehouses. Real estate related to business is easily affected by the economy and is not suitable for alternative investments.

Liquidity Is Extremely Low, and Borrowing Is Required

Many people are investing in real estate because it is an investment method that is not affected by the economy. However, the disadvantage of investing directly in real estate is that the cash flow is very poor. In short, even if you need a large sum of money, you can’t turn it into cash right away.

While alternative investments have advantages, they also have disadvantages of poor liquidity.

Also, in the case of direct investment, few people invest in property entirely with their own funds. You will have to borrow money from the bank, which means you will have to pay interest to the bank. In addition, there are property taxes and income taxes to be paid. Therefore, if you do not invest in good real estate, your income may become negative.

As with all investments, if you make a bad investment, you will lose money. This is also true for property investment. However, in the case of real estate investment, if you invest in a good property in a rural area, you can earn an annual interest rate of over 20% through rental income.

You Cannot Avoid Fluctuations in Real Estate Prices

However, when investing in alternatives, it does not mean that you are not affected by the economy at all. In particular, prices of land and buildings are subject to large fluctuations. These land and buildings are affected by the economy.

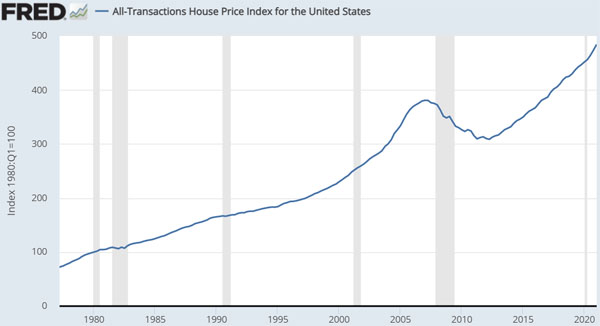

For example, the following is a chart of housing prices in the United States.

When investing in real estate, the United States is known to be the least risky place to invest. This is because the US population is growing all the time, and real estate prices have been rising for a long time.

However, even in the US, the least risky place to invest in real estate, property prices have stagnated or declined during recessions. Especially in 2007, when the subprime loan problem became apparent, we can see that real estate prices have been declining continuously for several years.

Naturally, when real estate prices fall, you may have to lower the rent. It is impossible to avoid the decline in real estate prices caused by the recession. However, real estate is an excellent alternative investment because the value of assets will not decrease by less than half, as in the case of stock investment.

Investing in Property Hedge Funds Is More Stable in Yield

On the other hand, there are many people who are not suitable for direct investment in real estate. When investing in real estate, you have to find an investment property, find people to live in it, and encourage them to pay rent. You also need to maintain your property and pay taxes. Therefore, there are many tasks to be done.

It is true that depending on the investment property, an annual interest rate of 20% or more is possible from rental income alone. If price appreciation of the land and building is added to this, the yield will be higher.

However, direct investment in real estate is more difficult to manage, so those who do not want to invest in real estate directly should invest in hedge funds. Hedge funds that deal in real estate are another alternative investment, and they are low-risk hedge funds that are not affected by the economy.

In the case of low-risk hedge funds that invest in real estate, a professional will manage the assets on your behalf. Therefore, you don’t need to select properties and negotiate the purchase and sale of real estate. In addition to investing in real estate, a variety of property-related investment methods are available.

When investing in hedge funds, you cannot borrow money and must use your own funds. However, you do not need as much money as direct investment in real estate, and you can invest in hedge funds if you have more than US$30,000.

Alternative investments in real estate using hedge funds include the following methods.

- Hedge funds that invest directly in real estate.

- Hedge funds that manage mortgage loans.

- Hedge funds that make loans to investors and earn interest income.

Although there are other types, these real estate funds are the most widely known. Unlike when you invest directly in real estate, you will not be able to earn more than 20% annual interest. However, by investing in real estate funds, you can achieve 6-13% annual interest.

Hedge Funds That Invest Directly in Real Estate

Instead of you investing in real estate, there are hedge funds that manage your assets by selecting the properties and managing the tenants.

It depends on the hedge fund what kind of properties they invest in. For example, there are hedge funds that invest in the following types of real estate.

- Single-family homes

- Condominiums

- Student dormitories

- Office buildings

For example, some hedge funds specialize in real estate investments in student dormitories, while others specialize in office buildings. Naturally, each hedge fund has a different yield.

