There are many people who invest in Singapore for their offshore investments. One of the leading financial centers in Asia is Singapore, and there are many excellent financial products available.

If you are not familiar with Singapore, you probably only have an image of the Merlion. However, there are many insurance companies (financial institutions) in Singapore, and there are excellent offshore insurance and mutual funds.

Singapore is a country where taxes are extremely preferential. As a result, investment money from all over the world is attracted to Singapore.

So we’ll explain the features of Singapore, an offshore region in Asia, as an investment place. For those who often travel to Singapore for business, as well as those who want to manage assets in Singapore while staying in your country, let’s understand how to invest in Singapore.

Table of Contents

Singapore Is Famous Offshore Region in Asia Like Hong Kong

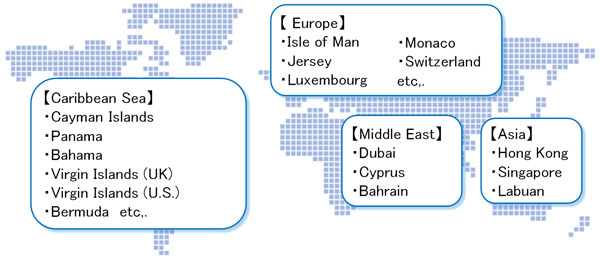

Singapore, like Hong Kong, is a famous offshore region. It is one of the two major offshore financial centers in Asia.

In Singapore, the corporate tax rate is low, and the income tax rate is also quite low. In addition, capital gains (money made from buying and selling stocks, etc.) are tax-free. This is the reason why a lot of investment money is attracted from all over the world.

Because of its location between Europe and East Asia, Singapore is also a place where European money is gathered.

In fact, when people start regular investment in Asia, they tend to choose Hong Kong or Singapore. This is because Singapore is very famous and the country is highly reliable.

No Country Risk Compared to Hong Kong

Another advantage of investing in Singapore instead of Hong Kong is that there is much less country risk.

Of course, this does not mean that Hong Kong is not reliable as a country. However, Hong Kong is considered to be a part of China. There is a risk because of the heavy influence of the Chinese government.

Many people know that the Chinese Communist Party is one of the most vicious organizations in the world. China has strict control over information, eliminates anyone who is not favorable to them without any reason and is able to manipulate the judiciary at will. In short, they ignore human rights and do whatever they want.

This is also the case in Hong Kong. In the past, the Hong Kong National Security Law was enforced under the direction of the Chinese Communist Party, and a number of pro-democracy activists in Hong Kong were arrested. Also, the system of Hong Kong elections was changed so that democracy activists could not be elected.

Source: BBC

Hong Kong has developed because of the one country, two systems, which has allowed free autonomy without the interference of the Chinese government. However, Hong Kong’s citizens have already lost their freedom due to the Chinese Communist Party, and there is no telling when the Chinese government will destroy Hong Kong’s status as an Asian financial center.

Singapore, on the other hand, has no such country risk. In the sense that the Chinese Communist Party is not involved, Singapore is less risky as a country than Hong Kong.

Major Financial Institutions and Banks in Singapore

What is the status of banks in Singapore, which excel in finance?

There are financial institutions in Singapore that are rated highly by the financial institution rating agencies, Standard & Poor’s (S&P) and Moody’s. They are as follows.

- DBS Bank

- OCBC Bank

- UOB (United Overseas Bank)

These financial institutions are banks with ratings such as AA-. For reference, the rating of a huge bank in Japan, a developed country in Asia, is A-. These banks in Singapore are better, as evidenced by the ratings from international rating agencies.

Offshore investment involves using companies that are huge and more secure than the financial institutions in your home country. In that sense, banks in Singapore dominate the top rankings in Asia in terms of bank trustworthiness. And you will be able to use offshore insurance and mutual funds in a superior environment.

You Can’t Open a Bank Account in Singapore, But You Can Invest

However, if you actually plan to make a regular investment in Singapore, you will not be able to open a bank account at these megabanks. If you want to open an account in Singapore, you have to be a resident of the country. In other words, you need to have a Singapore visa.

Singapore does not issue visas to foreigners unless they are employed in Singapore. Therefore, it is impossible to open a bank account in Singapore.

However, even if you don’t have a bank account, you can still invest in mutual funds. In your country, if you want to invest your assets with a life insurance company or a securities company, you need to make a direct deposit to the company. In the same way, if you sign a contract with an insurance company (financial institution) in Singapore and deposit money directly, you can invest without any problem.

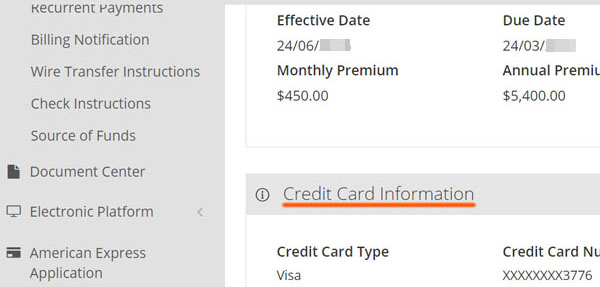

In offshore investment, there is also a way to invest directly into the fund with a credit card, which makes the investment itself very easy. For your reference, I also use credit card payment for my regular investment, as shown below.

