By purchasing life insurance sold in tax havens, you can efficiently increase your assets. Life insurance is the lowest risk asset management product, and if you want to increase your money many times over with principal protection, purchasing offshore life insurance is an excellent choice.

Among the offshore life insurance products, the Regent Series is a life insurance product sold by FTLife, a Hong Kong-registered company. Specifically, Regent Prime and Regent Elite are the key insurance products at FTLife.

These are life insurance products that specialize in asset management, allowing your money to grow many times over. Not only Hong Kong residents but also foreigners who do not live in Hong Kong can purchase FTLife insurance products. By investing your money in US dollars, you can grow your money.

One of the excellent life insurance products is Regent Prime (Premier) and Regent Elite (Premier). I will explain the details and reviews of these life insurance policies.

Table of Contents

FTLife Is a Highly Rated Company Headquartered in Hong Kong

Hong Kong is famous as an offshore tax haven with almost no taxes. FTLife is a life insurance company headquartered in Hong Kong.

FTLife is a large life insurance company and is highly rated by global rating agencies as follows.

- Fitch Ratings: A-

- Moody’s: A3

Because of its high rating, there is no need to worry about bankruptcy. The parent company of FTLife is a listed company, and one of the largest companies in Hong Kong is managing FTLife.

The Main Life Insurance Products Are Regent Series (Premier)

Being a life insurance company, FTLife sells many insurance products. Among them, the most popular life insurance products are the Regent Series. Within the Regent Series, the two main products are as follows.

- Regent Prime (Premier)

- Regent Elite (Premier)

Most people who purchase FTLife insurance products and are considering asset management purchase Regent Prime or Regent Elite. Therefore, it is sufficient to understand the details of these two insurance products.

With the Regent Series, your money can increase by about 2.7 times in 20 years or by about 5.8 times in 30 years. Among life insurance products, Regent Series is the investment product with faster money growth.

-Travel to Hong Kong Is Required

If you are a foreigner and want to buy an insurance product in Hong Kong, you need to travel to Hong Kong to make a contract. On the other hand, money can be paid by credit card, and overseas remittance is not necessarily required.

Details of Regent Prime and Regent Elite

What are the details of Regent Prime and Regent Elite?

Basically, it is important to understand that the two products are almost the same. Therefore, there is no need to distinguish between the two. In fact, most of the specifications are the same, including the age at which you can sign up and the payment period. They are also the same in that they are life insurance policies that specialize in asset management.

The specific product details are as follows.

| Issue age | age 0 to 75 years |

| Period | Up to age 128 |

| Payment period | Lump-sum, 2 years, 5 years |

| Payment Frequency | Lump-sum, annual, semi-annual, monthly |

| Minimum annual premium | US$4,500 (US$3,000 for 5-year payment) |

Regarding the age of subscribers, children as young as 0 years old can subscribe. Even elderly people of 75 years old can sign up. Therefore, it can be used by people of a wide range of ages.

Also, since it is specialized in asset management, your age, health condition, and smoking status will not affect the results of asset management.

Usually, with life insurance, if you are in poor health, you will be rejected or your asset management efficiency will suffer. On the other hand, anyone up to the age of 75 can buy Regent Series, and even if you are in poor health, you can purchase it without a medical examination.

The Break-Even Point Is After 5 Years for Both Regent Prime and Elite

What does the actual insurance design look like? As an example, let’s take a look at the insurance design for Regent Prime with a lump sum payment of US$30,000.

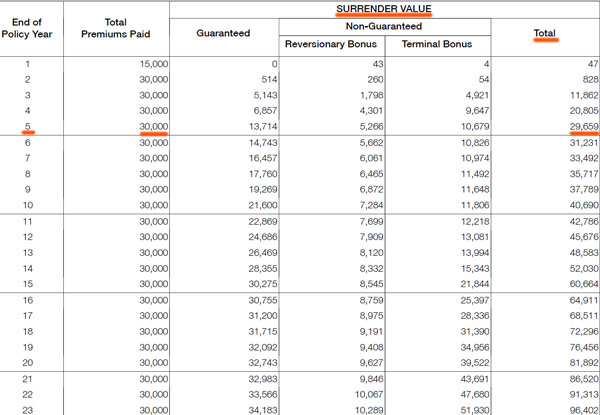

The following is the actual content of Regent Prime (Premier).

The policy is listed until the 23rd year after signing up, but in reality, the policy will continue until you turn 128.

