One of the insurance products that Sun Life offers is Victory. Victory is an insurance product that is used for asset management, although it doesn’t offer a high death benefit.

Compared to other insurance products, Victory has a superior annual interest rate because it specializes in asset management, allowing you to increase your assets efficiently. Also, the insured person can be changed freely, and your assets can be passed on to your unborn grandchildren and great-grandchildren.

However, there are few people who understand the details of Victory, and you need to understand the cautions before purchasing the product.

What do you need to consider when buying Sun Life’s Victory? I will explain the product details and precautions of Victory.

Table of Contents

Individual Annuity with Lump-sum Benefit Is Victory

Sun Life is a huge life insurance company in the world. Sun Life is many times larger than life insurance companies in developed countries like Japan and Germany. In other words, it is safer to invest your assets with Sun Life than with life insurance companies in your country. Moreover, in the case of Sun Life, your assets will increase dozens of times.

Sun Life has branches in many countries, and among them, Sun Life Hong Kong allows non-residents of Hong Kong to purchase insurance products. In other words, even foreigners can apply for insurance products.

Therefore, if you want to buy an offshore insurance policy in a tax haven where taxes are almost non-existent, it is common to apply from Sun Life Hong Kong. In my case, I applied for life insurance from Sun Life Hong Kong as follows.

Among the products sold by Sun Life, Victory is a financial product for creating a future personal annuity. By investing in Victory, your assets will grow many times over as time passes.

There are several types of annuities. Among them, Victory is a life insurance policy that allows you to receive money in a lump sum when the policy is canceled. Note that you will receive the money in a lump sum, not in installments.

-You Can Withdraw During the Term

Although Victory is an insurance product that allows you to receive money in a lump sum, it is possible to withdraw money through partial cancellation. You can withdraw the money you need and have Sun Life manage the rest of your assets.

If you use partial withdrawal many times, you will be in the same situation as receiving a private annuity every year. Although the annuity is not paid automatically, you can withdraw money many times by partial withdrawal.

Checking the Details of Victory’s Insurance Policy

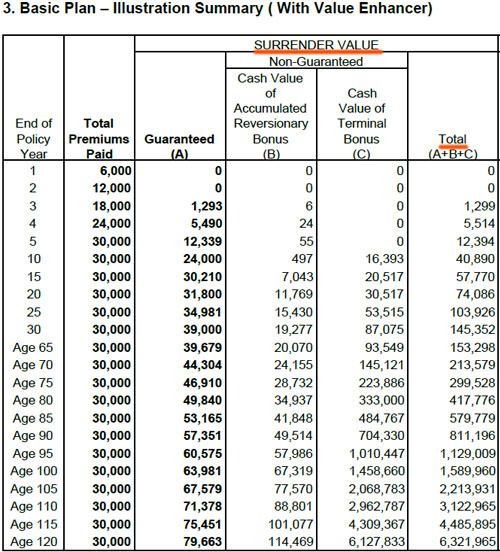

What kind of asset management is possible by using Victory? It is easier to understand if you check the actual insurance policy. I will show you the details of my Victory insurance policy below.

Total Premiums Paid is the total amount of money I paid. In my case, I paid US$30,000 in a lump sum when I was 34 years old. The insurance policy says that the payment is to be made in installments over five years, but in reality, I paid a lump sum.

Total, on the other hand, is the full amount of the surrender value. This is the amount of money that will be returned to me when I cancel this life insurance policy. You can see that the surrender value is increasing as the years go by. Specifically, it is as follows.

- After 20 years: $74,086 (about 2.5 times)

- After 30 years: $145,352 (about 4.8 times)

Thus, my assets will increase. In the case of offshore life insurance purchased in tax havens, the speed of asset growth is fast.

For reference, when I reach age 120, my assets will be $6,321,965. I don’t think I will live to be 120 years old, but if I leave my insurance policy alone for a long time without canceling it, $30,000 will turn into more than $6 million.

What Is the Yield on Life Insurance?

