Many people want to create a private annuity for the future. If you rely only on the government pension plan, you will not be able to make enough money. Instead, you can increase your money by using a private pension plan from an insurance company.

A company that sells excellent insurance products as individual overseas annuities is Sun Life. There are several Sun Life insurance products, and the product that allows you to receive your personal annuity in installments is called Vision. When you use Vision, your assets will grow while you receive money.

Why does the total amount of your assets continue to grow even though you receive money? What kind of insurance product is Vision in the first place?

There are many excellent insurance products available in foreign countries. So I will explain the details of Vision, which is excellent offshore life insurance.

Table of Contents

Vision Is Sun Life’s Individual Annuity Insurance

Superior insurance products can be found in tax havens. Tax havens, also known as offshore, are countries with almost no taxes. In Hong Kong, even non-residents of Hong Kong can purchase insurance products. For this reason, it is common to purchase life insurance in Hong Kong.

Among the insurance companies located in tax havens, Sun Life is one of the biggest insurance companies in the world. Compared to the top life insurance companies in developed countries, Sun Life is many times larger. This means that Sun Life is far less likely to go under than a life insurance company in your country.

Moreover, since it is an insurance company located in a tax haven, it can freely invest the funds deposited by its customers. Also, since there are no taxes to pay, they can manage assets efficiently. As a result, your money will grow many times over.

As for me, I have purchased life insurance policies from Sun Life Hong Kong as follows.

Among life insurance policies, Vision is the one that is used to create a private pension plan. It specializes in asset management and allows you to receive your money in installments.

The amount of money you can receive from the government pension alone is not enough. Therefore, by creating a private pension in advance, you can avoid having problems in your old age.

You Can Increase Your Assets While Receiving Money in Installment Payments

There are two major types of annuity insurance products offered by Sun Life. The product names are Victory and Vision. Each of them is as follows.

- Victory: Annuity insurance to receive money in a lump sum.

- Vision: Annuity insurance to receive money in installments.

Both are life insurance policies that specialize in asset management. In the case of Victory, you will receive the money in a lump sum, and the asset management will continue until you cancel the policy, so your assets will increase at a fast rate.

On the other hand, in the case of Vision, you receive the money in installments, so the speed at which your assets increase is slower than with Victory. However, if you want to get the money that you can use freely every year in installments instead of a lump sum, Vision is a better choice.

Whether you prefer to receive a lump sum or in installments depends on the person. Buy the insurance product you want.

-It Is Possible to Postpone the Receipt of Money

When using Vision, it is possible to postpone the receipt of the money in installments. For those who do not need a pension now but want to receive money after retirement, it is better to postpone the receipt of money.

Also, if you postpone the receipt of your money, your investment amount will increase by that amount. In other words, your money will grow more efficiently.

The actual Insurance Policy Details

What exactly are the details of Vision’s insurance policy? For this, let’s check the actual insurance policy.

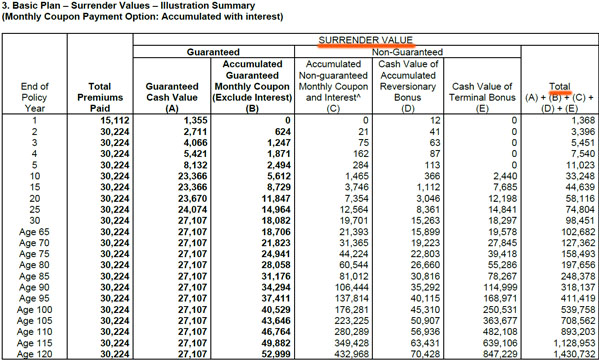

The following is my insurance policy for Sun Life Hong Kong’s Vision when I was 34 years old and paid a lump-sum premium of US$30,224.

You can see that the Total Premiums Paid is $30,224. Also, if you check the Surrender Value, the Total is as follows.

- Year 10: $33,248 (about 1.1 times)

- Year 20: $58,116 (about 1.9 times)

- Year 30: $98,451 (about 3.3 times)

By using the Vision, my assets will grow in this way. Life insurance in tax havens allows for this type of asset management.

How Much Will I Receive as Annuity?

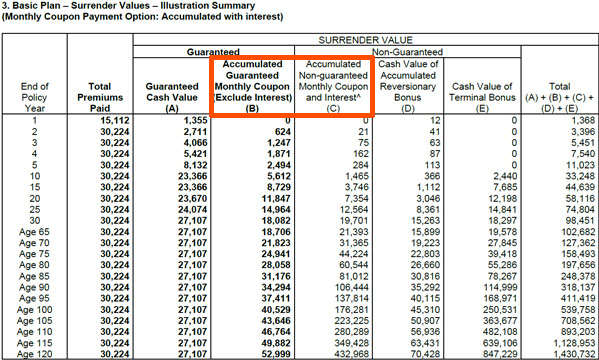

So how much will be paid out in installments? For this, check the Monthly Coupon. This is the part below.

In the Monthly Coupon, there is money that is guaranteed and money that is not guaranteed.