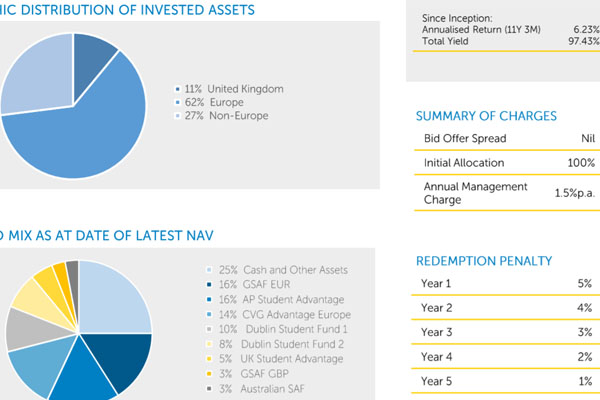

For example, below is a fact sheet of hedge funds that invest in student dormitories in Europe and Asia.

The average annual interest rate is 6.23%, which is a low yield among hedge funds. However, since the professionals manage the assets on your behalf, it can generate a stable yield every month.

Hedge Funds to Manage Mortgage Loans

On the other hand, you can use hedge funds for asset management that does not involve purchasing the real estate.

One of the most famous ways to earn interest income using real estate is through mortgage loans. Real estate is used as security to lend money. In the case of mortgage loans, there is no price movement of the land and buildings. Therefore, it is a low-risk investment method.

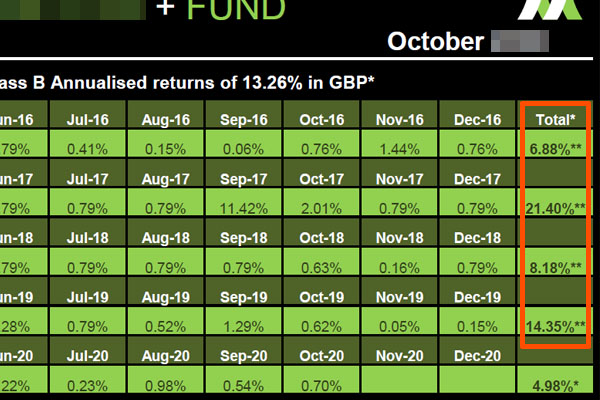

For example, below is a fact sheet on a hedge fund that provides mortgage loans to senior citizens.

In addition to the interest income from the mortgage loans, this hedge fund sells the mortgage rights to other investment companies. Through these methods, we are able to manage our assets at an average annual interest rate of 13.26%.

Hedge Funds That Make Loans to Investors and Earn Interest Income

There are also loan funds that lend money to real estate investors. When investing in properties, it is common to borrow money from banks. However, in many cases, banks will not lend money to foreigners, depending on the country. Especially when buying real estate in developed countries, local banks will not lend money to foreigners.

Therefore, there are hedge funds that provide loans to foreigners who want to invest in overseas real estate. For example, the following is a loan fund that lends money to people who want to invest in real estate in Australia.

If you invest in this hedge fund, the average annual return is 9.27%.

Normally, you invest in hedge funds in US dollars. On the other hand, in the case of this hedge fund, since it deals with Australian real estate, you will be investing in Australian dollars instead of US dollars. In other words, you can manage your assets in Australian dollars.

In any case, the types of real estate to invest in vary greatly depending on the hedge fund.

REITs Are Not Alternative Investments Due to Price Fluctuations

REITs (real estate investment trusts) are a well-known method of investing in real estate. This is a method of asset management in which an investment corporation collects money from investors and invests it in real estate.

It is similar to hedge funds in that it collects money from investors and invests in real estate. Investing in REITs also allows you to earn dividend income.

However, REITs are listed as ETFs (Exchange Traded Funds) at securities companies and can be bought and sold just like stocks. Since REITs have similar characteristics to stocks, their prices fluctuate widely. Therefore, unlike direct investments or hedge fund investments, the value of assets may fall significantly.

For example, below is an ETF called iShares US Real Estate ETF (IYR) that invests in US real estate.

As you can see, prices have fluctuated greatly. In addition, prices have fallen significantly in past recessions, such as the collapse of Lehman Brothers and the Corona Shock.

For this reason, investing in REITs is not an alternative investment. Alternative investments using real estate are only possible through direct investments in real estate or hedge fund investments.

Using Real Estate as an Alternative Investment

It is important to have investments that are not affected by the economy. So, by using alternative investments, you can increase your money without a decline in asset value, even if a major recession strikes.

Real estate is widely known as a typical example of alternative investment. The most popular way to invest in properties is to buy them directly. Alternatively, you can invest in a hedge fund that deals in real estate.

In the case of direct investment, high yields are possible if you invest in good properties. However, there are many things you need to do, such as selecting properties, paying taxes, and borrowing from banks. Therefore, if these tasks are troublesome for you, you should invest in hedge funds and earn 6-13% annual interest.

If you want to invest in alternative investments by investing in real estate, you should try to manage your assets either by purchasing properties or by investing in hedge funds.