I am showing you a part of the management screen, and by registering your card information, you can make your monthly payment automatically.

When investing in Singapore, it is possible to sign up while living in your country like this without having to travel to the country. Naturally, the financial institution you invest in will be a much larger company than your local bank, securities firm, or insurance company.

Offshore Insurance and Mutual Funds

What kind of financial products can you invest in Singapore? There are two types of financial products that you can invest in; offshore insurance and offshore mutual funds.

Offshore insurance is life insurance. You can buy life insurance in your country, and your money will grow. However, the speed of asset management is slow. On the other hand, if you buy offshore insurance for your regular investment, your US dollar assets will increase two to three times in 20 years, and it is normal for your assets to grow ten times or more.

The following are some of the life insurance products you can purchase.

- Whole Life Insurance: Life insurance that lasts for a lifetime.

- Endowment insurance: Life insurance that lasts for a specific period of time.

Endowment insurance is usually purchased for the purpose of asset management. For example, an endowment insurance policy is set to mature in 25 years. This way, when it reaches maturity, your money will be returned to you many times over.

On the other hand, if you want to give a large amount of money to your spouse or children as a death benefit, you should purchase whole life insurance.

Offshore Mutual Funds Are Available in Singapore

However, since it is a life insurance policy, it is common to see a doctor at a local medical institution. When you buy life insurance in your country, you have to see a doctor to show that you are in good health.

Also, life insurance in Singapore can only be purchased by people who live in Singapore. Therefore, if you are a foreigner who does not live in Singapore, you will have to choose an offshore mutual fund instead of life insurance.

With an offshore mutual fund, you simply deposit your money. It does not have a large death benefit. Therefore, depending on the product, you may be able to invest in a mutual fund while living in your country without having to travel. The financial products that can be paid by credit card fall into this category, as mentioned earlier.

Therefore, if you are a beginner in offshore investment, you should start with overseas mutual funds.

In addition, offshore investments aim for an annual interest rate of over 10%. For example, if you were to save US$100 every month in a developed country from the age of 25 to 65, you would only have about $48,000 in savings because the interest rate is almost zero. Even if you were to purchase life insurance and increase your assets, it would only be a small amount.

On the other hand, if you save $100 per month for the same period of time with an annual interest rate of 10%, you will have about US$638,000. Of course, in reality, you will live longer, so your assets will grow even more, not just tenfold.

Consult with an IFA (Agent ) to Select the Right Financial Products for You

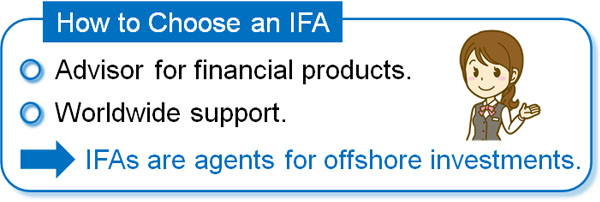

All financial institutions in the offshore region have one thing in common: they must be contracted through an agent called an IFA (Independent Financial Advisor). You cannot contract directly with insurance companies (financial institutions). It must always be through an agent.

When applying for offshore products, make sure to consult an agent who will honestly tell you about the risks and disadvantages of financial products.

It is a great advantage to have your money grow many times over. However, there are some disadvantages of offshore investments, such as little or no money back if you cancel early. This is the same feature as savings-type life insurance in your country.

Also, since you will be investing in Singapore, you will be dealing with a financial institution (fund) located in a foreign country. Therefore, an IFA that can support you properly is excellent.

If you want to change your investments or have any problems during the process, you can ask them immediately no matter where you live by applying to a worldwide IFA.

Therefore, the existence of an agency is very important for regular investment in Singapore. In the future, you will need to follow procedures when your money is returned to you, so make sure to sign up with a reliable company while looking ahead to the decades to come.

Investing in Singapore, a Tax Haven in Asia

Singapore, like Hong Kong, is one of the largest offshore financial centers in Asia. In fact, Singapore dominates the top rankings of banks in Asia.

These subsidiaries of the megabanks deal with insurance and mutual funds, so you can send your money directly to such companies to manage your assets. Your money will be returned to you many times over, instead of a financial product that will hardly increase your money.

However, you will need to purchase the products through an IFA. This is because you cannot buy directly from a financial institution.

This is why it is very important to choose an IFA to sign up with. You need to hire an agent who will be able to support you when it matures in a few decades.

Be sure to take these precautions before investing in Singapore. There are different types of offshore insurance and offshore mutual funds, and you can choose the best investment product from these by consulting with your agent.