Overseas investment is an essential method for wealthy people to increase their assets. To be more specific, they invest in offshore tax havens where there is little or no tax.

If you invest offshore in a tax haven, you can invest in hedge funds. The Harvard University Foundation, for example, is known to have invested in hedge funds because they can increase their assets significantly by investing offshore.

So what are some of the best offshore investments for the wealthy? In fact, it is possible to invest in hedge funds even for ordinary people. You don’t have to be a wealthy person to invest in hedge funds.

However, if you are a wealthy person, offshore investment will be more advantageous. So, I will explain how rich people invest offshore.

Table of Contents

Rich People Are Actively Investing Offshore

If you are a professional investor, you can manage your assets by investing in stocks and bonds, and increase your own assets. However, many wealthy people run their own businesses or are real estate owners, and are not professional investors.

Therefore, it is common for rich people to have their assets managed by professionals. This is why they invest offshore.

There are many institutional investors and family offices around the world. They invest in hedge funds as well as in mutual funds. Using tax havens allows you to make offshore investments.

There are different types of offshore investments. Offshore investments made by wealthy people are generally investments in hedge funds. For example, the following is a hedge fund invested by institutional investors and family offices worldwide.

It is a low-risk hedge fund that offers bridge loans in Europe. Since it does not invest in stocks or bonds, it is not affected by the economy and has never had negative returns in the past. It is impossible to aim for 20-30% annual interest like high-risk hedge funds, but it is possible to earn stable returns with low risk.

The Panama Papers Reveal the Use of Tax Havens by the Wealthy

To invest in hedge funds, you must use a tax haven. Even if you open a brokerage account in the country where you live, it is impossible to invest in hedge funds.

Also, the wealthy will never tell the public that they are investing offshore. In fact, many people, including politicians, executives, and celebrities, have invested in hedge funds through offshore investments. This is revealed in the Panama Papers that happened in the past.

The list of people using tax havens was revealed, including many big politicians, huge corporations, and celebrities. In short, they were actively using tax havens.

The wealthy invest offshore because it is much easier for them to make money than investing in their home countries. It is normal for the wealthy to invest offshore.

Offshore Investment and Hedge Fund Investment Is Possible for Ordinary People

In fact, offshore investments are not just for the wealthy. Ordinary people can also invest in hedge funds. You need to have at least US$30,000 to invest, and if you have this amount of money, you can invest in hedge funds.

Offshore investments can also be made as regular investments. If you want to accumulate your investment, you can start with $100 to $200 per month. Considering this fact, offshore investment is not for the wealthy, and anyone can start investing.

However, it is easier for wealthy people to receive excellent information than ordinary people. Naturally, excellent information includes offshore investments. This is why many rich people invest offshore.

Although there is a lot of fraudulent information in investments, in offshore investments, the investment companies that you invest in are super huge companies and are highly rated by global rating agencies. Some of the companies are listed on the stock market. For this reason, many wealthy people are using tax havens to manage their assets.

The More Money You Can Invest, the More Effective Compounding Interest Will Be

When you understand these facts, you will realize that offshore investment is not necessarily an investment product for the wealthy. This is because even ordinary people can invest.

However, if you are rich, investing offshore is definitely more advantageous than ordinary people. First of all, the amount of money you can invest is large, so the effect of compound interest is great.

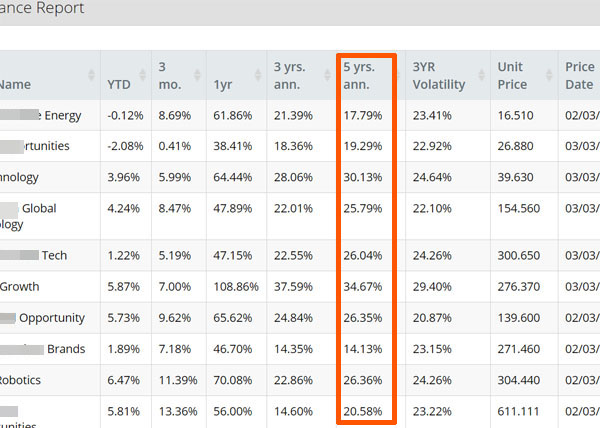

There are many ways to invest offshore, and one of the most common ways is to invest in hedge funds. The following is the management screen of the overseas savings-investment I am making.