What are the yields? In general, the annual interest rate of offshore investments is usually more than 10%. However, in the case of life insurance, the annual interest rate is never more than 10%.

Offshore life insurance is the most risk-free way to invest. The annual interest rate tends to be lower among offshore investments because it is an investment product that is suitable for people who want to increase their assets without risk.

The rate of return and yield depends on when you cancel your life insurance policy. Naturally, the later the timing of the cancellation, the higher the rate of return and the better the yield. Specifically, Victory’s return rate and yield are as follows.

| Number of years | Return rate | Interest rate |

| After 10 years | 136% | 3.2% |

| After 20 years | 246% | 4.7% |

| After 30 years | 484% | 5.4% |

| After 40 years | 940% | 5.8% |

| After 50 years | 1829% | 6.0% |

In the case of Victory, it can be canceled after more than 50 years. In this case, the rate of return and yield will be better.

Also, when I am 120 years old, it will have been 86 years since I purchased the insurance. In this case, I noted that $30,000 would become $6,321,965. The money has increased more than 200 times, and the more years pass, the greater the amount of assets under management.

-Your Age and Health Are Irrelevant to the Return on Investment

The important thing to remember is that your assets will be managed regardless of your age and health condition. In other words, no matter when you purchase the policy, you can achieve the yield shown in the table above.

Usually, the older you are, the less efficient the life insurance investment will be, and the lower the yield will be. Also, if you are a smoker or in poor health, the efficiency of asset management will be lower. Victory, on the other hand, has the advantage of not being affected by factors such as age and health conditions.

The Insured Can Be Changed Many Times, and the Assets Can Be Left to Your Grandchildren

In the case of Victory, you can use it to create your own personal pension, or you can use it to leave assets to your children, grandchildren, or great-grandchildren.

As noted in the previous insurance policy, the coverage period is until we reach 120 years old. In reality, people who can live to 120 years old are rare, but it is possible to invest assets for a very long period of time.

The important thing is that you can change the insured person as many times as you want. Therefore, after subscribing to Victory, you can change the insured person to your grandchildren or great-grandchildren. Also, by changing the insured, the insurance policy will continue until the new insured turns 120 years old.

In other words, by changing the insured, the policy can be continued permanently. Naturally, as time passes, the amount of assets will increase due to compound interest. Therefore, by using life insurance now, you can leave a very large amount of assets to your unborn grandchildren and great-grandchildren.

What About the Issue Age, Payment Methods, and Minimum Premiums?

What are the details of Victory’s issue age, payment method, and minimum premium? As mentioned above, the coverage period is until the insured turns 120 years old. As for the other items, they are as follows.

- Age of the insured: 0 to 70 years old

- Payment period: Lump-sum, 5 years, 10 years

- Payment frequency: monthly, half-yearly, or yearly

- Minimum premium: $3,000 per year ($250 per month)

Because it is a life insurance policy, an older insured person will be refused a policy. Therefore, you can apply if the insured is under 70 years old. If the payment period is 10 years, the insured’s age must be between 0 and 65 years.

The payment period can be lump sum, 5 years, or 10 years. We recommend the lump-sum payment or the 5-year payment so that you can complete the payment as soon as possible. If you choose to pay for 5 or 10 years instead of a lump sum, you can choose from monthly, half-yearly, or annual payments.

The minimum premium is $3,000 per year, and the minimum monthly premium payment is $250 per month.

If you pay less than $2 million in premiums, you do not need to take a medical examination beforehand. However, you will need to travel to Hong Kong to sign up for the policy.

-You Can Pay by Credit Card and Send Money Overseas

By the way, when you make a contract with Sun Life Hong Kong, you can pay by credit card. In other words, you don’t need to send money overseas when you purchase an offshore life insurance policy. The money will be automatically deducted from your credit card.

Visa and MasterCard have no remittance fees, so if you have one of these cards, choose to pay by credit card.

