Many people live in Thailand and are residents or expatriates. It is normal for these people to think about asset management and worry about how they can increase their wealth.

The reason why so many people living in Thailand try so hard to find good asset management methods is that there are no good investment methods in Thailand. Therefore, you have to study and find out how to manage your assets by yourself to achieve excellent asset management.

As long as you cannot increase your assets efficiently in Thailand, your investment destination will inevitably be overseas. This is called offshore investment, and you can increase your assets by investing outside of Thailand.

But how can you invest abroad? Here I will explain the best way for Thai residents and expatriates to increase their assets.

Table of Contents

There Is No Superior Investment Method in Thailand

In many countries, high taxes and strict financial regulations make it impossible to buy good financial products. Thailand does not have low taxes, and financial regulations prevent the purchase of investment products from around the world.

Therefore, even if you consider investing in Thailand, there are no good financial products available. Since there is no efficient way to increase your assets, your assets will not increase as long as you are thinking of investing in Thailand. For example, the following are some of the most popular ways to manage assets in Thailand.

- Fixed deposit at a bank.

- Investing in stocks of Thai companies.

However, even if you use these methods, your money will not increase.

Bank Deposits Have Low Interest Rates

There are many local banks in Thailand, and you can make a fixed deposit there. The safest method of asset management is a fixed deposit at a bank.

The interest rate is very low on fixed deposits because there is no risk of loss. In Thai banks, the interest rate on fixed deposits is usually about 1% per year. However, the actual yield will be less because of the tax imposed on the interest.

When investing, no matter how low the interest rate is, it is meaningless unless you can earn 3-4% per year. Compared to this standard, the interest rate on fixed deposits using banks is too low.

You Shouldn’t Invest in Thai Companies

On the other hand, some people may be thinking of investing in stocks. By investing in Thai companies, you can earn dividends and expect the stock price to rise.

However, you should not invest in Thai companies. The reason is simple: Thai stocks are not growing at all. For your reference, here are the price movements of Thai stocks over 10 years.

This is the Thailand SET Index, which shows the price movements of listed companies in Thailand. As you can see, the stock price is not going up.

When investing in stocks, it is common sense to invest in US stocks. In fact, US stocks have more than doubled in value in the same 10 years (in the case of the S&P 500). When investing in stocks, the basic rule is to invest in countries that are growing rapidly.

Investing in Thai companies does not increase the value of the stock, but rather there is a risk of decline. Unless you are a professional investor, it is impossible to make money by investing in listed companies in Thailand. Because of the difficulty of investing in Thai companies, you should not invest in stocks in Thailand unless you have a specific reason to do so.

At Maturity, Money Can Only Be Transferred to Banks in Thailand and the Currency is Limited to Baht

There is also a fatal drawback when investing in Thailand. For example, you have to use a bank in Thailand to invest money.

When you use a bank to make a fixed deposit, you will naturally use a Thai bank. Also, when you use a Thai brokerage firm to invest in stocks, you must use a Thai bank to receive your money. When purchasing financial products in Thailand, it is always necessary to go through a Thai financial institution.

Therefore, even if you were to live abroad, you would only be able to spend your money in Thailand.

Moreover, the investment currency is the Thai baht. In the case of non-developed countries, the value of the currency is very low. For example, during a global recession, the value of currencies in emerging countries drops sharply.

Therefore, in asset management, it is common sense to invest in US dollars. The US dollar has the largest share of the world’s currency and is the most trusted currency. Investing in Thai baht is risky and needs to be done in US dollars.

Offshore Investment Is the Best Way

People with investment knowledge will avoid investing in Thailand. Instead, they choose to invest overseas. In other words, they invest outside of Thailand.

There are areas in the world where little or no taxes are levied, called tax havens. They are also called offshore regions, and if you invest in tax havens, you can efficiently increase your assets. In addition, you can purchase excellent financial products from around the world.

Finance is the main industry in all tax haven countries. Therefore, there are many applications from foreigners, and in order to support these customers, they will transfer funds to banks all over the world at maturity. This means that no matter where you live at the time of maturity, you will not have any trouble receiving your money.

Not only that, but the investment currency is the US dollar. You can also invest in Euros or British Pounds, but usually you invest offshore in US dollars. Instead of investing in Thai baht, you can invest in a reliable currency. For example, below is the management screen of the offshore investment I use.

As you can see, the investment currency is the US dollar. Since investing in Thai baht is very risky, Thai residents and expatriates should invest in US dollars.

Familiar Tax Havens Are Hong Kong and Singapore

Tax havens are familiar to people living in Thailand. For example, Hong Kong and Singapore are tax havens near Thailand.

