Many people who are thinking of investing in hedge funds want to know how much average yield hedge funds are producing.

However, different hedge funds have different investment strategies. Some hedge funds are high-risk/high-return hedge funds, while others are middle-risk hedge funds. There are also low-risk hedge funds that do not invest in stocks.

Naturally, low-risk hedge funds have lower returns. Also, the investment performance varies from hedge fund to hedge fund. So, you need to understand how to check the average return of a hedge fund.

There are ways to invest in hedge funds with superior performance. We will explain how to find and invest in hedge funds with superior annual returns and dividend yields.

Table of Contents

The Average Return of Hedge Funds Varies by Risk

When investing in hedge funds, it does not make sense to try to know the overall average return. This is because each hedge fund has a different annual return.

In fact, there are many bad hedge funds. If you invest in these hedge funds, the yield will be negative. For example, all hedge funds in your country are scams, so the risk of not getting your money back at all is very high.

On the other hand, yields vary greatly from hedge fund to hedge fund, even if they are excellent hedge funds. First of all, you have to recognize this fact. Hedge funds are divided into the following categories according to risk.

- High-risk hedge funds: 15-30% annual interest rate.

- Middle-risk hedge funds: 10-13% annual interest.

- Alternative investment hedge funds (low risk): 6-13% annual interest.

As for which hedge fund is best for you to invest in, it depends on your risk tolerance. So make sure to check what the average yield and risk are for each hedge fund.

High-Risk Hedge Funds Earn 15-30% Annual Interest

Hedge funds are generally perceived as a high-risk, high-return investment approach. High-risk hedge funds use leverage to invest in stocks, bonds, forex, and futures. They also take short positions (sell) as well as long positions (buy).

These hedge funds may lose a lot of money in some years, but they may also gain a lot of money in other years. Averaging them all, annual interest rates of 15-30% are common.

High-risk hedge funds with annual interest rates below 15% are worthless. The reason is that it is widely known that if you invest in the Nasdaq 100 index, you can get 13-15% annual interest. There is no point in investing in a hedge fund that cannot give you a higher yield than the index.

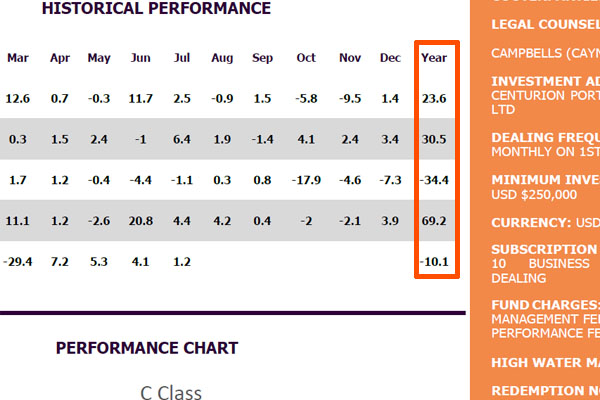

For example, below is a fact sheet on a high-risk fund investing in US stocks and bonds with leverage.

AI decides which stocks to invest in and buys and sells them. It is a hedge fund with an average annual interest rate of 16.3%, which can result in an annual interest rate of 69.2% in one year, or a negative return of -34.4% in one year. However, if averaged across the board, it is a high annual interest rate.

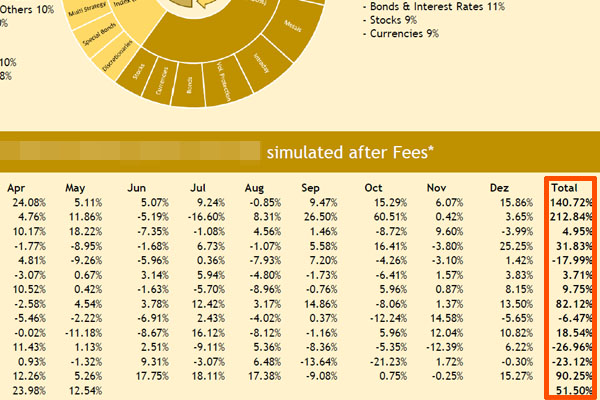

On the other hand, below is a hedge fund with an average annual interest rate of 29.20%.

It is a multi-strategy hedge fund. This hedge fund incorporates various strategies such as global macro strategy, long-short strategy, and managed futures strategy.

Likewise, there are years when the returns are negative, but the assets can increase two to three times in a year. On average, high-risk hedge funds can achieve high annual returns. However, it is important to understand that there is a possibility of negative returns in the short term.

Middle-Risk Hedge Funds with Average Dividend and Yield of 10-13%

For those who can take risks, they prefer high-risk hedge funds. On the other hand, there are many people who do not want to take big risks. In this case, you should invest in middle-risk hedge funds with annual returns of 10-13%.

