When a company has spare cash, it can increase its money through asset management. A company needs to make low-risk investments, and bonds are particularly popular investments.

By investing in government and corporate bonds, the company can earn dividends. The annual interest rate varies depending on the bond the company invests in, with low-risk bonds earning about 2% per year. Also, you can earn as much as 5% per year in dividend income from high-yield bonds.

So, what kind of bonds should you invest in? If your company wants to invest in bonds, you should use bond ETFs. Bond ETFs are mutual funds that combine a variety of bonds.

There are many different types of bond ETFs. I will explain bond ETFs, including which ones a company should use.

Table of Contents

Low-Risk Investments Are Superior for Corporations

Retail investors should aggressively invest in high-risk investments. In short, they should invest in stocks. With stocks, an annual interest rate of 10-15% is possible even with index investments.

On the other hand, for corporate asset management, you should not invest in stocks. This is because investing in stocks has the potential to increase your company’s assets significantly, but it also has the risk of decreasing them. Since companies often need large amounts of money suddenly, they need to choose investment methods that will not fail.

This is why the use of bonds is excellent for corporate asset management. By investing in government and corporate bonds, you can earn interest. While you cannot earn a high annual interest rate like stocks, you can increase your assets through dividends.

For example, below is a comparison of the S&P 500 (yellow line) and HYG (blue line).

The S&P 500 is an index that invests in the top 500 US companies. Also, HYG is a high yield bond. We can see that the price volatility of bonds (HYG) is less than that of stock investments (S&P500).

Since HYG is a high-yield bond, it has more price volatility among bond ETFs. However, compared to stocks, the price fluctuation is less.

Investing in Bond ETFs and Earning Interest

When you invest in bonds, your money is less likely to grow, but it is also less likely to fail. You can earn a steady return at a low annual interest rate.

In particular, it is a good idea to invest in bond ETFs. By investing in bond ETFs, which are a mixture of various government and corporate bonds, you can earn dividends. When investing in bond ETFs, you can buy and sell them at any time since they are listed mutual funds.

Most people use bond ETFs when investing in bonds, unless they have a specific reason. Also, in the case of a company, as mentioned earlier, there are times when a large amount of money is suddenly needed. For this reason, investing in bond ETFs that can be freely traded is excellent.

Recommended Bond ETFs for Corporations

What kind of bond ETFs should you invest in? The best bond ETFs are listed in the US. In other words, invest in US bond ETFs. Naturally, you will be investing in US dollars.

One thing to keep in mind is that you should not invest in bonds outside the United States. Government and corporate bonds outside the US are not worth investing in due to their low interest rates or low creditworthiness of the currency. For this reason, all companies worldwide, not just American companies, generally use US bond ETFs for their corporate asset management.

Except for US companies, investing in US dollars has currency risk. However, US bond ETFs are the best way to get higher yields while investing with low risk. The following bond ETFs are particularly recommended for corporate asset management.

- Vanguard Total Bond Market ETF (BND)

- iShares 7-10 Year Treasury Bond ETF (IEF)

- iShares iBoxx $ High Yield Corporate Bond ETF (HYG)

Each of these bonds will be explained in this section.

The BND, a Bond ETF with About 2% Annual Dividend and High Rank

Among bond ETFs, BND is a bond ETF with a large net asset value. BND invests in highly rated bonds such as US government bonds and corporate bonds of huge corporations.

Since the bonds are highly rated, the yield is low among bond ETFs, about 2% per year. However, since it is a mutual fund that invests in highly creditworthy bonds, the price fluctuation is low.

For example, the following is the price trend of BND when Lehman Brothers went bankrupt.

From 2007 to 2009, the stock price dropped by less than half. On the other hand, in the case of BND, the price dropped by 10% in September 2008 when Lehman Brothers collapsed, but three months later, the price was back to its original level. BND is a bond ETF that will not lose its value even if a major recession occurs.

Because it invests in highly rated government and corporate bonds, BND allows you to increase your company’s assets with almost no risk.