In Singapore, only residents of Singapore are allowed to purchase financial products in Singapore. However, in Hong Kong, even if you are a non-resident of Hong Kong, you can purchase financial products in Hong Kong.

In addition, tax havens exist all over the world. Therefore, you can invest not only in Hong Kong but also in other tax havens.

For example, in my case, I have taken out offshore life insurance policies in Hong Kong. Not only that, but I also make regular investments in a Cayman Islands-registered company. Moreover, I use a Bermuda-based company to invest in hedge funds to increase my assets.

The Cayman Islands and Bermuda are also famous tax havens, where finance is the main industry. Take advantage of these countries to invest abroad.

Increase Your Money by Investing in Life Insurance and Hedge Funds

What kind of financial products are available for offshore investment? There are three main types.

- Life Insurance

- Mutual Funds

- Lump-sum investment in hedge funds

The least risky way to invest in offshore investments is to use life insurance. If you live in Thailand, you can purchase offshore life insurance in Hong Kong. You will also be investing in companies such as Sun Life, a major life insurance company in Canada, which is by far a huge insurance company compared to life insurance companies in Thailand.

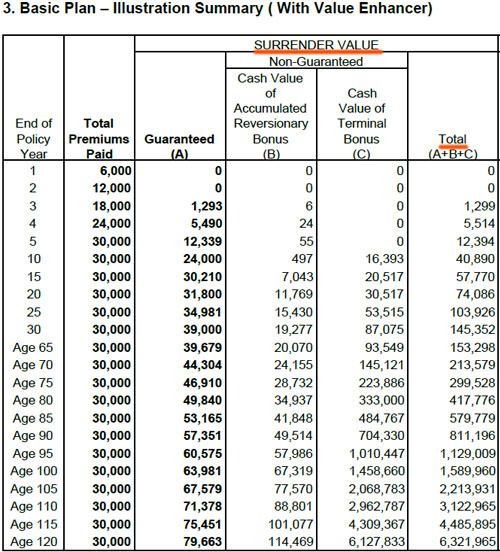

For example, the following is a life insurance policy called Victory offered by Hong Kong Sun Life.

When I was 34 years old, I took out this life insurance policy and invested a lump sum of US$30,000. After that, my assets will increase as the years go by as follows.

- After 20 years: $74,086 (about 2.5 times)

- After 30 years: $145,352 (about 4.8 times)

It is promised that my assets will increase like this by leaving my money without cancellation in the middle. The annual interest rate is about 4%, which is lower than most offshore investments. However, my assets will surely increase.

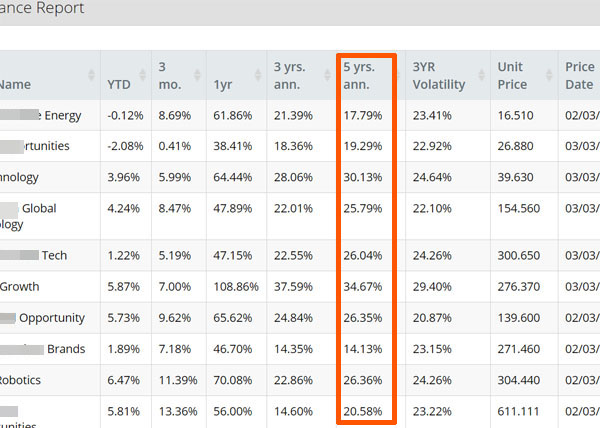

Alternatively, if you can take risks, you should invest in mutual funds or hedge funds. For example, below is the management screen of the offshore mutual fund I am investing in.

I invest in a diversified portfolio of 10 funds with an average annual interest rate of 24.1% over 5 years. Although there is risk, my assets are growing in this way.

In any case, with offshore investments, like life insurance, the lowest yield is 4% per year. In contrast, investments in Thailand have a low yield, or a high risk of loss when investing in stocks. Therefore, Thai residents and expatriates have to invest their assets in tax havens.

Thai Residents Should Manage Assets by Investing Abroad

In order to increase your assets by investing, you have to understand the right way to manage your assets. Therefore, you should always choose an offshore investment.

If you are living in Thailand, you tend to think of using financial products in Thailand. You will inevitably want to support the country where you live. However, in asset management, the goal is to increase your money. You should not invest to support a company in Thailand.

There are no excellent financial products in Thailand. Once you understand this fact, you will realize that only offshore investments can provide you with excellent asset management.

For this reason, you should start investing offshore. By managing assets in tax havens, people living in Thailand can increase their assets efficiently.