Hedge funds that invest in stocks and bonds are not necessarily all high risk. Hedge funds that use the following strategies are generally not high risk.

- Market neutral strategy

- Arbitrage strategy

- Fixed income investments (no leverage)

An annual interest rate of 15-30% is impossible for hedge funds using these investment strategies. However, there are almost no negative return years, and a stable annual interest rate of 10-13% is possible.

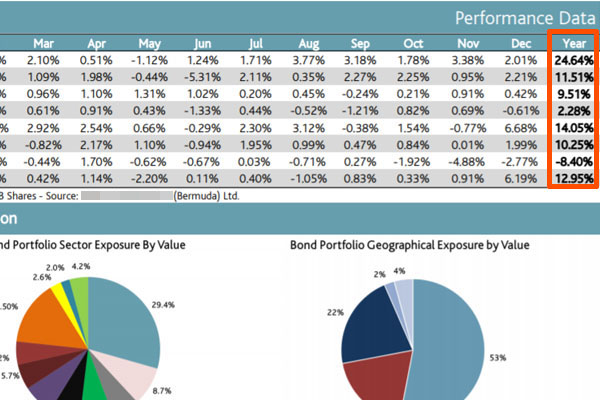

For example, below is a fact sheet on fixed income hedge funds.

This hedge fund invests in bonds without leverage and earns an annual dividend yield (fixed interest rate) of about 7%. With this fixed interest rate plus the expected increase in bond prices, the average return is 10.46% per year.

Although there are some years with negative returns, the losses are small compared to high-risk hedge funds. Most of the years have positive returns, and the average annual yield is about 10% when averaged across the board.

Even if you are an investor who likes to take risks, few people invest in all high-risk hedge funds. Therefore, if you invest in middle-risk hedge funds, your assets will grow at a stable annual interest rate of 10-13%.

Alternative Investments Earn Dividend Yield with Low-Risk Investments

When managing assets, there are other investment options besides investing in traditional assets such as stocks and bonds. They are called alternative investments, and there are hedge funds that deal in real estate, bridge loans, agricultural loans, etc.

When investing in alternative investment hedge funds, you can invest with low risk. This is because there is no price movement like stocks and bonds.

For example, the following is a hedge fund that offers bridge loans in Europe.

When investing in this hedge fund, the annual average dividend yield is 8-10%. Although there is a risk of default by the lender, there have been no negative return years in the past.

If you want to invest in a low-risk hedge fund, use a hedge fund that deals with alternative investments. Investment performance varies from hedge fund to hedge fund, and annual interest rates of 6-13% are possible.

Check the Fact Sheet for Fund Performance

How can we check the performance of a hedge fund? First of all, there is a 100% probability that excellent hedge funds are registered in offshore tax havens. They are certainly not registered in your country of residence.

Tax havens have low tax rates and no financial regulations, so any investment method is possible. This results in excellent investment performance. If you want to invest in hedge funds in tax havens, you need to open an offshore investment account. US$30,000 is enough to open an offshore investment account.

When opening an offshore investment account and investing in hedge funds, you must go through an IFA (Independent Financial Advisor). This is because investment companies and hedge funds in tax havens do not solicit clients directly.

Also, IFAs are the ones who have information on hedge funds. Therefore, ask your IFA which hedge funds are performing well.

What you should check is the fact sheet. All hedge funds that are available for investment through investment companies are audited by an outside agency. They need to show all of their bank account information and financial statements, and they cannot produce a false fact sheet. So be sure to ask your IFA to show you the hedge fund’s fact sheet.

In this article, we have presented fact sheets for several hedge funds. In the fact sheet, check the average annual return, volatility (the range of movement of the return), and investment strategy. After that, you can invest in the hedge fund through an offshore investment account.

-The Fact Sheet Shows the Numbers After Deducting Fees

When you invest in hedge funds, the fees are very high. Purchase fees (or surrender fees), management fees, and performance fees are charged.

However, the performance figures listed in the fact sheet are after deducting the fees. Therefore, you don’t need to worry about the fees.

Investment Performance Over the Past 5-10 Years Is Important

What are some other important points to consider when checking the yield of a hedge fund? You should check the performance of the fund over the past 5 to 10 years.

When checking the fact sheet of a hedge fund, you cannot make a decision based on the past two to three years of performance. This is because even an amateur investor can often achieve good results for two to three years by investing in a high leverage index. So, check how their performance has been over a long period of time over the past 5 to 10 years.

For example, would you want to invest in a fund with the following performance?

This is the price movement over two years, and the price has increased significantly. Therefore, you might think that you can make a lot of money by investing in this fund.

On the other hand, below is the price movement over six years instead of two years.