Sun Life invests in stocks and bonds, and returns the increased money to us through asset management. Therefore, there is always this kind of money that is not guaranteed. In general, however, the money will increase as stated in the policy.

The more years you have invested, the higher the annuity amount you will receive. For example, 46 years after I bought this insurance policy, I will be 80 years old, and the total amount of annuity I will receive between the ages of 80 and 84 is $23,586, including both guaranteed and non-guaranteed money. The annual amount of the annuity will be about $4,700.

The total premium paid is US$30,224. Nevertheless, I will receive a private pension of $23,586 for the five years between the ages of 80 and 84. And as I get older, such as 85 or 90 years old, the amount of pension I can receive will be larger.

In addition, you can also receive a high surrender value when you cancel your insurance policy. For example, if I were to surrender my policy at the age of 80, the total amount of the annuity and the surrender value I would receive would be $197,656.

With Vision, you can increase your personal assets while receiving money as a private annuity.

You Can Change the Insured Many Times and Keep the Money Until Your Grandchildren’s Generation

With Vision, you can change the insured as many times as you want. In other words, you can leave your insurance policy to your children, grandchildren, and great-grandchildren.

In general insurance policies, you cannot change the insured person. On the other hand, in the case of offshore life insurance, there is a high degree of flexibility in insurance design. Therefore, Sun Life created a vision as an insurance contract that allows the insured to be changed freely.

Since you can freely change the insured as many times as you want, your children, grandchildren, and great-grandchildren will not have to depend on the government system. For example, when your grandchild goes to college, you can change the name of the insured to your grandchild, and the money will be automatically paid into his or her name.

The grandchild will no longer have to work part-time and can concentrate on his or her university studies. Also, if the policy has already been in force for decades, the amount of annuity received will be high. In addition, by changing the insured again, you can leave the money to your great-grandchildren and other younger generations.

Leaving money permanently without the need to cancel the insurance policy is the Vision offered by Sun Life Hong Kong.

Details of Contract Age, Payment Period, and Minimum Premium

When you sign up for a vision policy from Sun Life Hong Kong, what are the details? Roughly speaking, the details are as follows.

- Age of the insured: 0 to 80 years

- Contract age: Up to 120 years old

- Payment period: Lump-sum, 2 years, 5 years, 10 years

- Frequency of payment: monthly, half-yearly, or yearly

- Minimum premium: $20,000

Since it is a life insurance policy, there is a limit on the age of the insured, and only people between the ages of 0 and 80 can purchase the policy. The premiums can be paid in a lump sum, two years, five years, or ten years. I recommend the lump-sum or two-year payment. The reason for this is that the speed at which your money grows through asset management is faster.

It is important to note that the maximum contract age for the 5-year payment is 0-70 years old. In the case of a 10-year payment, the possible age of the contract is 0 to 65 years old.

You can choose to pay monthly, semi-annually, or annually. The minimum premium is $20,000, so you will need to pay a higher amount of money than this as a premium.

Disadvantages of Not Having a High Death Benefit

With all these advantages of Vision, are there any disadvantages? One of the disadvantages of Vision is that it does not have a high death benefit.

As mentioned above, Vision is an annuity insurance that specializes in asset management. Therefore, although it is a life insurance policy, it does not provide your family with a high death benefit.

To be more precise, the surrender value is equal to the death benefit. In the case of ordinary life insurance, the death benefit is higher than the surrender value. However, in the case of Vision, the surrender value and the death benefit are the same.

If the policy has been in force for a few years, the surrender value is lower than the principal amount paid. Therefore, during this period, the death benefit will be the total amount of money paid up to that point. It is important to understand that this is not a life insurance policy that can add a high death benefit.

If You Cancel Your Contract Early, Your Principal Will Be Lost

If you cancel your Vision early, you will lose your principal. This is also a major disadvantage. Not only with Vision, but with all insurance policies, including life insurance in your country, if you surrender your policy early, you will surely lose your principal.

In the case of Vision, if you make a lump-sum payment or a two-year payment, the surrender value will exceed the principal after seven years have passed. On the other hand, in the case of a 5-year payment, the principal will not be reduced after 12 years. The longer the payment period, the less efficient the asset management will be, so the break-even point will be later.

In any case, always avoid early cancellation when using life insurance.

Offshore life insurance is an investment product that should be managed over a long period of time, at least 20 or 30 years. If you don’t need to use a lot of money right now, and want to increase your money through asset management, offshore life insurance is an excellent choice.

Using Vision to Create a Private Pension Plan

An insurance product offered by Sun Life Hong Kong is called Vision. It is a life insurance product that specializes in asset management and allows you to receive an individual annuity through installment payments.

There are several life insurance products that allow you to create an individual annuity, and if you want to choose installment payments, you can use Vision. Since your assets will be invested in tax havens, it will be far superior to the pension plans offered by the government of your country.

In fact, you will receive many times more money than you paid in premiums. The annuity payments will continue until you reach 120 years of age, and you will also receive a high surrender value. You can also transfer the policy to your children or grandchildren if you want.

The Vision is an offshore annuity that is highly flexible. If you have more than $20,000 in your pocket and you are not investing it, you should consider using Vision.