I invest offshore with an investment company registered in the Cayman Islands. I have invested in 10 funds, and the average annual interest rate for the past 5 years is 24.1%, as shown in the image above.

For this offshore investment, I invest in funds that only take long positions (buy). Although the performance will be lower during a recession, such a high yield is possible.

So, how does the difference in principal change the efficiency of asset management? Let’s assume that you can invest offshore with an annual interest rate of 10%. In this case, if the principal amount invested is different, the following differences will appear after 20 years.

- $10,000: about $67,300 after 20 years.

- $20,000: about $134,500 after 20 years.

- $30,000: about $201,800 after 20 years.

- $50,000: about $336,400 after 20 years.

- $100,000: about $672,700 after 20 years.

As you can see, the amount of future assets varies greatly depending on the difference in the principal amount; the fact that your assets will increase by about 6.7 times after 20 years is the same. Naturally, if you are wealthy, you can invest a lot of money, so the amount of increase is likely to be higher.

The Strength of the Wealthy Is to Be Able to Diversify

For wealthy people, it is possible to invest in several hedge funds. In my case, I have made the following offshore investments.

- Offshore savings investment

- Offshore life insurance

- Investing in hedge funds with a lump-sum payment

Some hedge funds are low-risk when you invest in hedge funds with a lump sum payment, while others are high-risk.

Each hedge fund has a different investment strategy. Some low-risk hedge funds invest in real estate, while others offer bridge loans. There are also low-risk hedge funds that invest in bonds.

In high-risk hedge funds, some funds use AI for automated trading, while others specialize in gold investment.

For retail investors who are not rich, the number of hedge funds they can invest in is limited. This is because the minimum investment amount for hedge funds is $10,000.

For example, if you open an offshore investment account with $30,000, you can invest in 3 hedge funds.

- $10,000 × 3 funds = $30,000

On the other hand, rich people can invest higher amounts of money. Therefore, they can invest in many hedge funds with different investment strategies. Diversification is the main principle of increasing assets through investment. In this regard, wealthy people can start investing offshore with more favorable conditions than ordinary people.

Private Banking Service Is Available If You Invest $1 Million

Private banking is the only offshore investment service available for the wealthy. The minimum investment amount for private banking is US$500,000.

In addition, the amount must be increased to US$1 million in the future. Therefore, ordinary people are not allowed to use private banking. Wealthy people can invest in hedge funds by using a private banking service registered in Switzerland.

It is important to note that whether you use an offshore investment account or a private banking service, the hedge fund you can invest in is the same.

An offshore investment account and private banking are just places to deposit your money. After that, you can choose which hedge funds you want to invest in.

In reality, the IFA (Independent Financial Advisor) decides where to invest in offshore investment. When you invest offshore, you have to go through an IFA, and an IFA will select the hedge funds for you. Therefore, it is important to choose the proper IFA.

In any case, if you invest in the same hedge fund, whether you use an offshore investment account available to ordinary people or private banking for wealthy people, the result of your asset management will be the same.

The Wealthy Invest in Hedge Funds

Many of the wealthy are investing offshore. They know that their assets will grow more efficiently if they use tax havens than investing in their home countries. In fact, the Panama Papers revealed that many politicians, huge corporations, and celebrities have been using tax-havens.

Anyone can start an offshore investment. Offshore investment is not only for the wealthy but also for individual investors.

However, the principal amount invested by wealthy people is larger, and they can also diversify their investments; they can increase their assets more efficiently than ordinary people.

Therefore, if you are rich, you should start investing offshore. Your assets will increase at an accelerated rate compared to when you invest in the country where you live. Invest in good hedge funds to get high returns.