If you check the chart over a long period of time like this, you will see that the assets have not increased at all compared to six years ago. This chart is the Shanghai Composite Index, which shows the price movements of Chinese stocks.

China is not a democracy, and it is a high-risk investment destination because the government can impose regulations on huge corporations without reason. Therefore, it is common sense to avoid investing in China, and this can be easily understood by checking the historical charts.

Similarly, when you check the fact sheet of a hedge fund, you should also check how the fund has performed over the past 5 to 10 years. This is because a hedge fund that has performed well in the past is likely to continue to perform well after you invest in it.

You Should Check Charts and Numbers to See What Yields in a Recession

Not only that, you should check the fact sheets for charts and numbers during recessions. One of the characteristics of hedge funds is that they are not affected by recessions.

In the case of high-risk hedge funds, they increase their assets by taking short positions (selling) during a recession. Alternative investments are not affected by the economy because they do not invest in stocks and bonds. In any case, investing in hedge funds allows you to increase your assets regardless of the economy.

However, there are some hedge funds that are not good at asset management. In this case, you will get a negative return during a recession. Avoid these hedge funds. You should not invest in hedge funds that have significantly underperformed during recessions.

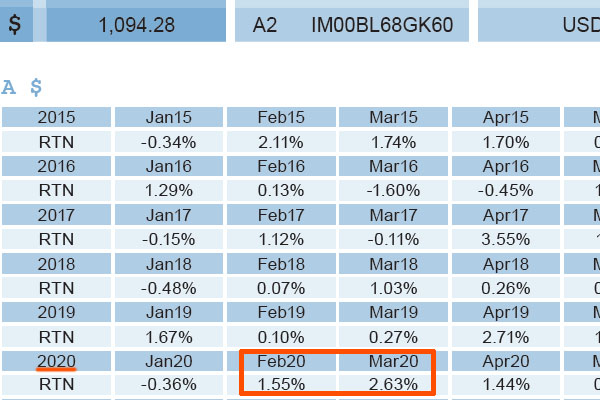

Check the following fact sheet for an example of a hedge fund that has produced excellent returns during recessions.

This is a fact sheet for a hedge fund that manages care property in the UK. This hedge fund has had positive returns in February and March of 2020.

In these months, a pandemic of coronavirus spread across the world, and stock prices crashed. Nevertheless, the returns were positive. When investing in hedge funds, check not only the overall dividend yield and average annual return but also the yield figures in recessions.

All Hedge Funds in Your Country Are Scams and the Numbers Fake

We have mentioned the important points to consider when checking annual returns on hedge funds. Just a reminder, as mentioned above, do not look for hedge funds in your country of residence. This is because they are all fraudulent funds.

Hedge funds do not manage assets in countries with strict financial regulations and high tax rates. Also, they do not target only people living in your country. Hedge funds have clients worldwide.

In addition, hedge funds that can be invested through offshore investment accounts are subject to strict audits by external agencies, as mentioned above. In addition, the assets are segregated, so hedge funds cannot use the money for anything other than investment.

In offshore investments, not only retail investors but also institutional investors and family offices invest. Naturally, fraudulent funds must be eliminated in order to protect investors’ assets. Also, you will not be scammed because the investment companies you use are huge corporations and have high ratings.

On the other hand, hedge funds soliciting in your country have the following characteristics and promotions.

- Targets only people living in your country.

- High yield, and no negative returns in the past.

- Monthly distributions.

- Private placement.

Naturally, there is no audit from outside agencies, so they can freely create false numbers. Also, since it is a private placement, the money collected from customers can be used freely. If you invest in such a fraudulent fund, the company will disappear after a few years, and you will not get your money back.

There are no hedge funds in your country. Although there are listed active funds, they are not hedge funds because they only take long positions (buy). In any case, you should understand that you cannot invest in hedge funds unless you invest offshore in a tax haven.

Even if you check the fact sheet and want to invest in a good hedge fund, the first thing you need to take care of is not to invest in a scam fund. You must understand how to invest in the proper hedge funds in order to earn excellent annual returns.

Investing in Hedge Funds by Checking Their Yields and Investment Performance

It is possible to invest in hedge funds through offshore investments. However, even when investing in hedge funds, each hedge fund has a different investment strategy and average yield. Some hedge funds are high risk, while others are low risk.

You should know in advance which hedge fund you want to invest in according to your risk tolerance. You can also check the hedge fund’s fact sheet through your IFA and look at the charts and numbers.

In the fact sheet, check the performance of the fund over the past 5 to 10 years. You also need to check the performance during recessions. Once you understand what to check, even an amateur retail investor will be able to know which hedge fund to invest in.

In addition, avoid investing in scam funds located in your country. Understand these and invest in hedge funds located in tax havens and get excellent annual returns.