It Is Life Insurance, But Doesn’t Offer High Death Benefits

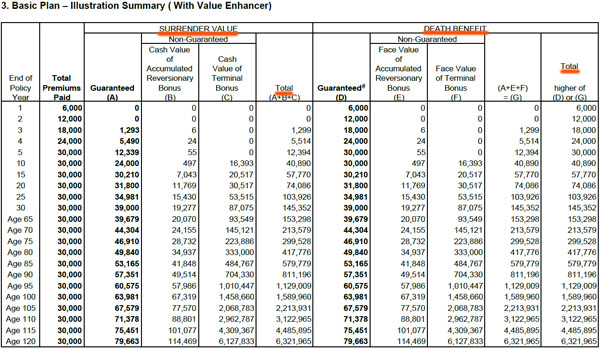

Although Victory is a life insurance policy, it is an insurance product that specializes in asset management. Therefore, unlike ordinary life insurance, Victory does not offer a high death benefit. To be more precise, the surrender value (or the total amount of money you paid) is the amount of the death benefit.

After investing in Victory, the surrender value is low for the first few years. Therefore, the death benefit will be the sum of the amounts you have paid up to that point. For example, if you have paid $30,000 up to that point, your death benefit will be $30,000.

On the other hand, as mentioned above, in Victory, your assets increase dozens of times as the years go by. In the event of death, the death benefit will be the surrender value of the policy at the time of death.

In general life insurance, a higher amount of money than the surrender value is paid out as the death benefit. However, in the case of Victory, there is no high death benefit because it is an individual annuity policy that specializes in asset management. If you check the entire insurance policy as shown below, you will notice that the surrender value (or the total amount of premiums paid) and the death benefit are the same.

Comparing the surrender value alone, Victory’s surrender value is much higher than life insurance policies with high death benefits. Therefore, if you do not need a death benefit and want to use your life insurance to create a future private pension, Victory is the best choice.

Or, as mentioned earlier, you can use it to leave assets to your grandchildren or great-grandchildren who are not born yet.

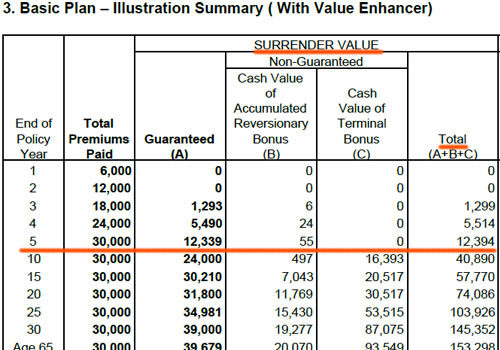

Principal Will Be Lost If 8 Years or More Have Not Passed

Another disadvantage of Victory is the loss of principal due to early surrender. As is the case with all life insurance policies, not just Sun Life, early surrender of savings-type life insurance policies will definitely result in a loss of principal.

However, in the case of Victory, because it is a life insurance policy that specializes in asset management, the period when the surrender value is higher than the total payment will come faster.

As shown in the following policy, the surrender value is less than the principal at the fifth year of subscription. On the other hand, you can see that the surrender value is high after 10 years of subscription.

To be more specific, if you sign up for Victory as a lump-sum payment, the surrender value will be more than the principal after 8 years. Therefore, be sure to invest in Victory for at least 8 to 10 years.

In the case of 5-year or 10-year payments, the speed of asset growth will be slower than that of a lump-sum payment. This is another reason why lump-sum or 5-year payments are recommended. By completing the payment earlier, you can manage your assets more efficiently.

Life Insurance for Individual Annuities Specializing in Asset Management

Although it is not designed to receive a high death benefit, Victory is one of the most efficient life insurance products for asset management.

The lack of a high death benefit allows your assets to grow efficiently. Therefore, if you do not need a death benefit, Victory is an excellent choice. Partial surrender is also possible, so you can withdraw a certain amount of the increased money every year.

You can also change the insured person as many times as you want. Therefore, you can leave assets for your grandchildren and great-grandchildren who are not yet born.

Because it specializes in asset management, Victory can be used in a variety of ways. Although it should be left without cancellation for at least 10 years after the policy is issued, it is an insurance product with a very high surrender value among offshore insurance products.