The IEF, which Invests in US Government Bonds

When investing in US dollars, it is also a good idea to consider investing in US government bonds. You can also invest in US government bonds by investing in BND, but BND includes corporate bonds. So, invest only in US government bonds.

The IEF is a bond ETF that invests in 7-10 year US government bonds with an annual interest rate of about 1-2%.

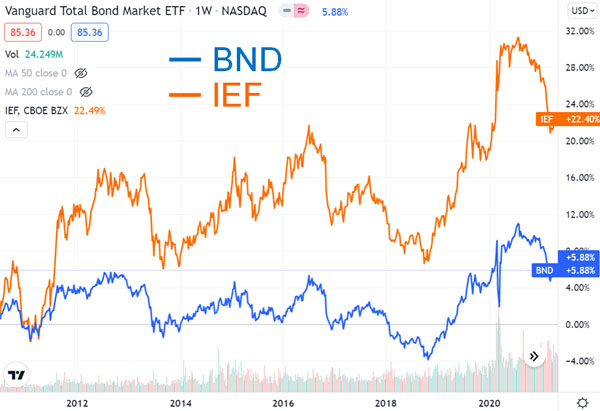

Note that bond price volatility is greater than that of BND. Below is a chart comparing the price movements of BND and IEF.

While the BND includes corporate bonds, the IEF invests only in US government bonds. Naturally, the price of US government bonds is greatly affected by the Fed’s policy rate and the US economy.

When comparing dividend yields, there is no significant difference between BND and IEF. However, the IEF has a larger fluctuation in bond value, and there is a possibility of future gains in price. Therefore, when investing in bonds, IEF is a riskier investment than BND.

The HYG That Offers a 5% Annual Dividend

However, the dividend yield of 1-2% per year is low. Therefore, many managers would like to get a bigger yield. In that case, you can invest in HYG, which will give you an annual yield of about 5%.

The HYG is considered a high-yield bond. It is also known as a junk bond. In other words, HYG is a bond ETF that invests in low-rated corporate bonds. Because of the low rating, the investment risk is high. This is why you can get a high yield.

However, even though they are junk bonds, they are listed in the US and include well-known companies. There are also many companies that have a market capitalization of over US$100 billion and whose stock prices continue to grow. However, they are smaller than the top companies in the US, so they are considered junk bonds.

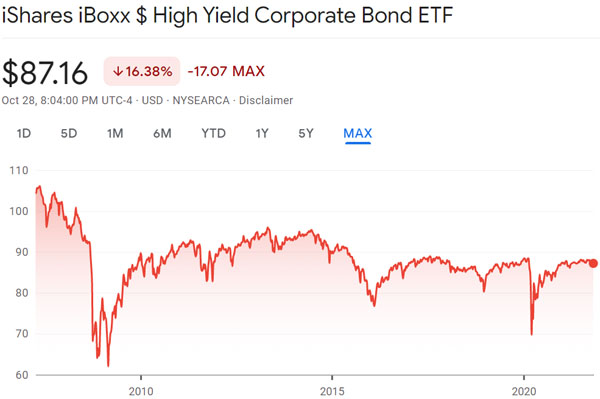

The price of HYG is more volatile than that of BND and IEF because of the low credit rating of the companies it invests in. The following is the price history of HYG.

As you can see, HYG’s price movements are large. And while we can’t expect it to rise in price like a stock, it won’t fall in price significantly as well.

This chart does not take into account the dividend income of about 5%. Therefore, if you invest in HYG, you will be able to increase the company’s assets through compounding. In addition, since the bond value does not change much over the long term, you can understand it as an investment that earns about 5% interest per year.

Corporate Asset Management with Bond ETFs

If your company has a large amount of spare cash, you should actively invest it. Depositing money in the bank will not increase the money, so invest it to increase your company’s money.

Low-risk investments are excellent for corporate asset management. Bond ETFs are known as such investments. While they don’t offer significant price growth like stocks, you can increase profits through compounding by earning dividends.

The best bond ETFs for corporations are BND, IEF and HYG. Try to use these bond ETFs to increase your company’s money.

There is a right way to manage your company’s assets. If you have retained money that you are not using, invest it using bond ETFs.