If you check the policy details, you will see that the surrender value after 5 years is $29,659 for a payment of $30,000. In other words, the break-even point for a lump-sum payment is after five years, and after that, the money will increase over time.

The break-even point after five years is not only for Regent Prime but also for Regent Elite.

Also, if you check the insurance policy, after 20 years of enrollment, the surrender value is $81,892. Your assets will increase by about 2.7 times, and your money will start to grow almost risk-free.

Unlimited Insured Changes and Policy Continuation Options Available

Another unique feature of FTLife’s Regent Series is the ability to change the insured without restriction. For example, you can change the insured from you to your children in the middle of the policy.

As mentioned above, the policy term of Regent Prime and Regent Elite is until you reach the age of 128. Therefore, if the insured person is changed to your child, the policy will continue until your child turns 128 years old.

It is also possible to change the insured from your child to your grandchild after that. In other words, you can buy an insurance policy for your unborn grandchildren or great-grandchildren.

Also, in general life insurance, if the insured dies, the death benefit will be paid, and the insurance policy will be terminated.

However, with the Regent Series, you can add a policy continuation option in advance. This allows another person (such as a child, grandchild, or any other person you designate) to take over the policy even in the event of the insured’s death.

In other words, even if the insured person dies, the insurance policy will not be terminated. By allowing others to take over the life insurance policy, asset management can be continued.

Partial Withdrawals Are Free, Allowing for Annuities

The other feature of the Regent Series is that you can freely make partial withdrawals. In other words, you can withdraw money little by little instead of surrendering the insurance and receiving the surrender value. The timing and amount of money you withdraw are up to you.

This is why many people use FTLife’s Regent Series as a private pension plan. They use offshore life insurance to build their future annuities because it is a reliable way to increase their money compared to the pensions they get from the government.

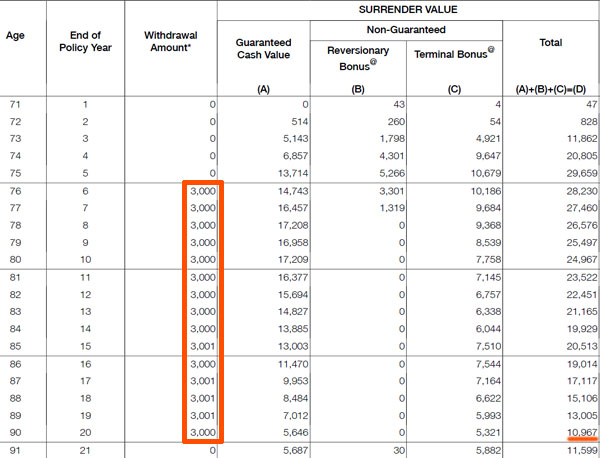

For example, if you were to purchase Regent Prime (Premier) at age 70 with a lump sum payment of US$30,000, and receive $3,000 annually from 6 to 20 years (ages 76 to 90), the following is a simulation.

You will be withdrawing money while you invest your assets. Although the surrender value decreases each year, the surrender value will not drop to zero; if you receive $3,000 each year from age 76-90, you will have received a total of $45,000.

- $3,000 × 15 years = $45,000

Also, if you check the surrender value at the end of 20 years (age 90), it is $10,967. You can cancel the policy at age 90 and receive the surrender value, or you can continue to receive the money as an annuity. Alternatively, you can change the insured person to your grandchild.

Even though the payment is US$30,000, you will receive a total of $45,000 in 15 years, leaving a surrender value of $10,967. This is how FTLife’s Regent Series can create a high-value annuity for the future.

There Is No High Death Benefit

As a reminder, it is important to understand that there is no high death benefit. Usually, life insurance policies pay a large death benefit when the insured person dies. However, in the case of the Regent Series, the surrender value is equal to the death benefit.

The surrender value is low for the first few years after the money is paid. For this period, the death benefit will be the amount of money you have paid up to that point.

On the other hand, as time goes by, your assets will increase through investment. In that case, a death benefit equal to the surrender value will be paid to the beneficiary.

This is the reason why many people take over the insurance policy through policy continuation rather than receiving the death benefit. Rather than receiving the money as a death benefit, the money received in the future will be more if the assets are invested through policy continuation.

The Difference Between Prime and Elite Is Short-Term and Long-Term Management

What is the difference between Regent Prime and Regent Elite? As mentioned above, the products are almost the same. The difference is that the rate at which your money increases depends on the period of asset management.

Specifically, let’s consider the following.

- Regent Prime: Investing money for the short term (29 years or less)

- Regent Elite: Investing money for the long term (30 years or more)

For example, when you make a lump-sum payment of US$30,000, there is a difference in the surrender value between Regent Prime and Regent Elite as follows.

| Prime | Elite | |

| After 15 years | $60,664 | $48,093 |

| After 20 years | $81,892 | $61,687 |

| After 25 years | $109,634 | $84,392 |

| After 30 years | $161,054 | $174,236 |

| After 35 years | $215,230 | $243,600 |

| After 40 years | $287,871 | $341,441 |

For the first 29 years after purchasing the product, Regent Prime offers a higher surrender value. On the other hand, Regent Elite offers a higher surrender value after 30 years of purchase. This is the only difference between Prime and Elite, although the products are almost the same.

Depending on the number of years you want to invest in your assets, you should consider whether Prime or Elite is the best choice for you.

-FTLife Invests Your Money in Stocks and Bonds to Increase Your Assets

FTLife invests the money you invest in stocks and bonds to increase your assets. Therefore, your money will not necessarily increase, as shown in the insurance policy. However, Regent Series is a principal protection product. Therefore, if you do not surrender early, your assets are guaranteed to increase.

In other words, even if the worst economic conditions, such as the Great Depression or the collapse of Lehman Brothers, continue for decades, your assets will grow many times over. In addition, it is usually designed to increase almost the same asset value as shown in the insurance policy.

What Is the Difference Between Sun Life’s Victory?

When purchasing offshore life insurance, one famous life insurance company is Sun Life Hong Kong. Sun Life sells a product called Victory, which is similar to FTLife’s Regent Series.

Victory specializes in asset management, does not have a high death benefit, and the insured can be changed many times. Therefore, the product is similar to the Regent Series.

Although there are differences in the minimum investment amount and contract age, the most important thing for us is how much money will grow. If we invest a lump sum of US$30,000, the comparison between Regent Series and Victory is as follows.

| Victory | Prime | Elite | |

| After 15 years | $57,770 | $60,664 | $48,093 |

| After 20 years | $74,086 | $81,892 | $61,687 |

| After 25 years | $103,926 | $109,634 | $84,392 |

| After 30 years | $145,352 | $161,054 | $174,236 |

| After 35 years | $205,579 | $215,230 | $243,600 |

| After 40 years | $289,528$ | 287,871 | $341,441 |

When compared in this way, the Regent series is more efficient in asset management than Victory. Also, in these life insurance policies, there is a part that promises the money will definitely increase through asset management (Guaranteed) and a part that does not guarantee it (Non-Guaranteed).

If you look at Victory and Regent Prime, the amount of money guaranteed to grow is almost the same. Therefore, FTLife is better in terms of asset management.

The Biggest Disadvantage Is Country Risk

However, in the case of FTLife, there is a country risk since it is headquartered in Hong Kong. The evilest organization in the world is the Chinese Communist Party, and today, Hong Kong citizens have no freedom.

If you invest in FTLife, the actual asset management will be done by BNP Paribas, UBS, or other financial institutions that have nothing to do with China and Hong Kong. The following are the main investment institutions that FTLife works with.

Therefore, even if the Chinese government completely eliminates the freedom of Hong Kong citizens, the money you have invested will continue to be invested. Also, there are millions of Chinese people who have life insurance policies in Hong Kong, so you will not lose your surrender value.

However, some people are still afraid of country risk. In that case, you should purchase a policy with Sun Life Hong Kong. Sun Life is headquartered in Canada and has nothing to do with Hong Kong and China. Therefore, even if Sun Life completely withdraws from Hong Kong, there will be no trouble because it is a Canadian company that manages the assets.

When you buy offshore life insurance, your assets will increase greatly with FTLife. But if you are worried about country risk, you should buy life insurance from Sun Life Hong Kong.

Buy FTLife Life Insurance and Manage Your Assets

FTLife is a large life insurance company headquartered in Hong Kong. As a life insurance company located in a tax haven, it offers excellent asset management by purchasing insurance products.

Among offshore investments, life insurance is known to be the least risky way to invest. Therefore, although it is impossible to earn more than 10% annual interest like other offshore investments, FTLife allows you to increase your assets with almost no risk. FTLife has a good reputation for people who want to increase their assets without fail.

In addition, compared to other life insurance companies, Regent Series has excellent reviews because the speed of money growth through asset management is fast.

However, since it is headquartered in Hong Kong, there is a country risk due to the Chinese Communist Party. So understand the advantages and disadvantages of FTLife’s Regent Series.